Creating Jobs and Supporting the U.S. Economy Swiss Direct Investment

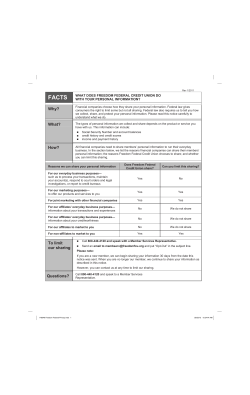

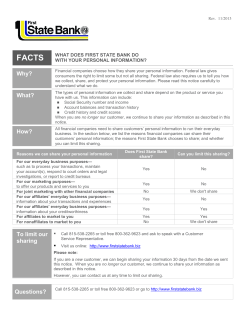

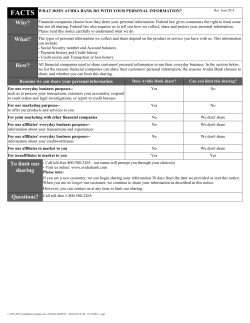

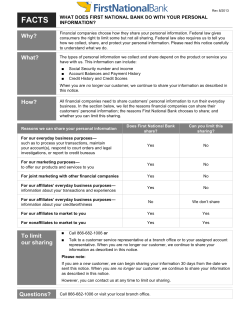

Creating Jobs and Supporting the U.S. Economy Swiss Direct Investment in the United States Report 2014 Contents Ambassador’s Foreword . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Quick Facts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Guest Forewords . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Swiss Direct Investment Abroad in 2012 . . . . . . . . . . . . . 6 Switzerland’s Impact on the U.S. Economy . . . . . . . . . . . 7 Company Profiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 2 Ambassador‘s Foreword The people of Switzerland and the United States have always based their nations on the foundations of democracy, federalism, and a free-market economy. They derive their strength from the shared values of personal freedoms, the rule of law, and solidarity. Swiss companies and their American affiliates have been among the leading direct investors in the U.S. for many years. As borne out by all current statistics, they remain committed to their endeavors in the U.S. with cumulative direct investment totaling $204 billion. In creating our first constitution, Swiss leaders sought inspiration and guidance from the U.S. Constitution. From those earliest days to the present, Swiss immigrants and their descendants have contributed to the American dream of opportunity and success. Furthermore, Swiss businesses today support nearly 450,000 jobs throughout the U.S. From 2009 to 2011, they added jobs in 36 states with gains of 100% or more in Mississippi, North Dakota, Louisiana, New Mexico, Wyoming and the District of Columbia. U.S. affiliates of Swiss companies even rank first with regard to two important indicators: expenditures for research and development (R&D) and average annual salaries of their employees: just below $100,000. Some of the most prominent Swiss-Americans include: ›› Albert Gallatin, fourth U.S. Secretary of the Treasury ›› Louis-Joseph Chevrolet, founder of the Chevrolet Motor Car Company ›› Othmar Ammann, engineer and bridge builder (George Washington Bridge, N.Y.) ›› Robert Portman, current U.S. Senator and Co-Chair of the Friends of Switzerland Caucus ›› Amy Klobuchar, current U.S. Senator and Co-Chair of the Friends of Switzerland Caucus Swiss businesses have operated in the U.S. for over a hundred years. Their success is rooted in their firm belief in entrepreneurship and innovation. With its small population of 8 million, Switzerland punches well above its weight in the U.S. economy and, given its world leadership in competitiveness and innovation, will continue to be a reliable partner of the United States in dealing with the economic and political challenges of our times. Martin Dahinden Ambassador of Switzerland to the United States of America 3 Quick Facts Punching way above its weight: Switzerland’s impact on U.S. jobs and the U.S. economy is very significant. 450,000 DIRECT JOBS % Of GROWTH JOB 160% GROWTH in FINANCE & INSURANCE—58,000 FooD—55,000 CHEMICAlS—51,000 R&D—23,000 oTHER—263,000 PARTNERS 15 STATES 2009–2011 VENDoRS SUPPLIERS 1 16% # JoBS IN All 50 STATES 1.8 MILLIoN INDIRECT JOBS AVERAGE SAlARy 100,000 SWITZERLAND’S IMPACT on U.S. Jobs & Economy 8.9 BIllIoN 206 R&D SPENDING 7 # BILLIoN in SAlES 1.4 204 BILLIoN 1 # 62 5 # BILLIoN +in VAlUE ADDED+ CUMUlATIVE INVESTMENT ASSETS TRILLIoN TRILLIONS 4 BILLIONS THOUSANDS 6 # 4 # HUNDREDS Guest Forewords This year’s numbers demonstrate once more the excellent economic ties between Switzerland and the United States. Data on foreign direct investment of Swiss affiliates in the U.S. tell the great success story of our business relationships. In the years since the financial crisis, trade has gone from record to record–in both directions! Over a two-year period, 2012-2013, Swiss exports to the USA grew nearly 20% and Swiss imports from the USA grew 25%. And all this in a rather anemic business environment! Foreign direct investments, which due to their longterm effects are an even better characterization of our mutual trust and appreciation, also went from record levels to new record levels. We take pride in our joint success. And we need to find even more opportunities Foreign direct investment (FDI) in the United States has played an important role throughout our nation’s history. The United States is proud of its robust entrepreneurial spirit, innovative mindset, and diversity. The United States is also proud of its investment regime, which is open, transparent, and nondiscriminatory. Today, foreign direct investment contributes to the U.S. economy across industry sectors and business activities in all 50 states. In 2012 alone, the United States attracted $160.1 billion of foreign direct investment. The total stock of FDI in the U.S. economy is valued at nearly $2.7 trillion, making it the largest recipient of FDI in the world. U.S. operations of foreign-owned firms support about 5.6 million jobs, and generate over one-fifth of U.S. annual exports. to work together on innovation and competitiveness. It is not by coincidence that Switzerland and the USA are both ranked the most innovative and most competitive countries in the world. In the following, you will read the story of a small, landlocked country in the Alps that has an astonishing footprint in the largest economy in the world and beats many countries boxing in a much higher weight class. Martin Naville CEO Swiss-American Chamber of Commerce Switzerland and the United States have numerous close ties to one another, including historical, financial, and familial. Not least among these ties are the robust business relationships that exist between our two countries. The United States places great value on our continued engagement and cooperation with our Swiss counterparts. Switzerland is the eighth largest source of direct investment in the United States by country of ultimate beneficial owner (UBO) and the sixth largest investor by country of foreign parent group. That is a remarkable position, and one that I am proud to encourage other potential Swiss investors to explore more closely through this report. Aaron S. Brickman Deputy Executive Director, SelectUSA U.S. Department of Commerce 5 Swiss Direct Investment Abroad in 2012 In 2012, almost one-fifth of all Swiss direct investment abroad went to the U.S., more than twice as much as to Luxembourg, the second largest country destination, and more than thirteen times as much as to China. Overall, Switzerland has the fifth highest rate of foreign direct investment outflows of all OECD countries, ahead of countries such as France, South Korea, Norway and Sweden. The main areas of investment are the financial and insurance sector (39.05%), chemicals and plastics (24.44%), other manufacturing and construction (10.01%), as well as electronics, energy, optical equipment and watchmaking (7.05%). Rest of the World, 14.6% Germany, 4.8% France, 2.9% Italy, 2.4% Luxembourg, 9.3% Brazil, 2.1% Netherlands, 5.7% Central & South American Financial Centers**, 12.1% Australia, 1.7% Singapore, 1.8% Japan, 1.3% China, 1.4% UK, 7.7% European Financial Centers*, 3.2% United States, 18.8% Rest of EU, 6.7% Canada, 3.5% Swiss Direct Investment Abroad in 2012 by country * Gibraltar, Guernsey, Jersey and the Isle of Man ** Anguilla, Bahamas, Barbados, Bermuda, Virgin Islands (British), Curaçao, Cayman Islands, Montserrat, Panama, Saint Kitts and Nevis, Saint Martin; as of 2000, including Virgin Islands (U.S.), Antigua and Barbuda, Belize, Dominica, Grenada, Saint Lucia, Saint Vincent and the Grenadines, Turks and Caicos Islands; as of 2011, including Aruba, excluding Bonaire, Saint Eustatius and Saba, Jamaica. Sources: Swiss National Bank, Statistics 2012, Swiss Direct Investment Abroad–by Country and Swiss Direct Investment Abroad-by Economic Activity OECD, FDI in Figures, April 2014 6 Switzerland’s Impact on the U.S. Economy The information presented here reveals the presence and strength of Swiss affiliates operating in the U.S. through various indicators such as their investments and job creation. The statistics show that Switzerland has a notable impact on the U.S. economy and adds to its growth across a range of sectors. Swiss Cumulative Direct Investment Tops $200 Billion Swiss companies have a long history of investing in the large and diversified U.S. economy that offers extraordinary business opportunities. State and local economic development agencies vie for Swiss investment because it brings skilled, and often highly paid, jobs to their communities. Switzerland is the sixth largest investing country in the United States. By the end of 2012, Switzerland had invested $204 billion, accounting for eight percent of the $2.7 trillion in foreign direct investment (FDI) stock in the United States. Switzerland and seven other countries make up the overwhelming majority of FDI in the United States. 1. United Kingdom $487 B All Others $541 B 2. Japan $308 B 8. Germany $199 B 7. Luxembourg $202 B 3. Netherlands $275 B 6. Switzerland 4. Canada $204 B 5. France $225 B $209 B Cumulative Foreign Direct Investment in the United States by Country through 2012 Swiss Direct Investment Flows Peak in 2008 $45.7 B $41.4 B Over the past decade, investment flows from Switzerland were exceptionally robust in 2008 and 2010, reaching $45.7 billion and $41.4 billion, respectively. A couple of notable years of disinvestment occurred in 2003 and 2007. *Foreign (Swiss in this instance) direct investment in the United States measures equity capital flows, reinvested earnings, and intercompany debt flows between U.S. affiliates and their parents abroad. 2013 investment flows for Switzerland are estimated because BEA disclosed data for quarter 3 and 4 only. Even though the U.S. government only disclosed Swiss investment data for two quarters in 2013, estimates indicate that Swiss affiliates invested $10 billion in the United States for the entire year. Based on that estimate, Switzerland would rank among the top ten largest foreign direct investors in the United States in 2013 flows. $19.9 B $12.6 B $10.7 B $10.0 B $6.6 B -$3.1 B 2003 2004 2005 $1.2 B -$4.3B 2006 2008 2007 2009 2010 2011 $0.3 B 2012 2013 (est.) Swiss Direct Investment in the United States* 2003–2013 7 Swiss Affiliates Rank 5th in Value Added $125.1 B $92.5 B *Value added measures the economic contribution of Swiss affiliates from the goods and services they sell in the United States. Swiss affiliates make a sizable contribution to the U.S. gross domestic product (GDP), contributing nearly $62 billion in value added to the U.S. economy in 2011. They accounted for eight percent of the $736 billion in value added generated by all foreign affiliates in 2011, placing Switzerland between Canada and France. The traditionally strong Swiss industries of chemicals, finance and insurance made up nearly half of the total value added from Swiss affiliates. 1. United Kingdom 2. Japan $84.8 B 3. Germany $64.8 B $61.9 B $61.0 B 4. Canada 5. Switzerland 6. France Top Countries in Value Added* by U.S. Affiliates of Foreign Companies, 2011 Swiss Affiliates Support Nearly 450,000 American Jobs Swiss affiliates create hundreds of thousands of American jobs. In 2011, 446,300 people were employed by Swiss affiliates in the United States, representing eight percent of the 5.6 million jobs created by all foreign affiliates. Switzerland ranks behind three European countries, Japan, and Canada. Some 450,000 people work directly for Swiss affiliates in the U.S. Through suppliers, vendors, and other business partners, Swiss affiliates indirectly support 1.8 million jobs in the U.S. 8 All Others 1,511,900 1. United Kingdom 943,500 2. Japan 686,600 7. Netherlands 399,800 3. Germany 581,300 6. Switzerland 446,300 5. France 4. Canada 524,400 546,900 Top Countries in Employment Supported by U.S. Affiliates of Foreign Companies, 2011 Top States in Employment by Swiss Affiliates, 2011 Employment 1. California 62,700 2. Texas 38,500 3. New York 38,300 4. New Jersey 34,100 5. Florida 20,900 6. Illinois 20,700 7. Pennsylvania 19,100 8. North Carolina 18,700 9. Ohio 17,000 10. Massachusetts 12,700 11. Georgia 10,200 12. Michigan 9,200 13. Indiana 8,900 14. Virginia 8,500 15. Wisconsin 8,000 15. Missouri 8,000 Employment by Swiss Affiliates, Top States, 2011 Top States in Job Growth by Swiss Affiliates, 2009–2011 Job Growth 2009–2011 1. Mississippi 160% 2. North Dakota 133% 3. District of Columbia 100% 3. Louisiana 100% 3. New Mexico 100% 3. Wyoming 100% 7. South Dakota 50% 8. Wisconsin 45% 9. Oklahoma 44% 10. Delaware 43% 11. Kansas 42% 12. Florida 22% 13. Texas 21% 14. Utah 19% 15. Iowa 16% 100%+ Growth 40%-100% Growth 15%-40% Growth Job Growth by Swiss Affiliates, Top States, 2009–2011 9 Swiss Affiliates’ Average Salary Nearly $100,000 $97,800 $89,600 $78,900 $78,400 3. France 4. Japan $74,500 Employees at Swiss affiliates earned an average salary (wages + benefits) of $97,800 in 2011, or about $40,000 more than the nation’s private sector average wage of $58,000. Collectively, the payrolls of Swiss affiliates totaled $44 billion in 2011. Of the seven largest countries by affiliated employment in the United States, Swiss companies paid the highest average salary, surpassing affiliates from Germany, France, Japan, and the United Kingdom. 1. 2. Switzerland Germany 5. United Kingdom Top Countries in Average Salaries by Foreign Affiliates in the United States, 2011 Swiss Affiliates Rank Sixth in Manufacturing Employment 312,100 270,100 246,400 Switzerland has always been strong in manufacturing. Through Swiss direct investment, U.S. manufacturing benefits from this strength. Swiss affiliates supported 161,900 manufacturing jobs in the United States in 2011, accounting for eight percent of the 2.1 million U.S. manufacturing jobs from all foreign-affiliated investment. 1. Japan 2. Germany 3. United Kingdom 178,100 175,200 4. France 5. Canada 161,900 6. Switzerland Top Countries in Manufacturing Employment Supported by Foreign Affiliates, 2011 Swiss Affiliates First in Food and Chemicals Manufacturing Swiss affiliates have made sizable investments in a number of manufacturing sectors which support tens of thousands of well-paying American manufacturing jobs. Four industrial sectors represented 80 percent of all jobs related to Swiss investment in U.S. manufacturing in 2011. Food manufacturing was the largest at nearly 55,000 jobs. Swiss investment in the U.S. chemicals industry, which covers pharmaceuticals and medicines, supported more than 50,000 American jobs in 2011. Swiss affiliates also accounted for 13,000 jobs in computers and electronic products, which includes semiconductor manufacturing, and almost 11,000 jobs in machinery manufacturing. 10 All Others 32,200 Food 54,800 Machinery 10,700 Computers & Electronics 13,000 Chemicals 51,200 U.S. Manufacturing Jobs Supported by Swiss Affiliates, 2011 Swiss Affiliates Rank Third in Finance and Insurance Employment 80,500 70,100 58,000 Swiss affiliates invest heavily in the U.S. finance and insurance sector. In 2011, they employed 58,000 U.S. workers, trailing only Canada and the United Kingdom. 37,500 32,000 1. Canada 2. 3. United Switzerland Kingdom 4. France 5. Germany Top Countries in Finance & Insurance Employment Supported by Foreign Affiliates, 2011 Swiss Affiliates Outspend All Other Countries in R&D Swiss affiliates bolster the U.S. R&D base. They accounted for 20 percent of R&D spending by all foreign affiliates in 2011. Ranked first, Swiss affiliates were ahead of affiliates from Japan, the United Kingdom, Germany, and France. These five countries made up nearly three-quarters of all foreign-affiliated R&D spending in 2011. 1. Switzerland $8.9 B All Others $12.5 B 2. Japan $6.9 B 5. France $5.1 B 4. Germany $5.5 B 3. United Kingdom $6.4 B Top Countries in R&D Performed by Foreign Affiliates, 2011 Swiss Affiliates Third in R&D Jobs 25,600 24,500 22,600 Research and development expenditures of Swiss affiliates yield thousands of U.S. jobs. In 2011, nearly 23,000 people worked in R&D of Swiss affiliates, placing Switzerland third behind German and British affiliates. They supported more U.S. jobs in R&D than French and Japanese affiliates. 20,000 19,200 The pharmaceuticals and medicines sector generated the greatest number of R&D jobs, employing more than 10,000 people, the most of any country’s affiliates in the United States. 1. Germany 2. 3. United Switzerland Kingdom 4. France 5. Japan Top Countries in R&D Employment Supported by Foreign Affiliates, 2011 11 Swiss Affiliates Export $10 Billion in Goods Exports to Foreign Parent Group $20.4 B $19.3 B Exports to Other Foreigners Swiss affiliates bolster U.S. exports. In 2011, their U.S. goods exports totaled $10 billion, representing three percent of the $304 billion exported from all foreign affiliates. U.S. affiliates from seven other countries each shipped more goods to foreign markets than Switzerland. More than 60 percent of exports from Swiss affiliates were exported back to their affiliate parents in Switzerland. In 2011, Swiss affiliates imported $19 billion, with most (84 percent) purchased from affiliates’ parents headquartered in Switzerland. $8.8 B 43% 5. France $9.9 B $9.7 B $4.9 B 25% $5.1 B 44% $6.0 B 61% $5.7 B 59% 6. Italy 7. Canada 8. Switzerland 9. South Korea Top Countries in Goods Exports by Foreign Affiliates, 2011 Swiss Affiliates’ Sales Exceed $200 Billion Swiss affiliates add to the American economy through sales. Totaling $206 billion in 2011, their sales made up six percent of the $3.5 trillion in sales by all foreign affiliates. Switzerland ranked seventh behind Japan (with more than one-half trillion dollars in sales), four other European countries, and Canada. Combined sales of Swiss manufacturing affiliates totaled $96 billion in 2011, with chemicals at $47 billion. Finance and insurance, along with wholesale trade, also represented significant shares of Swiss-affiliated sales. All Others $995 B 1. Japan $571 B 2. United Kingdom $494 B 7. Switzerland $206 B 3. Germany $386 B 6. Canada 4. $243 B 5. France Netherlands $354 B $262 B Top Countries in Sales by Foreign Affiliates, 2011 12 Swiss Affiliates Pay Billions in U.S. Income Taxes $8.5 B $7.5 B $6.4 B Like all companies in the United States, foreign affiliates pay U.S. income taxes. Swiss affiliates ranked sixth, paying only slightly less than Canadian affiliates in 2011, with both hovering around $4.5 billion. Swiss companies in the chemicals sector paid the most taxes, totaling nearly $2.3 billion. $5.1 B $4.6 B 1. 2. 3. 4. Japan Germany United France Kingdom $4.5 B 5. 6. Canada Switzerland Top Countries in U.S. Income Taxes Paid by Foreign Affiliates, 2011 Swiss Affiliates Rank Fourth in Assets Swiss affiliates boast significant assets in the United States. Holding $1.4 trillion in assets in 2011, Swiss affiliates ranked fourth behind the United Kingdom, Germany, and Canada. Finance and insurance accounted for nearly 85 percent, or $1.2 trillion, of all Swiss-owned assets in the United States in 2011. All Others $2.3 T 1. United Kingdom $2.2 T 7. Netherlands $1.0 T 6. France $1.2 T 5. Japan $1.3 T 2. Germany $1.5 T 3. Canada $1.5 T 4. Switzerland $1.4 T Top Countries in Total Assets from Foreign Affiliates, 2011 13 Employment by State Every state in the U.S. benefits from Swiss direct investment and therefore from employment opportunities. In the majority of states, the employment rate of U.S. workers at Swiss affiliates has seen a gradual increase over the years. Some significant figures demonstrate the prosperity of Swiss affiliates by region. State Employment by Swiss Affiliates, 2009–2011 2009 United States Total Alabama Alaska 2010 2011 2009–2011 Change 408,500 445,900 446,300 9% 3,100 3,200 3,200 3% Montana 300 300 300 0% 300 300 300 0% Nebraska 1,900 2,100 2,100 11% Arizona 6,400 6,900 7,200 13% Nevada 2,500 2,200 2,200 -12% Arkansas 2,600 2,700 2,800 8% New Hampshire 2,500 2,400 2,400 -4% California 59,600 63,100 62,700 5% New Jersey 31,300 32,100 34,100 9% Colorado 5,700 6,300 6,400 12% New Mexico 400 800 800 100% Connecticut 8,100 8,600 7,700 -5% New York 35,600 37,600 38,300 8% Delaware 2,100 2,100 3,000 43% North Carolina 18,000 17,800 18,700 4% 700 1,300 1,400 100% North Dakota 300 500 700 133% Florida 17,100 20,900 20,900 22% 17,500 16,700 17,000 -3% Georgia 10,200 11,300 10,200 0% Oklahoma 2,500 3,400 3,600 44% Hawaii 1,000 900 1,000 0% Oregon Idaho 1,300 1,200 1,100 -15% Pennsylvania Illinois 19,300 19,300 20,700 7% Rhode Island 1,100 Indiana 8,800 8,900 8,900 1% South Carolina 6,100 Iowa 2,500 2,000 2,900 16% South Dakota Kansas 4,500 6,700 6,400 42% Tennessee Kentucky 5,400 5,900 5,900 9% Louisiana 2,300 4,300 4,600 100% Maine 2,300 2,000 2,000 -13% Maryland 6,500 7,300 7,000 8% District of Columbia Massachusetts Ohio 4,100 4,200 4,300 5% 18,200 19,700 19,100 5% 1,000 1,000 -9% 6,000 5,900 -3% 200 300 300 50% 3,900 4,200 4,200 8% Texas 31,700 42,900 38,500 21% Utah 2,700 3,300 3,200 19% Vermont 1,400 1,400 1,500 7% Virginia 7,500 8,400 8,500 13% 11,500 12,700 12,700 10% Washington 3,600 4,000 3,800 6% Michigan 9,600 9,200 9,200 -4% West Virginia 1,500 1,800 1,000 -33% Minnesota 5,200 4,500 4,600 -12% Wisconsin 5,500 7,800 8,000 45% Mississippi 500 1,300 1,300 160% Wyoming 400 700 800 100% 7,700 6,700 8,000 4% Missouri 14 2011 Ranking* United States Total Employment 446,300 1. California 62,700 2. Texas 38,500 28. Washington 3,800 3. New York 38,300 29. Oklahoma 3,600 4. New Jersey 34,100 30. Alabama 3,200 5. Florida 20,900 30. Utah 3,200 6. Illinois 20,700 32. Delaware 3,000 7. Pennsylvania 19,100 33. Iowa 2,900 8. North Carolina 18,700 34. Arkansas 2,800 9. Ohio 17,000 35. New Hampshire 2,400 10. Massachusetts 12,700 36. Nevada 2,200 11. Georgia 10,200 37. Nebraska 2,100 12. Michigan 9,200 38. Maine 2,000 Vermont 1,500 13. Indiana 8,900 39. 14. Virginia 8,500 40. District of Columbia 1,400 Mississippi 1,300 15. Wisconsin 8,000 41. 15. Missouri 8,000 42. Idaho 1,100 Rhode Island 1,000 17. Connecticut 7,700 43. 18. Arizona 7,200 43. West Virginia 1,000 19. Maryland 7,000 43. Hawaii 1,000 20. Kansas 6,400 46. New Mexico 800 20. Colorado 6,400 46. Wyoming 800 22. Kentucky 5,900 48. North Dakota 700 22. South Carolina 5,900 49. South Dakota 300 24. Minnesota 4,600 49. Alaska 300 24. Louisiana 4,600 49. Montana 300 26. Oregon 4,300 27. Tennessee 4,200 *tied states receive the same ranking 15 Company Profiles Highlights of Strategic Investments by Swiss Affiliates in the U.S. The Swiss-American Chamber of Commerce in Zurich, Switzerland, invited leading Swiss affiliates in the U.S. to provide complementary case studies. These company profiles highlight significant achievements of Swiss affiliates and include small businesses with approximately 100 employees up to large multinational Swiss-affiliated businesses with more than 51,000 employees based in the United States. They reflect a cross section of industries including finance and insurance, manufacturing, and pharmaceuticals and medicine. ABB, with some 140,000 employees worldwide and more than 19,000 employees across the U.S., is a leading power and automation technology group. Its activities include power grid technology, robotics, energy-efficient motors and drives and solutions for building automation. With its most recent U.S. acquisition, Power-One, ABB has become a global leader in solar inverters. In the past four years, ABB has strongly expanded its U.S. operations, investing over $11 billion, with annual revenues of around $7 billion. One of its seven global R&D centers is located on the campus of North Carolina State University in Raleigh along with its Smart Grid Center of Excellence and the regional headquarters for ABB’s power-related businesses. 16 Autoneum is the leading supplier to the major light vehicle and heavy truck manufacturers around the world, providing innovative solutions for noise reduction and thermal management in vehicles. In 2013, Autoneum generated over $2.2 billion in sales, around $970 million of which was earned in the Business Group North America (USA, Canada and Mexico). The Business Group North America buys from mainly U.S. suppliers and has invested around $100 million in capital expenditures over the past three years. Autoneum’s eight U.S. manufacturing sites provide 2,700 jobs. Its expansion into two new manufacturing sites in the U.S. has been announced and will create new investment and jobs. Bühler is a specialist and technology partner for plant, equipment and services for processing basic foods and for manufacturing advanced materials. The Group holds leading market positions worldwide in technologies and processes for transforming grain into flour and feeds, making pasta and chocolate, as well as in the field of aluminum die casting. In 2012, Bühler created the first U.S.-based food-grade Food Innovation Center at its North America headquarters in Plymouth, Minnesota. That same year, Bühler introduced its Apprenticeship Academy to the U.S. (based at its North America headquarters), offering apprentices three-year programs that utilize a hands-on approach to developing technical, methodological, and social skills across a wide range of disciplines. Bühler Group operates in over 140 countries and 750 of its 10,000 employees worldwide are employed in the North America Region. The company’s total investment in the U.S. amounted to $150 million over the last 8 years. Conzzeta is an industrial holding company specializing in industrial manufacturing as well as in mountaineering and sports equipment. With $92 million of its capital invested in seven U.S. business units, the company employs more than 313 people in Illinois, Colorado, Vermont, South Carolina, Tennessee, and New Jersey. By purchasing goods and services, the secondary effects on the U.S. economy are estimated at $63 million. GF Georg Fischer AG has a worldwide presence in 32 countries and employs 14,000 people. In the U.S., 1,177 employees work for GF. GF Piping Systems specializes in plastic piping systems for the safe transport of water and gas in a variety of industries, including the utilities and building sectors, providing fittings, valves, pipes, automation and jointing technology. GF Machining Solutions provides electrical discharge, high-speed milling and laser texturing machines along with automation solutions. The company is the world leader in the tool and mold making industry and among manufacturers of precision components and serves customers in the information and communication technology and aerospace sectors and the automotive industry. U.S. sales exceeded $500 million in 2013. The value of goods and services purchased from American suppliers in 2013 amounts to $280 million. Holcim is one of the world’s leading cement manufacturers and has a presence on all continents. Aggregate Industries US of the Holcim Group is a leading provider of aggregate materials, ready-mix concrete and asphalt in the U.S. Together, both companies employ approximately 5,000 people here. Holcim has invested more than $750 million in the U.S. over the past five years and will complete a modernization of its plant in Hagerstown, Maryland, by 2016. A major investment was the construction of the St. Genevieve plant in Missouri, considered to be one of the most modern and environmentally friendly cement plants in the U.S. Kaba Group is a leading global provider of high-quality and innovative keys, cylinders, physical access systems, enterprise data, time recording, and lodging access systems and also leads the global market in high-security locks, key blanks, transponder keys and key manufacturing machines. Kaba’s sales revenue in the Americas of $320 million per year mainly comes from the U.S. Kaba employs about 1,400 people in the Americas, the majority of whom in the U.S. Kaba Group’s total investments in the U.S. amount to $500 million. Over the past twelve months, the company has invested $3 million and another $5 million investment is planned. The value of goods and services purchased from American suppliers in the past twelve months amounts to $115 million. Kudelski Group is a world leader in digital security, offering a wide range of services and applications to secure the revenues of content owners and service providers for digital television. Kudelski leads the market in access control and management of people or vehicles to sites and events such as smart card-based systems for public access applications at ski resorts, arenas and parking lots. The company also offers cybersecurity solutions and services focused on helping clients assess risks and vulnerabilities and protect their data and systems. Over 3,000 people work for Kudelski worldwide. In the U.S., Kudelski has fourteen companies, employing over 400 people and generating an annual revenue of more than $150 million in 2013. Max Daetwyler Corporation is a worldwide leading supplier of Doctor Blades and other pressroom products for the printing industry. In addition, Daetwyler Industries, a world-class supplier of precision machinery, offers single-source manufacturing capabilities. In 2009, Micro Waterjet, LLC (MWJ) was formed through a partnership with Waterjet AG and Max Daetwyler Corporation to bring micro manufacturing services utilizing advanced abrasive Waterjet technologies to North America. Also in 2009, Daetwyler Clean Energy LLC was founded to offer Daetwyler’s engineering, manufacturing and assembly strengths to the growing renewable energy industry, including a product line with commercial ground mount, rooftop and parking deck solar mounting structures. Daetwyler Corporation employs about 100 people in the U.S., has invested a total of $12 million in the country and on average purchases $7 million in goods and services from American suppliers every year. 17 Novartis, with 27,071 employees across the U.S., is a leader in the global healthcare business, providing medicine, eye care, generic pharmaceuticals, preventative vaccines, diagnostic tools and over-the-counter and animal health products. The U.S. is a major center for its R&D, manufacturing, sales and marketing, with operations in California, Colorado, Florida, Georgia, Illinois, Iowa, Massachusetts, Nebraska, New Jersey, New York, North Carolina, Pennsylvania, Puerto Rico, Texas, Washington, D.C., and West Virginia. Roche, a leader in research-focused health care with consistent strength in pharmaceuticals and diagnostics, employs 20,000 people in the U.S. In recent years, it has acquired several U.S.-based companies such as Genentech, Anadys Pharmaceuticals, Constitution Medical and IQuum amounting to U.S. investments of around $48 billion. U.S. investments in property, plant and equipment amounted to $3 billion. Swiss Post Solutions SPS North America, a subsidiary of Swiss Post, is a leading provider of strategic business process outsourcing and document management services. Services include invoice and forms processing, physical and digital mailroom management, physical and digital records management, and onsite office support services, including reception desk operations as well as management of conference rooms, print services, call centers/switchboards and IT. SPS employs over 1,500 people in more than 70 cities throughout the U.S. and Canada. Tetra Pak® is the world’s leading food processing and packaging solutions company. Tetra Pak provides 1,200 jobs at facilities in Texas, Washington state, and Missouri. Since establishing a presence in the U.S. almost 40 years ago, Tetra Pak has invested approximately $400 million, including over $34 million invested in the past three years. Approximately 75% of the Tetra Pak products sold in the U.S. are manufactured in the U.S. This year Tetra Pak will invest in a new printing press, which will increase its Denton, Texas, factory’s overall capacity and allow future growth for safe, innovative and environmentally sound products which meet the needs of hundreds of millions of people across the globe. 18 UBS is one of the largest global financial services businesses, with about 21,000 employees in 283 locations in 48 states across the U.S., the District of Columbia, and Puerto Rico. UBS’s U.S. work force represents 33% of the firm’s global permanent staff. Since 2010, UBS has recruited at over 50 colleges and provided 1,128 full-time positions and 1,723 internships to U.S. students. In 2013, UBS conducted more than $3 billion in business with U.S.-based vendors including Microsoft, Bloomberg, Cigna, Cognizant Technology, IBM and Hewlett-Packard. UBS also leases more than 10.6 million square feet of commercial space in the U.S. WICOR is the market leader in electrical insulation of power and distribution transformers in North America. WICOR is an important supplier of equipment used to maintain and improve the electric power transmission grid. Innovations include contributing to the implementation of the so-called smart grid, which is crucial to the overall reliability of the North American electric power transmission system. The company employs 522 people in the U.S. at facilities in Vermont, Ohio and Alabama. The company also owns R&D laboratories in several states throughout the U.S. To date WICOR has invested over $300 million, over $100 million of which was invested in Ohio in the past three years. Additional investment between $10 million and $15 million is in the plans over the coming two to three years, not including a planned acquisition. Zurich opened its New York branch in 1912, making it one of the oldest insurance companies in the U.S. Zurich serves the U.S. as one of the country’s largest insurers of vehicles, homes, small and mid-sized businesses, farm businesses, local governments and Fortune 500 companies. Zurich U.S. companies employ over 8,200 people in offices throughout the country with major centers of employment in the metropolitan areas of Chicago, New York City, Kansas City, Omaha, Baltimore and Orlando. Through Zurich’s affiliation with Farmers Insurance, an additional 50,000 exclusive and independent agents and nearly 24,000 people have jobs all over the U.S. 19 Published by: Embassy of Switzerland in the U.S. 2900 Cathedral Ave., N.W., Washington, D.C. 20008 www.swissemb.org [email protected] Acknowledgments The Embassy of Switzerland would like to thank Aaron S. Brickman, Martin Naville and all the Swiss affiliates that contributed information to this report. About the Data: This report presents the most current statistics on the business activities of Swissowned affiliates from the U.S. Bureau of Economic Analysis (BEA) at the time of publication. The data refer only to commercial activities of Swiss companies that are unambiguously under Swiss control (those more than 50 percent owned by Swiss direct investors, or majority-owned affiliates). Annually, BEA requires foreign-owned affiliates to report on their business activities in the United States. Statistical research and reporting Content First LLC, Washington, D.C. Graphs and photos Federal Department of Foreign Affairs Clear Sky Creative, LLC, Washington, D.C. Dent Digital, Washington, D.C. Printing Gabro Printing & Graphics, Virginia More Swiss FDI Online Visit us on YouTube for a short video about Swiss direct investment in the U.S. featuring interviews with CEOs of Swiss companies and FDI experts. Download this brochure as a PDF file from our webpage at www.swissemb.org Washington, D.C., September 2014

© Copyright 2026