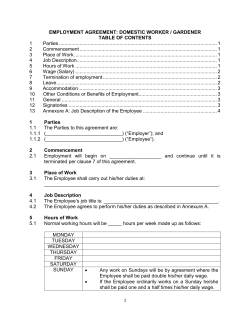

Your Guide to the Employment Standards Act, 2000 Ministry of Labour