Document 62462

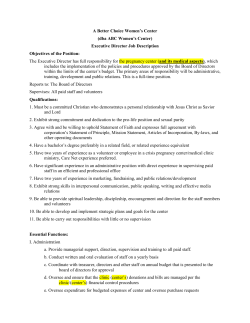

BY-LAWS FOR THE CHILDREN'S MUSEUM OF CENTRAL NEW JERSEY, INC. (A Not-for-Proiit Corporation) MISSION STATEMENT The mission of the Children's Museum of Central New Jersey is to offer an accessible, affordable, interactive and educational environment that will inspire children and families to learn about themselves and our culturally diverse world. The museum will provide a diverse, creative center for hands-on learning through permanent and changing exhibits that will stimulate intellectual curiosity and exploration in children with all types of backgrounds. ARTICLE) BOARD OF DIRECTORS Section 1. PERSONNEL The Corporation shall be managed by a Board of Directors. Each director shall be at least 18 years of age. The initial Board of Directors shall consist of five people. Thereafter, the number of Directors constituting the entire Board shall be no less man five, nor more than twenty-five. Subject to the foregoing, the number of the Board of Directors may be fixed from time to time by action of the Directors, provided that any action of the Board to effect such increase or decrease shall require a vote of a majority of the entire Board of Directors. No decrease shall shorten me term of any Director then in office. Section!. NOMINATION The Secretary of the Board of Directors shall present a list of candidates for the positions to be filled on the Board of Directors. Additional nominations can be presented by the members of the Board of Directors. To qualify for nomination, nominees should serve at least one term on the Board of Advisors. Section 3. ELECTION AND TERM The first Board of Directors shall consist of those persons named as the initial Board of Directors in the Certificate of Incorporation, and shall hold office for a term of three years. At each Annual Meeting or Special Meeting called for this purpose, the Board of Directors may elect Directors by majority vote to hold o£Bce for a term of three years. They shall assume their duties immediately after me Meeting. Each Director shall bold office until the expiration of the term for which he or she was elected, and until his or her successor has been duly elected and qualified, or until his or her prior resignation or removal as hereinafter provided. Section 4. REMOVAL AND RESIGNATION (a) The Board of Directors may remove any Director thereof for cause only. The removal may not be arbitrary or capricious, but there must be some cause affecting and concerning the ability and fitness of the Director to serve in that capacity and perform the duties required of him or her as set forth in these By-Laws and in the New Jersey Not-for-Profit Corporation Law, or other applicable law. (b) A director may resign at any time by giving written notice to the Board of Directors or to an officer of the Corporation, Unless otherwise specified in the notice, the resignation shall take effect upon receipt thereof by the Board of Directors or such Officer. Acceptance of such resignation shall not be necessary to make it effective. (c) Newly-created directorships or vacancies in the Board of Directors may be filled by a vote of a majority of the Board of Directors then in office, although less than a quorum. A Director elected to fill a vacancy caused by resignation, death or removal shall be elected to bold office for the unexpired term of his or her predecessor. Sections. REMUNERATION No member of the Board of Directors or tbe Board of Advisors shall receive remuneration for their role as a Director. The Board of Directors shall have the authority to compensate a member of the Board of Directors or A member of the Board of Advisors for any services actually rendered to tbe Corporation. The authorization must be by majority vote. The interested Director may not vote to authorize remuneration in his or her own interest, although his or her presence can count toward the quorum requirement at the meeting of the Board or of a committee which authorizes such contract or transaction. ARTICLE D MEETINGS Section 1. REGULAR MEETINGS Regular meetings of the Board of Directors shall be held as scheduled by the President or an Officer of the Board of Directors. Tbe primary purpose of tbe Regular Meetings is to oversee the business and affairs of the Corporation, and shall be held not less than once a fiscal quarter, as set by the Board of Directors. The Annual Meeting may be held at the same time as the Regular Meeting. Section!. ANNUAL MEETING The Annual Meeting of the Board of Directors of the Corporation shall be called by the President or an Officer of the Board of Directors. It shall be held on such date or dates as shall be fixed from time to time by the Board of Directors of the Corporation. Tbe first Annual Meeting shall be held on a date within thirteen months after tbe formation of the Corporation. Each successive Annual Meeting shall beheld on a date not less than eleven nor more than thirteen months following the preceding Annual Meeting. At each Annual Meeting, the Board of Directors shall present an Annual Report. Sections. SPECIAL MEETINGS Special Meetings may be called by the President or by a member of the Board of Directors, from time to time, as needed. Section4. LOCATION Any Meeting of the Board of DirectorsTnay be held at such place within or without the State as the Board of Directors of the Corporation may from time to time fix. hi the event that tbe Board of Directors fail to fix such place, then such meeting shall be held at tbe principal office of the corporation. Sections. NOTICE (a) No additional notice shall be required to be given to the members of tbe Board of Directors present at a Regular Meeting of the Board of Directors at which the time and place have been fixed for tbe next Regular Meeting of the Board of Directors. Otherwise, notice should be made to the members of the Board of Directors in oral or written form, or via e-mail, at least 10 days prior to the next scheduled meeting. (b) Notice of the Annual Meeting shall be make to each Director in writing not less man fourteen days, and not more than fifty days, before the date set for the Annual Meeting. (c) Notice for Special Meetings of the Board of Directors shall be made in written or oral form indicating the time and place of the Meeting in sufficient time for the convenient assembly of the Board of Directors. (d) The notice of any meeting need not specify the purpose of such meeting, except as provided in Article VCD, Section 4, when the Board of Directors will be taking a vote to amend or repeal the By-Laws of this Corporation. (e) If a quorum shall not be present at a meeting of the Board of Directors, a majority of tbe Directors then present may vote to adjourn tbe meeting and reconvene without notice, other than an announcement of tbe meeting, until a quorum shall be present (f) The requirement for furnishing notice may be waived by any Director who signs a Waiver of Notice before or after the meeting or who attends the meeting without protesting the lack of notice to him or her. Section 6. QUORUM (a) A majority of the membership of the entire Board of Directors shall constitute a quorum. (b) Whenever a vacancy on the Board of Directors sbaD prevent a quorum from being present, then, in such event, the quorum shall consist of a majority of the members of the Board of Directors, excluding the vacancy. (c) Except to the extent provided by law and by these By-Laws, an act of the Board of Directors shall be by a majority of the Directors present at the time of the vote, a quorum being present at such time. (d) Any action authorized by a majority of the Board of Directors by resolution, in writing, and filed with the minutes of the Board of Directors of the Corporation shall be enacted with the same force and effect as if the same had been passed by a majority vote at a duly caUed meeting of the Board Section 7. VOTING BY PROXY Members of the Board of Directors can designate another member to cast a vote on a specific matter before the Board of Directors. The designation by proxy can be fixed up to two weeks prior to a meeting of the Board of Directors, and expires at the close of that meeting. ARTICLE ID OFFICERS Section 1. PERSONNEL The Officers of this Corporation shall consist of a President, a Vice-President, a Secretary and a Treasurer. Any two or more offices may be held by the same person except the Office of the President. Section 2. NOMINATION AND ELECTION The Secretary of the Board of Directors shall present a list of candidates for the offices to be filled. Officers shall be elected by a majority of the Board of Directors at the Annual Meeting or at a Special Meeting called-for Aat-purposer— Section 3. TERM (a) Duration of Term - The Officers shall assume their duties immediately after the Meeting. Each Officer shall bold office for a term of two years, and until his or her successor has been duly elected and qualified, or until his or her prior resignation or removal as hereinafter provided. A year is defined for these purposes as the amount of time between one Annual Meeting and the next Annual Meeting. The Board of Directors may remove any Officer by a majority Vote with or without cause at any time. (b) Term Limits - It is intended that no Officer serve more than three consecutive terms in office, without taking at least a year off between terms. Section 4. DUTIES (a) PRESIDENT - The President shall act as chief executive officer and shall have the responsibility for the general management of this Corporation. He or she shall preside at meetings of the Board of Directors; shall be a member ex-officio of all committees; with the Treasurer, shall co-sign all bank checks over $2500.00 authorized by the Board of Directors, and also co-sign all contracts and obligations over $2500.00 authorized by the Board of Directors; shall see that all orders and resolutions of the Board of Directors are carried into effect; and shall have such additional powers as are otherwise provided by these By-Laws. In the absence of the President, the President-Elect shall assume the duties of the President In the absence of the President-Elect, the Secretary shall act on the President's behalf. (b) VICE-PRESIDENT - The Vice-President shall assist the President The Vice President shall succeed the President, subject to a majority vote of the Board of Directors. He or she shall assume the duties of the President in the absence of the President The Vice-President shall also perform such duties as prescribed by the Board of Directors from time to time. (c) TREASURER - The Treasurer shall have the care and custody of all of the funds and securities of the Corporation, and shall deposit said funds in the name of the Corporation in such bank accounts as the Board of Directors may from time to time determine. The Treasurer shall make payments in accordance with the budget which has been approved by the Board of Directors, or upon orders for the payment of money of amounts over $2500.00, which have been duly authorized by the Board of Directors. The Treasurer shall, when duly authorized by the Board of Directors, sign and execute all contracts in the name of the Corporation. The Treasurer shall keep full and accurate accounts and shall present financial statements at the Regular Meetings of the Board of Directors. The Treasurer shall also turn over to his or successor all books and financial records. The Treasurer shall serve as the Chairperson of the Finance Committee. (d) ASSISTANT TREASURER - The Assistant Treasurer shall be appointed from time to time, as needed, by the Board of Directors. The Assistant Treasurer shall assist the Treasurer. The Assistant Treasurer shall additionally perform any duties assigned by the Board of Directors. The Assistant Treasurer does not confer any voting privileges, nor any privileges as an Officer of the Board for the purposes of these By-Laws.. (e) SECRETARY - The Secretary shall keep and distribute fall and accurate minutes of the meetings of the Board of Directors. The Secretary shall have custody of the seal of the Corporation, and shall affix and attest to the same for documents duly authorized by the Board of Directors. She or be shall serve Notices for the Corporation which have been authorized by the Board of Directors, and shall have charge of any additional records of the Corporation not in the control of the Treasurer. ARTICLE IV COMMITTEES Section ]. STANDING COMMITTEES The following committees shall be chaired by members of the Board of Directors. Additional members of the committee are drawn from the Board of Advisors, volunteers and staff of the Children's Museum of Central New Jersey. In addition to periodic reporting at General and Special Meetings of the Board of Directors, a report will be presented by each Committee at the Annual Meeting. The Chairperson will report to the Board of Directors on the business of the Committee from time to time, or upon request of the Board of Directors. Each Committee w31 meetas|_qften_asjs ^eeded,_and jdjeastoncejperyear,:to accomplish the responsibilities set forth in these By-Laws, or as directed by the Board of Directors. (a) Volunteer and Staff Development Committee - The Volunteer and Staff Development Committee is responsible for reporting to the Board of Directors on the recruitment, training and oversight of the volunteers and staff of the Children's Museum of Central New Jersey. (b) Finance Committee - Thefinancecommittee is responsible for managing the finances and investments of the Corporation, in addition to overseeing investment decisions. The Finance Committee shall oversee the growth and management funds. The Treasurer serves as the chair of the Finance Committee. (c) The Fundraising Committee - The Fundraising Committee is responsible for identifying potential grants, overseeing the grant application process, and initiating and coordinating the fundraising efforts of the Children's Museum of Central New Jersey. (d) Museum and Exhibit Development - The Committee of Museum and Exhibit Development has the initial task of locating potential spaces for the Museum to be housed, and working with architects, contractors, and building inspectors to create the physical space of the Children's Museum. It will designate a sub-committee, the Site Committee, whose initial purpose will be to locate and evaluate potential sites for the Children's Museum of Central New Jersey. The She Committee will have additional purposes as set by the Board of Directors, and the Chair of the Site Committee will report to the Board of Directors on its progress. Additionally, the Museum and Exhibit Development Committee will contact exhibit developers and curators to report to the Board of Directors on the design of the exhibit spaces of the Children's Museum of Central New Jersey. Finally, the Committee of Museum and Exhibit Development will work with the Fundraising and Finance Committee to explore possible sources of donations for exhibits at the Museum. (e) Publicity Committee - The Publicity Committee is responsible for oversight of both public relations and printed materials for the Corporation. The Committee will oversee internal publications, eventplanning, public relations and contact with media, and design and content of al] printed materials, including the Annual Report, to assure quality and adherence to the mission of the Corporation and The Children's Museum of Central New Jersey. Section 2. AD HOC COMMITTEES The Board of Directors may, from time to time, appoint an ad hoc committee, and, at that time, specify its objectives. Section 3. TERM The members of any Standing Committee shall serve for one year from the time of their appointment by the Board of Directors. The members of any Ad Hoc Committees will serve at the discretion of the Board of Directors, until their tasks have been completed, or until the Board has voted to disband the Committee. A Committee member can be terminated at wiU by the Board of Directors, or may tender his or her resignation to the Board of Directors or it's President. Section 4. POLICIES AND PROCEDURES Participation in a Standing or Ad Hoc Committee does not confer membership status in the Children's Museum of Central New Jersey, nor does it confer any voting privileges. ARTICLE V MEMBERS There will be no members of the Children's Museum of Central New Jersey. Only the members of the Board of Directors have the ability to vote and determine the operation and management of the Children's Museum of Central New Jersey. ARTICLE VI BOARD OF ADVISORS Section 1. BOARD OF ADVISORS The Board of Advisors is comprised of people committed to the creation and maintenance of a Children's Museum where children can expand their understanding of the world and enhance their knowledge through creative hands-on learning and discovery. Members of the Board of Advisors also contribute to the development of interactive programs and exhibits at the Museum which explore subjects such as the arts, the environment, diversity and the local and global communities. Section 2. TERM The members of the Board of Advisors shall serve for one year from the time of their appointment by the Board of Directors. An Advisor can be terminated at wiL1 by the Board of Directors, or may tender his or her resignation to the Board of Directors or its President Section 3. POLICD2S AND PROCEDURES Participation in the Board of Advisors does not confer membership status in the Children's Museum of Central New Jersey, nor does it confer any voting privileges. ARTICLE VD. STAFF Section 1. EXECUTIVE DIRECTOR At the time of the incorporation of the Children's Museum of Central New Jersey, there is no paid staff. At the discretion of the Board of Directors, it may choose to hire staff at the appropriate time in the development of the Children's Museum. At that time, tbe Board of Directors shall select and evaluate the Executive Director of the Children's Museum of Central New Jersey. The Executive Director is an at-will employee, and can be removed with or without cause by a majority vote of the Board of Directors, in accordance with applicable New Jersey or federal law. Section 2. STAFF All employees of the Children's Museum of Central New Jersey are at-will employees, who can be removed with or without cause, in accordance with any applicable New York or federal law. Tbe Executive Director shall report to the Board of Directors on the management of tbe staff of the Children's Museum of Central New Jersey. Section 3. EQUAL OPPORTUNITY EMPLOYER The Children's Museum of Central New Jersey is an equal opportunity employer, and does not discriminate on the basis of race, color, religion, age, sex, sexual preference, or national origin, in hiring, promotion, firing, wages, testing, training, apprenticeship, and all other conditions of employment. ARTICLE VJH POLICIES AND PROCEDURES Section 1. PRINCIPAL OFFICE The principal office of the Corporation shall be in Union County. Complete an correct records and books of accounts, and full and accurate minutes of the Meetings of the Board of Directors, and the minutes of tbe meetings of any other Committee appointed by the Board of Directors or created in these By-Laws, shall be kept at the principal office. Section 2. FISCAL POLICIES (a) The fiscal year of the Children's Museum of Central New Jersey, Inc. shall be fixed by the board of Directors from time to time, subject to applicable law. (b) The books and accounts of the Corporation shall be kept in accordance with the Generally Accepted Accounting Principles and shall be audited or reviewed annually by a certified public accountant at tbe end of the fiscal yeaiYTIiis audit will be made public in accordance with the laws of tbe state of New Jersey. (c) Liability of tbe members and Officers of tbe Board of Directors will be limited, as set forth by the New Jersey Not-for-profit Corporation Law. (d) Tbe Treasurer and any other members, at me discretion of the Board, shall be bonded in the amount to be set by the Board of Directors. (e) la the event of the dissolution of die Corporation, any assets remaining afler payment, or provision for payment of. all debts and Liabilities shall be distributed to such corporations and organizations in the community which are organized and operated exclusively for charitable purposes and which have established their tax-exempt status under Section 501 (cX3) of tbe Internal Revenue Code, as the Board of Directors shall determine. Section 3. CORPORATE SEAL AND NAME (a) CORPORATE SEAL - Tbe corporate seal shall be in such form as tbe Board of Directors shall from time to time proscribe. (b) NAME — The name of the Corporation created in the Certificate of Incorporation is "The Children's Museum of Central New Jersey, Inc." The Board of Directors reserve tbe possibility to name the Museum, traveling exhibits, or satellite Museums, at its own discretion. Section 4. BY-LAWS Tbe board of Directors shall have the power to make, alter, or repeal, from time to time, by a vote comprised of two-thirds of the members of the Board of Directors, the By-Laws of this Corporation. Written or oral notice of any meeting at which a change in the By-Laws will be put to a vote shall be given at least ten days prior to the date of the meeting, and shaD include notice of the substance of the action which is contemplated. Section 5. INTERNET SITE The Board of Directors will oversee the function and content of the o£Gcia] web site for the Corporation. The Board of Directors may from time to time create a special or additional web site at its discretion. Section 6. PARLIAMENTARY PROCEDURE AJJ questions of parliamentary procedure or order not set forth in these By-Laws shall be governed by the Robert's Rules of Order. Section 7. CERTIFICATE OF INCORPORATION Nothing in these By-Laws may or shall be construed to authorize any actions inconsistent with the Certificate of Incorporation of the Corporation, and, in particular, but without limitation, with the restrictions upon the corporate purposes set forth therein, the requirement not to carry on any activity not permitted by a corporation exempt from federal income tax under Section 501 (c)3 of the United States Internal Revenue Code, and the requirement not to engage in any activity listed in New Jersey Not-ForProfit Corporation law. Heather Hays, President Date Adopted INTERNAL REVENUE SERVICE P. O. BOX 2508 CINCINNATI, OH 45201 Date: OCT 2 6 2001 THE CHILDRENS MUSEUM OF CENTRAL NEW JERSEY C/O HEATHER HAYS 514 FAIRMONT AVE WESTFIELD, NJ 07090 DEPARTMENT OF THE TREASURY Employer Identification Number: 22-3828660 DLN: 17053271022001 Contact Person: MICHAEL RYAN ID# 31362 Contact Telephone Number: (877) 829-5500 Accounting Period Ending: June 30 Foundation Status Classification: 509(a)(1) Advance Ruling Period Begins: August 30, 2001 Advance Ruling Period Ends: June 30, 2006 Addendum Applies: No Dear Applicant: Based on information you supplied, and assuming your operations will be as stated in your application for recognition of exemption, we have determined you are exempt from federal income tax :under section 501(a) of the Internal Revenue Code as an organization described in section 501(c) (3) . Because you are a newly created organization, we are not now making a final determination of your foundation statue under section 509(a) of the Code. However, we have determined that you can reasonably expect to be a publicly supported organization described in sections 509(a)(1) and 170(b)(1)(A)(vi). Accordingly, during an advance ruling period you will be treated as a publicly supported organization, and not as a private foundation. This advance ruling period begins and ends on the dates shown above. Within 90 days after the end of your advance ruling period, you must send us the information needed to determine whether you have met the requirements of the applicable support test during the advance ruling period. If you establish that you have been a publicly supported organization, we will classify you as a section 509 (a) (1) or 509 (a) (2) .organization as long as you continue to meet the requirements of the applicable support test. If you do not meet the public support requirements during the advance ruling period, we will classify you as a private foundation for future periods. Also, if we classify you as a private foundation, we will treat you as a private foundation from your beginning date for purposes of section 507(d) and 4940. Grantors and contributors may rely on our determination that you are not a private foundation until 90 days after the end of your advance ruling period. If you send us the required information within the 90 days, grantors and Letter 1045 (DO/CG) -2- THE CHILDRENS MUSEUM OP CENTRAL NEW contributors may continue to rely on the advance determination until we make a final determination of your foundation statue. If we publish a notice in the Internal Revenue Bulletin stating that we will no longer treat you as a publicly supported organization, grantors and contributors may not rely on this determination after the date we publish the notice. In addition, if you lose your status as a publicly supported organization, and a grantor or contributor was responsible for, or was aware of, the act or failure to act, that resulted in your loss of such status, that person may not rely on this determination from the date of the act or failure to act. Also, if a grantor or contributor learned that we had given notice that you would be removed from classification as a publicly supported organization, then that person may not rely on this determination as of the date he or she acquired such knowledge. If you change your sources of support, your purposes, character, or method of operation, please let us know so we can consider the effect of the change on your exempt status and foundation status. If you amend your organizational document or bylaws, please send us a copy of the amended document or bylaws. Also, let us know all changes in your name or address. As of January 1, 1984, you are liable for social security taxes under the Federal Insurance Contributions Act on amounts of $100 or more you pay to each of your employees during a calendar year. You are not liable for the tax imposed under the Federal Unemployment Tax Act (FUTA). Organizations that are not private foundations are not subject to the private foundation excise taxes under Chapter 42 of the Internal Revenue Code. However, you are not automatically exempt from other federal excise taxes. If you have any questions about excise, employment, or other federal taxes, please let us know. Donors may deduct contributions to you as provided in section 170 of the Internal Revenue Code. Bequests, legacies, devises, transfers, or gifts to you or for your use are deductible for Federal estate and gift tax purposes if they meet the applicable provisions of sections 2055, 2106, and 2522 of the Code. Donors may deduct contributions to you only to the extent that their contributions are gifts, with no consideration received. Ticket purchases and similar payments in conjunction with fundraising events may not necessarily qualify as deductible contributions, depending on the circumstances. Revenue Ruling 67-246, published in Cumulative Bulletin 1967-2, on page 104, gives guidelines regarding when taxpayers may deduct payments for admission to, or other participation in, fundraising activities for charity. You are not required to file Form 990, Return of Organization Exempt From Income Tax, if your gross receipts each year are normally $25,000 or less. If you receive a Form 990 package in the mail, simply attach the label provided, check the box in the heading to indicate that your annual gross receipts are normally $25,000 or less, and sign the return. Because you will be treated as a public charity for return filing purposes during your entire advance ruling Letter 1045 (DO/CG) -3THE CHILDHENS MUSEUM OF CENTRAL NEW period, you should file Form 990 for each year in your advance ruling period that you exceed the $25,000 filing threshold even if your sources of support do not satisfy the public support test specified in the heading of this letter. If a return is required, it must be filed by the 15th day of the fifth month after the end of your annual accounting period. A penalty of $20 a day is charged when a return is filed late, unless there is reasonable cause for the delay. However, the maximum penalty charged cannot exceed $10,000 or 5 percent of your gross receipts for the year, whichever is less. For organizations with gross receipts exceeding $1,000,000 in any year, the penalty is $100 per day per return, unless there is reasonable cause for the delay. The maximum penalty for an organization with gross receipts exceeding $1,000,000 shall not exceed $50,000. This penalty may also be charged if a~ return is not complete. So, please be sure your return is complete before you file it. You are not required to file federal income tax returns unless you are subject to the tax on unrelated business income under section 511 of the Code. If you are subject to this tax, you must file an income tax return on Form 990-T, Exempt Organization Business Income Tax Return. In this letter we are not determining whether any of your present or proposed activities are unrelated trade or business as defined in section 513 of the Code. You are required to make your annual information return. Form 990 or Form 990-EZ, available for public inspection for three years after the later of the due date of the return or the date the return is filed. You are also required to make available for public inspection your exemption application, any supporting documents, and your exemption letter. Copies of these documents are also required to be provided to any individual upon written or in person request without charge other than reasonable fees for copying and postage. You may fulfill this requirement by placing these documents on the Internet. Penalties may be imposed for failure to comply^witih^tbese requirements. Additional information is available in Publication 557, Tax-Exempt Status for Your Organization, or you may call our toll free number shown above. You need an emplover identification number even if you have no employees. If an employer identification number was not entered on your application, we will assign a number to you and advise you of it. Please use that number on all returns you file and in all correspondence with the Internal Revenue Service. If we said in the heading of this letter that an addendum applies, the addendum enclosed is an integral part of this letter. Because this letter could help us resolve any questions about your exempt status and foundation status, you should keep it in your permanent records. Letter 1045 (DO/CG) -4- THE CHILDRENS MUSEUM OF CENTRAL NEW If you have any questions, please contact the person whose name and telephone number are shown in the heading of this letter. Sincerely yours, Steven T. Miller Director, Exempt Organizations Enclosure(s) : Form 872-C Letter 1045 (DO/CG) ductible for federal income tax purposes is limited to the excess of any money (and the value of any property other than money) contributed by the donor over the value of goods or services provided by the charity, and (2) provide the donor with a good-faith estimate of the value of the goods or services that the donor received. The charity must furnish the statement in connection with either Ihc solicitation or the receipt of the quid pro quo contribution. If the disclosure statement is furnished in connection with a particular solicitation, il is not necessary for me organization to provide another nalrmml when the associated contribution is actually received The disclosure must be in writing and must be made in a manner that is reasonably likely to come to Ihc attention of the donor. For example, a disclosure in small print within a larger document might not meet this requirenent In the following three circumstances, the disclosure statement is not required. • • •'(1) (2) Where the only goods or services given to a donor meet the standards for "insubstantial value" set out in section 3.01, paragraph 2 of Rev. Rroc. 90-12, 1990-1 C.B.471, as amplified by section 2.01 of Rev. Proc. 92-49, 1992-1 CS. 987 (or any updates or revisions thereof); Where there is no donative element involved in a particular transaction with a charily, such as in a typical museum gift shop calt. (3) Where mere is only an intangible religious benefit provided to the donor. The intangible religious benefit must be provided to Internal Revenue Service 1111 Constitution Avenue, NW Washington, D.C. 20224 the donor by an organization organized exclusively for religious purposes, and must be of a type that generally is not sold in a commercial transaction outside the donative context. An example of an intangible religious benefit would be admission to a religious ceremony. The exception also generally applies to dc minimis tangible benefits, such as wine, provided in connection with a religions ceremony. The intangible religious benefit a cepb'on, however, does not apply to such items as payments for tuition for education leading to a recognized degree, or for travel cervices, or consumer goods. A penalty is imposed on charities thai do not meet the disclosure requirements. For failure to make the required disclosure in connection with > quid pro quo contribution of more than 575, there is a penalty of SIO per contribution, not to exceed 35,000 per fundnunng event or mailing. The chariry may avoid the penally if it can show thai the failure was due to reasonable cause. Plraie Dole that the prevailing basic rule allowing donor deductions only to tit extent that the payment exceeds the fair market valui of the goodi or aervices received in return still applies generally to all quid pro qoo contributions. The S75 threshold pertains only to the obligation to disclose and the imposition of the SIO per cootributiDD penalty, not the rule on deductibib'ty of the payment Department of the Treasury Internal Revenue Service Publication 1771 (11-93) Catalog Number 20054O Bulk Rate Postage and Fees Paid IRS Permit No. G-48 Form 8 7Z-C (Rev. September 1996) Consent Fixing Period of Limitation Upon Assessment of Tax Under Section 4940 of the Internal Revenue Code Department of the treasury Internal Revenue Service (See instructions on reverse side.) OMB No. 1545-0056 To be used with Form 1023. Submit in duplicate. Under section 6501 (c)(4) of the Internal Revenue Code, and as part of a request filed with Form 1023 that the organization named below be treated as a publicly supported organization under section 170(b)(1)(A)(vi) or section 509(a)(2) during an advance ruling period. - - - - -The - £hi Idren -'«- -Mveeian - Of- -Central: -Sea - Jersey i- • -Inc . (wet legal name of organization as shown in organizing document! ^ •* , , and the _ (Humber. street, dly Of town, sate, and ZIP code) District Director of Internal Revenue, or Assistant Commissioner (ErnpJpyee_Elans and Exempt Organizations) consent and agree that the period for assessing tax (imposed under section 4940 of the Code) for any of the 5 tax years in the advance ruling period will extend 8 years, A months, and 15 days beyond the end of the first tax year. However, if a notice of deficiency in tax for any of these years is sent to the organization before the period expires, the time for making an assessment will be further extended by the number of days the assessment is prohibited, plus 60 days. Ending date of first tax year 4//-bUr- frith, day, and year) - Name of organization (as shown In organizing document) The Children 's Museian Of Central Sew Jersey, Date Inc. Officer or trustee having authority to sign 9/20/02 Type or print name and title Signature KZj^^c5tMivJLA~_-AA Qfr^iOLX-fS> For IRS use only District Director or Assistant Commissioner (Employee Plans and Exempt Organizations) rp UH na-» Bj-T.ejQ'slBs, ]&5C~j o Qrgatii BaibJUM '.£ Steven 3..* MIJUIW *> %CT09ZOW For Paperwork Reduction Act Notice, see page 7 of the Form 1023 Instructions. Cal. No. 169050 STATE OF NEW JERSEY JAMES E. McGREEVEY GOVERNOR DEPARTMENT OF THE TREASURY JOHN E. McCORMAC, CPA STATE TREASURER DIVISION OF REVENUE PO Box 628 Trenton NJ 08625-0628 THE CHILDREN'S MUSEUM PO BOX 3073 W E S T F I E L D NJ 07090 RE: OF C E N T R A L JE In reply 1o: Clienl Registration Bureau PO Box 252 Trenton, NJ 08646-0252 609-984-6150 223-828-660/000 Dear Sir/Madam: Congratulations! Your application for exemption from New Jersey sales and use tax has been approved. An Exempt Organization Certificate (Form ST-5) is enclosed. Please retain this unsigned original as part of your permanent records and make as many copies as needed to give to vendors for proof of exempt purchases. The ST-5 exemption ^certificate grants your organization exemption from New Jersey sales anct;use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services. Also, your organizatipriMs exempt from collectihg:sales tax on occasional fundraising sales (except sales of motor vehicles) ;ahd on sales of donated goods made from a store in which at least 75% of the merchandise is donated and 75% of the workers are volunteers. Please note that this exemption does not apply to regular (on-going) sales of taxable goods, meals, beverages and services. If your organization operates a catering business, restaurant, bar or similar business, or is a store or mail-order business, you must collect sales tax on taxable goods such as prepared foods, beverages, alcoholic and soft drinks, cigarettes and cigars. If the name, address, purpose or operations of your organization change, you must notify the Client Registration Bureau in writing at P.O. Box 252, Trenton, NJ 08646-0252. For more information on your exempt organization status, please call the Regulatory Services Branch of the Division of Taxation at (609) 292-5994. Sincerely, RJ.B:td;. :,;; ;.:.<:-: :/ • •:;;.:.-.;•••• ••-:•••. :-, •-:. v . . 'Enclosures. ,.'.. . :;• c.-ir-i.::.:...;;.;'.; •. .. .,..;.:.:.-.:.-. Robert J. Benco Jr., CPA Chief ^Client' R efcijst rat ion" Bureau'-•-...: ..;••-.' :.u •",-•••/• - . : .- ; -j--.--.•- .-•,-, Please visit the Division 'ol Revenue website at http:tlwww.sta ts^nl.usl treasury/revenue New Jersey Is an Equal Opportunity Employer . Printed on Recycled and Recyclable Paper ST-5 (2-OO.R-16) Invoices and receipts must show [exempt organization as purchaser. Slate of New Jersey DIVISION OF TAXATION SALES AND USE TAX Read instructions on bottom ol torm * EXEMPT ORGANIZATION CERTIFICATE * FORM ST-5 EXEMPT ORGANIZATION NUMBER ISSUED BY: THE CHILDREN'S MUSEUM OF CENTRAL JE 514 FAIRMONT AVE WESTFIELD NJ 07090 223-828-6SO/000 Effective Date: 02/18/04 Date Issued: 02/25/04 Transaction Date: TO (Name ot Vendor) The undersigned certifies: that the Division of Taxation has determined this organization is exempt from New Jersey Sales and Use Tax for this transaction; and this purchase is directly related to the purposes for which this organization was formed and is being purchased with the organization's funds. Description of purchase: (Signature of Officer or Trustee ot the organization) "DIRECTOR DIVISION OF TAXATION Name and Title ol Officer (Please Print) INSTRUCTIONS FOR EXEMPT ORGANIZATION: Form ST-5 Is valid for exemption from sales and use tax on all purchases (except energy and utility service), if the purchase is directly related to the organization's purposes and made with organization (not personal) funds. Retain the original ST-5 (unsigned) in files, make copies and complete and sign them for vendors. Notify the Division of changes in organization name, address or exempt status. INSTRUCTIONS FOR VENDORS (AND EXEMPT ORGANIZATIONS): In general, a seller or lessor who accepts an exemption certificate in 'good faith' is relieved of liability for collection or payment of tax upon transactions covered by the certificate. "Good faith' requirements include: (a) The certificate must be an official certificate having the signature of a Director of the Division of Taxation (or a photocopy of the certificate) and must have the organization's name, address and exempt organization number pre-printed by the Division on the upper portion of the certificate, with no apparent alterations. (b) The certificate must be properly completed, dated, and signed by an officer of the organization. (c) The vendor has no reason to believe that the purchase is a type not ordinarily used by the organization for its purposes. Sales transactions not supported by proper exemption certificates shall be deemed to be taxable. The vendor has the burden of proving that tax was not required. Bills or receipts must show the exempt organization as the purchaser. Payment must be from the funds of the exempt organization. Certificates must be retained by the vendor for a period of not less than four years from the date of the last sale covered by the certificate. Subordinate or affiliated organizations may not use the exemption number assigned to the parent organization. Additional Purchases - This certificate covers additional similar purchases by the same organization. Each sales slip or invoice must show the organization's name and exempt organization number. ST-5A PERMIT - This Exempt Organization Certificate (ST-5) also serves as an Exempt Organization Permit (ST5A) for the organization to which the certificate is issued. 01/21/2005 18:02 FAX 12)003 GATEWAY SERVICES CERTIFICATE OF INC, WON PROFIT) THE CHILDREN'S MUSEUM OF CENTRAL NEW JERSEY A NJ NONPROFIT CORPORATION 0400003067 The above-named DOMESTIC NON-PROFIT CORPORATION was duly filed in accordance with New Jersey State Law on 08/29/2001 and was assigned identification number 0400003067. Following are the articles that constitute its original certificate. 1. Name: THE CHILDREN'S MUSEUM OF CENTRAL NEW JERSEY A NJ NONPROFIT CORPORATION 2. The Registered Agent: HEATHER HAYES 3 The Registered Office: 514 FAIRMONT AVENUE WESTFIELD, NJ 07090 4. Business Purpose: Other Please Specify in detail as an additional article 5. Rights and Limitations of the different classes of members as set forth herein: . _..._ .._ ..._ ... AS SET FORTH IN THE BYLAWS 6. Method of ejecting Trustees asset forth herein: — ._ • AS SET FORTH IN THE BYLAWS 7. Method, of distributing aasesta as set forth herein: . ... __ SAID CORPOFtATIONTlS ORGANIZED BC€LOSIVELYTOR-eHARITABLE Rf Lj6l6y^-E_pyeATtONAL.AND SCIENTIFIC PURPOSES, THE MAKING OK.DISTRJBUTJONS TO ORGANIZATIONS. THAT QUALIFY AS EXEMPT CORPGRATTONS-UNDER SECTION 501fC)(3)-OF THEINTERNAL REVENUE CODErOrlTHE;C.QRRESPPNDING SECTION.OF ANY FUTURE FEDERAL T CODE. -— _— Continued on next page ... 121004 01/21/2005 18:02 FAX NEW JERSEY DEPARTMENT OF TREASURY DIVISION OF REVENUE, BUSINESS GATEWAY SERVICES CERTIFICATE Of INC, (NON PROFIT) THE CHILDREN'S MUSEUM OF CENTRAL NEW JERSEY A NJ NONPROFIT CORPORATION 0400003067 8. FIRST BOARD OF TRUSTEES: HEATHER HAYES 514 FAIRMONT AVENUE WESTFIELD, NJ 07090 MARION MCCART 9. Incomorators: HEATHER HAYES 514 FAIRMONT AVENUE WESTFIELD, NJ 07090 10. Additional Articles/Provisions: 1 NOTHWJTHSTANDING ANY OTHER PROVISION OF THESE ARTICLES, THIS CORPORATION SHALL NOT, EXCEPT TO AN INSUBSTANTIAL DEGREE, ENGAGE IN ANY ACTIVITIES OR EXERCISE ANY POWERS THAT ARE NOT IN FURTHERANCE OF THE PURPOSES OF THIS CORPORATION. 2 THE CORPORATION SHALL NOT CARRY ON ANY OTHER ACTIVITIES NOT PERMITTED TO BE CARRIED ON (A) BY A CORPORATION EXEMPT FROM FEDERAL INCOME TAX UNDER SECTION 501 (C)(3) OF THE INTERNAL REVENUE CODE, OR THE CORRESPONDING SECTION OF ANY FUTURE FEDERAL TAX CODE, OR (B) BY A CORPORATION, CONTRIBUTIONS TO WHICH ARE DEDUCTIBLE UNDER SECTION 170(C)(2) OF THE INTERNAL REVENUE CODE, OR THE CORRESPONDING SECTION OF ANY FUTURE FEDERAL TAX CODE. Continued on next page ... 01/21/2005 18:02 FAX 11)005 NE W JERSEY DEPARTMENT Of TREASURY DIVISION OF REVENUE, BUSINESS GATEWAY SERVICES CERTIFICATE OF INC, (NONPROFIT) THE CHILDREN'S MUSEUM OF CENTRAL NEW JERSEY A NJ NONPROFIT CORPORATION 0400003067 3 UPON DISSOLUTION OF THE CORPORATION, ASSETS SHALL BE DISTRIBUTED FOR ONE OR MORE EXEMPT PURPOSES WITHIN THE MEANING OF SECTION 501(C)(3) OF THE INTERNAL REVENUE CODE, OR THE CORRESPONDING SECTION OF ANY FUTURE FEDERAL TAX CODE, OR SHALL BE DISTRIBUTED TO THE FEDERAL GOVERNMENT FOR A PUBLIC PURPOSE 4 ANY ASSETS NOT DISTRIBUTED IN ACCORDANCE WITH THESE ARTICLES SHALL BE DISPOSED OF BY A COURT OF COMPETENT JURISDICTION OF THE COUNTY IN WHICH THE CORPORATION IS THEN LOCATED, EXCLUSIVELY FOR SUCH PURPOSES OR TO SUCH ORGANIZATION OR ORGANIZATIONS, AS SAID COURT SHALL DETERMINE, WHICH ARE ORGANIZED AND OEPRATED EXCLUSIVELY FOR SUCH PURPOSES. 5 NO PART OF THE NET EARNINGS OF THE CORPORATION SHALL INURE TO THE BENEFIT OF, OR BE DISTRIBUTABLE TO ITS MEMBERS, TRUSTEES, OFFICERS, OR OTHER PRIVATE PERSONS EXCEPT THAT THE CORPORATION SHALL BE AUTHORIZED AND EMPOWERED TO PAY REASONABLE COMPENSATION FOR SERVICES RENDERED AND TO MAKE PAYMENTS AND DISTRIBUTIONS IN FURTHERANCE OF HT EPURPOSES SET FORHT IN THESE ARTICLES. 6 NO SUBSTANTIAL PART OF THE ACTIVITIES OF THE CORPORATION SHALL BE THE CARRYING ON OF PROPOGANDA OR OTHERWISE ATTEMPTING TO INFLUENCE LEGISLATION, AND THE CORPORATION SHALL NOT PARTICIPATE IN OR INTERVENE IN ANY POLITICAL CAMPAIGN FOR PUBLIC OFFICE. Signatures: HEATHER HAYES Continued on next page 01/21/2005 18:02 FAX NEW JERSEY DEPARTMENT OF TREASURY DIVISION OF REVENUE, BUSINESS GATEWAY SERVICES CERTIFICATE Of INC, (NONPROFIT) THE CHILDREN'S MUSEUM Of CENTRAL NEW JERSEY A NJ NONPROFIT CORPORATION 0400003067 flV TESTIMONY WHEREOF, 1 have hereunto set my hand and Official Seal at Trenton, 08/30/2001 Peter R Loan-once Treasurer of the State of New jersey

© Copyright 2026