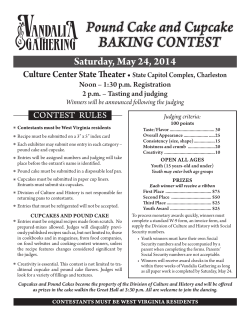

Culinary Calculations