Family Day Care Business & Customer Support Centre Compliance Information Guide

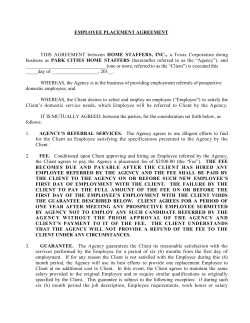

Family Day Care Business & Customer Support Centre Compliance Information Guide October 2012 – Version 2 1 2 Contents CHILD CARE BENEFIT 4 Child Care Benefit is not paid 5 CHILD CARE REBATE 6 BILLING MODELS 7 TOTAL FEE 8 WHEN THE BUSINESS CENTRE RECOUPS MONEY 9 SIGNING AND DATING 10 ABSENCES 12 24 HOUR CARE 13 FRAUD 14 IMPORTANT POINTS 15 HANDY NUMBERS / WEBSITES 16 3 Child Care Benefit Child Care Benefit (CCB) is a payment available to parents to help with the cost of child care. Parents use CCB to reduce their child care fees. Educators are paid the CCB part of the parent’s child care bill by lodging a claim form with the Family Day Care Business and Customer Support Centre. The claim form is processed by Family Day Care and the Department of Education, Employment and Workplace Relations (DEEWR) via the Child Care Management System (CCMS). The FDC – Claim for Child Care Benefit (including Attendance Record) is used to record all the information needed to claim the benefit. If the claim forms are not filled in correctly the parents will not get their CCB and will have to pay the educator the full fee for their child care. DEEWR check the claim forms and other documents when they audit the scheme. Family day care has to make sure that CCB claims are completed properly and that paperwork is not missing. Information in this booklet will help you to fill in the forms correctly and ensure the CCB claims are paid. This will help to keep family day care funded and operating properly, and ensure CCB claims are being paid to educators. 4 Child Care Benefit is not paid: 1. If you charge a fee to reserve a place for a child. For example, a parent wants to start care with you in 4 weeks time and agrees to pay a fee for you to keep the place for them until their child starts care. This fee is not able to be claimed under CCB as it is not a direct child care fee. 2. For absences when a family ceases care without giving you notice. If a family leaves care without providing 2 weeks notice you cannot claim CCB as absences for the 2 weeks, you should ask the parent to pay the full fee for the 2 weeks. This is not always possible if the parent has left no forwarding address or contact number, therefore to avoid losing the 2 weeks fees it is recommended to charge a bond when care begins. If the parent gives you 2 weeks notice you can return the bond when they leave, and if they don’t give you notice you keep the payment to cover the fees. 3. For absences claimed on the first and/or last day/s of care. If the child does not attend the first or last day/s of care you are unable to claim an absence. The parent will need to pay the full fee for that day/s. Please note: The Business Centre will recover any CCB inadvertently paid to educators in these cases. 4. If you are not available to do the care, even if it is contracted. If care has to be cancelled because you are unable to do it, for instance if you are sick, go on holiday, have an emergency, or attend a training course (Family Day Care or external) you cannot claim CCB for the booked care. 5. For a bond that you charge a parent A bond is a separate payment that you manage with a parent. You cannot claim CCB for a bond as it is not a direct child care fee. 6. For a public holiday absence claimed from hours booked on a short term contract. 5 Child Care Rebate Families can choose from four different options for payment of their CCR. They can receive the payment fortnightly to their own bank account, or have it paid direct to family day care as a fee reduction. Alternatively they can continue with a quarterly or annual payment. The following example explains how CCR as fee reductions are calculated through Family Day Care, so you can understand and explain variations. Please note: Educators are not required to calculate these amounts and should avoid estimating the fee reduction amounts in advance, as an estimate is unlikely to be accurate. Example If a family’s Total Fee for the week is $500 and their CCB fee reduction amount is $200; they currently have an out-of-pocket (or gap) fee of $300. The CCR fee reduction amount will be half (50%) the out-of-pocket amount ($150) less 15%. This is $150 – $22.50, making a payment of $127.50 to the service on the family’s behalf. The remaining gap fee that the family owes the service is $172.50. In this example, the fee owed to your service is made up of three parts: Child Care Benefit $200.00 Child Care Rebate $127.50 Family contribution $172.50 (gap fee) Total $500.00 Why is CCR paid when the family hasn’t paid their fees? Family Assistance law states that CCB and CCR are family entitlements based on having a liability to pay the child care fees. Even if a family account falls behind, the family still has a liability and CCB and CCR can still be paid. How you recover the gap fee is a business decision based on your debt collection strategy. 6 Billing Models Many educators estimate CCB fee reduction amounts and charge families an approximate gap fee in advance. If you choose to invoice in advance and charge families the approximate gap fee before you are notified of the exact CCB and CCR amount by the CCMS, complications can arise when a family’s CCB entitlement changes or is cancelled. If you haven’t already adapted your business model to suit the CCMS payment cycle, you may like to consider an alternative to estimating CCB fee reductions. Three potential invoicing models are described below for your consideration: BILLING MODEL ADVANTAGES DISADVANTAGES Start with full fees Good for your cash flow Correct CCB/CCR amount applied once pay advice received Less chance of adjustments after a child has left care Less affordable for families at start of care Charge when you receive your pay slip Correct CCB/CCR amount is applied Fewer adjustments to parent’s fee amounts Impact on your cash flow ie delay in your first payment Families can owe money when they leave care Estimate CCB / CCR in advance Familiar model CCB amount likely to change CCR difficult to calculate Families can owe money when they leave Frequent adjustments to parent’s fee amounts 7 Total Fee The total fee is the amount the family is responsible to pay and for which you have invoiced the family for providing standard services, including: hourly rate, meals, nappy services and excursions that form part of the standard care service provided in that week. This includes where you charge fees for different age groups eg: 0-2 year olds $5.50 2-5yrs $5.00 This is part of your standard fee schedule and is allowable. The total fee does not include one off charges, surcharges or penalty fees. Where a discount is applied to the total fee, the total fee reported should be the discounted fee. Where you include an additional charge on top of the standard fee, the total fee reported should be the fee for standard service only, not including the surcharge e.g. An educator who has only 3 hours of care and charges the family a surcharge of $14 per day for having a minimum number of hours, can only report the standard hourly fee to CCMS in the total fee. The parent would have to pay the $14 out of their own pocket. Example You are required to complete these areas on your claim forms Standard Full time hrs Standard part time hrs Weekly Cost of Care (including Admin Levy) $ 96.45 Meals $ 10.00 Travel $ Other Costs $ Total Cost of Care $ 106.45 3 Extended Hrs 12 NOTES Childcare Benefit Entitlement $ Parent to pay $ 8 When the Business Centre recoups money how/why? There are occasions when it is mandatory for the Business Centre to process an adjustment to recover money from an educator. In this instance you will be contacted by the Business Centre and advised on the course of action we will take to recover CCB or CCR. The course of action taken to recover CCB or CCR can occur either by: o An adjustment in your fortnightly pay o A payment schedule - to take smaller amounts over a period of time o An invoice issued from DECD Accounts Unit. Admin Levy: In the instance where an educator has only families who do not claim or are not eligible for CCB or CCR then we need to collect the admin levy from the educator. You will receive an invoice from DECD Accounts Unit with the amount you are required to pay and payment options. 9 Signing and Dating Educators and parents are required to date the CCB Claim Forms when signing them at the bottom of the form. Undated signatures could mean that the claim forms were signed in advance (before the care actually happened). The parent or guardian must fill in the shaded area of the claim form (attendance part), showing the exact time the child comes into care and the exact time the child leaves (to the nearest 5 minutes). Educators are not to sign the children in and out of care on behalf of the parent or put in the hours the child has attended in the attendance section of claim forms; except-: when a child arrives into care or leaves care without a parent. Then you can write the time and your initials in the shaded area of the claim form. The parent then counter initials that part of the form the next time they see you. This is what you do if you take a child to pre-school or school, or if you pick a child up from preschool or school. When a neighbour or friend of the parent is required to sign the child in or out of care (drop off / pick up) you must have written permission from the parent and you must keep this in your files. Where a friend or relative is caring for the child longer term (eg a few weeks) a copy of the permission slip needs to be sent to the Business Centre. I give permission for my child, neighbour Signed Jennifer Jackson to be collected from family day care by my Pauline Brown (Auntie Pauline) James Jackson date 20/05/12 Pauline Brown date 20/05/12 10 The parent (or pick up person) to fill in the attendance times and sign the child in and out of care (shaded area) WEEK 1 Monday 8.05 a 8am JJ 4.55p 5pm JJ Start End Educator to fill in contracted hours or actual hours provided (unshaded area) Example Tuesday NC Wednesday NC Thursday NC Friday NC Saturday 10.30am 10.30am JJ 1.30pm 1.30pm JJ Sunday NC Start End Absence Code WEEK 2 Monday 3.25pm 3.30pm SS JJ 6.30pm 6.30pm JJ Start End Tuesday NC Wednesday NC Thursday NC Friday NC Saturday NC Sunday NC Start End Absence Code Timesheet - Educator to complete, detailing contracted hours of care or actual hours of care (to the nearest half hour). Attendance Record - parent to complete actual time and initial (shaded column) You can fill in the times if you are picking up or dropping off a child. The parent initials when they see you next. Educator must write the date when it is signed. Parent must write the date when it is signed. This is a true and correct record of care booked and/or used for this period Educator Signature SSmith White Copy – For Data Entry Please submit fortnightly for payment Date 23/7/12. Parent Signature Yellow Copy – Parent Copy To be issued to parent each fortnight J Jackson Date 23/7/12 Green copy – Careprovider Retain for your records (for 3 years) 11 White Copy - For Data Entry Please submit fortnightly for payment Absences Each child is eligible to receive CCB for an initial 42 absence days per financial year without supporting documentation (this includes public holidays). Absences must be recorded on the claim form by writing “A” in the Absence Code section. See example below Absences are not to be claimed in lieu of notice. If a parent ceases care without giving you the expected 2 weeks notice, you must not claim absences for the following 2 weeks. Absences cannot be claimed on the first and/or last day/s of care. Any additional absences occurring after the 42nd absence will only be paid for ‘permitted circumstances’. Parents will need to seek approval and provide documentation for additional absences through the Business Centre. Where sessions of care are greater than 12 hours the care must be actual care and not booked care. For example, if a child is booked in for 18hours, but only attends for 10, then you can only claim the first session of 12 hours plus a 6 hour absence session. See example below Preschool absences: all educators who claim the hours that a child attends preschool/kindergarten are required to write the attended preschool/kindy session time on the child’s claim form each fortnight. See example below Example Week 1 Start End Monday 8am Absent JJ 6pm Tuesday Wednesday Thursday Friday 8am 8am 8am 3pm 6pm 6pm 6pm 12am PS 8.45a- 11.30a PS 8.45a- 11.30a & 12.15p-3p Saturday 3.05p JJ Sunday 12am 10am 1.00a JJ N/C Start End Absence Code Regular absence A Preschool attendance A Greater than 12 hour session absence 12 24 hour Care A Child is considered to be in 24 hour care if he or she does not return to the care of their parents or guardians for any time during a 24 hour period. An educator must not provide a period of 24 hour care to a child unless the parent/guardian has sought approval from a Coordinator at the Coordination Unit. 24 hour care can only be approved when a child needs care because neither the parent nor guardian is able to care for the child due to: Work related commitments or Exceptional circumstances that exist during that period (for example, short term family crisis/emergency) CCB will be paid for authorised 24 hour care only. Special Child Care Benefit cannot be paid for 24hr periods unless exceptional circumstances apply. 13 Fraud What is fraud? In the broadest sense, a fraud is a deception made for personal gain. Deception is the act of convincing another to believe information that is not true. Writing things on a contract or claim form that are not true so you can obtain CCB payment is fraud. Fraud that relates to Child Care Benefit includes: Asking or letting parents sign a blank claim form or contract Asking or letting parents sign a claim form in advance Claiming for care that did not happen (excluding absences on contracted care) Claiming for care at a time different to when you did the care Signing or initialling a contract or claim form for the parent Continuing to claim CCB after the family has left your care If you need to change something on a contract or claim form you must use black or blue ink (pen or biro) and you are required to ask the parent to put their initials next to the changes. Fraud is a serious breach of your conditions of registration. If it is found that you have committed fraud you could have your registration revoked and you could be prosecuted by the police. 14 Important points Don’t sign a contract or claim form for the parent. Don’t change the hours or times on a contract or claim form after the parent has signed it. Don’t claim for care that you haven’t done, unless it is one of the eligible 42 or additional absences. Don’t write contracts for more days than the parent needs. Don’t use white out to change a contract or claim form. 15 Handy Numbers / Websites: Family Day Care Business & Customer Support Centre 5 Harewood Ave, Enfield SA 5085 8343 6533 1300 551 890 (Country Callers) 8343 6544 (Fax) [email protected] www.decd.sa.gov.au/familydaycare Department of Human Services (DHS) - formally known as Family Assistance Office (FAO) 13 61 50 www.humanservices.gov.au 16

© Copyright 2026