How To Decide Your Car

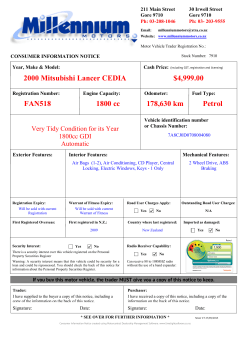

How To Decide Your Car’s Value When Taking Registration Loans Registration loans are temporary loans offered to people with poor credit in return for a vehicle’s title as security. A registration loan can assist tide you over throughout emergencies and crises. As extensive as you hold a clear vehicle title that is paid up or almost paid up, you can get accepted for online registration loans. But how you can get a correct evaluation for your vehicle so you can borrow the most possible amount? How to Check The Value of Your Car for Registration Loans Online At start you have to recognize how your online loan provider will evaluate your vehicle. Value of a car is decided by comparing and evaluating different factors, including: * Model and make: It is based mainly on the safety and reliability of vehicle. In case they are possible to sell, they keep their value higher compare to others. * Demand & Popularity: Vehicles which are famous in the second hand car market are a good sale for the moneylender should they need to sell and repossess it. Therefore, famous brands hold their worth better. * History of the vehicle: Salvaged vehicles and those which have been in accidents are less precious as the damage they have unremitting makes them tough to sell. * Mileage & Age: The higher your vehicle was used, the more it’s value will go down. * Condition: For clear reasons vehicle which have been well preserved attain a greater resale value. * Options: Maker upgrades like new tires, interior upgrades etc. all improve the car’s value. * Location: Normally the place where a vehicle is sold can directly affect its value, mostly if it was built for a particular terrain or weather situations. Moneylenders utilize the wholesale worth of the vehicle when deciding how much they are eager to lend to borrowers. Should the amount of loan turn into delinquent, the moneylenders will wish to sell the vehicle as fast as possible to get back their money. If talking about The Kelley Blue Book then it is a famous online resource for checking the used car value. This highly effective online research tool lets clients to input all of the information regarding a vehicle to get an accurate market worth for that specific vehicle. In case you have added features like upgraded interior packages, tires and sound systems, it can very much affect the vehicle’s value. As a result, it pays to leave not more detail out when explaining a specific vehicle. Whenever you give all the important details you can online, you can confirm of getting an outstanding evaluation. Performing this will assist you predict your car’s value thus you can borrow the higher possible amount on registration loans in mesa that may be beneficial for you. Car registration loans online have moneylenders that would loan up 50% of the vehicle’s value used for security, though a few would just loan up to 25%. A few moneylenders would just lend up to a set amount in spite of how much value of a vehicle is.

© Copyright 2026