2014 Documentary Stamp Tax Registration Information

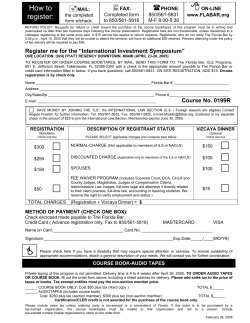

2014 Documentary Stamp Tax Registration Information Register online at www.floridabankers.com or complete this form and send to Florida Bankers Association, 1001 Thomasville Rd, Suite 201, Tallahassee, FL 32303 or by fax to (850) 222-6338. Contact Pete Brokaw at (850) 224-2265 or [email protected] with any questions concerning this event. (docstamp14). Presents a Seminar on Pricing BeforeAfter 10/23/1410/23/14 FBA Members..............................................................................$305.00 $355.00 All Other Non- Member Institutions............................................$610.00$710.00 Live Video Streaming FBA Members..........................................$725.00 $775.00 Live Video Streaming Non-Member Institution.......................$1,450.00 $1,550.00 2014 Documentary Stamp Tax Contact Person:____________________________________________________________ Organization: _____________________________________________________________ Phone:_______________________________Fax: _______________________________ Address:________________________________________________________________ City____________________________________ State__________Zip ______________ List Registrants’ Names (and email addresses for confirmation): __________________________________________________ MiamiTampa Video __________________________________________________ __________________________________________________ __________________________________________________ Total Amount Due:_____________ Method of Payment (check one): Payment is required at time of submission to process registration. Approved refunds will be payable via FBA check. MasterCard VISA American Express Discover Credit Card Number:_____________________________________________________ Name on card:_______________________________________ Exp. Date:___________ Cancellation and Refund Policy: In the event you are unable to attend a meeting, the FBA strongly encourages sending a substitution. Cancellations prior to four (4) weeks will be refunded minus a 10% processing fee. Cancellations 2-4 weeks prior to an event will be refunded minus a 25% processing fee. There are no refunds or credits for cancellations within two (2) weeks of an FBA event. November 6, 2014 Airport Marriott Miami, FL November 7, 2014 Embassy Suites USF Tampa, FL November 7, 2014 Live Streaming Video This event has been applied for 7.0 CLE Credits and approved for 7.0 CPE credits. 2014 Documentary Stamp Tax The Program Deed Tax on Contributions Deeds in Lieu Overview of Documentary Stamp Taxes and Nonrecurring Intangible Taxes in Florida Credit Transactions - Documents Subject to Tax - Rate of Tax - Exemptions Non-revolving Loans and Revolving Loans Secured by Real Property Letters of Credit Loan and Letters of Credit Not Secured by Real Property Out of State Loan Closing Procedures Guaranties; Loans with Guaranties Hypothecations; Cross Collateralization Renewals International Banking Transactions Impact of Florida Legislation; Update on New Rulings and Positions of the Department of Revenue (DOR) Florida Department of Revenue Organization; Procedures and Compliance Issues (time permitting) - Organizations of the DOR and Responsibilities for Documentary Stamp Taxes - DOR Audit Functions and Procedures - Assessments and Administrative Review - Technical Assistance Advisements (“TAA”) - Liability of Officers, Directors and Shareholders with the division of Ad Valorem Tax, one year as an Audit Assignment Officer, four and a half years as an Auditor, twenty years as a Tax Law Specialist and eight years as a Revenue Program Administrator supervising the Tax Law Specialists that prepared written analysis of legislative proposals and written responses to practitioner and taxpayer inquiries. Jim Silvey is a consultant from The Villages, Florida with over 30 years of experience in state and local tax as a tax law specialist with the Department of Revenue, public accounting and industry. He has been recognized as an expert witness for documentary stamp tax, sales tax and tax on communications. In addition, he has been an instructor for the FICPA, Florida Bar, Florida Title Association and other professional organizations. Barbara Smith is the State Tax Risk Manager for Wells Fargo Bank, N.A. She has approximately 34 years experience in banking, with 18 years in state tax risk mitigation. She is a subject matter expert, who has in-depth knowledge and experience, with identifying state tax risk issues and in developing adequate controls and monitoring systems to ensure the tax risk associated with loan documentation is mitigated. Live, Same Day Streaming Video Connection We are pleased to offer this educational venue as a way to help you educate your employees in a very cost effective way. If you can’t travel to Miami or Tampa then simply register for the live streaming venue; assemble as many of your co-workers that will fit into your training room; and educate them for very few dollars per person. There will be opportunities to ask questions via your computer throughout the day. And you will have unlimited access to the same content for six (6) months after the event. The minimum technology requirements you will need are: A wireless or ethernet connection to a computer (ethernet preferred) A video projector and appropriate speakers attached to the computer At least 512 KB/S internet download speed Schedule of Events 8:30 a.m. - 9:00 a.m................................................................................Registration 9:00 a.m. -12:00 p.m......................................................................................Program 12:00 p.m. - 1:00 p.m......................................................................................... Lunch 1:00 p.m. - 4:00 p.m......................................................................................Program Who Should Attend This program will be especially beneficial to all CEO’s, Senior Loan Policy Officers, Auditors, Compliance Officers, Cashiers and Real Estate Attorneys. The Manual A revised handbook will be distributed at the workshop and will provide guidance on Florida Documentary Stamp Tax (Florida Statutes, Chapter 201) and Florida Intangibles Tax (Florida Statutes, Chapter 199) issues in a variety of situations involving the extensions of credit by lenders located in Florida. The recurring Annual Intangibles Tax (Florida Statutes, Chapter 199) will not be addressed in this handbook. Meet the Speakers Peter O. Larsen is a shareholder in the Jacksonville law offices of Akerman Senterfitt, P.A. He concentrates on State and Local taxation and banking law. He attended Alma College (B.A., cum laude with honors); University of Kentucky (J.D.); University of Florida (L.L.M. in Taxation). Joe Parramore retired from the Florida Deparment of Revenue after 35 years. His time with the DOR was spent dealing with Documentary Stamp Tax, Intangible Personal Property Tax and Ad Valorem taxation. His experience includes two and a half years as a budget analyst The program will begin promptly at 9:00 am Lunch will be provided Appropriate attire is Business Casual Please note that meeting rooms tend to be cold Date & Hotel Information Contact the hotel for room rate and availability. The FBA does not have a room block contracted for this event. Thursday, November 6, 2014 Airport Marriott 1201 NW Lejeune Road Miami, FL 33126 - (305) 649-5000 Friday, November 7, 2014 Embassy Suites USF 3705 Spectrum Blvd Tampa, FL 33612 - (813) 977-7066 Thursday, November 7, 2014 Live Streaming Video

© Copyright 2026