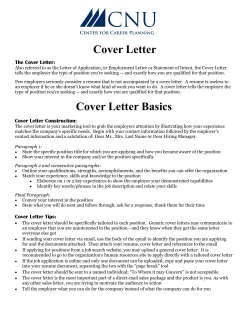

Vermont Employment Law Handbook VERMONT EMPLOYMENT LAW HANDBOOK