Maharashtra Gramin Bank

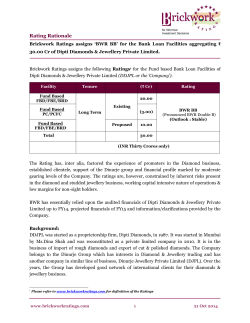

Rating Rationale Brickwork Ratings upgrades the ratings from BWR BBB+ to ‘BWR A-’ with Stable Outlook for Maharashtra Gramin Bank’s Perpetual Bond Issue of ₹ 10.25 Cr On a review of the performance of the Bank Brickwork Ratings have upgraded the Rating1 of Maharashtra Gramin Bank’s Perpetual Bond issue of ₹ 10.25 Crores as follows: Issue Perpetual Bond Amount (₹ Cr) Previous Rating (March 2014) Rating1 (April 2015) 10.25 BWR BBB+ (Pronounced BWR Triple B Plus) (Outlook: Stable) BWR A(Pronounced BWR A Minus) (Outlook: Stable) BWR has essentially relied upon the audited financials of FY13, FY14, and financial results upto Q3 FY15, publicly available information and other information/clarifications, provided by the Bank. The rating factors inter alia, operating profits, asset quality, capital adequacy, and equity stakes of the Central Government, State Government and the Sponsor Bank. The rating factors equity stakes of the Government of India, State Government and the Sponsor Bank and their continued support to the Bank, comfortable capital level and marginal deterioration in the asset quality indicators. It also factors satisfactory credit growth as also improvement in Provision Coverage ratio, net interest margin and marginal decline in the CASA ratio during the review period. Bank Profile Maharashtra Gramin Bank came into existence on 20th July 2009 after amalgamation of erstwhile Maharashtra Godavari Gramin Bank and Marathwada Gramin Bank as per the notification issued by Government of India, Ministry of Finance, and Department of Financial Services. The head office of the Bank was shifted from Nanded to Aurangabad in July 2014. The Bank is led by Chairman and Managing Director Mr. Unnam R V. The Board of Directors of the Bank comprises of members nominated by the Government of India, the Government of Maharashtra, RBI, NABARD and the Bank of Maharashtra. As on FY14, the Bank has 378 branches and 6 Regional offices across 17 districts in state of Maharashtra. All branches of this Bank are linked via Core Banking Solution (CBS). 1 Please refer to www.brickworkratings.com for definition of the Ratings www.brickworkratings.com 1 6 Apr 2015 Shareholding Pattern As per the Regional Rural Banks (RRB) Act, the share capital has to be contributed by the Central Government, the State Government & the Sponsor Bank in the ratio 50:15:35. The authorized and paid up share capital of the Bank is ₹ 3 Crores. The share capital is contributed in the aforesaid proportion by the Central Government, the Government of Maharashtra and the Bank of Maharashtra respectively. The share capital deposit amounting to Rs.206.35 Cr as on FY14 has been contributed by the shareholders in the same ratio. Perpetual Bond The said Perpetual Bond issue of Rs.10.25 Cr is subscribed by the Sponsor Bank, with plans to raise upto Rs.10.10 Cr. It has raised Rs.8.28 Cr of the said Bonds in March 2014 and Rs.1.82 Cr utilization by end of March 2015. The coupon at 9.50% is serviceable annually. The redemption of these Bonds can be made with the approval of RBI, with the Bank having a call option at the end of 10 years from the date of allotment. Financial Performance Total Business of the Bank has increased from ₹ 6325.11 Cr in FY13 to ₹ 6974.84 Cr in FY14, registering a growth of 10.27%. Gross Advances have grown by 14.20%, an increase from ₹ 2517.51 Cr in FY13 to ₹ 2874.96 Cr in FY14, And the Deposits grown by 7.68% from ₹ 3807.60 Cr in FY13 to ₹ 4099.87 Cr in FY14. The Bank’s CASA deposits increased marginally from 62.67% in FY13 to 64.27% in FY14. During FY14, the Bank’s Loan growth was primarily driven by strong growth in agriculture of 15.94% YoY growth, from ₹ 1576.66 Cr in FY13 to ₹ 1828.00 Cr in FY14. The operating profit increased by 41.1% from ₹ 54.08 Cr in FY13 to ₹ 76.31 Cr in FY14. The Net profit increased by 31.70% from ₹ 26.97 Cr in FY13 to ₹ 35.52 Cr in FY14. The Net Interest margin has marginally improved from 3.63% in FY13 to 3.72% in FY14. The Cost to Income ratio has reduced from 64.33% in FY13 to 58.95% in FY14. Although, the Cost of funds has increased from 5.55% in FY13 to 5.90%, the Yield on Funds has improved from 9.18% in FY13 to 9.62% in FY14 The Gross NPA has increased from 5.16% in FY13 to 5.96% in FY14 and the Net NPA increased from 1.85% in FY13 to 2.45% in FY14. The Provision Coverage ratio has reduced from 64.12% in FY13 to 58.95% in FY14. The Owned funds of the Bank have increased from ₹ 236.22 Cr in FY13 to ₹ 272.19 Cr in FY14 with retention of increased profits in the business. The Borrowings has increased from ₹ 656.56 Cr in FY13 to ₹ 776.50 Cr in FY14 with the support from NABARD. The Capital adequacy has improved from 9.65% in FY13 to 10.88% in FY14 as against the Regulatory Capital requirement of 9%. There is requirement from NABARD for RRBs to maintain 9 % of CRAR. www.brickworkratings.com 2 6 Apr 2015 9MFY15 – YoY performance: As of 9MFY15, The Business has grown by 19.94% from ₹ 6279.29 Cr in 9MFY14 to ₹ 7531.24 Cr in 9MFY15 attributed by growth of 20.23% in Deposits and 19.58% in Advances. There has been a decline in CASA by 6% and it stands at 56.91% as of 9MFY15 as against 60.54% in 9MFY14. Priority sector advances has increased by 31.67% from ₹ 2401.18 Cr in 9MFY14 to ₹ 3161.67 Cr in 9MFY15, with increase in Agricultural advance by 29.20% from ₹ 1712.75 Cr in 9MFY14 to ₹ 2212.83 Cr in 9MFY15. Operating Profits have grown considerably by 54.29% from ₹ 52.59 Cr in 9MFY14 to ₹ 81.14 Cr in 9MFY15, while the net profits by 53.52% from ₹ 27.96 Cr in 9MFY14 to ₹ 42.92 Cr in 9MFY15. The cost of funds has been managed within 6% while the yield on advances moving towards 10%, with the Net Interest Margin maintained above 3.5%. The Credit-Deposit ratio has marginally reduced from 81.87% to 81.43%. Gross NPA has reduced from 4.69% in 9MFY15 to 4.45% in 9MFY15 with improved recovery by 45.57%. The Net NPA has also reduced from 1.41% in 9MFY15 to 1.10% in 9MFY15. The Provision Coverage ratio has increased from 70.97% in 9MFY15 to 75.20% in 9MFY15. The Owned funds of the Bank have improved from ₹ 264.17 Cr in 9MFY14 to ₹ 315.12 Cr in 9MFY15 with retention of increased profits in the business. The Borrowings have increased from ₹ 511.84 Cr in 9MFY14 to ₹ 915.56 Cr in 9MFY15 with funding support from NABARD to the tune of ~₹ 400 Cr. The Capital adequacy has marginally reduced from 10.80% in 9MFY14 to 10.71% in 9MFY15. Rating Outlook The above ratings have factored inter alia, the Government of India, Government of Maharashtra and the Bank of Maharashtra ownership, which guarantees somewhat perpetual existence with active government support in the rural development area. The rating is however constrained by usual problems of RRBs in terms of inherent political and regulatory risk for RRBs , frequent loan waivers that impinge on borrower discipline, and any susceptibility to reduction in RoA and increase in the gross and net NPA levels. Analyst Contact [email protected] Phone 1-860-425-2742 Relationship Contact [email protected] Media Contact [email protected] Disclaimer: Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine the precision or completeness of the information obtained. And hence, the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does not make any representation in respect to the truth or accuracy of any such information. The rating assigned by BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the right to change, suspend or withdraw the ratings at any time for any reasons. www.brickworkratings.com 3 6 Apr 2015 Maharashtra Gramin Bank Annexure -Key Financials Sno Parameters – Amt Rs Cr Actual Actual 31.03.2013 31.03.2014 YoY % Growth Actual 31.12.2013 Actual 31.12.2014 YoY % Growth 1 Deposits (Total) 3807.60 4099.87 7.68% 3452.53 4151.06 20.23% 2 CASA 2386.11 2635.05 10.43% 2090.15 2362.33 13.02% CASA Ratio 62.67% 64.27% 2.56% 60.54% 56.91% -6.00% 3 Term Deposits 1421.49 1464.82 3.05% 1362.38 1788.73 31.29% 4 Advances (Gross) 2517.51 2874.96 14.20% 2826.76 3380.18 19.58% 5 Total Business (Deposit + Adv) 6325.11 6974.84 10.27% 6279.29 7531.24 19.94% 6 Priority Advances 2148.67 2650.74 23.37% 2401.18 3161.67 31.67% 7 Total Agri. Advances Amt. 1576.66 1828.00 15.94% 1712.75 2212.83 29.20% 8 Operating Profit 54.08 76.31 41.11% 52.59 81.14 54.29% 9 Net Profit 26.97 35.52 31.70% 27.95 42.92 53.52% 10 NPA Recovery 23.62 47.84 102% 18.48 26.90 45.57% 11 Gross NPA 129.99 171.39 31.85% 132.66 150.38 13.36% 12 Gross NPA% 5.16% 5.96% 4.69% 4.45% -5.14% 13 Net NPA% 1.85% 2.45% 1.41% 1.10% 14 CRAR 9.65% 10.88% 10.80% 10.71% 15 Provision Coverage Ratio 64.12% 58.95% 70.97% 75.20% 16 Cost to Income Ratio 64.33 58.95 67.34 52.33 17 Cost of Funds 5.55 5.90 5.98 5.90 18 Yield on Funds 9.18 9.62 9.49 9.67 19 Net Interest Income 129.91 160.77 116.27 151.16 20 Net Interest margin% 3.63% 3.72% 3.51% 3.77% www.brickworkratings.com 4 6 Apr 2015

© Copyright 2026