Danske Daily - Danske Bank

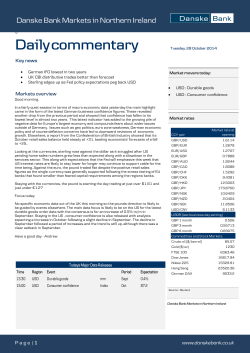

Investment Research — General Market Conditions 12 January 2015 Danske Daily Market movers today In the US the Fed will release its Labour Market Conditions Index (LMCI) for December based on data from Friday’s labour market report. According to the LMCI indicator the improvement in the labour market slowed in both October and November and in November improved at its slowest pace since January 2014. Hence, the continued decline in LMCI suggests that there remains considerable slack in the labour market despite strong payroll gains and continued decline in the unemployment rate. A couple of central bank speeches in the calendar. Atlanta Fed president Dennis Lockhart (voter, neutral) will speak about the US economic outlook at 18:40 CET. At 19:00 CET ECB governing council member Ewald Nowotny will speak about 2015 monetary policy in Vienna. The most important events this week are the EU Court of Justice’s non-binding ruling on the legality of ECB’s OMT-programme on Wednesday and retail sales and consumer prices in the US on Wednesday and Friday, respectively. Inflation in Denmark. For more on Scandi markets see page 2. Selected market news The big event on Friday was the December employment report that showed a very solid job growth of 252,000 and positive net revisions to the figures of the two previous months of 50,000. The unemployment rate fell to 5.6%, as the labour force declined by 273,000 and as household employment increased by 111,000. Despite the solid gain in employment, wage inflation continued to be very modest, as hourly earnings decreased 0.2% m/m in December and as November earnings were revised down to 0.2%, from 0.4%. Hence, despite the solid job growth, the Fed seems in no hurry to hike rates as the limited wage pressure leaves the Fed room to be patient. The bond market took its clue from the modest wage inflation and 10y treasury yields dropped once again below 2.0%. The US stock market also ended the session lower, especially as the market adopted the bearish sentiment from the European session. European equity markets came under pressure, as Bloomberg claimed to know that the governing council had been presented with a model in which the ECB buys as much as EUR500bn in investment grade assets. If the story is correct, it would be in the low end of expectations and it is questionable whether the ECB balance sheet can be boosted as much as intended by the ECB. The ‘investment grade’ focus leaves Greece out of any purchases, whereas Portuguese government bonds should be accepted, as Portugal has one investment grade rating (DBRS). Market expectations are very high that the ECB will announce a QE-programme on 22 January. However, keep an eye on the European Court of Justice’s opinion on the OMTprogramme on Wednesday and comments from ECB members like the one from Germany’s Lautenschläger over the weekend, where she once again argued against asset purchases. Important disclosures and certifications are contained from page 5 of this report. Market overview 07:30 S&P500 (close) S&P500 fut (chng from close) Nikkei Hang Seng 2044.8 2033.6 17197.7 23961.6 1 day +/-,% 17:00 07:30 US 2y gov US 10y gov 0.55 1.96 0.56 1.94 iTraxx Europe (IG) iTraxx Xover (Non IG) 63 346 64 348 1.184 118.600 1.20 0.781 9.509 9.05 1.187 118.190 1.20 0.782 9.545 9.07 49.4 1218.3 49.4 1229.8 EUR/USD USD/JPY EUR/CHF EUR/GBP EUR/SEK EUR/NOK Oil Brent, USD Gold, USD -0.84 -0.08 0.18 0.17 +/-, bp 1.2 -1.7 0.4 1.7 +/-, % 0.23 -0.35 0.02 0.13 0.38 0.22 USD -0.08 0.94 Note: * The iTraxx Europe Index shows the spread development for the most liquid investment grade CDS contracts in the euro credit market. **The iTraxx Europe Crossover show the spread development of the most liquid non-investment grade CDS contracts in the euro credit market. ***The Markit CDX North America Investment Grade Index shows the spread development for the most liquid investment grade CDS contracts in the US credit market. Source: Bloomberg Selected readings from Danske Bank US: solid job growth but no inflation, 9 January 2015 Weekly Focus, 9 January 2015 Rotation of FOMC voting rights, 9 January 2015 Chief Analyst Arne Lohmann Rasmussen +45 45 12 85 32 [email protected] www.danskeresearch.com Today’ [Tex Danske Daily Scandi markets Denmark. Fuel prices dragged down Danish inflation in December but there are no indications that other energy prices fell. Large movements in fuel prices mean large uncertainties, as we do not know exactly which days prices were sampled. We are also expecting some negative impact from clothes and book prices that were unusually high in November. Food prices seem to remain under pressure but, on the other hand, were unusually high in Germany in December. It is highly likely that CPI inflation is below zero y/y in January but unlike in the euro area, there are some fairly strong base effects, which should pull inflation back up above zero during the spring. US S&P500 future 2066 2066 2046 2046 2026 2026 2006 2006 1986 1986 Fri Mon Tue Wed Thu Mon Source: Bloomberg, Danske Bank Markets Fixed income markets Although US job creation appears solid overall, there are also signs of slack as there is limited wage pressure. Last Friday’s US job report created more downward pressure on US rates. We still prefer a sidelined approach and to let the rally continue until we see stabilisation, before we enter short positions. This week’s main event will the opinion on the OMT from the European Court of Justice on Wednesday. The Greek election is also moving closer but with SYRIZA and Germany indicating that they are willing to reach a compromise, the ‘Grexit’ risk is diminishing, at least for now. This should contribute to a more positive sentiment about Greek assets, which in turn should bring relief to periphery markets. We have a dense issuance calendar this week with gross issuance of more than EUR25bn. New benchmarks will be launched from the Netherlands, Germany and possibly the EFSF. Austria and Spain are both set to have tap auctions. Large coupons and redemptions out of France and the Netherlands imply a small positive cash flow this week, despite the high supply. High volatility prevailed in the government bond market in the first full week of 2015. If the reduced market liquidity is a consequence of the regulatory changes, it is likely that market participants just have to get used to this new regime. US 10y gov yield 2.24 2.24 2.14 2.14 2.04 2.04 1.94 1.94 1.84 1.84 Thu Mon Tue Wed Thu Fri Source: Bloomberg, Danske Bank Markets Global FX EUR/USD (LHS) USD/JPY (RHS) 1.215 120.8 119.9 1.195 119 1.175 Thu 118.1 Mon Tue Wed Fri Mon Source: Bloomberg, Danske Bank Markets FX markets Despite the strong US payrolls on Friday afternoon the dollar index ended the day lower, as worries over weak earnings grabbed markets following the initial cheer; EUR/USD closed above 1.18, thus highlighting that the FX market remains alert to the fact that the Fed will most likely have to move very slowly on rate hikes. This came after a fourth consecutive week in which speculators added to EUR shorts (according to IMM data), underlining that while the single currency certainly seems soft for now due to a range of political risks, there are already a lot of EUR bears out there. Fitch's downgrade of Russia on Friday should, however, ensure that risks to the euro zone from this side will stay around for now and hence keep both the EUR and RUB under pressure. In the Scandi sphere the SEK could remain soft ahead of Tuesday's CPI report, whereas the NOK should stay focused on oil-price moves. Brent crude oil dipped briefly below USD49/bbl on Friday and a stabilisation in the oil price will most likely be a prerequisite for EUR, RUB and NOK alike to shrug off recent weakness. 2| 12 January 2015 Scandi FX EUR/SEK (LHS) EUR/NOK (RHS) 9.32 9.53 9.23 9.48 9.14 9.43 9.05 9.38 Thu 8.96 Mon Tue Thu Fri Source: Bloomberg, Danske Bank Markets www.danskeresearch.com Danske Daily Key figures and events Monday, January 12, 2015 9:00 DKK CPI 9:00 CHF Centralbank - press briefing 9:30 SEK Budget balance 16:00 USD Fed's LMCI 18:40 USD Fed's Lockhart (voter, neutral) speaks Period Danske Bank m/m|y/y Dec -0.30%|0.20% SEK bn Dec 11 m/m Dec 2.9% Consensus Previous -0.20%|0.50% Source: Bloomberg, Danske Bank Markets 3| 12 January 2015 www.danskeresearch.com Danske Daily Today’s market data: 12 January 2015 STOCKS S&P500 Intraday, % 0.30 0.30 0.10 -0.10 -0.10 -0.60 -0.50 -1.30 -0.90 -2.00 -1.30 -2.70 Max Min -0.50 0.3 -1.3 0.4 -0.90 Eurostoxx Intraday, % Max Min 0.1 Close -0.6 0.1 -2.7 0.7 -1.3 +/- DJSTOXX50 2955 -1.8% OMXC20 OMXS30 753 1444 0.1% -0.8% OSE BX 580 0.1% -2 Close -1.30 15 16 17 18 19 20 Grey line indicates closing of Danish markets 21 10 11 12 13 14 15 16 17 18 Grey line indicates opening of US markets 1 month Year-to-date -2.7 09 2.1% -0.7% 1 month Year-to-date 1.6% -1.6% +/- DOW JONES 17737 -1.0% NASDAQ 4704 -0.7% S&P500 NIKKEI (07:30) 2045 17198 -0.8% -1.8% FX & COMMODITIES EUR/USD Intraday 118.7 EUR USD Max Min 118.3 119 118 0.4 117.9 117.5 07:30 118.66 +/0.27 07:30 JPY 140.41 140.24 -0.17 1 day 7.26 -0.71 118.3 GBP NOK 78.13 905.07 78.23 907.09 0.10 1 month 2.02 Year-t-date 7.28 44.92 -12.45 -7.93 117.9 SEK 950.89 954.48 DKK 743.92 743.91 427.17 PLN USD 117.5 07 10 13 16 19 22 01 04 1 month Year-to-date Oil, Brent, $ 49.40 17:00 118.39 118.7 -5.96 -2.32 426.67 17:00 Gold, $ 1229.78 3.59 -0.01 0.50 +/07:30 07:30 JPY 118.60 118.19 -0.41 1 day GBP CHF 151.53 101.44 151.68 101.22 0.15 1 month -0.22 Year-t-date CRB CRB, Raw 1M future 225.57 Industrials 490.27 -0.31 0.03 -18.18 -4.39 -10.73 -1.84 * The chart plo ts 07:30 - 23:00 Fri and 23:00 Sun to 07:30 M o n YIELDS & INTEREST RATES USD-Yields Intraday USD2Y Max 0.6 0.59Min 0.5 0 USD10Y Max 2.0 Min 1.9 0 0.62 0.56 2.02 1.99 1.96 0.53 1.93 07 10 13 16 19 22 USD2Y (lhs) 01 04 Policy Rate 3M Spread, bp 17:00 07:30 USD EUR 0.25 0.05 0.25 0.07 0 2 USD 10Y USD 30Y 1.96 2.56 1.94 2.53 -2 -3 GBP DKK SEK 0.50 0.20 0.00 0.56 0.29 0.26 6 9 26 JPY 10Y 0.29 0.28 -2 07:30(-1)* 17:00 NOK PLN 1.25 2.00 1.42 1.95 17 -5 DEM 10Y DKK 10Y SEK 10Y 0.50 0.81 0.86 0.48 0.75 0.82 -2 -6 -3 NOK 10Y 1.48 1.48 0 PLN 10Y 2.31 2.33 2 USD10Y (rhs) 10Y Yield Spread to Germany 1.84 2.0 1.5 1.45 1.39 0.99 1.0 0.29 0.0 0.5 USD JPY GBP FRF ITL DKK SEK NOKPLN -0.5 -1.3 2.0 -2.3 1.0 0.270.34 -0.21 0.5 0.0 0.0 -3.3 3.00 Max 0.00 Min USD2Y Europe (IG) HiVol Xover (N-IG) 64 68 348 -7.3 USD10Y USD5Y -0.1 -0.3 -0.5 1.00 Max 0.00 Min 1 month 0 -1 -14 72 0 6 Finan. Sub. Non-finan. 161 0 13 90 80 70 60 50 40 30 20 10 0 Feb Apr May Jul Aug Oct Nov Jan iTraxx Europe (IG) (left axis) iTraxx Xover (Non IG) (right axis) -0.7 -0.9 DEM2Y -1.3 DEM10Y DEM5YR D-t-D +/-, bp (right axis) 07:30 (left axis) 1 month ago (left axis) Swap Spread, bp* * 450 400 350 300 250 200 150 100 50 0 Jan 0.000 -1.300 -1.1 Credit spreads Finan. Sr. * Ask pric e -5.3 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 D-t-D +/-, bp (right axis) 07:30 (left axis) 1 month ago (left axis) Credit spread, iT raxx s. 11* 1 day 0 0 0 -4.3 0.000 -7.320 -6.3 -0.5 07:30 German Yield Curve -0.3 2.5 1.5 1.0 0.5 US Yield Curve 3.0 1.5 1.11 +/-, bp * As of c losing previous trading day * The chart plo ts 07:30 - 23:00 Fri and 23:00 Sun to 07:30 M o n 2.0 +/-, bp 17:00 07:30 +/- USD 10Y JPY 10Y 12 07:30(-1)* 14 17:00 2 +/- EUR 10Y DKK 10Y SEK 10Y 0 27 31 28 34 0 3 NOK 10Y 30 32 2 * As of c losing previous trading day ** Ask pric e Source: Bloomberg, Danske Bank Markets 4| 12 January 2015 www.danskeresearch.com Danske Daily Disclosure This research report has been prepared by Danske Bank Markets, a division of Danske Bank A/S (‘Danske Bank’). Analyst certification Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report. Regulation Danske Bank is authorised and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority (UK). Details on the extent of the regulation by the Financial Conduct Authority and the Prudential Regulation Authority are available from Danske Bank on request. The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association. Conflicts of interest Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of highquality research based on research objectivity and independence. These procedures are documented in Danske Bank’s research policies. Employees within Danske Bank’s Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to Research Management and the Compliance Department. Danske Bank’s Research Departments are organised independently from and do not report to other business areas within Danske Bank. Research analysts are remunerated in part based on the overall profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions. Financial models and/or methodology used in this research report Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request. Risk warning Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text. Expected updates Danske Daily is updated on a daily basis. First date of publication Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication. 5| 12 January 2015 www.danskeresearch.com Danske Daily General disclaimer This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) (‘Relevant Financial Instruments’). The research report has been prepared independently and solely on the basis of publicly available information that Danske Bank considers to be reliable. While reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report. The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgement as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in this research report. This research report is not intended for retail customers in the United Kingdom or the United States. This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent. Disclaimer related to distribution in the United States This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”. Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction. Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission. 6| 12 January 2015 www.danskeresearch.com

© Copyright 2026