Daily Stock Market Report: Technical Analysis & Outlook (Nov 17, 2014)

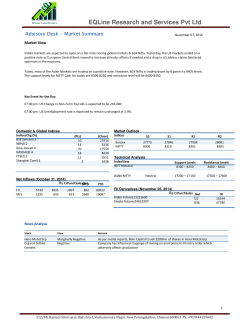

Daily Report Monday, Nov 17th, 2014 Technical Stock to Focus for Short – Midterm (keep Stop loss for every trade) Scrip Name Buy / Sell Bata India Buy at current level or on a decline up to 1285 Indian Indices Open High Low Close Change % Chg BSE 27949.54 28093.23 27912.90 28046.66 106.02 0.38 NSE 8360.70 8400.65 8346.80 8389.90 32.05 0.38 Close (% )Chg Dow Jones 17634.74 -0.10 Nasdaq 4688.54 0.18 Nikkei 17037.65 -2.59 Hang Seng 23915.27 -0.71 FTSE 6654.37 0.29 Close Chg CMP Stop Loss Target 1313.65 1220 1400-1430-1474 Market Overview And Technical Outlook Source: BSE NSE Global Indices Source- Falcon In our previous weekly report, we had mentioned that if Nifty was to trades and close above 8365 level, there was high probability that Nifty would test 8492 – 8600 – 8779 levels in couple of weeks. The week began on a subdued note and traded in a narrow band with positive bias which led the Sensex to end with marginal gains of 0.64% whereas Nifty gained 0.63% vis-à-vis the previous week. Source: Bloomberg . Commodity Gold($/Ounce) 1185.80 0.20 Silver ($/Ounce) 16.26 -0.05 Crude( $/bbl) 75.49 -0.33 Currency Close (%) Chg Rs/USD 61.8650 0.30 Rs/EUR 77.0375 0.13 Nifty 8357 8325 8411 8433 Sensex 27942 27837 28121 28197 Source: Bloomberg Pattern Formation: On the weekly chart, we are observing a narrow range body formation which indicates that markets are indecisive at current level. On the daily chart, we are observing that prices have closed well above the short term 5-days EMA which suggest that the undertone in the markets is positive. Source: MCX-SX.Com. Support/Resistance Support 1 Support 2 Resistance 1 Resistance 2 52 Wk High (A group) 52 Wk Low (A group) 52 Close Company Wk Price Low Cairn 267.6 258.3 Company Close Price Alstomt&d 400.7 52 Wk High 429.0 Aurobindo 1120 1133 -- -- -- Bajaj Auto 2645 2660 -- -- -- Bosch 16571 17299 -- -- -- Britannia 1625 1668 -- -- -- Source: BSE Generating Wealth. Satisfying Investors. Outlook: Combining the above pattern formations it is evident that the undertone is still positive. We reiterate our view that the weekly trends still remains up, hence buy on decline theory should be adopted in this markets. On the upside, in coming week, if Nifty trades and close above 8415 level, there is high probability that Nifty may test 8492 – 8600 – 8779 levels in couple of weeks. On the downside, Nifty has support at 8200 – 8117 – 8050 levels. We maintain our earlier stance that, if we see consolidation or a correction up to 8241 – 8190 levels it is an opportunity to go long for the weekly target of 8405 – 8500 – 8600 levels. 1 Update Report Market Breadth NSE BSE Advances 821 1581 Declines 711 1450 Same 59 117 1.15:1 1.09:1 A/D Ratio Source: BSE NSE Market Turnover (Rs. in crores) Indices 14-Nov 13-Nov Chg (%)chg BSE 3459.09 3531.93 -72.84 -2.06 NSE 18127.60 17095.66 1031.94 6.04 Futures 38259.45 40403.37 -2143.92 -5.31 Options 142706.4 165490.6 -22784.20 -13.77 202553 226522 -23969.02 -10.58 Total Source: BSE NSE Indices Watch Indices Bank Nifty Close 17576.80 (%) Chg 0.71 CNX IT 11571.75 0.28 BSE Midcap 10154.81 0.52 CNX Midcap 12198.60 0.90 BSE Small Cap 11217.39 0.52 BSE Auto 18659.93 0.62 BSE Bankex 20118.77 0.72 BSE Capital Goods 15884.90 0.55 BSE Consumer Durables 9830.03 0.16 BSE FMCG 7752.93 -0.12 BSE HC 14840.27 -1.22 BSE IT 10892.17 0.22 BSE Metal 11401.49 2.53 BSE Oil & Gas 10837.84 1.06 BSE Power 2123.00 0.52 BSE PSU 8224.97 1.61 BSE Realty 1669.36 2.35 BSE TECk 6028.62 0.20 India VIX 13.9725 1.25 Data Alert From India – Trade data for October, by commerce and industry ministry. Data Alert From Overseas – Italian Trade Balance at 2:30 pm Europe Trade Balance at 3:30 pm German Buba Monthly Report at 4:30 pm ECB President Draghi Speaks at 7:30 pm US Industrial Production m/m at 7:45 pm Domestic Stock Specific News – India Oct WPI inflation falls to five-year low of 1.77% vs 2.38% in Sep Finance ministry source says FIPB clears 15 FDI proposals FIPB approves hike in foreign holding in HDFC Bank to 74% Moody's says not enough evidence now to up India outlook Bank sources say RBI may be comfortable with some rupee depreciation GST panel head says rollout in FY16 doable if bill passed next session IOC says no proposal to merge arm Chennai Petro with company GAIL says incorporated company to set up 1,800 km Turkmenistan-India pipeline Minister says Rashtriya Chemicals plans new 1.3 mln tn urea plant at Thal Delhi regulator withdraws power adjustment fee for NovFeb IFCI says stake sale in NSE, two arms still under process IDFC Kakar says working on rural, inclusion-focused viable bank model DoT won't reschedule Feb spectrum auction despite industry demand Jubilant Life arm to acquire majority stake in Cadista Holdings Era Infra wins 4.41-bln-rupees construction orders from govt Source: BSE NSE Index PE Nifty Sensex 14-Nov 21.35 Yr high 25.91 Yr low 15.23 19.10 24.47 15.84 Source: BSE NSE Macro Economic Data Monthly Inflation (m-o-m) IIP growth (m-o-m) Repo Rate Reverse Repo Rate CRR GDP Growth (q-o-q) Current 1.77% 2.50% 8.00% 7.00% 4.00% Previous 2.38% 0.40% 8.00% 7.00% 4.00% 5.70% 4.60% Source: Various Generating Wealth. Satisfying Investors. . International News – US Oct core retail sales up 0.3%, retail sales up 0.3% vs -0.3% US Nov UoM consumer sentiment rose to 89.4 from 86.9 Japan GDP contracts 0.4% in Sep quarter from -1.8% (QoQ) Macro Economic Calendar Date th Indian GDP Data 28 Nov 2014 Indian Monetary Policy 02 Dec 2014 Indian IIP Data 12 Dec 2014 Indian Inflation Data 14 Dec 2014 nd th th Source: Various 2 Update Report FII and DII Cash Activities 14-11-2014 – FIIs Purchase DII Sales Net Purchase Sales Net Total Net Date (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) 14/11/14 4986.80 4340.90 645.90 1418.23 1935.74 -517.51 128.39 13/11/14 3933.01 3242.40 690.61 1090.87 1829.11 -738.24 -47.63 12/11/14 4112.93 3653.46 459.47 1249.68 1809.12 -559.44 -99.97 11/11/14 4443.96 3985.92 458.04 1181.26 1698.24 -516.98 -58.94 10/11/14 4291.60 3936.30 355.30 1435.41 1750.34 -314.93 40.37 Month to date – Nov 1143407.34 1032522.19 110884.94 399194.87 464511.75 -65433.98 45698.48 (Data Source: NSE; Rs in crores) The FII’s total buying on 14-11-2014 is Rs 645.90 cr while DII total selling Rs 517.51 cr. FII Derivative Statistics 14-11-2014 – BUY SELL OPEN INTEREST No. of contracts Amt in Crores No. of contracts Amt in Crores Total No. of contracts Amt in Crores Amt. Cr. (Pre. Day) Change in OI% INDEX FUTURES 26707 789.73 42503 998.20 -208.47 886637 19733.24 19510.12 1.14 INDEX OPTIONS 560511 13210.70 530084 12474.52 736.17 2781134 66869.30 64403.84 3.83 STOCK FUTURES 84205 2576.65 81049 2478.51 98.13 1673154 49676.31 49027.53 1.32 STOCK OPTIONS 106568 3370.60 105902 3348.45 22.14 94922 2966.55 2859.02 3.76 TOTAL 777991 19947.67 759538 19299.68 647.99 5435847 139245.40 135800.51 2.54 Symbol Open Interest of derivative segment increased to Rs 139245.40 cr vs Rs 135800.51 cr. FIIs net seller in index futures to the amount of Rs 208.47 cr and in index options net buyer to the amount of Rs 736.17 cr. Put-Call Ratio at 1.08 vs 1.01 (Bearish). Most Active Nifty Call Option Contracts – Symbol Expiry Date Strike Price No. of Contracts Traded % Change in Contracts Contract Value (Rs. Lakhs) Closing Price % Change in Price Open Interest (OI) % Change in OI NIFTY 27-Nov-14 8400 725520 -21.75 1535840.59 72.30 17.56 5157950 -4.93 NIFTY 27-Nov-14 8500 723262 -11.55 1541904.18 30.00 18.11 5544250 -5.14 NIFTY 27-Nov-14 8600 365468 -25.48 786571.19 9.60 16.36 4526950 -2.84 NIFTY 27-Nov-14 8300 151715 -31.35 319780.33 140.00 13.91 2402600 -4.23 NIFTY 27-Nov-14 8550 113302 45.14 242603.38 15.50 15.67 2059100 180.75 Most active Nifty call option is at 8400 with 725520 contracts 2nd highest active Call at Strike 8500. Generating Wealth. Satisfying Investors. . 3 Update Report Most Active Nifty Put Option Contracts – Symbol Expiry Date Strike Price No. of Contracts Traded % Change in Contracts Contract Value (Rs. Lakhs) Closing Price % Change in Price Open Interest (OI) % Change in OI NIFTY 27-Nov-14 8400 610441 -21.34 1292534.04 62.00 -22.11 3131275 11.29 NIFTY 27-Nov-14 8300 601843 -23.55 1254114.42 31.50 -25.36 5912675 10.72 NIFTY 27-Nov-14 8200 397696 -23.50 816999.82 16.00 -23.99 5320375 2.13 NIFTY 27-Nov-14 8100 281147 -13.53 569979.86 8.80 -22.81 5257950 15.99 NIFTY 27-Nov-14 8000 210621 14.05 421539.50 5.65 -19.29 5278250 1.77 Most active Nifty put option is at 8400 with 610441 contracts 2nd highest active Put at Strike 8300. Most Active Stock Futures – Expiry Date No. of Contracts Traded Contract Value (Rs. Lakhs) Closing Price % Change in Price Close Open Interest (OI) % Change in OI Value of Underlying SBIN 27-Nov-14 116381 404848.77 2800.00 2.47 6226375 3.89 2784.80 TATASTEEL 27-Nov-14 35009 83858.81 482.35 2.17 19916500 1.61 480.50 HDFCBANK 27-Nov-14 27517 63919.93 938.60 1.77 44458250 0.45 932.00 BHEL 27-Nov-14 22342 53323.65 242.45 -0.43 37602000 2.44 246.45 SUNPHARMA 27-Nov-14 21757 48667.69 886.80 -2.80 9665000 2.64 887.50 Symbol Most active stock future is SBIN with 116381 contracts while 2nd active stock is TATASTEEL. Open Interest Figures (Nov Month Futures) – Bullish Trend : in OI - in Price Bearish Trend : in OI - in Price Symbol Open Interest % Chg in OI Price % Chg in Price ASIANPAINT 6982000 25.58 675.60 4.66 VOLTAS 6846000 23.46 272.00 6.56 SIEMENS 1438500 6.12 931.60 HINDPETRO 8400000 6.03 557.60 LICHSGFIN 10375000 5.52 422.15 Open Interest % Chg in OI TVSMOTOR -COLPAL 6296000 399375 4.50 SUNTV 2.48 2.60 Short Covering: In OI - In Price % Chg in Price 9.27 243.05 -4.69 6.46 1994.45 -0.18 2127000 4.62 317.85 -2.78 TATAMOTORS 17854500 4.56 525.40 -0.49 SRTRANSFIN 1198500 4.22 1048.75 -0.21 Long Position Squared Off: In OI - In Price Symbol Open Interest % Chg in OI Price % Chg in Price BATAINDIA 761250 -17.70 1321.50 IOC 6543000 -10.88 ONGC 23468500 AUROPHARMA JUBLFOOD Symbol Open Interest % Chg in OI Price % Chg in Price 3.19 IGL 941000 -6.04 436.10 -1.30 357.15 3.00 -7.08 393.40 1.72 YESBANK MOTHERSUMI 7816000 4105500 -3.17 -2.99 692.25 426.85 -0.56 -0.29 7305750 -6.98 1121.95 1.94 POWERGRID 18922000 -2.68 144.55 -0.38 1862750 -6.14 1473.05 3.88 MINDTREE 375250 -2.66 1128.10 -0.63 Generating Wealth. Satisfying Investors. . Price Symbol 4 Update Report Securities in Ban For Trade Date 17-11-2014 UNITECH Today’s Result – N.A. EX- Dividend + Board Meeting – EX-Dividend – LGB Bros Ltd, Noida Toll, Orbit Exports, Page Ind, Sundram Fasteners, Welspun India Board Meeting (Purpose) – Goodluck Steel (General), Oswal Overseas (General) Bulk Deals (BSE)* Deal Date 14-Nov-14 Scrip Name DECCANCE Client Name UTI MUTUAL FUND Deal Type Quantity Price B 150,891 390.00 Deal Type Quantity Price SELL 3000000 1030.02 Bulk Deals (NSE)* Deal Date 14-Nov-14 Scrip Name SHRIRAM TRANS FIN Client Name FUL FD MGT COM LTD A/C CENTAURA INVTS (MAU) PTE LTD Note- Executed on 14th Nov, 2014. Bulk Deal Buy/sell done by fund house is considered. Generating Wealth. Satisfying Investors. . 5 Update Report Contact Website Email Id SMS: ‘Arihant’ to 56677 www.arihantcapital.com [email protected] Arihant is Forbes Asia’s ‘200 Best under a $Billion’ Company ‘Best Emerging Commodities Broker’ awarded by UTV Bloomberg Disclaimer: This document has been prepared by Arihant Capital Markets Limited (hereinafter called as Arihant) and its subsidiaries and associated companies. This document does not constitute an offer or solicitation for the purchase and sale of any financial instrument by Arihant. Receipt and review of this document constitutes your agreement not to circulate, redistribute, retransmit or disclose to others the contents, opinions, conclusion, or information contained herein. This document has been prepared and issued on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst meticulous care has been taken to ensure that the facts stated are accurate and opinions given are fair and reasonable, neither the analyst nor any employee of our company is in any way is responsible for its contents and nor is its accuracy or completeness guaranteed. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make their own investigation, seek appropriate professional advice. The investments discussed in this material may not be suitable for all investors. The recipient alone shall be fully responsible/are liable for any decision taken on the basis of this material. Arihant Capital Markets Ltd (including its affiliates) or its officers, directors, personnel and employees, including persons involved in the preparation or issuance of this material may; (a) from time to time, have positions in, and buy or sell or (b) be engaged in any other transaction and earn brokerage or other compensation in the financial instruments/products discussed herein or act as advisor or lender/borrower in respect of such securities/financial instruments/products or have other potential conflict of interest with respect to any recommendation and related information and opinions. The said persons may have acted upon and/or in a manner contradictory with the information contained here and may have a position or be otherwise interested in the investment referred to in this document before its publication. The user of this report assumes the entire risk of any use made of this data / Report. Arihant especially states that it has no financial liability, whatsoever, to the users of this Report. ARIHANT Capital Markets Ltd st RCH-DMU-01 #1011, Solitaire Corporate Park, Building No.10, 1 Floor, Andheri Ghatkopar Link Road, Chakala, Andheri (E), Mumbai-400093 T. 022-42254800. Fax: 022-42254880 www.arihantcapital.com Generating Wealth. Satisfying Investors. . 6

© Copyright 2026