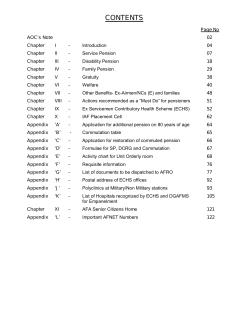

CENTRAL GOVERNMENT PENSIONERS ASSOCIATIONS, CHANDIGARH