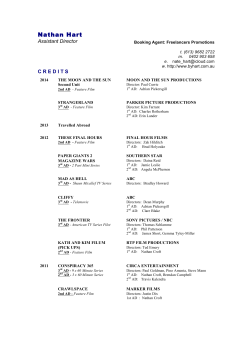

Report & Accounts 2014