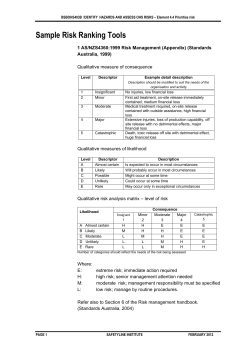

EXCHANGE RATES

WEDNESDAY, NOVEMBER 19, 2014 BUSINESS Australia exports to China still face hurdles after hyped deal Australia shifting from ‘mining boom to dining boom’ SYDNEY: A trade deal signed with great fanfare between China and Australia has been touted as a major step towards Australia shifting its economy from a “mining boom” to a “dining boom,” but the reality is likely to be more sobering. Australia is looking to replace its reliance on exports of minerals such as coal and iron ore as mining investment wanes and demand begins to dwindle. The government would prefer to expand its food and agricultural exports to capitalize on a rapidly growing Asian middle class. It has high hopes for the proposal for a free trade agreement (FTA) signed on Monday by Prime Minister Tony Abbott and Chinese President Xi, but the more likely winner from the deal is the services sector. The deal is designed to open up Chinese markets to Australian farm exporters and the services sector, while easing curbs on Chinese investment in Australia. China is already Australia’s top trading partner, with two-way trade of around A$150 billion ($130 billion) in 2013. Several major agricultural foodstuffs, including sugar, rice and cotton, are currently excluded from the FTA, and Australia’s frequent severe droughts impose a natural production ceiling on those sectors that are part of the pact. Experts are waiting for the full text of the pact, which Australia called the best ever between Beijing and a Western country, warning the devil may yet be in the detail. “Labor is deeply concerned that key export sectors like sugar have been told to expect nothing from the deal,” said opposition Labor Party leader Penny Wong. “Mr Abbott has talked about a two-step FTA. The fact is Australia can’t afford a second-rate FTA with China.” Exclusions HSBC chief economist Paul Bloxham said the deal would support Australia’s “great rebalancing act”, but others warned the agricultural sector is comparatively tiny. Of Australia’s total exports to China of A$94.7 billion in 2013, iron ore accounted for A$52.7 billion, according to the Department of Foreign Affairs and Trade. Wool, the top agricultural export, made up just A$1.9 billion. Boosting agriculture also requires big investment in isolated, dry and volatile areas with limited water supply. Large swathes of eastern Australia are currently in drought. Australian farms’ return on capital has seldom topped 2 percent in a year on average during the past decade, excluding changes in land values, according to government research bureau ABARES. The unpredictability of earnings is greater than in the United States, Africa and Brazil. Meanwhile, the sugar, rice, wheat and cotton sectors will have to wait three years for a review of their tariffs. Even then, any changes are likely to be contingent on Australia relaxing its existing requirement that all investment proposals by Chinese state-owned entities be scrutinized by the Foreign Investment Review Board. “In this day and age, sugar being excluded in what looks like a political trade -off is an absolutely unacceptable outcome,” said Paul Schembri, chairman of industr y group Canegrowers. Faltering demand At the other end of the deal, China faces a supply glut as economic growth falters. Inventories of iron ore, coal and cotton are bulging at ports across the country and state granaries are overflowing. The Australian dairy industry’s hopes of a “white gold” rush have been dashed. Businesses last week complained about Beijing’s response, using non-tariff barriers from customs clearance to quality restrictions, which would skirt the FTA, to curb raw material imports. The financial sector is also cautious, noting the dominance of its Asian peers in China. That means Australian businesses will probably dabble in niche projects, rather than trying to compete in core banking services. Andrew Whitford, Westpac Banking Corp’s head of Greater China, said it was still early days, and Westpac was “certainly not going to be opening more branches.” Ageing population One sector where the road seems clearer is healthcare. Chinese per capita health spending is growing the fastest in Asia, having quadrupled to $321 a year in 2012 from $80 in 2005, according to the World Bank. China wants to shift to a community-based health system, as opposed to hospital-based, to cut costs and ensure universal access, leaving it with a shortage of providers in out-of-hospital health sectors like aged care and pharmacy. An advanced aged care industry is “one of Australia’s great comparative advantages”, said Business Council of Australia CEO Jennifer Westacott. Peter Hope, who runs a pharmacy in the small Australian state of Tasmania, said the new rules would allow him to quickly expand beyond his already planned Beijing store in April next year to 1,000 franchises around China.—Reuters MALANG: Demonstrators protest against fuel price increase in Malang, in East Java province yesterday after Indonesian President Joko Widodo unveiled a hefty increase in the price of subsidized fuel, taking a bold, first step towards fixing the tattered finances of Southeast Asia’s top economy. — AFP Indonesia raises its interest rates Price of subsidized fuel increased by over 30% JAKARTA: Indonesia’s central bank raised interest rates yesterday for the first time in a year in anticipation of surging inflation after the new government increased the price of subsidized fuel by over 30 percent. At a special meeting called following the price increase, Bank Indonesia raised its key rate by 25 basis points to 7.75 percent, the first rise since November last year. The move was aimed at keeping inflation in check, with economists predicting it will jump by over two percentage points in the coming weeks as the fuel price rise pushes up the costs of transporting goods. Inflation edged up to 4.83 percent in October. President Joko Widodo announced the reduction in government fuel subsidies late Monday, his first serious move to strengthen the economy since taking office last month. The move was in line with an election campaign pledge. The government estimates the price rise will lead to about $8 billion of savings in next year’s budget, money that Widodo, known as Jokowi, plans to divert to overhauling infrastructure and policies to help the poorest. The subsidies “can now be used to build schools for the young and hospitals for the old, rather than being burned in engines of cars idling in traffic jams”, said Wellian Wiranto, an economist from OCBC Bank in Singapore. The payouts, which have in the past gobbled up 20 percent of the state budget, are also blamed for a widening current account deficit. Reducing the subsidies was seen as an urgently needed move to revive the economy, which grew at 5.01 percent in the third quarter, its slowest pace in five years. But a fuel price increase is unpopular among the public due to the effect on inflation, and small protests broke out in major cities yesterday. The price of petrol has risen by 2,000 rupiah to 8,500 (70 US cents) a liter, an increase of just over 30 percent, while diesel has gone up 2,000 rupiah to 7,500 a liter, a 35 percent increase. After a large fuel price increase last year, inflation jumped several points before slowly falling back to its current level. However, tighter monetary policy is also likely to weigh on growth.—AFP EXCHANGE RATES Al-Muzaini Exchange Co. ASIAN COUNTRIES 2.521 4.740 2.865 2.223 2.964 226.140 37.594 3.761 6.487 8.889 59.000 116.000 GCC COUNTRIES Saudi Riyal 77.764 Qatari Riyal 80.115 Omani Riyal 757.730 Bahraini Dinar 774.540 UAE Dirham 79.417 ARAB COUNTRIES Egyptian Pound - Cash 40.860 Egyptian Pound - Transfer 40.684 Yemen Riyal/for 1000 1.360 Tunisian Dinar 159.550 Jordanian Dinar 411.550 Lebanese Lira/for 1000 1.956 Syrian Lira 2.078 Morocco Dirham 33.314 EUROPEAN & AMERICAN COUNTRIES US Dollar Transfer 291.500 Euro 364.960 Sterling Pound 464.960 Canadian dollar 257.670 Turkish lira 129.110 Swiss Franc 303.330 Australian Dollar 254.190 US Dollar Buying 290.300 GOLD 20 gram 226.000 10 gram 116.000 5 gram 59.000 Japanese Yen Indian Rupees Pakistani Rupees Srilankan Rupees Nepali Rupees Singapore Dollar Hongkong Dollar Bangladesh Taka Philippine Peso Thai Baht Irani Riyal transfer Irani Riyal cash UAE Exchange Centre WLL COUNTRY Australian Dollar Canadian Dollar Swiss Franc Euro US Dollar Sterling Pound Japanese Yen Bangladesh Taka Indian Rupee Sri Lankan Rupee Nepali Rupee Pakistani Rupee UAE Dirhams Bahraini Dinar Egyptian Pound Jordanian Dinar Omani Riyal Qatari Riyal Saudi Riyal SELL DRAFT 236.01 262.55 307.32 366.78 291.90 459.35 2.54 3.761 4.720 2.223 2.942 2.870 79.32 774.72 40.71 414.75 756.98 80.38 77.75 SELL CASH 233.01 263.55 305.32 367.78 294.90 462.35 2.56 4.031 5.020 2.658 3.477 2.790 79.78 776.79 41.31 420.40 764.28 80.93 78.15 Dollarco Exchange Co. Ltd Rate for Transfer US Dollar Canadian Dollar Sterling Pound Euro Swiss Frank Bahrain Dinar UAE Dirhams Qatari Riyals Saudi Riyals Jordanian Dinar Egyptian Pound Sri Lankan Rupees Indian Rupees Pakistani Rupees Bangladesh Taka Philippines Pesso Cyprus pound Japanese Yen Selling Rate 291.450 261.210 458.920 366.995 304.615 774.960 79.250 80.850 77.895 411.235 40.665 2.223 4.722 2.855 3.760 6.793 715.130 3.515 Syrian Pound Nepalese Rupees Malaysian Ringgit Chinese Yuan Renminbi Thai Bhat Turkish Lira 2.725 3.945 87.980 47.930 9.850 130.860 Sierra Leone Singapore Dollar South African Rand Sri Lankan Rupee Taiwan Thai Baht 0.000064 0.221444 0.020249 0.001912 0.009374 0.008554 Bahraini Dinar Egyptian Pound Iranian Riyal Iraqi Dinar Jordanian Dinar Kuwaiti Dinar Lebanese Pound Moroccan Dirhams Nigerian Naira Omani Riyal Qatar Riyal Saudi Riyal Syrian Pound Tunisian Dinar Turkish Lira UAE Dirhams Yemeni Riyal 0.766485 0.038348 0.000081 0.000194 0.406922 1.000000 0.000142 0.023800 0.001179 0.750859 0.079330 0.077070 0.001727 0.155608 0.129038 0.078356 0.001315 0.000070 0.227444 0.028749 0.002492 0.009554 0.009104 Arab Bahrain Exchange Company CURRENCY BUY SELL Europe Belgian Franc British Pound Czech Korune Danish Krone Euro Norwegian Krone Romanian Leu Slovakia Swedish Krona Swiss Franc Turkish Lira 0.007586 0.451155 0.005174 0.045007 0.359799 0.039156 0.083583 0.008496 0.035425 0.297571 0.129038 Australasia Australian Dollar 0.247554 New Zealand Dollar 0.225543 America Canadian Dollar 0.252713 US Dollars 0.287300 US Dollars Mint 0.287800 Asia Bangladesh Taka 0.003395 Chinese Yuan 0.046039 Hong Kong Dollar 0.035486 Indian Rupee 0.004438 Indonesian Rupiah 0.000020 Japanese Yen 0.002431 Kenyan Shilling 0.003234 Korean Won 0.000256 Malaysian Ringgit 0.084255 Nepalese Rupee 0.002978 Pakistan Rupee 0.002706 Philippine Peso 0.006355 0.008586 0.460155 0.017174 0.050007 0.367799 0.044356 0.083583 0.018496 0.040425 0.307771 0.136038 0.774485 0.041448 0.000082 0.000254 0.414422 1.000000 0.000242 0.047800 0.001814 0.756539 0.080543 0.077770 0.001947 0.163608 0.136038 0.0795505 0.001395 0.259054 0.235043 Al Mulla Exchange 0.261213 0.292000 0.292000 0.003995 0.049539 0.038236 0.004839 0.000026 0.002611 0.003234 0.000271 0.090225 0.003148 0.002986 0.006635 Currency US Dollar Euro Pound Sterlng Canadian Dollar Indian Rupee Egyptian Pound Sri Lankan Rupee Bangladesh Taka Philippines Peso Pakistan Rupee Bahraini Dinar UAE Dirham Saudi Riyal *Rates are subject to change Transfer Rate (Per 1000) 291.150 367.000 458.200 260.150 4.723 40.695 2.221 3.757 6.480 2.868 775.150 79.300 77.750

© Copyright 2026