The End-User Guides to Derivatives Regulation Eligible Contract Participant Definition Version 2.0

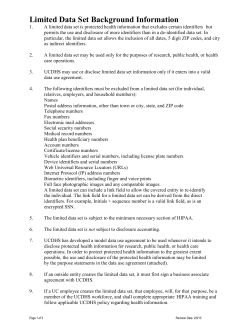

The End-User Guides to Derivatives Regulation Eligible Contract Participant Definition Version 2.0 Eligible Contract Participant Definition: Effective October 12, 2012, only “eligible contract participants” are permitted to enter into over-thecounter swaps, as defined by the Commodity Exchange Act. This “limitation on participation” rule means that a party must be an eligible contract participant at the time of trading. Generally, eligible contract participants include: • Entities with $10 million in total assets; • Entities with a guarantor that is an entity with $10 million in assets; • Entities with a net worth of at least $1 million and are hedging; • Individuals with “amounts invested on a discretionary basis” that exceed $10 million, or $5 million if hedging; • An entity who meet the following conditions: (i) all of its owners are ECPs; (ii) it and its owners have, in aggregate, $1 million in net worth; (ii) it is entering into an interest rate, FX, or commodity derivative; and (iii) it is using the swap to hedge a commercial risk. This guide contains the text of the Eligible Contract Participant definition. The orange text shows changes effectuated by Congress pursuant to the Dodd-Frank Act; these changes were effective July 16, 2012. The green text is further definition by the CFTC in its final rule “Further Definition of ‘Swap Dealer,’ ‘SecurityBased Swap Dealer,’ ‘Major Swap Participant,’ ‘Major Security-Based Swap Participant’ and ‘Eligible Contract Participant’; these green changes were effective as of July 23, 2012 (except for 17 CFR 1.3(m)(5) and (6), which are effective December 31, 2012). PR OPR IE TA RY – A L L R IGH TS RES ERVE D Section 1a(128) of the Commodity Exchange Act: Eligible contract participant. The term “eligible contract participant” means— (A) acting for its own account— (i) a financial institution; (ii) an insurance company that is regulated by a State, or that is regulated by a foreign government and is subject to comparable regulation as determined by the Commission, including a regulated subsidiary or affiliate of such an insurance company; (iii) an investment company subject to regulation under the Investment Company Act of 1940 (15 U.S.C. 80a–1 et seq.) or a foreign person performing a similar role or function subject as such to foreign regulation (regardless of whether each investor in the investment company or the foreign person is itself an eligible contract participant); (iv) a commodity pool that— (I) has total assets exceeding $5,000,000; and (II) is formed and operated by a person subject to regulation under this chapter or a foreign person performing a similar role or function subject as such to foreign regulation (regardless of whether each investor in the commodity pool or the foreign person is itself an eligible contract participant); (v) a corporation, partnership, proprietorship, organization, trust, or other entity— (I) that has total assets exceeding $10,000,000; (II) the obligations of which under an agreement, contract, or transaction are guaranteed or otherwise supported by a letter of credit or keepwell, support, or other agreement by an entity described in subclause (I), in clause (i), (ii), (iii), (iv), or (vii), or in subparagraph (C); or (III) that— (aa) has a net worth exceeding $1,000,000; and (bb) enters into an agreement, contract, or transaction in connection with the conduct of the entity’s business or to manage the risk associated with an asset or liability owned or incurred or reasonably likely to be owned or incurred by the entity in the conduct of the entity’s business; (vi) an employee benefit plan subject to the Employee Retirement Income Security Act of 1974 (29 U.S.C. 1001 et seq.), a governmental employee benefit plan, or a foreign person performing a similar role or function C H AT H A M F I N A N C I A L subject as such to foreign regulation— (I) that has total assets exceeding $5,000,000; or (II) the investment decisions of which are made by— (aa) an investment adviser or commodity trading advisor subject to regulation under the Investment Advisers Act of 1940 (15 U.S.C. 80b–1 et seq.) or this chapter; (bb) a foreign person performing a similar role or function subject as such to foreign regulation; (cc) a financial institution; or (dd) an insurance company described in clause (ii), or a regulated subsidiary or affiliate of such an insurance company; (vii) (I) a governmental entity (including the United States, a State, or a foreign government) or political subdivision of a governmental entity; (II) a multinational or supranational government entity; or (III) an instrumentality, agency, or department of an entity described in subclause (I) or (II); except that such term does not include an entity, instrumentality, agency, or department referred to in subclause (I) or (III) of this clause unless (aa) the entity, instrumentality, agency, or department is a person described in clause (i), (ii), or (iii) of paragraph (11)(A) of this section paragraph (17) (A); (bb) the entity, instrumentality, agency, or department owns and invests on a discretionary basis $25,000,000 $50,000,000 or more in investments; or (cc) the agreement, contract, or transaction is offered by, and entered into with, an entity that is listed in any of subclauses (I) through (VI) of section 2 (c)(2)(B)(ii) of this title; (viii) (I) a broker or dealer subject to regulation under the Securities Exchange Act of 1934 (15 U.S.C. 78a et seq.) or a foreign person performing a similar role or function subject as such to foreign regulation, except that, if the broker or dealer or foreign person is a natural person or proprietorship, the broker or dealer or foreign person shall not be considered to be an eligible contract participant unless the broker or dealer or foreign person also meets the requirements of clause (v) or (xi); (II) an associated person of a registered broker or dealer concerning the financial or securities activities of which the registered person makes and keeps records under section 15C(b) or 17(h) | 235 Whitehorse Lane Kennett Square, PA 19348 | T 610.925.3120 | F 610.925.3125 PROPRIE TA RY – A L L R IGH TS RE S ERVE D 2 CHATHAMFINANCIAL.COM of the Securities Exchange Act of 1934 (15 U.S.C. 78o–5 (b),78q (h)); (III) an investment bank holding company (as defined in section 17(i) of the Securities Exchange Act of 1934 (15 U.S.C. 78q (i)); (ix) a futures commission merchant subject to regulation under this chapter or a foreign person performing a similar role or function subject as such to foreign regulation, except that, if the futures commission merchant or foreign person is a natural person or proprietorship, the futures commission merchant or foreign person shall not be considered to be an eligible contract participant unless the futures commission merchant or foreign person also meets the requirements of clause (v) or (xi); (x) a floor broker or floor trader subject to regulation under this chapter in connection with any transaction that takes place on or through the facilities of a registered entity (other than an electronic trading facility with respect to a significant price discovery contract) or an exempt board of trade, or any affiliate thereof, on which such person regularly trades; or (xi) an individual who has total assets in an amount amounts invested on a discretionary basis, the aggregate of which is in excess of— (I) $10,000,000; or (II) $5,000,000 and who enters into the agreement, contract, or transaction in order to manage the risk associated with an asset owned or liability incurred, or reasonably likely to be owned or incurred, by the individual; (B) (i) a person described in clause (i), (ii), (iv), (v), (viii), (ix), or (x) of subparagraph (A) or in subparagraph (C), acting as broker or performing an equivalent agency function on behalf of another person described in subparagraph (A) or (C); or (ii) an investment adviser subject to regulation under the Investment Advisers Act of 1940 [15 U.S.C. 80b–1 et seq.], a commodity trading advisor subject to regulation under this chapter, a foreign person performing a similar role or function subject as such to foreign regulation, or a person described in clause (i), (ii), (iv), (v), (viii), (ix), or (x) of subparagraph (A) or in subparagraph (C), in any such case acting as investment manager or C H AT H A M F I N A N C I A L fiduciary (but excluding a person acting as broker or performing an equivalent agency function) for another person described in subparagraph (A) or (C) and who is authorized by such person to commit such person to the transaction; or (C) any other person that the Commission determines to be eligible in light of the financial or other qualifications of the person. 17 CFR Part 1: Section 1.3 “Definitions” is amended by adding 1.3(m): 1.3(m) Eligible contract participant. This term has the meaning set forth in Section 1a(18) of the Commodity Exchange Act, except that: (1) A major swap participant, as defined in Section 1a(33) of the Act and paragraph (hhh) of this section, is an eligible contract participant; (2) A swap dealer, as defined in Section 1a(49) of the Act and paragraph (ggg) of this section, is an eligible contract participant; (3) A major security-based swap participant, as defined in Section 3(a)(67) of the Securities Exchange Act of 1934 and § 240.3a67–1 of this title, is an eligible contract participant; (4) A security-based swap dealer, as defined in Section 3(a)(71) of the Securities Exchange Act of 1934 and § 240.3a71–1 of this title, is an eligible contract participant; (5) [relating to commodity pools] (i) A transaction-level commodity pool with one or more direct participants that is not an eligible contract participant is not itself an eligible contract participant under either Section 1a(18)(A)(iv) or Section 1a(18)(A)(v) of the Act for purposes of entering into transactions described in Sections 2(c)(2)(B)(vi) and 2(c)(2)(C)(vii) of the Act; and (ii) In determining whether a commodity pool that is a direct participant in a transaction-level commodity pool is an eligible contract participant for purposes of paragraph (m)(5)(i) of this section, the participants in the commodity pool that is a direct participant in the transaction-level commodity pool shall not be considered unless the 3 | 235 Whitehorse Lane Kennett Square, PA 19348 | T 610.925.3120 | F 610.925.3125 PROPR IE TA RY – A L L RIGH TS RES ERVE D CHATHAMFINANCIAL.COM transaction-level commodity pool, any commodity pool holding a direct or indirect interest in such transaction-level commodity pool, or any commodity pool in which such transaction-level commodity pool holds a direct or indirect interest, has been structured to evade subtitle A of Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act by permitting persons that are not eligible contract participants to participate in agreements, contracts, or transactions described in Section 2(c)(2)(B)(i) or Section 2(c)(2)(C)(i) of the Act; (6) A commodity pool that does not have total assets exceeding $5,000,000 or that is not operated by a person described in subclause (A)(iv)(II) of Section 1a(18) of the Act is not an eligible contract participant pursuant to clause (A)(v) of such Section; (7) [relating to hedging or mitigating commercial risk] (i) For purposes of a swap (but not a security-based swap, security-based swap agreement or mixed swap) used to hedge or mitigate commercial risk, an entity may, in determining its net worth for purposes of Section 1a(18)(A)(v)(III) of the Act, include the net worth of any owner of such entity, provided that all the owners of such entity are eligible contract participants; (ii) (A) For purposes of identifying the owners of an entity under paragraph (m)(7)(i) of this section, any person holding a direct ownership interest in such entity shall be considered to be an owner of such entity; provided, however, that any shell company shall be disregarded, and the owners of such shell company shall be considered to be the owners of any entity owned by such shell company; of the business; (3) Directly is responsible for all of the liabilities of the business; and (4) Acquires its interest in the entity seeking to qualify as an eligible contract participant under paragraph (m)(7)(i) of this section in connection with the operation of the individual’s proprietorship or to manage the risk associated with an asset or liability owned or incurred or reasonably likely to be owned or incurred by the individual in the operation of the individual’s proprietorship; and (iii) For purposes of paragraph (m)(7)(i) of this section, a swap is used to hedge or mitigate commercial risk if the swap complies with the conditions in paragraph (kkk) of this section; and (8) Notwithstanding Section 1a(18)(A)(iv) of the Act and paragraph (m)(5) of this section, a commodity pool that enters into an agreement, contract, or transaction described in Section 2(c)(2)(B)(i) or Section 2(c)(2)(C) (i)(I) of the Act is an eligible contract participant with respect to such agreement, contract, or transaction, regardless of whether each participant in such commodity pool is an eligible contract participant, if all of the following conditions are satisfied: (i) The commodity pool is not formed for the purpose of evading regulation under Section 2(c)(2)(B) or Section 2(c)(2)(C) of the Act or related Commission rules, regulations or orders; (ii) The commodity pool has total assets exceeding $10,000,000; and (iii) The commodity pool is formed and operated by a registered commodity pool operator or by a commodity pool operator who is exempt from registration as such pursuant to § 4.13(a) (3) of this chapter. (B) For purposes of paragraph (m)(7)(ii)(A) of this section, the term shell company means any entity that limits its holdings to direct or indirect interests in entities that are relying on this paragraph (m)(7); and (C) In determining whether an owner of an entity is an eligible contract participant for purposes of paragraph (m)(7)(i) of this section, an individual may be considered to be a proprietorship eligible contract participant only if the individual—(1) Has an active role in operating a business other than an entity; (2) Directly owns all of the assets C H AT H A M F I N A N C I A L | 235 Whitehorse Lane Kennett Square, PA 19348 | T 610.925.3120 | F 610.925.3125 PROPR IE TA RY – A L L R IGH TS RES ERVE D 4 CHATHAMFINANCIAL.COM About Chatham Chatham Financial is the largest independent interest rate and currency risk advisory, and a recognized leader in accounting, valuations and debt advisory. Founded in 1991, Chatham has built its business bringing transparency, fairness and responsiveness to more than 1,000 firms globally. Through our work on tens of thousands of complex financial transactions, Chatham has married deep capital markets expertise with best-in-class technology. For the past two years Chatham has been actively engaged in the policy debate over effective regulation of the over-the-counter (“OTC”) derivatives market, playing a lead role in the legislative and regulatory rulemaking process for Title VII of the Dodd-Frank Act. Contact Information REGULATORY ADVISORY SERVICES INDUSTRY SECTOR LEADERSHIP LUKE ZUBROD TED MCCULLOUGH LAURA GRANT BOB NEWMAN MARK AUDIGIER Director, Regulatory Advisory Services 610.925.3136 [email protected] MIKE ASHBY Senior Advisor, Clearing Services 720.221.3503 [email protected] PAM BROWN Senior Advisor, Regulatory Advisory Services 484.731.0414 [email protected] JAMIE MCCONNEL Senior Advisor, Regulatory Advisory Services 484.731.0028 [email protected] RYAN MCKEE Senior Advisor, Regulatory Advisory Services (Europe) +44 (0) 207.557.7012 [email protected] Managing Director, Global Hedging Advisory Services 610.925.4765 [email protected] Managing Director, Financial Institutions Advisory Services 610.925.3137 [email protected] Director, Public Real Estate & Structured Finance Advisory Services 484.731.0006 [email protected] Director, Emerging & Frontier Markets Advisory Services 484.731.0252 [email protected] AMOL DHARGALKAR Director, Corporate Advisory Services 484.731.0226 [email protected] BRIAN CONLY Director, Private Equity & Real Estate Advisory Services 610.925.3129 [email protected] CRAIG PFLUMM Senior Advisor, Reporting and Operations 484.731.0256 [email protected] CHRISTINA NORLAND AUDIGIER Deputy General Counsel & Senior Advisor, Regulatory Advisory Services 484.731.0093 [email protected] Version 2.0 © August 2012: First version of this online guide. All Rights Reserved. Disclaimer The information in this document is for informational purposes only and should not be used as legal, accounting, financial or regulatory advice. The information in this document is not intended as a substitute for appropriate professional advice. The impact of the DoddFrank Act and related laws will vary for any particular situation based upon numerous factors; therefore, you should not act upon any information in this document without seeking an appropriate professional legal, accounting or financial advisor. No responsibility is assumed for the accuracy or timeliness of any information in this document. 5 C H AT H A M F I N A N C I A L | 235 Whitehorse Lane Kennett Square, PA 19348 | T 610.925.3120 | F 610.925.3125 PROPR IE TA RY – A L L R IGH TS RES ERVE D CHATHAMFINANCIAL.COM

© Copyright 2026