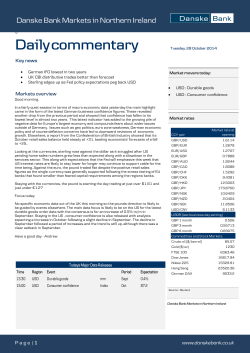

FX Forecast Update – December

FX Forecast Update 16 December 2014 It’s the oil, stupid! Thomas Harr Global Head of FICC Research Stefan Mellin Senior Analyst Jens Nærvig Pedersen Senior Analyst Kristoffer Lomholt Analyst Morten Helt Senior Analyst Lars Christensen Chief Analyst Christin Tuxen (on leave) Senior Analyst www.danskebank.com/research Investment Research www.danskebank.com/CI Important disclosures and certifications are contained from page 11 of this report. Vladimir Miklashevsky Analyst Main forecast changes part I NOTE: This month’s FX Forecast Update is in a reduced form • We are lifting our EUR/NOK forecasts as oil prices have collapsed and Norges Bank has cut interest rates, which we did not expect. There is a significant risk of the oil price undershooting, which would weigh on the NOK. In addition, the market is likely to price in two additional 25bp cuts from Norges Bank in the coming months, while we expect ECB sovereign QE in Q1 to mitigate NOK losses. Medium term, we continue to see significant value in the NOK due to strong internal and external balances and valuation. To sum up, we lift our EUR/NOK forecasts to 9.25 (from 8.80) in 1M, 9.40 (8.70) in 3M, 9.00 in 6M (8.50) and 8.50 (8.20) in 12M. See page 4 for details. • We have kept our EUR/SEK forecast unchanged from 3 December where we raised our targets for EUR/SEK to 9.40 in 1M (from 9.20), 9.30 in 3M (9.10), 9.20 in 6M (9.00) and 9.00 in 12M (8.90) in the light of a weaker outlook for the Swedish economy. See Scandi Strategy 2015: Converging growth, low for longer and carry (3 December) for details. EUR/SEK has edged higher in recent weeks towards our 1M target at 9.40 and we expect the cross to trade around the 9.40 level in the coming months. Fundamental macro arguments unambiguously suggest the SEK is undervalued, which in turn serves as an anchor for our medium- to long-term forecasts on EUR/SEK. See page 5 for details. • Recent months have confirmed our expectation of a continued uptrend in USD/JPY – albeit the recent risk-off sentiment and year-end profit taking in the USD has temporarily slowed the move higher. We still expect relative monetary policy and portfolio flows to be important drivers in 2015 and as a result we lift our USD/JPY profile. We target the cross at 120 (previously 118) in 1M, 122 (120) in 3M, 124 (122) in 6M and 126 (124) in 12M. • We are ‘rolling’ our 1M EUR/USD forecast to 1.23 from 1.24, keeping our 3M, 6M and 12M forecasts unchanged. ECB easing in Q1 will weigh on EUR/USD near term. www.danskebank.com/CI 2 Main forecast changes part II • We revise our USD/RUB forecast substantially higher due to the weak oil price outlook and the challenging situation in the Russian economy. Tightening monetary policy, capital outflows and western sanctions are keeping fixed investment growth in negative territory, which will send the economy into a deep recession in 2015. We expect accelerating inflation to hit double-digit levels in Q1 15, weighing further on the rouble's nominal exchange rate. However, major external shocks will be mitigated due to the free floating rouble. We now target USD/RUB at 72 (previously 48) in 1M, 75 (49) in 3M, 78 (51) in 6M and 80 (51) in 12M. • Last week, we modified our AUD/USD forecast, as we now believe that the Reserve Bank of Australia (RBA) will make a single rate cut in Q1 15. The five main reasons for this are disappointing growth figures, low inflation, high unemployment, macro prudential policy alerts and recent dovish RBA comments (for more information see AUD/USD Forecast Update: RBA to cut the interest rate in Q1 15, 11 December). Specifically, we expect the RBA to cut in March and governor Glenn Stevens to communicate an explicit easing bias at the RBA’s next meeting in February. What is more, we still expect US growth outperformance, relative monetary policy and the USD’s role as an asset currency to pull AUD/USD lower. In light of the above, we revised our targets and expect AUD/USD to trade at 0.82 (previously 0.86) in 1M, 0.81 (0.85) in 3M, 0.80 (0.84) in 6M and 0.79 (0.83) in 12M. • In the short term, we expect moderate depreciation pressure on the CNY on the back of both a stronger easing bias in monetary policy and less favourable seasonal inflows from the trade balance. We have revised our onemonth and three-month forecasts for USD/CNY higher to 6.20 (previously 6.13) and 6.18 (6.15) respectively. In the medium term, we expect the CNY to remain on a moderate appreciation path supported by an increasing trade balance surplus and we target 6.02 for USD/CNY on a 12-month horizon. www.danskebank.com/CI 3 EUR/NOK – It’s all about oil • Growth. Norwegian growth has been mixed, with the sharp fall in oil-related investments and activity counteracted by solid performances in the housing market, domestic demand and labour markets. Norges Bank forecasts mainland GDP of 1.5% in 2015; we forecast 1.75%. However, there are significant downside risks to both Norges Bank’s and our growth forecasts. Norwegian growth is a negative for the NOK over the coming three months. • Monetary policy. Norges Bank cut interest rates by 25bp in December and the market is likely to price in 50bp of additional rate cuts near term. The market is currently pricing in around 40bp of rate cuts from Norges Bank over the coming 12 months. We expect the ECB to enact sovereign QE in Q1 15. Relative monetary policy is mixed for the NOK versus the EUR in 2015. • Flows. Looking at the cumulative purchases for the past four weeks, foreign banks have sold almost NOK14bn. This suggests that positioning has reached stretched levels and that EUR/NOK is vulnerable to the downside should fundamentals improve. • Valuation. Our PPP models put EUR/NOK at 8.17, suggesting that the NOK is cheap. • Risks. The risk is that oil prices continue to fall and that Norway is hit by a substantial slowdown. Thomas Harr, Chief Analyst, [email protected], +45 45 13 67 31 Forecast: 9.25 (1M), 9.40 (3M), 9.00 (6M), 8.50 (12M) 10.50 10.25 10.00 9.75 9.50 9.25 9.00 8.75 8.50 8.25 8.00 Dec-13 EUR/NOK Mar-14 75% conf. int. EUR/NOK Jul-14 50% conf.int. Oct-14 Jan-15 Forward k Apr-15 Aug-15 Danske fcst Nov-15 Consensus fcst 1M 3M 6M 12M Forecast (pct'ile) 9.25 (59%) 9.40 (69%) 9.00 (38%) 8.50 (17%) Fwd. / Consensus 9.21 / 8.41 9.23 / 8.48 9.26 / 8.42 9.30 / 8.22 50% confidence int. 8.97 / 9.40 8.89 / 9.49 8.78 / 9.62 8.68 / 9.74 75% confidence int. 8.84 / 9.60 8.71 / 9.77 8.53 / 10.00 8.32 / 10.25 Source: Danske Bank Markets Conclusion. We are lifting our EUR/NOK forecasts as oil prices have collapsed and Norges Bank has cut interest rates, which we did not expect. There is a significant risk of the oil price undershooting, which would weigh on the NOK. In addition, the market is likely to price in two additional cuts from Norges Bank in coming months while ECB sovereign QE in Q1 will mitigate NOK losses. Medium term, we continue to see significant value in the NOK due to strong internal and external balances and valuation. To sum up, we lift our EUR/NOK forecasts to 9.25 (from 8.80) in 1M, 9.40 (8.70) in 3M, 9.00 in 6M (8.50) and 8.50 (8.20) in 12M. www.danskebank.com/CI 4 EUR/SEK – the SEK expected to stay weak near term • Growth. We have a more downbeat view on Swedish growth for 2015 than consensus. Weak foreign demand continues to be a headwind. In addition, we expect private consumption to take a hit from new mandatory amortisation rules coming into effect next year. This said, we still expect Sweden to outperform euroland in terms of growth. Forecast: 9.40 (1M), 9.30 (3M), 9.20 (6M), 9.00 (12M) 10.25 10.00 9.75 9.50 9.25 • Monetary policy. The Riksbank has reached the ZLB, meaning 9.00 rates are basically flat versus the ECB. The Riksbank will probably need to delay future repo rate hikes further. If this is not enough, it will have to dig deeper into the unconventional toolbox; negative rates and QE are options, while currency floors and direct FX measures are not in the pipeline. The ECB is likely to do QE in Q1, which could send EUR/SEK lower. 8.75 • Flows. PPM payments (SEK36bn, of which a third is estimated to affect the SEK) was due on 15 December. The SEK tends to weaken ahead of, and appreciate after, the PPM date. • Valuation. Fundamental macro arguments unambiguously • suggest the SEK is undervalued, which in turn serves as an anchor for our medium- to long-term forecasts on EUR/SEK. Risks. The SEK is sensitive to Riksbank/ECB measures and spillover effects from the NOK. A sharp downturn in the Swedish housing market is a more fundamental risk. The messy political situation could affect foreign attitudes to Sweden, although, in our view, significant financial ramifications are not warranted. Stefan Mellin, Senior Analyst, [email protected], +46 8 568 805 92 EUR/SEK 8.50 Dec-13 Mar-14 75% conf. int. EUR/SEK Jul-14 50% conf.int. Oct-14 Jan-15 Forward k Apr-15 Danske fcst Aug-15 Nov-15 Consensus fcst 1M 3M 6M 12M Forecast (pct'ile) 9.40 (53%) 9.30 (40%) 9.20 (35%) 9.00 (27%) Fwd. / Consensus 9.40 / 9.24 9.41 / 9.21 9.41 / 9.16 9.42 / 9.02 50% confidence int. 9.24 / 9.54 9.17 / 9.60 9.08 / 9.67 8.97 / 9.76 75% confidence int. 9.14 / 9.67 9.03 / 9.79 8.88 / 9.94 8.69 / 10.14 Source: Danske Bank Markets Conclusion. EUR/SEK has edged higher in recent weeks towards our 1M target at 9.40. Basically, it is a natural response to weaker growth signals given the procyclicality of the SEK and year-end flows (PPM). Forecasters in general may be too optimistic on Swedish growth, a potential headwind for the SEK going into next year. The trend rise in EUR/SEK also reflects relatively expansionary policy on behalf of the Riksbank over the past year. However, short rates are now at the same low level. The ECB and Riksbank may elaborate further with unconventional measures next year but from a relative stance the ECB is likely to be more aggressive going forward. www.danskebank.com/CI 5 Danske Bank Markets FX forecasts vs EUR and USD +1m Forecast +3m +6m +12m Forecast vs forward outright, % +1m +3m +6m +12m 1.23 148 0.79 1.205 1.22 149 0.77 1.210 1.20 149 0.76 1.220 1.23 155 0.79 1.240 -1.7 1.4 -1.1 0.4 -2.5 2.3 -3.7 0.8 -4.2 2.3 -5.1 1.7 -2.1 6.6 -1.7 3.5 7.4425 9.25 9.40 7.4425 9.40 9.30 7.4390 9.00 9.20 7.4390 8.50 9.00 0.0 -1.8 -1.1 0.1 -0.4 -2.2 0.0 -4.9 -3.3 0.0 -10.6 -5.4 Exchange rates vs USD JPY 116.4 GBP 1.57 CHF 0.96 120 1.56 0.98 122 1.58 0.99 124 1.58 1.02 126 1.56 1.01 3.1 -0.6 2.1 4.9 1.2 3.4 6.7 1.0 6.2 8.9 -0.4 5.7 DKK NOK SEK 5.95 7.52 7.60 6.05 7.52 7.64 6.10 7.70 7.62 6.20 7.50 7.67 6.05 6.91 7.32 1.8 -0.1 0.6 2.6 2.2 0.4 4.4 -0.7 1.0 2.2 -8.7 -3.4 CAD AUD NZD 1.17 0.82 0.78 1.14 0.82 0.78 1.14 0.81 0.75 1.14 0.80 0.74 1.13 0.79 0.73 -2.2 -0.3 0.9 -2.4 -1.1 -2.5 -2.6 -1.8 -2.9 -3.8 -1.9 -2.6 7.2 -0.4 7.7 -1.3 6.7 -2.8 2.2 -5.3 Spot Exchange rates vs EUR USD 1.251 JPY 145.6 GBP 0.799 CHF 1.201 DKK NOK SEK 7.4396 9.41 9.50 RUB 65.91 72.00 75.00 78.00 80.00 CNY 6.19 6.20 6.18 6.12 6.02 Note: GBP, AUD and NZD are denominated in local currency rather than USD Source: Danske Bank Markets www.danskebank.com/CI 6 Danske Bank Markets FX forecasts vs DKK Spot +1m Exchange rates vs DKK EUR 7.4398 7.4425 USD 5.97 6.05 JPY 5.09 5.04 GBP 9.36 9.42 CHF 6.19 6.18 Forecast +3m +6m +12m Forecast vs forward outright, % +1m +3m +6m +12m 7.4425 6.10 5.00 9.67 6.15 7.4390 6.20 5.00 9.79 6.10 7.4390 6.05 4.80 9.42 6.00 0.0 1.3 -1.0 0.7 -0.3 0.0 2.2 -1.8 3.4 -0.7 0.0 3.9 -1.9 4.9 -1.6 0.0 1.8 -5.8 1.4 -3.3 NOK SEK 0.80 0.78 0.80 0.79 0.79 0.80 0.83 0.81 0.88 0.83 0.5 1.1 -0.8 2.3 3.8 3.4 10.4 5.8 CAD AUD NZD 5.13 4.92 4.63 5.31 4.96 4.72 5.35 4.94 4.58 5.44 4.96 4.59 5.35 4.78 4.42 3.5 1.2 2.4 4.5 1.3 -0.2 6.5 2.4 1.1 5.6 0.0 -0.8 PLN CZK HUF RUB 1.78 0.27 0.24 0.10 1.78 0.27 0.24 0.08 1.79 0.27 0.24 0.08 1.79 0.27 0.24 0.08 1.77 0.27 0.24 0.08 0.6 -1.6 0.4 -13.9 1.4 -1.5 -0.1 -14.2 1.7 -1.7 0.2 -12.2 1.4 -1.7 1.0 -11.5 CNY 0.96 0.98 0.99 1.01 1.00 1.8 3.6 7.1 7.6 Source: Danske Bank Markets www.danskebank.com/CI 7 Danske Bank Markets FX forecasts vs SEK Spot Exchange rates vs SEK EUR 9.50 USD 7.63 JPY 6.50 GBP 11.95 CHF 7.91 +1m Forecast +3m +6m +12m Forecast vs forward outright, % +1m +3m +6m +12m 9.40 7.64 6.37 11.90 7.80 9.30 7.62 6.25 12.08 7.69 9.20 7.67 6.18 12.11 7.54 9.00 7.32 5.81 11.39 7.26 -1.1 0.2 -2.1 -0.4 -1.4 -2.2 -0.1 -4.0 1.2 -2.9 -3.2 0.6 -5.0 1.5 -4.8 -5.4 -3.8 -11.0 -4.2 -8.6 NOK DKK 1.02 1.28 1.02 1.26 0.99 1.25 1.02 1.24 1.06 1.21 -0.6 -1.1 -3.0 -2.2 0.4 -3.3 4.4 -5.5 CAD AUD NZD 6.56 6.28 5.91 6.70 6.27 5.96 6.69 6.17 5.72 6.73 6.13 5.67 6.48 5.78 5.34 2.3 0.1 1.2 2.2 -1.0 -2.4 3.1 -1.0 -2.2 -0.2 -5.5 -6.2 PLN CZK HUF RUB 2.27 0.34 0.31 0.13 2.25 0.34 0.31 0.11 2.24 0.33 0.30 0.10 2.22 0.33 0.30 0.10 2.14 0.32 0.29 0.09 -0.5 -2.7 -0.8 -14.9 -0.9 -3.7 -2.3 -16.1 -1.6 -4.8 -3.0 -15.0 -4.2 -7.1 -4.5 -16.4 CNY 1.23 1.23 1.23 1.25 1.22 0.7 1.3 3.6 1.7 Source: Danske Bank Markets www.danskebank.com/CI 8 Danske Bank Markets FX forecasts vs NOK Spot Exchange rates vs NOK EUR 9.28 USD 7.46 JPY 6.35 GBP 11.68 CHF 7.73 +1m Forecast +3m +6m +12m Forecast vs forward outright, % +1m +3m +6m +12m 9.25 7.52 6.27 11.71 7.68 9.40 7.70 6.32 12.21 7.77 9.00 7.50 6.05 11.84 7.38 8.50 6.91 5.48 10.76 6.85 -0.5 0.8 -1.5 0.2 -0.8 0.9 3.1 -1.0 4.3 0.1 -3.6 0.1 -5.4 1.1 -5.2 -9.4 -7.9 -14.7 -8.2 -12.5 SEK DKK 0.98 1.25 0.98 1.24 1.01 1.26 0.98 1.21 0.94 1.14 0.6 -0.5 3.1 0.9 -0.4 -3.7 -4.2 -9.5 CAD AUD NZD 6.41 6.13 5.77 6.60 6.17 5.87 6.76 6.24 5.78 6.58 6.00 5.55 6.12 5.46 5.04 2.9 0.7 1.8 5.4 2.1 0.7 2.6 -1.4 -2.6 -4.4 -9.5 -10.1 PLN CZK HUF RUB 2.22 0.34 0.30 0.12 2.22 0.33 0.30 0.10 2.27 0.34 0.30 0.10 2.17 0.32 0.29 0.10 2.02 0.30 0.27 0.09 0.1 -2.1 -0.2 -14.4 2.2 -0.7 0.8 -13.4 -2.0 -5.2 -3.4 -15.4 -8.2 -11.0 -8.6 -19.9 CNY 1.20 1.21 1.25 1.23 1.15 1.3 4.5 3.2 -2.6 Source: Danske Bank Markets www.danskebank.com/CI 9 Danske Bank EMEA FX forecasts PLN HUF CZK RUB TRY ZAR 16-Dec-14 +1M +3M +6M +12M 16-Dec-14 +1M +3M +6M +12M 16-Dec-14 +1M +3M +6M +12M 16-Dec-14 +1M +3M +6M +12M 16-Dec-14 +1M +3M +6M +12M 16-Dec-14 +1M +3M +6M Danske 4.19 4.17 4.15 4.15 4.20 309 308 310 310 310 27.6 28.0 28.0 28.0 28.0 75.0 88.6 91.5 93.6 98.4 2.93 2.79 2.80 2.78 2.95 14.6 14.3 14.2 14.2 +12M 14.9 EUR Forward 14.7 14.8 15.1 Danske 3.36 3.39 3.40 3.46 3.41 248 250 254 258 252 22.1 22.8 23.0 23.3 22.8 64.9 72.0 75.0 78.0 80.0 2.35 2.27 2.30 2.32 2.40 11.7 11.63 11.60 11.80 15.6 12.15 4.19 4.20 4.22 4.25 309 310 311 313 27.6 27.6 27.5 27.5 76.2 78.5 82.2 87.0 2.96 3.00 3.06 3.20 USD Forward 11.8 11.9 12.1 Danske 178 178 179 179 177 24.1 24.2 24.0 24.0 24.0 27.0 26.6 26.6 26.6 26.6 9.8 8.4 8.1 7.9 7.6 254 267 266 268 252 51.0 52.0 52.6 52.5 12.5 49.8 3.37 3.37 3.39 3.40 248 249 249 250 22.1 22.1 22.1 22.0 65.6 67.6 70.6 75.0 2.37 2.40 2.45 2.56 DKK Forward 50.7 50.2 49.4 Danske 227 225 224 222 214 3.08 3.05 3.00 2.97 2.90 34.5 33.6 33.2 32.9 32.1 12.7 10.6 10.2 9.8 9.1 324 337 332 331 305 65.1 65.7 65.7 65.0 47.7 60.2 177 177 176 175 24.1 24.0 23.9 23.8 27.0 27.0 27.0 27.0 9.8 9.5 9.1 8.5 252 248 243 232 SEK Forward 64.8 64.1 63.1 Danske 222 222 227 217 202 3.01 3.00 3.03 2.90 2.74 33.7 33.0 33.6 32.1 30.4 12.4 10.4 10.3 9.6 8.6 317 332 336 324 288 63.7 64.7 66.4 63.6 61.0 56.9 227 226 225 224 3.08 3.07 3.06 3.04 34.5 34.5 34.5 34.6 12.5 12.1 11.6 10.9 321 317 311 298 NOK Forward 222 222 221 221 3.01 3.01 3.01 3.00 33.7 33.8 33.9 34.1 12.2 11.9 11.4 10.8 314 311 305 293 63.4 62.8 62.0 60.2 Source: Danske Bank Markets www.danskebank.com/CI 10 Disclosures This research report has been prepared by Danske Bank Markets, a division of Danske Bank A/S (‘Danske Bank’). The authors of this research report are Thomas Harr (Chief Analyst), Stefan Mellin (Senior Analyst), Stanislava Pravdová-Nielsen (Analyst), Morten Helt (Senior Analyst), Jens Naervig Pedersen (Analyst), Lars Christensen (Chief Analyst), Kristoffer Lomholt (Analyst) and Vladimir Miklashevsky (Analyst). Analyst certification Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report. Regulation Danske Bank is authorised and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority (UK). Details on the extent of the regulation by the Financial Conduct Authority and the Prudential Regulation Authority are available from Danske Bank on request. The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association. Conflicts of interest Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high-quality research based on research objectivity and independence. These procedures are documented in Danske Bank’s research policies. Employees within Danske Bank’s Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to Research Management and the Compliance Department. Danske Bank’s Research Departments are organised independently from and do not report to other business areas within Danske Bank. Research analysts are remunerated in part based on the overall profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions. Financial models and/or methodology used in this research report Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors on request. Risk warning Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text. Date of first publication See the front page of this research report for the date of first publication. www.danskebank.com/CI 11 General disclaimer This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) (‘Relevant Financial Instruments’). The research report has been prepared independently and solely on the basis of publicly available information that Danske Bank considers to be reliable. While reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report. The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgement as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in this research report. This research report is not intended for retail customers in the United Kingdom or the United States. This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent. Disclaimer related to distribution in the United States This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to ‘U.S. institutional investors’ as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to ‘U.S. institutional investors’. Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA but satisfy the applicable requirements of a non-U.S. jurisdiction. Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in non-U.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission. www.danskebank.com/CI 12

© Copyright 2026