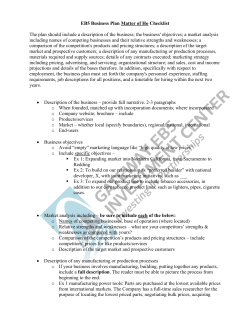

Public Discussion Draft