Morning Note

18 November 2014

Singapore Morning Note

Weekly Market Outlook Webinar

Register HERE for Monday’s 11.15am webinar if you have not already done so.

Our webinars are an opportunity for clients, remisiers, and sales staff, to ask questions on our coverage and the market's direction.

We hope to have as many of you as possible.

Archived Webinar videos can be accessed via UniPhillip website - http://www.uniphillip.com/=> Education Programs => Phillip

Securities Research Webinars

In this week's archived webinar, we featured updates on Pan United, Boustead, ComfortDelGro, SATS, Singtel, Silverlake Axis,

Lantrovision, Sarine, Sinarmas Land, Amara, Ho Bee Land and Iconix.

Source: Phillip Securities Research Pte Ltd

Company Highlights

Centurion Corporation Limited announced that Westlite Dormitory (Penang Juru) Sdn. Bhd. (“Dormitory (Penang Juru)”), an

indirect wholly-owned subsidiary of the Company, has won an open tender from Penang Development Corporation (“PDC”), a

government statutory board in Penang, Malaysia in respect of the proposal submitted by Dormitory (Penang Juru) to design, build

and operate a purpose-built workers village (the “Proposed Development”) on the land (the “Land”) located at Juru in Central

District of Province Wellesley, Penang, Malaysia (near Bukit Minyak Industrial Park). The Group has accepted the letter of offer

from PDC on 14 November 2014. The price payable for the Land is MYR20,800,000 (equivalent to SGD8,062,000). In addition,

Centurion will pay PDC an amount of MYR2,400,000 (equivalent to SGD930,230), which will be payable equally over two tranches

upon the commencement of operation of the Phase 1 and Phase 2 of the Proposed Development respectively. (Closing Price

S$0.535, -0.93%)

Midas Holdings Limited announced that its subsidiary, Jilin Midas Aluminium Industries Co., Ltd has secured ontracts worth

RMB151.7 million for the supply of high-speed train car body components. Awarded by CNR Changchun Railway Vehicle Co., Ltd,

the new contracts will see Jilin Midas supply aluminium alloy extrusion profiles and certain fabricated parts for high-speed trains

that will operate at speeds of up to 250km/hr and 350km/hr. Slated for delivery in 2014 and 2015, these contracts are expected to

contribute positively to Midas’ financial performance for the financial years ending December 31, 2014 and 2015. (Closing Price

S$0.295, -7.81%)

Boustead Singapore Limited announced that its 88.2%-owned subsidiary, Esri Australia Pty Ltd (“Esri Australia”) – an exclusive

distributor of worldleading Esri geo-spatial technology and the number one provider of geographic information systems (“GIS”) in

Australia – has been awarded a landmark A$16.5 million contract (approximately S$18.6 million) from the Australian Government

Department of Defence. The three-year Contract includes the provision of Esri ArcGIS software, professional services, training and

after-sales software services to Defence. (Closing Price S$1.875, 0%)

CSE Global Limited, a provider of integrated solutions to the oil and gas(O&G) industry, announced that its wholly-owned US

subsidiary, CSE W-Industries, Inc. has won two contracts from a US energy company valued at US$17 million (approximately S$ 22

million) for a deepwater project in the Gulf of Mexico. Work has commenced for the two contracts, slated for offshore execution

from Q4 2014 to Q4 2015. (Closing Price S$0.66, -2.94%)

Source: SGX Masnet, The Business Times, Phillip Securities Research

Page | 1

MCI (P) 021/11/2014

Ref. No.: SGMN2014_0222

18 November 2014

Morning Commentary

STI

JCI

HSI

Nifty

NIKKEI

Stoxx 50

-0.81%

0.09%

-1.21%

0.49%

-2.96%

0.81%

to

to

to

to

to

to

3,288.7

5,053.9

23,797.1

8,430.8

16,973.8

3,084.8

KLCI

SET

HSCEI

ASX200

S&P 500

-0.40%

-0.43%

-1.93%

0.21%

0.07%

to

to

to

to

to

1,806.5

1,569.1

10,554.3

3,562.9

2,041.3

SINGAPORE:

The Straits Times Index (STI) ended -27.00 points lower or -0.81% to 3288.67, taking the year-to-date performance to

+3.91%.

The FTSE ST Mid Cap Index declined -0.48% while the FTSE ST Small Cap Index declined -0.98%. The top active stocks were

SingTel (-0.51%), DBS (-2.08%), Global Logistic (-1.95%), ThaiBev (-5.92%) and CapitaLand (-0.31%).

The outperforming sectors today were represented by the FTSE ST Real Estate Investment Trusts Index (-0.17%). The two

biggest stocks of the FTSE ST Real Estate Investment Trusts Index are CapitaMall Trust (unchanged) and Ascendas REIT (0.44%). The underperforming sector was the FTSE ST Basic Materials Index, which declined -4.73% with Midas Holdings’

share price declining -7.81% and Geo Energy Resources’ share price declining -4.44%.

Currently consolidating at resistance at 3310, a successful break out implies a move to 52 week high at 3380. Downside

supports are at 3200, 3150 and 3060

SECTOR/STRATEGY REPORTS:

- Sector Reports

: Transport, 21 Aug / US Oil & Gas, 9 July / Banking, 30 June / Offshore & Marine, 7 April /

Commodities, 21 Mar / Telecommunications, 10 Mar / Property, 16 Dec

- Country Strategy

: China & HK, 3 Nov / Thai, 8 Oct / For SG Strategy, Please see Webinar

Source: Phillip Securities Research Pte Ltd, SGX, Masnet

Macro Data

U.S.A

Industrial production in the U.S. unexpectedly dropped in October, weighed down by declines at utilities, mines and automakers

that signal manufacturing started the fourth quarter on soft footing. Output fell 0.1 percent after a 0.8 percent increase in

September that was smaller than previously estimated, figures from the Federal Reserve in Washington showed today. The median

forecast in a Bloomberg survey of 83 economists projected a 0.2 percent gain. Factory production rose 0.2 percent, matching the

prior month’s advance that was also revised down. A pickup in manufacturing is needed to help bolster the expansion, now is its

sixth year, as global growth from Europe and Japan to emerging markets cools. Rising consumer confidence and the drop in

gasoline prices are brightening the outlook for holiday sales, indicating factories will get a lift in the next few months.

Japan

A slide in stocks of unsold goods last quarter signals that Japan’s companies were challenged in managing their plans for the April

sales-tax increase, the first since 1997. While businesses drew down their inventories in the six months ahead of the bump, they

saw their stockpiles surge in the April-to-June quarter. A subsequent tumble helps explain the surprise 1.6 percent annualized

contraction in gross domestic product last quarter, reported by the Cabinet Office today. Stabilization of inventories would aid a

bounce-back in GDP in the final three months of 2014. A bigger question from today’s release is what companies will do with capital

investment after last month indicating their willingness to spend more.

India

India’s exports contracted by 5.04% to USD26 billion in October while imports grew 3.62% to USD39.45 billion, pushing up the trade

deficit as gold imports shot up during the month. Gold imports last month surged 280.39% to USD 4.17 billion from USD 1.09 billion

a year ago. As a result, trade deficit widened to $13.35 billion in October from $10.59 billion in the corresponding period last year,

according to data released by the Commerce Ministry.

During April-October period of the current fiscal, the country’s exports are up 4.72% to USD189.79 billion, while imports are up

1.86% to USD273.55 billion. Trade deficit during the seven month period of 2014-15 stands at USD83.75 billion as against USD 87.31

billion in the same period last fiscal.

Source: Phillip Securities Research Pte Ltd

Page | 2

18 November 2014

Macro Data (cont.)

Thailand

Thailand's economy grew 1.1% q-o-q saar in the third quarter, and 0.6% y-o-y, as exports contracted, the National Economic and

Social Development Board (NESDB) said. The agency revised up growth in April-June from the previous three months to 1.1% from

0.9%. Notwithstanding that the economy avoided a technical recession in the second quarter, the pace of recovery has been slow.

The weak outlook has raised new doubts the junta can quickly turn the economy around even after pledging to roll out

infrastructure spending and other measures to boost consumption, forcing the authorities to again cut the country's growth

forecast for the year. Thailand's planning agency trimmed its economic growth forecast for this year to 1.0% from 1.5-2.0% seen in

August, citing weak exports. That would be the weakest growth since 2011, when devastating flooding cut growth to 0.1%. In 2013,

the economy expanded 2.9%.

Singapore

Singapore's non-oil domestic exports (NODX) fell 1.5% on-year in October, in contrast to the 0.9% growth in September, due to a

decrease in both electronic and non-electronic shipments, International Enterprise (IE) Singapore reported. On a month-on-month

seasonally adjusted basis, NODX rose 1.1% in October, recovering from the previous month's 8.8% decline.

Meanwhile, non-oil re-exports (NORX) contracted 5.4% on-year in October, compared to the 4.2% rise in the previous month, due

to a decrease in both electronic and non-electronic goods. Singapore's non-oil exports tend to be volatile because a significant

portion comprises pharmaceuticals and oil rigs that can vary sharply from month to month.

IE Singapore has forecast that Singapore's 2014 NODX will fall 1-2% this year.

Hong Kong

The unemployment rate in Hong Kong remained unchanged at a seasonally adjusted 3.3% in the three-month period ended

October, the Census and Statistics Department said. Commenting on the labor market, “both total employment and labour force

registered moderate year-on-year growth," said Matthew Cheung, the Secretary for Labour and Welfare. On the short-term

outlook, Cheung said, "The latest figures still indicated a largely steady employment situation up to October. However, as labor

market indicators are lagging in nature, and with the impact of the 'Occupy Movement' on the domestic economy only likely to

surface progressively in the coming few months, we need to closely monitor the potential impact on employment and the income

of grassroots workers."

Source: Phillip Securities Research Pte Ltd

Page | 3

18 November 2014

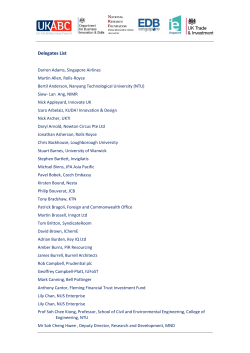

Phillip Securities Research - Singapore Stocks Coverage

Company

Commodities & Supply Chain Managers

FIRST RESOURCES LTD

GOLDEN AGRI-RESOURCES LTD

WILMAR INTERNATIONAL LTD

Consumer Goods

DEL MONTE PACIFIC LTD

GENTING SINGAPORE PLC

OSIM INTERNATIONAL LTD

Banking & Finance

DBS GROUP HOLDINGS LTD

OVERSEA-CHINESE BANKING CORP

SINGAPORE EXCHANGE LTD

UNITED OVERSEAS BANK LTD

Healthcare

RAFFLES MEDICAL GROUP LTD

Property

AMARA HOLDINGS LTD

CITY DEVELOPMENTS LTD

GLOBAL LOGISTIC PROPERTIES L

HO BEE LAND LTD

OUE LTD

SINARMAS LAND LTD

CHIP ENG SENG CORP LTD

Property (Trusts)

CROESUS RETAIL TRUST

Industrials

BOUSTEAD SINGAPORE LTD

PAN-UNITED CORP LTD

SIN HENG HEAVY MACHINERY LTD

SARINE TECHNOLOGIES LTD

800 SUPER HOLDINGS LTD

CIVMEC LTD

Offshore & Marine

EZION HOLDINGS LTD

EZRA HOLDINGS LTD

KEPPEL CORP LTD

SEMBCORP MARINE LTD

KIM HENG OFFSHORE & MARINE H

Transport

COMFORTDELGRO CORP LTD

SMRT CORP LTD

SATS LTD

SIA ENGINEERING CO LTD

Technology & Communications

M1 LTD

LANTROVISION SINGAPORE LTD

SILVERLAKE AXIS LTD

SINGAPORE TELECOMMUNICATIONS

STARHUB LTD

VALUETRONICS HOLDINGS LTD

SINGAPORE POST LTD

Analyst

Date of Last

Report

Rating

Target Price

(S$)

Current

Price

Performance since

Last Report

Potential Return

at Current Price

Caroline Tay

Caroline Tay

Change of Analyst

14-Aug-14 Buy

15-Aug-14 Neutral

9-May-14 Accumulate

2.58

0.550

3.61

1.97

0.455

3.17

-4.4%

-14.2%

-5.1%

31.0%

20.9%

13.9%

Colin Tan

Change of Analyst

Caroline Tay

16-Sep-14 Accumulate

5-Nov-13 Neutral

29-Oct-14 Accumulate

0.605

1.490

2.69

0.515

1.045

1.99

-1.9%

-30.4%

-11.6%

17.5%

42.6%

35.2%

Benjamin Ong

Benjamin Ong

Benjamin Ong

Benjamin Ong

31-Oct-14

31-Oct-14

23-Oct-14

31-Oct-14

21.60

11.00

7.30

25.40

19.30

10.19

7.28

23.00

4.4%

5.2%

6.1%

2.4%

11.9%

7.9%

0.3%

10.4%

Colin Tan

31-Oct-14 Neutral

3.90

3.82

-0.3%

2.1%

Caroline Tay

Change of Analyst

Caroline Tay

Caroline Tay

Caroline Tay

Caroline Tay

Wong Yong Kai

13-Nov-14

15-Aug-14

5-Nov-14

14-Nov-14

7-Nov-14

13-Nov-14

12-Aug-14

0.700

11.26

3.03

2.33

2.52

0.960

1.030

0.515

9.59

2.52

2.00

2.09

0.590

0.905

-1.0%

-1.9%

-6.3%

0.8%

-1.9%

-2.5%

9.0%

35.9%

17.4%

20.2%

16.8%

20.6%

62.7%

13.8%

Change of Analyst

29-Aug-14 Buy

1.150

0.945

-5.5%

21.7%

Joshua Tan

Joshua Tan

Kenneth Koh

Benjamin Ong

Richard Leow

Kenneth Koh

12-Nov-14

13-Nov-14

5-Nov-14

11-Nov-14

30-Oct-14

14-Nov-14

Buy

Neutral

Accumulate

Accumulate

Trading Buy

Neutral

2.40

0.950

0.182

3.27

0.670

0.690

1.88

0.870

0.180

2.94

0.520

0.745

1.4%

-1.1%

-3.2%

-5.2%

8.3%

2.1%

28.0%

9.2%

1.1%

11.2%

28.8%

-7.4%

Change of Analyst

Change of Analyst

Change of Analyst

Change of Analyst

Benjamin Ong

4-Aug-14

14-Apr-14

17-Apr-14

5-May-14

7-Nov-14

Accumulate

Neutral

Neutral

Reduce

Buy

2.67

1.090

11.35

3.70

0.230

1.400

0.770

9.16

3.38

0.187

-34.6%

-28.0%

-18.1%

16.7%

-1.6%

90.7%

41.6%

23.9%

-9.5%

23.0%

Richard Leow

Richard Leow

Richard Leow

Richard Leow

14-Nov-14

3-Nov-14

14-Nov-14

6-Nov-14

Accumulate

Reduce

Neutral

Reduce

2.85

1.370

2.88

3.95

2.61

1.600

2.96

4.08

-0.4%

-7.4%

-2.3%

8.9%

9.2%

14.4%

-2.7%

3.2%

Colin Tan

Colin Tan

Colin Tan

Colin Tan

Colin Tan

Kenneth Koh

Colin Tan

17-Oct-14

13-Nov-14

12-Nov-14

13-Nov-14

6-Nov-14

7-Nov-14

7-Nov-14

Buy

Buy

Neutral

Accumulate

Neutral

Buy

Accumulate

3.95

0.720

1.320

4.12

4.25

0.495

2.030

3.64

0.54

1.255

3.93

4.06

0.340

1.920

5.8%

2.9%

-6.0%

0.8%

-2.9%

0.0%

-1.0%

8.5%

34.6%

5.2%

4.8%

4.7%

45.6%

5.7%

Target Price

(US$)

15.45

17.16

12.57

49.13

38.06

82.83

74.71

79.13

11.00

21.00

57.62

96.14

Current

Price

15.45

14.55

9.33

37.98

28.52

71.82

55.72

63.54

5.77

22.68

59.22

100.84

Performance since

Last Report

-10.1%

10.5%

7.7%

0.2%

2.0%

2.1%

-3.6%

12.3%

-22.6%

5.8%

20.3%

17.4%

Potential Return

at Current Price

0.0%

17.9%

34.7%

29.4%

33.5%

15.3%

34.1%

24.5%

90.6%

-7.4%

0.0%

0.0%

Possible

Current Performance since

Price (Est.)

Price

Last Presentation

USD 38.98 USD 42.10

31.6%

SGD 2.11

SGD 2.38

31.7%

Potential Return

at Current Price

0.0%

0.0%

Buy

Accumulate

Accumulate

Accumulate

Buy

Accumulate

Accumulate

Accumulate

Accumulate

Buy

Trading Buy

Phillip Securities Research - US Stocks Coverage

Date of Last

Report

BANK OF AMERICA CORP

Wong Yong Kai

19-Aug-14

FNFV GROUP

Wong Yong Kai

31-Oct-14

GENWORTH FINANCIAL INC-CL A

Wong Yong Kai

7-Nov-14

ICONIX BRAND GROUP INC

Wong Yong Kai

14-Nov-14

NATIONAL INTERSTATE CORP

Wong Yong Kai

29-Oct-14

NATIONAL OILWELL VARCO INC

Wong Yong Kai

30-Sep-13

OIL STATES INTERNATIONAL INC

Wong Yong Kai

30-Sep-13

OUTERWALL INC

Wong Yong Kai

31-Oct-14

PERION NETWORK LTD

Wong Yong Kai

7-Aug-14

SODASTREAM INTERNATIONAL LTD

Kenneth Koh

30-Oct-14

SEAGATE TECHNOLOGY

Wong Yong Kai

19-Aug-14

WESTERN DIGITAL CORP

Wong Yong Kai

19-Aug-14

* NOV, OIS Target Price have been adjusted for individual spin-offs.

BAC, STX, WDC current price and performance are as of 18 Aug 2014.

Company

Analyst

Rating

Neutral

Trading Buy

Trading Buy

Trading Buy

Trading Buy

Trading Buy

Trading Buy

Trading Buy

Trading Buy

Neutral

Trading Sell

Trading Sell

Phillip Securities Research - Webinar Highlights

Company

Analyst

Date of Last

Rating

Presentation

23-Dec-13 Non-Rated

4-Nov-13 Non-Rated

InterContinental Hotels (NYSE)

Wong Yong Kai

United Engineers (SGX)

Wong Yong Kai

Source: Phillip Securities Research Pte Ltd

* IHG, UE current price and performance are as of 10 July 2014.

Page | 4

18 November 2014

STI - Index Members

0.0%

0.0%

0.0%

0.0%

0.2%

0.2%

0.3%

0.3%

0.6%

1%

0.8%

1.0%

2%

0%

-2.3%

-2.2%

-2.1%

-2.0%

-1.9%

-3%

-1.7%

-1.2%

-1.2%

-1.1%

-0.8%

-0.7%

-2%

-0.7%

-0.5%

-0.5%

-0.4%

-0.3%

-0.2%

-1%

-4.0%

-4%

-5%

-7%

Olam

Sembcorp Mar.

Golden Agri-R.

DBS

Noble Group

GLP

ST Eng.

UOB

SPH

Sembcorp Ind.

SGX

Hutchison Port

HK Land

Singtel

OCBC

Ascendas REIT

Capitaland

SIA Eng.

ComfortDelGro

Capitamall Trust

Genting SP

Jardine Stra.

SIA

Starhub

Jardine C&C

Keppel Corp. Ltd

Wilmar

CDL

Jardine Mat.

-5.9% Thai Beverage

-6%

Source: Bloomberg

FTSE ST Breakdown (% Change)

ST Technology

-1.4%

ST China

-2.4%

ST Real Estate

ST Financials

-1.3%

1.5%

ST Re Invest Trust

ST Utilites

-1.0%

-0.1%

STI-0.7%

ST Telecommunicate

0.6%

ST Oil & Gas

-17.0%

ST Basic Materials

ST Consumer Service

-4.1%

-17.9%

ST Healthcare

-10.3%

FTSE ST Market Cap. Breakdown (3M % Change)

ST Al l Share

ST Sma l l Ca p

-7.3%

-1.6%

STI

-0.7%

ST Mid Cap

-3.2%

Source: Bloomberg

ST Fl edgl i ng

-6.9%

ST Industrials

ST Consumer Goods

-2.7%

-2.2%

Top Gainers (%)

YUUZOO CORP LTD

TOP GLOBAL LTD

SUNPOWER GROUP LTD

HENGXIN TECHNOLOGY LTD

ASIA FASHION HOLDINGS LTD

Last

0.380

0.007

0.142

0.215

0.094

% Chg

18.8

16.7

14.5

10.8

10.6

Top Losers (%)

JK TECH HOLDINGS LTD

GLOBAL TECH HOLDINGS LTD

SPACKMAN ENTERTAINMENT GROUP

MIDAS HOLDINGS LTD

LTC CORP LTD

Last

0.280

0.015

0.240

0.295

0.665

% Chg

-12.5

-11.8

-11.1

-7.8

-7.6

Source: Bloomberg

Turnover ('mn shares)

Turnover (S$'mn)

UP

DOWN

UNCHANGED

1,226

1,030

152

318

466

Source: SGX

Page | 5

18 November 2014

340

320

300

280

260

90

88

86

84

82

80

78

76

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

-0.81%

3,288.67

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

+0.07%

17,647.75

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Mar-14

Feb-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

16,000

Dec-13

Nov-13

18,000

Dec-13

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

20,000

Nov-13

3,600

3,400

3,200

3,000

2,800

2,600

620

600

580

560

540

520

500

480

460

440

420

Feb-14

12,000

1,100

Jan-14

14,000

1,400

Dec-13

16,000

1,700

-2.96%

Nikkei 225 Index

Nov-13

22,000

Nov-14

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

24,000

Nov-13

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

18,000

2,000

Jan-14

80

Dec-13

90

Oct-14

Sep-14

Aug-14

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

20,000

18,000

16,000

14,000

12,000

10,000

8,000

6,000

26,000

Nov-13

Oct-14

100

16,973.80

-1.21%

23,797.08

Hang Seng Index

Sep-14

110

Straits Times Index

-0.63%

567.85

MSCI Asia x-Japan

Aug-14

120

DJI

+0.03%

1,186.55

Gold (US$/Oz)

Jul-14

Jun-14

May-14

Apr-14

Mar-14

Feb-14

Jan-14

Dec-13

Nov-13

3.20

3.00

2.80

2.60

2.40

2.20

2.00

1.80

1.60

1.40

1.20

130

+0.02%

2.340

US Treasury 10yr Yield

+1.13%

78.62

Crude oil, Brent (US$/bbl)

+0.24%

267.42

TR/CC CRB ER Index

+0.50%

87.96

Dollar Index

17,000

15,000

13,000

Source: Bloomberg

Page | 6

18 November 2014

ETF Performance

ETF

ABF SINGAPORE BOND INDX FUND

CIMB FTSE ASEAN 40

DBX CSI 300

DB X-TRACKERS FTSE CHINA 50

DBX FTSE VIETNAM

DBX MSCI EUROPE (DR)

DBX MSCI INDONESIA

DBX MSCI JAPAN

DBX MSCI TAIWAN

DB X-TRACKERS MSCI WORLD TRN

DBX S&P 500

DBX S&P500 INVERSE

DBX CNX NIFTY

DBX S&P/ASX 200 (DR)

DBX EURO STX 50 (DR)

ISHARES MSCI INDIA INDEX ETF

LYXOR UCITS ETF CHINA ENTER

LYXOR ETF COMMODITIES THOMSO

LYXOR UCITS ETF HANG SENG IN

LYXOR ETF JAPAN TOPIX

LYXOR UCITS ETF ASIA EX JP

LYXOR ETF MSCI EMER MKTS-B

LYXOR ETF MSCI EUROPE-B

LYXOR ETF MSCI INDIA

LYXOR ETF MSCI KOREA-USD B

LYXOR ETF MSCI TAIWAN

LYXOR ETF MSCI WORLD-E

NIKKO AM SINGAPORE STI ETF

SPDR GOLD SHARES

SPDR STRAITS TIMES INDEX ETF

UNITED SSE 50 CHINA ETF

Source: Bloomberg

% Change

Change

-0.34

-0.19

-0.92

-1.89

-0.27

+0.21

+0.70

-1.49

-0.60

-0.22

-0.06

+0.48

+0.80

-0.05

+0.36

+0.91

-1.63

+1.23

-0.99

-1.68

-0.59

+0.00

+0.21

+0.47

+0.60

-1.38

-0.17

-0.59

+3.04

-0.60

-1.75

Last

-0.00

-0.02

-0.07

-0.60

-0.08

+0.12

+0.10

-0.69

-0.13

-0.01

-0.02

+0.11

+1.11

-0.02

+0.17

+0.07

-0.24

+0.03

-0.03

-0.02

-0.03

+0.00

+0.03

+0.08

+0.03

-0.02

-0.00

-0.02

+3.37

-0.02

-0.03

1.14

10.51

6.30

27.18

26.87

62.41

14.16

43.85

20.44

4.38

31.10

25.23

113.73

41.40

53.94

6.47

13.02

2.87

2.77

1.15

4.94

10.26

16.14

14.24

5.61

1.09

1.71

3.34

126.52

3.27

1.43

Corporate Action: Dividend

EX Date

Company

11/18/2014

SINGAPORE POST LTD

11/18/2014

NOBLE GROUP LTD

11/18/2014

LIPPO MALLS INDONESIA RETAIL

11/20/2014

CHINA YUANBANG PROPERTY HOLD

11/20/2014

DATAPULSE TECHNOLOGY LTD

11/20/2014

ASCENDAS INDIA TRUST

11/20/2014

JASON MARINE GROUP LTD

11/20/2014

RELIGARE HEALTH TRUST

11/20/2014

VODAFONE GROUP PLC-SP ADR

11/21/2014

HAFARY HOLDINGS LTD

11/21/2014

KING WAN CORP LTD

11/21/2014

AUSNET SERVICES

Source: Bloomberg

Type

2nd Interim

Special Cash

Distribution

Regular Cash

Regular Cash

Distribution

Interim

Distribution

Regular Cash

Interim

Interim

Income

Net Amount

0.0125

0.0300

0.0069

0.0100

0.0022

0.0240

0.0050

0.0361

0.5494

0.0100

0.0070

0.0198

Currency

SGD

USD

SGD

CNY

SGD

SGD

SGD

SGD

USD

SGD

SGD

AUD

Frequency

Quarter

Annual

Quarter

Irreg

Annual

Semi-Anl

Irreg

Semi-Anl

Semi-Anl

Irreg

Semi-Anl

Semi-Anl

Record Date

11/20/2014

11/20/2014

11/20/2014

11/24/2014

11/24/2014

11/24/2014

11/24/2014

11/24/2014

11/24/2014

11/25/2014

11/25/2014

11/25/2014

Payout Date

11/28/2014

12/5/2014

12/5/2014

12/4/2014

12/2/2014

12/10/2014

12/5/2014

12/10/2014

2/4/2015

12/4/2014

12/9/2014

12/24/2014

Page | 7

18 November 2014

Economic Announcement

US

Date

11/18/2014

11/18/2014

11/18/2014

11/18/2014

11/18/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

Singapore

Statistic

PPI Final Demand MoM

PPI Ex Food and Energy MoM

PPI Final Demand YoY

PPI Ex Food and Energy YoY

NAHB Housing Market Index

Net Long-term TIC Flows

Total Net TIC Flows

MBA Mortgage Applications

Housing Starts

Housing Starts MoM

Building Permits

Building Permits MoM

Fed Releases Minutes from Oct.

11/20/2014 28-29 FOMC Meeting

11/20/2014 CPI MoM

11/20/2014 CPI Ex Food and Energy MoM

Source: Bloomberg

For

Survey

Prior

Oct

Oct

Oct

Oct

Nov

Sep

Sep

14-Nov

Oct

Oct

Oct

Oct

-0.10%

0.10%

1.20%

1.50%

55

---1025K

0.80%

1038K

0.60%

-0.10%

0.00%

1.60%

1.60%

54

$52.1B

$74.5B

-0.90%

1017K

6.30%

1018K

1.50%

Oct

Oct

-0.10%

0.10%

0.10%

0.10%

Date

11/19/2014

11/19/2014

11/19/2014

11/24/2014

11/24/2014

11/24/2014

11/24/2014

11/24/2014

11/26/2014

11/26/2014

11/28/2014

11/28/2014

Statistic

Automobile COE Open Bid Cat A

Automobile COE Open Bid Cat B

Automobile COE Open Bid Cat E

CPI NSA MoM

CPI YoY

CPI Core YoY

GDP SAAR QoQ

GDP YoY

Industrial Production SA MoM

Industrial Production YoY

Credit Card Bad Debts

Credit Card Billings

11/28/2014 Bank Loans and Advances YoY

11/28/2014 Money Supply M1 YoY

11/28/2014 Money Supply M2 YoY

Source: Bloomberg

For

Survey

Prior

19-Nov

19-Nov

19-Nov

Oct

Oct

Oct

3Q F

3Q F

Oct

Oct

Oct

Oct

-------------

64900

70890

71300

-0.10%

0.60%

-1.20%

2.40%

-3.30%

-1.20%

24.4M

3888.9M

Oct

Oct

Oct

----

10.60%

1.60%

1.90%

Page | 8

18 November 2014

Calendar

Earnings Announcement - Singapore

Name

Viking Offshore and Marine Ltd

BRC Asia Ltd

Halcyon Agri Corp Ltd

Hengxin Technology Ltd

LionGold Corp Ltd

MFS Technology Ltd

Eu Yan Sang International Ltd

TIH Ltd

Chew's Group Ltd

CosmoSteel Holdings Ltd

Mclean Technologies Bhd

GDS Global Ltd

Craft Print International Ltd

Rowsley Ltd

China Energy Ltd

Teledata Singapore Ltd

S I2I Ltd

Avi-Tech Electronics Ltd

Regal International Group Ltd

Frasers Hospitality Trust

Accordia Golf Trust

IREIT Global

Marco Polo Marine Ltd

Datapulse Technology Ltd

PNE Industries Ltd

Amplefield Ltd

Starland Holdings Ltd

Technics Oil & Gas Ltd

Keong Hong Holdings Ltd

Nam Lee Pressed Metal Industries Ltd

Goodland Group Ltd

PNE Micron Holdings Ltd

Casa Holdings Ltd

Asiatravel.com Holdings Ltd

Envictus International Holdings Ltd

Mortice Ltd

Avago Technologies Ltd

Low Keng Huat Singapore Ltd

Stamford Tyres Corp Ltd

Popular Holdings Ltd

KOP Ltd

Vibrant Group Ltd

LifeBrandz Ltd

Ipco International Ltd

XMH Holdings Ltd

Xpress Holdings Ltd

T T J Holdings Ltd

Asaplus Resources Ltd

MS Holdings Ltd

Axis Offshore Pte Ltd

Source: Bloomberg

Expected Report Date

11/18/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

11/19/2014

11/20/2014

11/20/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/21/2014

11/26/2014

11/27/2014

11/27/2014

11/27/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

11/28/2014

12/2/2014

12/3/2014

12/5/2014

12/5/2014

12/9/2014

12/10/2014

12/11/2014

12/12/2014

12/12/2014

12/12/2014

12/12/2014

12/12/2014

12/12/2014

12/15/2014

12/16/2014

Page | 9

18 November 2014

Important Information

This publication is prepared by Phillip Securities Research Pte Ltd., 250 North Bridge Road, #06-00, Raffles City Tower, Singapore 179101 (Registration Number:

198803136N), which is regulated by the Monetary Authority of Singapore (“Phillip Securities Research”). By receiving or reading this publication, you agree to be

bound by the terms and limitations set out below. This publication has been provided to you for personal use only and shall not be reproduced, distributed or

published by you in whole or in part, for any purpose. If you have received this document by mistake, please delete or destroy it, and notify the sender

immediately. Phillip Securities Research shall not be liable for any direct or consequential loss arising from any use of material contained in this publication.

The information contained in this publication has been obtained from public sources, which Phillip Securities Research has no reason to believe are unreliable

and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this publication are based on such information and

are expressions of belief of the individual author or the indicated source (as applicable) only. Phillip Securities Research has not verified this information and no

representation or warranty, express or implied, is made that such information or Research is accurate, complete, appropriate or verified or should be relied

upon as such. Any such information or Research contained in this publication is subject to change, and Phillip Securities Research shall not have any

responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no

event will Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors,

employees or persons involved in the preparation or issuance of this report, (i) be liable in any manner whatsoever for any consequences (including but not

limited to any special, direct, indirect, incidental or consequential losses, loss of profits and damages) of any reliance or usage of this publication or (ii) accept

any legal responsibility from any person who receives this publication, even if it has been advised of the possibility of such damages. You must make the final

investment decision and accept all responsibility for your investment decision, including, but not limited to your reliance on the information, data and/or other

materials presented in this publication.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this material are as of the date indicated and are subject to change at any

time without prior notice. Past performance of any product referred to in this publication is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This publication should not be relied upon exclusively

or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this publication has

been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this

material is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this publication involve

significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all

such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained

herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks. Nothing in this report shall be

construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this research should take into

account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees

or persons involved in the preparation or issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and

worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities),

brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not

limited to its officers, directors, employees or persons involved in the preparation or issuance of this report, may have participated in or invested in transactions

with the issuer(s) of the securities mentioned in this publication, and may have performed services for or solicited business from such issuers. Additionally,

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees

or persons involved in the preparation or issuance of this report, may have provided advice or investment services to such companies and investments or related

investments, as may be mentioned in this publication.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or

persons involved in the preparation or issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in

related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other

compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any

fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an

adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its

officers, directors, employees or persons involved in the preparation or issuance of this report, may at any time engage in any of the above activities as set out

above or otherwise hold a interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this

publication. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research,

including but not limited to its officers, directors, employees or persons involved in the preparation or issuance of this report, which is not reflected in this

material, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors,

employees or persons involved in the preparation or issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior

to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not

limited its officers, directors, employees or persons involved in the preparation or issuance of this report, may have issued other material that is inconsistent

with, or reach different conclusions from, the contents of this material.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country

where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research

to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction. Section 27 of the Financial

Advisers Act (Cap. 110) of Singapore and the MAS Notice on Recommendations on Investment Products (FAA-N01) do not apply in respect of this publication.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of

any particular person. The products mentioned in this material may not be suitable for all investors and a person receiving or reading this material should seek

advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking

into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such

products.

Please contact Phillip Securities Research at [65 65311240] in respect of any matters arising from, or in connection with, this document.

This report is only for the purpose of distribution in Singapore.

Page | 10

18 November 2014

Contact Information (Singapore Research Team)

Management

Chan Wai Chee

(CEO, Research - Special Opportunities)

Joshua Tan

(Head, Research - Equities & Macro)

Macro | Equities

Soh Lin Sin

Bakhteyar Osama

+65 6531 1516

+65 6531 1793

Research Operations Officer

Jaelyn Chin

+65 6531 1240

+65 6531 1231

+65 6531 1249

Market Analyst | Equities

Kenneth Koh

+65 6531 1791

Finance | Offshore Marine

Benjamin Ong

+65 6531 1535

Real Estate

Caroline Tay

Telecoms | Technology

Colin Tan

Transport & Logistics

Richard Leow, CFTe

+65 6531 1735

Contact Information (Regional Member Companies)

MALAYSIA

Phillip Capital Management Sdn Bhd

B-3-6 Block B Level 3 Megan Avenue II,

No. 12, Jalan Yap Kwan Seng, 50450

Kuala Lumpur

Tel +603 2162 8841

Fax +603 2166 5099

Website: www.poems.com.my

+65 6531 1221

SINGAPORE

Phillip Securities Pte Ltd

Raffles City Tower

250, North Bridge Road #06-00

Singapore 179101

Tel +65 6533 6001

Fax +65 6535 6631

Website: www.poems.com.sg

US Equities

Wong Yong Kai

+65 6531 1685

+65 6531 1792

HONG KONG

Phillip Securities (HK) Ltd

11/F United Centre 95 Queensway

Hong Kong

Tel +852 2277 6600

Fax +852 2868 5307

Websites: www.phillip.com.hk

JAPAN

Phillip Securities Japan, Ltd.

4-2 Nihonbashi Kabuto-cho Chuo-ku,

Tokyo 103-0026

Tel +81-3 3666 2101

Fax +81-3 3666 6090

Website: www.phillip.co.jp

INDONESIA

PT Phillip Securities Indonesia

ANZ Tower Level 23B,

Jl Jend Sudirman Kav 33A

Jakarta 10220 – Indonesia

Tel +62-21 5790 0800

Fax +62-21 5790 0809

Website: www.phillip.co.id

CHINA

Phillip Financial Advisory (Shanghai) Co Ltd

No 550 Yan An East Road,

Ocean Tower Unit 2318,

Postal code 200001

Tel +86-21 5169 9200

Fax +86-21 6351 2940

Website: www.phillip.com.cn

THAILAND

Phillip Securities (Thailand) Public Co. Ltd

15th Floor, Vorawat Building,

849 Silom Road, Silom, Bangrak,

Bangkok 10500 Thailand

Tel +66-2 6351700 / 22680999

Fax +66-2 22680921

Website www.phillip.co.th

FRANCE

King & Shaxson Capital Limited

3rd Floor, 35 Rue de la Bienfaisance 75008

Paris France

Tel +33-1 45633100

Fax +33-1 45636017

Website: www.kingandshaxson.com

UNITED KINGDOM

King & Shaxson Capital Limited

6th Floor, Candlewick House,

120 Cannon Street,

London, EC4N 6AS

Tel +44-20 7426 5950

Fax +44-20 7626 1757

Website: www.kingandshaxson.com

UNITED STATES

Phillip Futures Inc

141 W Jackson Blvd Ste 3050

The Chicago Board of Trade Building

Chicago, IL 60604 USA

Tel +1-312 356 9000

Fax +1-312 356 9005

Website: www.phillipusa.com

AUSTRALIA

Phillip Capital Limited

Level 12, 15 William Street,

Melbourne, Victoria 3000, Australia

Tel +61-03 9629 8288

Fax +61-03 9629 8882

Website: www.phillipcapital.com.au

SRI LANKA

Asha Phillip Securities Limited

No-10 Prince Alfred Tower,

Alfred House Gardens,

Colombo 03, Sri Lanka

Tel: (94) 11 2429 100

Fax: (94) 11 2429 199

Website: www.ashaphillip.net

TURKEY

PhillipCapital Menkul Degerler

Dr. Cemil Bengü Cad. Hak Is Merkezi

No. 2 Kat. 6A Caglayan

34403 Istanbul, Turkey

Tel: 0212 296 84 84

Fax: 0212 233 69 29

Website: www.phillipcapital.com.tr

DUBAI

Phillip Futures DMCC

Member of the Dubai Gold and

Commodities Exchange (DGCX)

Unit No 601, Plot No 58, White Crown Bldg,

Sheikh Zayed Road, P.O.Box 212291

Dubai-UAE

Tel: +971-4-3325052 / Fax: + 971-4-3328895

Website: www.phillipcapital.in

INDIA

PhillipCapital (India) Private Limited

No.1, 18th Floor

Urmi Estate

95, Ganpatrao Kadam Marg

Lower Parel West, Mumbai 400-013

Maharashtra, India

Tel: +91-22-2300 2999 / Fax: +91-22-2300 2969

Website: www.phillipcapital.in

Page | 11

© Copyright 2026