Document 432786

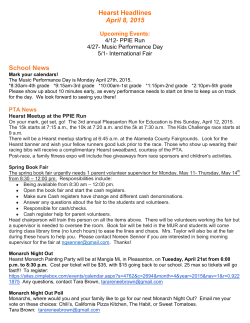

since 1987 Client Briefing November 2014 I N DEPEN DENT I N VESTMENT BAN K I N G FO R M E DI A , I N FORMATION, MARKETI NG & TECH NOLOGY In This Issue 01 02 03 04 05 08 • 2014 Outsell Signature Event • Outsell’s 2015 Information Industry Outlook • Overview of Hearst International • JEGI Welcomes Jeff Becker • Global Economic Outlook • M&A Driving Connections between Brands, Consumers & Digital Things • JEGI Q3 2014 M&A Overview • Exceptional Transaction Experience JEGI July 2014 Emerging Company Dinner (from left) Rich Harris, CEO, AddThis; Matt Egol, Partner, Strategy&; Wilma Jordan, Founder & CEO, JEGI; Helen Thomas, President, America, BlueFocus Communication Group; and Sheldon Owen, Co-Founder & CEO, Unified Social To subscribe to JEGI’s Client Briefing Newsletter: http://bit.ly/YzEqQK Follow JEGI on Twitter: http://twitter.com/JordanEdmiston 1 2014 Outsell Signature Event: Convergence Now! The 8th annual Outsell Signature Event, titled “Convergence Now!”, brought together approximately 120 senior executives and thought leaders from across the global information industry for three days of networking, learning and sharing ideas among peers. The convergence of media, information, and technology presents a huge opportunity for the industry, and it’s happening now. information industry in the years ahead. Excerpts from these presentations follow. Outsell’s 2015 Information Industry Outlook Leigh Watson Healy, Chief Analyst, Outsell, Inc. Outsell’s theme in 2014, and for the Signature Event, was Convergence Now! We’re beyond the concept of content vs. technology and the digital shift – we are Held September 30-October 2 at the Tri- seeing true convergence as devices, huanon Palace in Versailles, this collaborative mans, technologies, value chains, content, effort between Outsell, a leading research machines, and workflows blend at an firm for the information industry, and The unprecedented pace into one interactive Jordan, Edmiston Group, Inc. (JEGI), a lead- ecosystem. ing provider of investment banking ser- With this convergence and with our exvices to the information industry, creates panded coverage of emerging growth an environment where global information segments – the information industry is industry executives can retool and en- now $738 billion in annual revenues globhance their perspectives on the industry ally. Marketing Services & Automation is and their marketplaces. the biggest segment, followed closely by Education Content, Technology & HCM This peer-to-peer, by-invitation-only con(Human Capital Management). ference was highlighted by a superior (continued on page 7) line-up of industry leading executives and thought leading speakers, including: BenJEGI July 2014 Emerging jamin Ware Starnes, M.D., F.A.C.S., ProCompany Dinner fessor of Surgery & Chief of the Vascular Surgery Division at the University of Washington; Stephen Carter, Group Chief Executive, Informa; Bob Carrigan, President & CEO, Dun and Bradstreet; Richard Bejtlich, Chief Security Strategist, FireEye; Ben Hammersley, Journalist, Futurist & Technologist; and many more. The conference opened with “on the record” presentations from Outsell, JEGI, and The Financial Times, providing an outlook on the 2015 economy and M&A markets and key trends to consider across the (from left) Megan Cunningham, CEO, Magnet Media; Sam Barthelme, Director, JEGI; and Scott Peters, Co-President, JEGI > for more information visit www.jegi.com Overview of Hearst International At the Outsell Signature Event, Wilma Jordan, Founder & CEO, JEGI, had a fireside chat with Duncan Edwards, President, Hearst International. Here is an excerpt of their discussion… Hearst is a private company with five core operating divisions: newspapers; magazines; broadcast TV; cable TV; and business information. All of the divisions are managed separately, but in a very collegial management structure. Outside of the US, Hearst’s operations are largely magazines, and its key markets are UK, Russia and China, with a large presence across Eastern Asia, Western Europe, and Southeast Asia. “One of the key strengths of Hearst is that it has been good at partnerships.” Hearst’s joint venture partners (of which they have around 30 globally) range from being some of the world’s largest media companies to very small independent operators. So, Hearst has always taken a very pragmatic approach to building its business (for example, Hearst does not have a big strategy department). The company looks at opportunities on their merits and makes judgments and decisions accordingly. One of the key strengths of Hearst is that it has been good at partnerships. A large proportion of Hearst’s revenues and earnings come from partnerships, including its largest business by earnings – cable TV, where Hearst partners with Disney, ESPN and A&E, and business information, where Hearst partners with Fitch. Hearst relies on its judgment in choosing partners, and then leaves them to it. In most markets, the local partner is better able to make judgments about strategy, so Hearst maintains a light touch. Outside of the US, Hearst’s magazine business generates around 85% of its revenue from selling magazines to consumers and selling advertising in those magazines. This remains a very large and profitable business. Hearst has a three-legged digital strategy: 1) build a large-scale free web business around major brands, such as Cosmopolitan; 2) try to get paid by the consumer for content; and 3) experiment in e-commerce. On the paid digital side, Hearst is selling around a million digital magazines a month in the US, but this is small in comparison to the 30 million print magazines Hearst sells a month. There are compelling choices for smart device users, and magazines are not high enough up the consideration list. This is ultimately a product issue. Good Housekeeping is a very powerful brand for Hearst in the UK. The business is doing exceptionally well in print, but it also has the Good Housekeeping Institute, which conducts consumer research “There’s still money to be made in the magazine business, but it would not be wise to ignore the massive changes in consumer behavior...” on products and services, primarily for use in the magazine. Hearst is ramping up the number of products and services that GHI tests, and plans to put that data behind a pay wall. The track record of media companies moving into transactions has not been good, so we shall see. Frank Bennack, the former CEO of Hearst said that “magazines would be around as far as the eye could see.” There’s still money to be made in the magazine business, but it would not be wise to ignore the massive changes in consumer behavior that are taking place. We also see pressure on consumer sales of magazines, due to changes in infrastructure and points of sale. In markets like India and China, points of sale are being reduced by city governments wanting to change how their cities look. (continued on page 6) JEGI Welcomes Jeff Becker as Managing Director Jeff Becker, a senior software and technology M&A banker, has joined the firm as Managing Director and Co-Head of Technology Banking. In his new role, Mr. Becker will join Joseph Sanborn, who started with JEGI in July 2014, to co-head the firm’s technology advisory practice. Mr. Becker has over 20 years of experience as a technology banker, with particularly extensive experience in the enterprise software, services and human capital management solutions sectors. Mr. Becker has completed well over 100 technology transactions during his career, including nearly 40 strategic advisory or private capital raising assignments. Prior to joining JEGI, he headed or co-headed software banking efforts at JMP Securities, Robertson Stephens, RBC Capital Markets, and, most recently, AGC Partners, all technology/growth company-centric investment banks. Throughout his career, Mr. Becker has focused on providing high-quality strategic advisory services to his clients, leveraging his extensive banking experience and deep domain expertise within the technology industry. In particular, he seeks to assist clients in mergers, acquisitions, recapitalizations, growth equity capital raises, and divestitures. Earlier in his career, Mr. Becker served as a valued underwriter on dozens of notable technology IPOs and other public financing transactions, along with providing M&A advisory services. Mr. Becker can be reached at (212) 754-0710 or [email protected]. n 2 Global Economic Outlook Chris Giles, Economics Editor, The Financial Times The global economy matters for any business, whether an emerging company or Google, which by the way is relatively small compared to the $91 trillion global economy in 2014. People sometimes fail to get a good grounding of the world economy. For example, China is on the verge of surpassing the US in size, based on purchasing power. In 2006, America’s economy was twice the size of China’s. Between 2007 and 2013, emerging economies grew nine times faster than advanced economies. To pay down debt, a country needs real economic growth or inflation. Real growth is hard to come by. It is possible to inflate away debt, but globally, we’re seeing inflation fall, primarily due to low energy costs. Low inflation gives people purchasing power. But, there is also the worry that people will delay spending in expectation of decreasing prices. Nominal GDP growth globally has been trending downward since 2003, while debt has been increasing. The combination of these two trends is why interest rates have to be low, in an attempt to get people to spend. Overall, there’s a pretty gloomy atmosphere in the world economy right now, because advanced economies are not recovering as expected following a recession. In 2011, the forecast from the International Monetary Fund (IMF) made it look like things were improving. But, the forecast changed considerably from 2012 to 2014, with growth about 3% lower than expected. The 2015 economic outlook chart from the OECD (The Organization of Economic Cooperation and Development) is optimistic. Most of the lines are up, with the US, Canada and the UK looking as if they are recovering well. Emerging economies were growing 7+% annually on average between 2003 and 2008. Since then, the growth rate has declined to around 5%. Expectations for China’s growth have decreased markedly, to 6% annually, down from 10+%/year. Questions from the audience… However, if you look at the overall global economy, it is interesting to note that growth by decade has been fairly steady, in the low to mid 3% range. In fact, in the 2000’s, the global economy grew 3.6%/year on average, surpassing the growth rates of the 1980’s and 1990’s. So, the key takeaway is that while individual countries and regions can fluctuate and decline, there is little effect on the global economy, primarily because emerging economies now comprise more than 50% of the world economy. While growth has slowed in emerging regions, they are still growing faster than advanced economies. One of the most worrying trends right now is the growth of debt. Debt can become a problem, if future income doesn’t meet expectations, and that is where China’s slowing growth could be an issue. In advanced economies, debt in the private sector is falling rapidly. But, the public sector has been taking on huge amounts of debt (e.g., in the US, debt is about 100% of national income). In the Eurozone, there are certain economies, particularly on the periphery, where the debt levels are much higher than in the US and UK. Another crisis could occur in the Eurozone, if people lose confidence in the economy. Overall, while the sentiment may sound downbeat, in reality, it is normal. There are always problems in the world economy, and yet it still continues to grow around 3-3.5%/year. Q1: We’ve seen a rising focus on inequality…how do you see that conversation evolving? A1: I think it’s one of the most important issues in the world economy right now. Within advanced economies, particularly in the US, there has been a widening of income inequality. This matters in regards to how people feel about the economy and the future. Q2: At what point does China’s debt relative to the slowing growth of the Chinese economy become a substantial issue? A2: China has a choice…it can slow its overall growth rate and not take on any more debt. Or, it can slow credit expansion and use its still strong overall growth of 5-6%, with a little bit of inflation bringing nominal cash growth to 7-8%, to whittle away debt quite quickly. Q3: How good are dollars at measuring productivity? For example, I Skyped my daughter in Brisbane this morning, and it cost me nothing. A3: There is a lot of real output in the economy that can’t be monetized, so you can’t measure these outputs as part of GDP. I don’t think we’re going to get around this problem of measurement, because you can only measure what people pay for. n 3 M&A Driving Connections between Brands, Consumers & Digital Things David Clark, Managing Director, JEGI Here at JEGI we are gearing up for our first annual Connected Conference, centered around the “Internet of Things” and taking place on November 6th in San Francisco. Like JEGI, our partner for the event, Strategy&, is laser focused on trends and opportunities in technology, marketing, and media and where they intersect. Our recent Tech M&A Updates have spoken to an increasingly connected and converging world – via data, services and devices. So, we revisited some recent sector transactions to gauge the impact that M&A is having on enabling or strengthening connections between brands, consumers and digital things. always on crm – Traditional CRM implies the use of first-party customer data to better understand who bought what, who might buy, and how that translates into customer value. “Always On CRM” implies the use of multiple sources of data to draw connections between why someone bought, how they bought, and how they got there (attribution). In the past few months, all of the major marketing data providers (Alliance/Epsilon, Acxiom and Experian) have made notable acquisitions that get them closer to CRM data. Epsilon’s September 2014 acquisition of Conversant (fka ValueClick) provides it with direct access to online traffic data from affiliated publisher sites, and via Dotomi (itself a recent acquisition of ValueClick’s), direct access to real-time ad serving and ad exposure data, all of which can be used to enrich first party customer data for campaign targeting and optimization. In May 2014, Acxiom acquired LiveRamp, a data onboarding specialist, with the express aim of building a marketing Data Management Platform that (finally) connects offline and online customer data. And Experian’s acquisition of The 41st Parameter is uniquely (and spookily) focused on verifying the connection between consumers and their mobile devices. Which tend to be…Always On. mass personalization – It is a rapidly evolving field. Version 1 of “Mass Personalization” might be viewed as “credibly customized” online ads and offers. For example, I am in-market for holiday JEGI July 2014 Emerging Company Dinner (from left) Neil Capel, Founder & CEO, Sailthru; John Swadener, Partner, PwC; Wilma Jordan, Founder & CEO, JEGI; Paul Chachko, CEO, V12 Group; and Amir Akhavan, Managing Director, JEGI 4 vacation travel, you’re showing me a targeted ad that features my destination. Version 2 is the more mature recommendation and offer engines that sit behind better built e-commerce sites, or better built apps that directly connect consumers with day-to-day service providers – banks, 401Ks, frequent flyer programs. Today, flawless performance on the part of e-commerce merchants and primary service providers are table stakes. They better know who I am when I show up, and they better send me alerts when necessary. Version 3 is the wild proliferation of subscription-based consumer services that are far more discretionary, such as Netflix, Spotify, Pandora, etc. In their current form, these services are about convenience and lifestyle, or in marketing parlance, “concierge” and “curation”. But underneath, they are further conditioning consumers to share detailed personal profiles (product preferences, purchase intent, financial data and even medical conditions), presaging a new class of “digital service providers”. Big brands will lead in this area and are planting many seeds, including Apple’s acquisition of Booklamp (product recommendation); Yahoo’s acquisition of Flurry (app subscription and in-app purchase data); and Google’s acquisition of Lynx Design (medical monitoring). The services will continue to evolve as consumers become more comfortable with the passive monitoring capabilities that are creeping into stores, phones, homes, etc. connected devices – Connected devices will sit at the center of the “Internet of Things”. Google’s recent acquisition of Nest (IP-connected home monitoring systems) and Samsung’s acquisition of SmartThings (home automation and sensor systems) represent a push into developing the home-based “hub” for the mobile sensors that we carry around in our pockets and purses, as well as the sensor data that we drag in our wake. Via carrier systems, GPS, WiFi and Bluetooth, our phones and wearables are constantly connected to networks that know where we are, and increasingly know what we’re doing. Combined with low-power, low-cost beacons, our location can be tracked with greater precision. Merchants can see us cross geofences around their stores and standing in front of specific displays. Loyalty and “Wish List” apps can connect with Always On CRM systems to present us with time and placed offers. And late at night, when our recently purchased Thync (mood monitoring and neuro-signaling device) senses that we’re feeling flush (this is real!), our device can connect with our home automation system, check that we have room in the closet, and buy that sweater while we sleep. CapitalOne just acquired a UI/UX firm to make sure the payment interface will be pleasing. Experian will verify our identity. Futuristic? Yes. Foreseeable? Yes. All of the ingredients…and connections…are in place: the data, the software and hardware, the service providers, and growing consumer acceptance. These topics and developments will be top of mind at our upcoming event, and we look forward to connecting with you then. n JEGI Q3 2014 M&A Overview •Rakuten The media, information, marketing and technology sectors saw 1,128 transactions worth $94 billion announced in the first three quarters of 2014. Deal volume increased slightly over 2013, but Facebook’s $19 billion acquisition of mobile messaging app WhatsApp in Q1 and several other mega transactions drove deal value to more than double 2013’s $45 billion. Although a majority of transactions have price tags under $50 million, we are seeing a sharp uptick of larger deals in the M&A market. The first three quarters of 2014 saw 35 transactions over $500 million in value, compared to only 17 large deals through Q3 2013. There was also a strong increase in the number of deals between $50 million and $500 million in value, with 155 of such middle-market deals so far in 2014 vs. 110 in the same period last year. large deals through q3 2014 The first three quarters of 2014 saw 15 mega deals hitting the $1 billion+ mark, including the: • Facebook acquisition of WhatsApp for $19 billion in February; • Carlyle Group acquisition of Acosta Sales & Marketing, provider of outsourced sales and retail merchandising services to CPG brands and retailers, from Thomas H. Lee Partners for $4.7 billion in July; acquisition of Ebates Performance Marketing, provider of online shopping rebates, for $1 billion in September; and •Relativity Media acquisi- tion of Fullscreen, a digital media company that builds next-generation channels and networks on YouTube, for nearly $1 billion in May, according to several sources. debt markets help drive large m&a transactions • Gannett acquisition of a majority stake in Classified Ventures, operator of Cars. com, an automotive classifieds business, in a deal valued at approximately $2.5 billion in August; • Alliance Data Systems acquisition of digital marketing and technology group Conversant for $2.4 billion in September; According to GE Capital, volume in the debt markets January through August 2014 surpassed all of 2013, with 157 collateralized debt obligations totaling $85 billion. For companies with over $10 million in EBITDA, total leverage is up to 6x EBITDA on middle-market deals, with 4.5x of senior debt and 1.5x of mezzanine debt. Leverage can reach even higher on large • Charterhouse Capital Partners acqui- transactions for businesses with strong sition of SkillSoft, a provider of on-demand training and e-learning solutions, for a reported $2.3 billion in March; • Berkshire Partners acquisition of a ma- jority stake in Catalina Marketing, a provider of data-driven marketing solutions to CPG brands and retailers, in a deal valued at $2.5 billion in March; • Cox Enterprises acquisition of a 25% stake in AutoTrader Group, a digital automotive marketplace for car shoppers and sellers, for $1.8 billion in January; growth, high quality assets and business models, such as those with recurring revenue driven by data or software. The availability of debt helps drive M&A activity, especially in larger transactions, as we have seen so far this year. If the economy continues to grow, investor demand for yield is expected to remain robust, with vibrant debt markets continuing into early 2015. This is good news for the M&A market. looking forward • CVC Capital Partners and Leonard Green • Cerner Corporation acquisition of Barring a major destabilizing event, we & Partners acquisition of Advantage Sales & Marketing, another CPG sales and marketing agency, from Apax Partners for $4 billion in June; • Cognizant Technology Solutions acquisition of TriZetto, provider of information technology and service solutions for health plans, hospitals and healthcare systems, for $2.7 billion in September; • Priceline acquisition of restaurant reser- vation solutions provider OpenTable for $2.6 billion in June; healthcare information technology solutions provider Siemens Health Services for $1.3 billion in August; • KKR acquisition of Internet Brands, operator of media and e-commerce sites related to consumer purchases, from Hellman & Friedman for $1.1 billion in June; expect the US economy to remain steady. The Fed has pumped unprecedented amounts of liquidity into the US economy, and the US stock market has soared with this infusion of capital, and in turn the stock market is an excellent leading indicator. • Hellman & Friedman acquisition of a We are also pleased to see that Asian buymajority stake in Renaissance Learning, a provider of computer-based assessment technology and school improvement programs, for $1.1 billion in March; ers are finally starting to acquire “soft” assets in the US. Asian buyers have purchased real estate in the US for decades (continued on page 6) 5 Overview of Hearst International (continued from page 2) Hearst had a very good year in the UK, as well as in Japan, where people spent a lot of money before a new consumption tax went into effect at the end of April. Most of East Asia is strong. Hearst is the only player in the luxury magazine business in Hong Kong and so it does very well, but the unrest there is extremely worrying. China is big and has been growing fast, but there has been a huge clampdown on gift giving, which has hurt the high end of the market, where Hearst plays. Hearst has done very well in Russia for more than 20 years. It launched Cosmo there in the early 1990’s, and it became a phenomenon. Hearst has many other magazines in Russia, all part of a joint venture with Sanoma, a Finnish company. And then, three years ago in Russia, it acquired 60% of another company, which is now called Hearst Shkulev Media. Hearst management is used to the ups and downs of Russia, but the changes that have just gone through the Duma are extremely concerning. This includes a new bill that would limit foreign ownership of media in Russia to a maximum of 20%. There are many countries where foreign ownership of media is not allowed or is restricted, including France, the US, Brazil, Indonesia, and China, where every media asset is owned by the state. But, Hearst does very well in China by finding creative ways to do business. For example, all of Hearst’s journalists are part of companies that are owned by Chinese entities. Hearst pays for them and manages them, but legally they are Chinese government employees. “There are many countries where foreign ownership of media is not allowed or is restricted...” Whether this structure will work in Russia remains to be seen. It is unlikely that the restrictive legislation against foreign ownership is targeting Cosmo. There are political and economic magazines and newspapers that are more likely the targets. The geopolitical issues are hugely disruptive, and they fall into the category of things that you can’t do anything about. Talent selection is also hard, particularly in Asia. There are 1.2 billion people in China, but trying to find people who are qualified to take on leadership roles is challenging. “Geopolitical issues are hugely disruptive, and they fall into the category of things that you can’t do anything about.” Questions from audience… Q1: How do you deal with the fast changing regulatory environment in China? A1: Hearst has been dealing with government in a highly regulated industry for quite a while now, and we navigate this fairly well via meetings with top government officials; dedicated specialists in our organization focused on government relations; and good lawyers. In regards to doing business in China, it is really hard. We have adopted a zero tolerance policy and have gotten ourselves in a very good position, but it has been difficult getting there. For example, we had to make a number of significant changes to the business we bought in 2011, such as firing the CEO and CFO, because it was not Sarbanes Oxley compliant. Cash is very much still used in China and Japan, and eliminating cash is probably the single most important thing we’ve done. Q2: With all the investment that companies are making in digital infrastructure, is there anything that’s leveraged centrally for all the regions that Hearst is investing in? A2: Hearst has built a platform to house all of its digital assets, starting with Cosmo and Elle. And, we will be requiring that Hearst’s partners use our platform to create local digital editions of our publications. We will be changing from a licensing model to more of a franchising model. And, we will enter new markets with digital editions, where we’ve never been in print due to lack of infrastructure or lack of appropriate partners, such as in Nigeria and Ghana and other African countries. So the answer to your question is absolutely yes. n JEGI Q3 M&A Overview (continued from page 5) and European companies have long been acquirers of content and intellectual property in the US, but now we see Asian companies stepping up to acquire companies in the media and marketing services space. Over the past few months, we have seen the Hong Kong-based Integrated Whale Media Investments acquire Forbes Media, Chinese marketing agency BlueFocus buy industrial design studio 6 fuseproject, and Japanese e-commerce conglomerate Rakuten pick up Ebates Performance Marketing. We expect this trend to continue into 2015. With a stable economy, strong debt markets and healthy competition in the market, we anticipate M&A activity will remain strong, and we expect to continue to see both strategic companies and private equity firms as active buyers. n Information Industry Outlook (continued from page 1) Outsell is projecting industry growth of 3.5% to 4.0% over the next several years, enhanced by 10%-11% CAGR for Marketing Services & Automation. No longer the number one growth segment, Search continues to grow strongly, as does Governance, Risk & Compliance, given all the challenges that come with data usage, privacy and protection. spectively. Medicine, insurance, agriculture are transforming, due to technology. New demands at an accelerated pace means systems, staff, and information solutions must be more nimble and agile than ever. Traditional “old world” information lags the overall industry, but continues to experience modest growth, except for the News and Yellow Pages segments, which are dragging down industry growth. Looking at market share by major world regions, the US continues to account for the largest share of the information industry (~44%). The pace of growth, however, has slowed a bit in many regions, including Asia Pacific. As we head into 2015, we are increasingly living on a data-driven planet, where traditional models are irreparably broken and convergence is everywhere. Our world and lives and businesses are always on – everything is sensored, tracked, quantified, and analyzed. Industries are undergoing unprecedented change, and the world is in social and political upheaval. Our theme for 2015 is “Sensored World, Sensible Choices”, as nearly everything we do is sensored, tracked, and analyzed. For example, the average American is on some kind of video surveillance camera 200 times a day. What will result from the clash between “sensorship” and privacy and security? The implications for our industry are profound as we grapple with challenges of value creation and monetization in our connected and sensored world. Here are some of the key trends to watch: 1. Volatility continues. Political instability, terrorism, hackers, social and political unrest all continue to impact our industry. Leaders must be ready with scenarios to harness this explosive energy and seize opportunities that result. 2. Structural change is prevalent across our industry. Companies like Uber and Kayak are upending the taxi and travel industries, re- 3. Data security is potentially the kryptonite of the Internet. The challenge to security and privacy could sap the strength of the information industry. Our systems must be made bulletproof, and new information offerings show promise for many companies in our industry. 4. The future of money is completely changing. Will currency exist in a few years or be replaced by Bitcoin or lookalikes? Our industry needs to be prepared for conducting commerce in a virtual currency environment. 5. Sustainability can be helped by data and information in regards to solving for enough water, food, and health services to improve the world. 6. GAFA (Google, Apple, Facebook, Amazon) has a grip on controlling design, the user interface, the user experience, as well as our interactions with commerce, the Internet and with many information services. “Take it anywhere with you on any device” will permeate user expectations, and this will have profound implications for desktop usage patterns and end-user workflows. 7. The need for physical connection is increasing in this data and technology-driven world. This is spawning trends, such as purchasing homemade goods and outdated technology. Urban Outfitters, for example, sells turntables to a young gen- eration that is investing in vinyl LPs. Fuji is bringing back old Instamatic cameras for instant photographs. Information services will be derived off these new (old) trends to connect people and support the creativity. 8. Machine-made is still prevalent, and artificial intelligence is a growing part of this ecosystem. Will AI replace high-end analytics jobs in analyst-intensive industries and essentially sit on top of our information and content? There is already displacement occurring in advertising, marketing, and lead gen businesses, where programmatic buying and machine-driven algorithms are prevalent. This trend is starting to take hold in paid content businesses, where algorithms are determining the creation, distribution and analysis of content. Industry players need to transform and reduce the cost of creating product. 9. The future of jobs. If machines can replace our technical jobs, then can we be freed up to create? This is what Sergey Brin has described as a nirvana, where we have lots of free time, while the machines take care of us. If employment changes, so will our industry. Outsell predicts single-digit growth for the industry over the next several years. Leaders must battle for market share and evolve their strategies to compete with disruptive new entrants and incumbents. 10. “The new parochialism” is something we need to watch. This is the concern that something might happen, if we leave our desks, if we leave our office, if we get on a plane. Outsell is seeing many leaders staying close to home/the office, worried that something might happen if they break away. The industry needs to keep its head up and continue to engage its customers and knowledge workers. We are at a crossroads of choice: What kind of world do we want to create and live in? What will result from the clash between “sensorship” and privacy and security? The implications and opportunities for our industry are profound, as we grapple with challenges of value creation and monetization in our connected and sensored world. n 7 JEGI - The Consistent Leader in Media, Marketing, Information & Technology M&A Transactions a leading event housing software and services provider a leading event housing software and services provider has been sold to has been sold to a subsidiary of a subsidiary of October 2014 October 2014 a leading tech-enabled search and digital marketing agency has sold has been sold certain assets of its school business to to July 2014 July 2014 PRODUCTIONS, INC. a television and digital content production, distribution and marketing platform specializing in automotive tech programming a leading independent provider of proprietary financial research and analytics has been sold to has received The Investing in African Mining Indaba a control equity investment to October 2014 August 2014 July 2014 a leading mobile app market intelligence and analytics provider has sold a majority stake to the leader in media strategy, planning and buying for emerging brands targeting women and a portfolio company of has sold from has been sold and The undersigned provided a fairness opinion to the special committee of the Board of Directors of F+W Media, Inc. to May 2014 has been sold to May 2014 February 2014 jegi’s client is mentioned first in each of the above transactions. Wilma Jordan Founder & CEO [email protected] Scott Peters Co-President [email protected] Jeff Becker Managing Director [email protected] New York (Headquarters) 150 East 52nd Street 18th Floor New York, NY 10022 Phone: +1 (212) 754-0710 Tolman Geffs Co-President [email protected] Tom Pecht Managing Director [email protected] Boston CIC Boston 50 Milk Street Boston, MA 02109 Phone: +1 (617) 294-655 Richard Mead Managing Director [email protected] Bill Hitzig Chief Operating Officer [email protected] David Clark Managing Director [email protected] Adam Gross Chief Marketing Officer [email protected] Atlanta 40 Wallace Road Buford, GA 30519 Phone: +1 (770) 932-8700 Amir Akhavan Managing Director [email protected] Tom Creaser Executive Vice President [email protected] London (JEGI Affiliate) 90 Long Acre London WC2E 9RA Phone: +44 20 3402 4900 Joseph Sanborn Managing Director [email protected] Sam Barthelme Director [email protected] Bangalore (JEGI Affiliate) Akash Embassy, 3rd Floor, #9, 3rd Cross Artillery Road, Ulsoor Bangalore 560 008 Phone: +91 80 42036793

© Copyright 2026