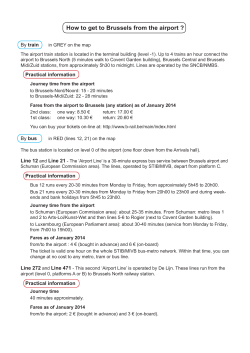

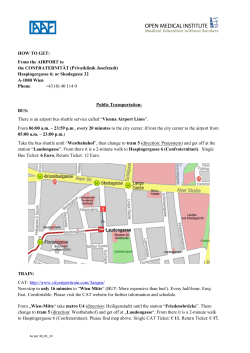

Consultation Document