Superior Court, State of California

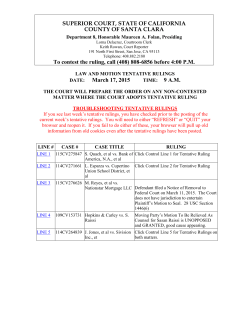

SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS DATE: DECEMBER 23, 2014 TIME: 9 A.M. PREVAILING PARTY SHALL PREPARE THE ORDER (SEE RULE OF COURT 3.1312) LINE # CASE # CASE TITLE RULING LINE 1 114CV261671 Brite Semiconductor USA Plaintiff’s Motion to Strike Answer is v Cloudvue Technologies unopposed. The motion is based on the failure of defendant Cloudvue, a corporation, to be represented by an attorney as is required. [CCP section 436(b)] Under the authority cited by plaintiff [Merco Constr. Engineers, Inc. v. Municipal Court (1978) 21 Cal.3d 724], a corporation may not be represented in court by a non-attorney corporate officer. That rule will affect the ability of the corporation to defend itself going forward. (Indeed, as it has in not opposing this motion.) However, the answer of defendant was appropriately filed by an attorney. There is no authority cited by plaintiff, nor is the court aware of any, that compels the court to strike all previous pleadings of defendant during the time it was represented by counsel. Therefore, the motion is DENIED. LINE 2 114CV270401 Khari v Dewing LINE 3 114CV271688 Nosrati v JPMorgan Chase Click on line 3 for ruling LINE 4 106CV073896 Vo v Machado Claim of Exemption LINE 5 114CV259760 AGI Publishing v Just Windows No opposition is filed to this motion. Motion to be Relieved as Counsel is GRANTED. LINE 6 114CV264469 Craft v Regional Medical Off calendar Center LINE 7 114CV268142 Arciga v Cabrera LINE 8 114CV270696 Becho, Inc. v Balfour No opposition is filed to this motion. Beatty Infrastructure, Inc. Plaintiff’s Motion to File Second Amended Complaint is GRANTED. Click on line 2 for ruling No opposition is filed to this motion. Defendant Cabrera’s Motion to Set Aside Default is GRANTED. SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS LINE 9 113CV257536 Cach, LLC v Krulee Plaintiff’s Motion for Protective Order is GRANTED, IN PART. Defendant’s Motion to Compel Production of Further Documents and ESI (Set One) is DENIED, IN PART. Portions of the Loan Sale Agreement are trade secrets entitled to informational privacy and shall not be disclosed. Defendant is entitled to production of so much of the LSA as is necessary to confirm the complete assignment of all interest in the account and the account balance at the time of the transfer of the debt to plaintiff. That much of the LSA shall be produced with the remainder redacted even if, as plaintiff claims, the same information can be found in the Bill of Sale. While the amount paid for the assignment by plaintiff may assist defendant in negotiating a settlement, it is not reasonably calculated to lead to the discovery of admissible evidence. It is relevant how much, if anything, is owed on the account by defendant and discovery directed to proof of that amount is appropriate. However, the amount paid to purchase the account by plaintiff is not relevant. Sanctions are DENIED. LINE 10 111CV214032 Board of Trustees of Off Calendar per Moving Party California State University v Construction Testing LINE 11 112CV224450 Mintel Learning Continued to 1/20/15 per Stipulation & Technology v IvyMax, Inc Order LINE 12 112CV235009 Metzgar v 3M Company Continued to 1/13/15 per Stipulation & Order LINE 13 113CV245555 Aimz Investment v Lehrer Case Dismissed, Off Calendar LINE 14 113CV256283 RREF CB SBL-AZ, LLC Off Calendar per Moving Party v Stepovich LINE 15 114CV259298 Avila v Figueroa Off Calendar per Moving Party SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS LINE 16 114CV264802 Kyes v Ocwen Loan Servicing LINE 17 LINE 18 LINE 19 LINE 20 LINE 21 LINE 22 LINE 23 LINE 24 LINE 25 LINE 26 LINE 27 LINE 28 LINE 29 LINE 30 Click on line 16 for ruling Calendar line 1 - oo0oo - Calendar line 2 Case Name: Khari v. Dewing, et al. Case No.: 1-14-CV-270401 Defendants University Café, Inc. (the “Café”) and Thoits Bros., Inc. (“Thoits”) each separately demur to the first amended complaint (“FAC”) filed by plaintiff Paul Khari (“Plaintiff”), by and through his guardian ad litem, Berta Khari. This is an action for premises liability and vehicular negligence. On July 31, 2014, Plaintiff was struck by a vehicle driven by defendant Robert Louis Dewing while he was sitting at a table in front of the Café when the vehicle mounted the sidewalk. (FAC at ¶¶ 4-7.) Plaintiff alleges that Thoits (alleged owner of the Café) and the Café acted negligently in failing to take measures to protect customers sitting at the tables in front of the establishment from the foreseeable risk of vehicles inadvertently driving onto the sidewalk such as the placement of planters, bumpers, barricades, or other types of protective obstructions. On October 29, 2014, Plaintiff filed the FAC asserting the following causes of action: (1) vehicular negligence; and (2) general negligence. On November 17, 2014, the Café filed its demurrer to the second cause of action on the ground of failure to state facts sufficient to constitute a cause of action. (Code Civ. Proc., § 430.10, subd. (e).) On November 21, 2014, Thoits filed its demurrer to the second cause of action on the ground of failure to state facts sufficient to constitute a cause of action. (Id.) Plaintiff’s request for judicial notice is DENIED. In demurring to the second cause of action in the FAC, Thoits and the Café (collectively, “Defendants”) make the same argument and assert that no claim for negligence has been stated or can be maintained against them because it is not reasonably “foreseeable,” as a matter of law, that a random vehicle would jump the curb and strike someone sitting at a table located on the sidewalk, nor is there any legal duty to place barriers along the sidewalk simply because someone might lose control of their vehicle and jump the curb. Plaintiff conversely asserts that a claim for negligence has been sufficiently pleaded because a vehicle jumping the curb in the circumstances described in the FAC was foreseeable as a matter of law. A necessary element of a cause of action for negligence is the existence of a duty of care on the part of the defendant to the plaintiff. (See Ladd v. County of San Mateo (1996) 12 Cal.4th 913, 917 [stating that the elements of negligence are “(a) a legal duty to use due care; (b) a breach of such legal duty; [and] (c) the breach as the proximate or legal cause of the resulting injury”].) Pursuant to Civil Code section 1714, subdivision (a), all persons have a duty to use ordinary care to prevent injury to others from their own conduct. “This general rule requires a property owner to exercise ordinary care in the management of his or her premises in order to avoid exposing persons to an unreasonable risk of harm.” (Scott v. Chevron U.S.A. (1992) 5 Cal.App.4th 510, 515.) The instant action involves the wrongful act of a third party relative to Defendants, defendant Robert Louis Dewing. “[A] duty to take steps to prevent the wrongful acts of a third party ‘will be imposed only where such conduct can be reasonably anticipated’ [citation],” i.e., is foreseeable. (Jefferson v. Qwik Korner Market, Inc. (1994) 28 Cal.App.4th 990, 993.) In determining the existence of a duty, foreseeability is generally a question of law. (Ann M. v. Pacific Plaza Shopping Center (1993) 6 Cal.4th 666, 678.) “An act must be sufficiently likely before it may be foreseeable in the legal sense.” (Jefferson, supra, 28 Cal.App.4th at 996.) Relying primarily on Jefferson v. Qwik Korner Market, Inc., supra, Defendants assert that a car jumping the curb as it attempted to parallel park in front of the Café on University Avenue is not sufficiently likely and thus not foreseeable as a matter of law. They argue that the circumstances of this case are analogous to those in Jefferson, where a child was injured in front of a convenience store when he was struck by a vehicle that jumped the curb after attempting to park. The Jefferson court ultimately held that the store was not liable, after first acknowledging both the relative dearth of California case law regarding cars negligently coming onto sidewalks of businesses and then discussing the types of circumstances in which other jurisdictions either found a lack of liability because incidents of curb-jumping are not foreseeable as a matter of law or found that liability was a question of fact for the jury. The latter grouping is comprised of cases where the following circumstances are present: (1) the business provided no protection at all (including a curb) from encroaching vehicles; (2) the defendants had knowledge of prior similar incidents and therefore the subject accident was foreseeable; and (3) the building design required customers to await service by standing adjacent to a parking lot or driveway such that if a car jumped the curb, there was a high likelihood that a pedestrian would be at the location. (Id. at 994-995.) The facts of the case before it did not fall within any of the aforementioned three categories and thus the Jefferson court concluded that the act of the vehicle jumping the curb in front of the convenience store was not foreseeable as a matter of law. Defendants urge that a similar conclusion is warranted here. While a cursory review of Jefferson would appear to support Defendants’ position, they ignore critical distinctions between Jefferson and the case at bar. First, it is worth noting that Jefferson was decided on the defendant’s summary judgment motion, whereas in the instant action, the Court is only considering the pleadings. Second, in Jefferson, a critical element that weighed against the imposition of liability on the store was the fact that it had done nothing to encourage customers to remain where they could be hit by vehicles that jumped over the curb. Here, in contrast, it is alleged that Plaintiff was struck by the vehicle while he was sitting at a table on the sidewalk in front of the Café that was placed there by Defendants for use by their customers. These allegations move this case into the third category of curb-jumping cases permitting liability described in Jefferson and make this case, as currently pleaded, more analogous to Bigbee v. Pacific Tel. & Tel. Co. (1983) 34 Cal.3d 49, a case cited by Plaintiff. In that case, the court held that foreseeability could not be decided as a matter of law because the defendant had provided an amenity (a telephone booth) that had encouraged customers to remain at the specific location where the accident occurred. The Court reasoned that foreseeability was a question of fact for the jury, and could only be decided as a matter of law if, “under the undisputed facts there is not room for a reasonable difference of opinion.” (Bigbee, 34 Cal.3d at 56.) Under the circumstances alleged, the court reasoned that a jury could reasonably find the type of accident at issue to be foreseeable to the defendant and therefore it could not conclude as a matter of law that the act which injured the plaintiff was unforeseeable as a matter of law. The Court reaches an identical conclusion here. Based only upon what is currently pleaded within the four corners of the FAC, particularly Plaintiff having been injured while sitting at a table, an amenity, placed on the sidewalk by Defendants, and considering the cases cited by the parties, the Court cannot conclude at this juncture that the accident which injured Plaintiff was unforeseeable as a matter of law. Accordingly, Thoits and the Café’s demurrers to the second cause of action on the ground of failure to state facts sufficient to constitute a cause of action are OVERRULED. - oo0oo - Calendar line 3 Case Name: Nosrati v. JP Morgan Chase Bank, N.A. Case No.: 1-14-CV-271688 Defendant JP Morgan Chase Bank, N.A. (“Defendant”) demurs to the complaint (“Complaint”) filed by plaintiffs Rahim Nosrati and Farahanz Nosrati (collectively, “Plaintiffs”) and moves to strike portions contained therein. On December 5, 2006, Plaintiffs purchased the property located 6473 Sulu Court, San Jose (the “Property”) with a loan from Washington Mutual Bank, FA (“WaMu”) that was secured by a Deed of Trust (“DOT”) on the Property. (Complaint, ¶ 8.) Defendant is the successor in interest to WaMu and is the beneficiary and servicer under the DOT. (Id.) On June 8, 2011, Defendant recorded a Notice of Default. (Complaint, ¶ 9.) On September 9, 2011, Defendant recorded a Notice of Trustee’s Sale. (Id.) Upon the receipt of the latter document, Plaintiffs contacted Defendant to explore foreclosure alternatives. (Id., ¶ 10.) On September 30, 2011, Plaintiffs submitted a complete loan modification application. (Id.) Despite having done this, on January 3, 2012, Defendant sent a letter to Plaintiffs requesting that they submit another application and supporting documents by January 18, 2012. (Id.) Plaintiffs immediately complied with Defendant’s instructions. (Id.) In January 2012, Plaintiffs were assured by Defendant that it had all of the documents necessary to review their application. (Complaint, ¶ 12.) Despite the submission of a completed modification application, Plaintiffs received notices regarding a scheduled trustee’s sale on February 6, 2012. (Complaint, ¶ 13.) In response to their concerns about the scheduled sale, the Customer Assistance Specialist working with Plaintiffs, Marco Ramos (“Ramos”), instructed Plaintiffs to ignore the notices, which he stated were automatically generated. (Id.) Ramos promised that the sale would not proceed because Plaintiffs were in loan modification review and all sales actions had been stopped by Defendant. (Id.) Contrary to Ramos’ representations, on February 6, 2012, Defendant sold the Property at a trustee’s sale while Plaintiffs were still awaiting a determination on their loan modification application. Shortly thereafter, individuals came onto the Property and informed Plaintiffs that they had purchased the Property at auction. (Complaint, ¶ 15.) Plaintiffs immediately called Ramos, who told them not to worry, that they were in loan modification review, and that they should call the police if those individuals returned to the Property. (Id.) However, several weeks later, Ramos confirmed that the Property had been sold at the trustee’s sale. (Id., ¶ 16.) On October 9, 2014, Plaintiffs filed the Complaint asserting the following causes of action: (1) breach of the covenant of good faith and fair dealing; (2) negligent misrepresentation; (3) fraud; and (4) unfair competition- violation of Bus. & Prof. Code § 17200, et seq. On November 24, 2014, Defendant filed the instant demurrer to each of the four causes of action asserted in the Complaint on the grounds of uncertainty and failure to state facts sufficient to constitute a cause of action. (Code Civ. Proc., § 430.10, subds. (e) and (f).) Defendant also filed the motion to strike Plaintiffs’ request for punitive damages and allegations relating thereto. (Code Civ. Proc., §§ 435 and 436.) Defendant’s request for judicial notice is GRANTED. (Evid. Code, § 452, subd. (h); see also Poseidon Develop., Inc. v. Woodland Lane Estates, LLC (2007) 152 Cal.App.4th 1106, 1117 [stating that publicly recorded documents may be judicially noticed as to their existence and legal effect]; see also Evans v. California Trailer Court, Inc. (1994) 28 Cal.App.4th 540, 549 [“the court may take judicial notice of recorded deeds”].) Defendant’s demurrer to the first (breach of the implied covenant), second (negligent misrepresentation), third (fraud) and fourth (unfair competition) causes of action on the ground of uncertainty is OVERRULED. A demurrer for uncertainty is disfavored and will be sustained only where the allegations of the complaint are so unintelligible that the defendant cannot reasonably respond to them. (See Khoury v. Maly’s of Calif., Inc. (1993) 14 Cal.App.4th 612, 616.) The allegations of the Complaint do not qualify as such. As initial matter, Defendant’s contention that Plaintiffs’ entire Complaint fails because (1) they fail to allege tender and (2) their claims are barred by the statute of frauds, is unavailing. Plaintiffs are not suing to set aside the foreclosure sale and therefore tender of their indebtedness is not required in order to assert their claims. (See Lauras v. BAC Home Loans Servicing, LP (2013) 221 Cal.App.4th 49, 74.) Further, while it is true as a general matter that an agreement to modify a promissory note or deed of trust must be in writing in order to be enforceable (see, e.g., Nguyen v. Calhoun (2003) 105 Cal.App.4th 428, 445), Defendant’s attempt to apply the statute of frauds to Plaintiffs’ claims suggests that it misunderstands the nature of these claims. Plaintiffs are not alleging that Defendant agreed to postpone the foreclosure sale; instead, they allege that Defendant repeatedly mislead them on the status of that sale, representing that it would not occur on February 6, 2012 as indicated on the Notice of Trustee’s Sale because Plaintiffs’ application for a loan modification was pending review. Thus, the statute of frauds is not applicable and therefore does not bar Plaintiffs’ claims. Defendant’s demurrer to the first cause of action (breach of implied covenant) on the ground of failure to state facts sufficient to constitute a cause of action is SUSTAINED WITH 10 DAYS’ LEAVE TO AMEND. “The implied covenant of good faith and fair dealing rests upon the existence of some specific contractual obligation. [Citation.] ‘The covenant of good faith is read into contracts in order to protect the express covenants or promises of the contract, not to protect some general public policy interest not directly tied to the contract’s purpose.’ [Citation.] … ‘In essence, the covenant is implied as a supplement to the express contractual covenants, to prevent a contracting party from engaging in conduct which (while not technically transgressing the express covenants) frustrates the other party’s rights to the benefits of the contract.’” (Racine & Laramie, Ltd. v. Development of Parks & Recreation (1992) 11 Cal.App.4th 1026, 1031-1032.) While Plaintiffs have pleaded that Defendant interfered with their right to reinstate the loan under Covenant 19 of the DOT by representing that the trustee’s sale would not take place on February 6, 2012 as noticed, they fail to plead facts showing the existence of a special relationship between the parties with fiduciary characteristics. The existence of such a relationship is required in order to state a claim for breach of the implied covenant in this context. (See, e.g., Kelly v. Mortg. Elec. Regis. Sys., Inc. (N.D. Cal. 2009) 642 F.Supp.2d 1048, 1056; Mitsui Mfrs. Bank v. Superior Court (1989) 212 Cal.App.3d 726, 730 [“Generally, no cause of action for the tortious breach of the implied covenant of good faith and fair dealing can arise unless the parties are in a ‘special relationship’ with ‘fiduciary characteristics’”].) Defendant’s demurrer to the second cause of action (negligent misrepresentation) on the ground of failure to state facts sufficient to constitute a cause of action OVERRULED. Defendant’s insistence that no claim for negligent misrepresentation can be stated against it because it did not owe Plaintiffs a legal duty of care is unpersuasive. While it is generally true that financial institutions owe no duty of care to a borrower (see, e.g., Nymark v. Heart Fed. Sav. Loan Assn. (1991) 231 Cal.App.3d 1089, 1096), California courts have held that a lender owes a legal duty to a borrower to “not make material misrepresentations about the status of an application for a loan modification or about the date, time, or status of a foreclosure sale. The law imposes a duty not to make negligent misrepresentations of fact.” (Lueras v. BAC Home Loans Servicing, LP (2013) 221 Cal.App.4th 49, 68 [emphasis added].) Plaintiffs allege in the Complaint that Defendant misrepresented to them that the foreclosure sale would not go forward as scheduled. Plaintiffs have otherwise sufficiently plead the necessary elements of this claim, including their foregoing restating their loan or filing for bankruptcy to prevent the sale of the Property in reliance on Defendant’s representations, resulting in the loss of their home and damage to their credit. (See Fox v. Pollack (1986) 181 Cal.App.3d 954, 962 [“Negligent misrepresentation is a form of deceit, the elements of which consist of (1) a misrepresentation of a past or existing material fact, (2) without reasonable grounds for believing it to be true, (3) with intent to induce another’s reliance on the fact misrepresented, (4) ignorance of the truth and justifiable reliance thereon by the party to whom the misrepresentation was directed, and (5) damages”].) Defendant’s demurrer to the third cause of action (fraud) on the ground of failure to state facts sufficient to constitute a cause of action is OVERRULED. Plaintiffs have pleaded their claim for fraud with the requisite specificity in setting forth when the misrepresentations to them were made regarding the status of the trustee’s sale, who made them and by what means. (Complaint, ¶¶ 13, 14.) Defendant’s demurrer to the fourth cause of action (unfair competition) on the ground of failure to state facts sufficient to constitute a cause of action is OVERRULED. The Unfair Competition Law (“UCL”) (Bus. & Prof. Code, § 17200, et seq.) prohibits “unfair competition,” which is defined as including “any unlawful, unfair or fraudulent act or business practice and unfair, deceptive, untrue or misleading advertising and any act prohibited by [California’s false advertising law].” (Bus. & Prof. Code, § 17200, et seq.) “Because section 17200 is written in the disjunctive, a business act or practice need only meet one of the three criteria- unlawful, unfair or fraudulent- to be considered unfair competition under the UCL.” (Buller v. Sutter Health (2008) 160 Cal.App.4th 981, 986.) Here, in alleging that Defendant misrepresented that the foreclosure sale would not go forward as scheduled because their loan modification application was pending review, Plaintiffs have pleaded both a fraudulent and unfair business practice within the meaning of Business and Professions Code section 17200, et seq. An “unfair” business practice occurs not only when it “offends an established public policy,” but also when the practice is “immoral, unethical, oppressive, unscrupulous or substantially injurious to consumers.” (Smith v. State Farm Mutual Automobile Ins. Co. (2001) 93 Cal.App.4th 700, 719 [internal citations omitted].) Plaintiffs have essentially accused Defendant of engaging in the practice of dual-tracking, which although not illegal when it took place, nevertheless supports a claim for violation of the UCL under the “unfair” prong. (See, e.g., Jolley v. Chase Home Finance (2013) 213 Cal.App.4th 872, 907-908.) Defendant’s motion to strike Plaintiffs’ request for punitive damages and allegations relating thereto is DENIED. A properly pleaded fraud claim will by itself support the recovery of punitive damages. (See Stevens v. Superior Court (1986) 180 Cal.App.3d 605, 610.) - oo0oo - Calendar line 4 - oo0oo - Calendar line 5 - oo0oo - Calendar line 6 - oo0oo - Calendar line 7 - oo0oo - Calendar line 8 - oo0oo - Calendar line 9 - oo0oo - Calendar line 10 - oo0oo - Calendar line 11 - oo0oo - Calendar line 12 - oo0oo - Calendar line 13 - oo0oo - Calendar line 14 - oo0oo - Calendar line 15 - oo0oo - Calendar line 16 Case Name: Kyes v. Ocwen Loan Servicing, LLC, et al. Case No.: 1-14-CV-264802 Defendants Ocwen Loan Servicing, LLC (“Ocwen”) and U.S. Bank National Association, as Trustee for Greenpoint Mortgage Funding Mortgage Pass-Through Certificates, Series 2006-AR7 (“U.S. Bank”) demur to the First Amended Complaint filed by plaintiff Georgia Brown Kyes (“Plaintiff”). Plaintiff filed a complaint against U.S. Bank and Ocwen (collectively “Defendants”) on May 5, 2014. The initial complaint set forth three causes of action: (1) negligence; (2) unfair business practices in violation of Business and Professions Code section 17200; and (3) declaratory relief. Defendants demurred to the initial complaint on the grounds that Plaintiff’s suit is barred by the doctrine of res judicata and on the ground that, as to each of the three causes of action, Plaintiff failed to plead facts sufficient to constitute a cause of action. On September 9, 2014, the Court ruled on Defendants’ demurrer to the initial complaint, overruling the demurrer on the basis of res judicata and sustaining the demurrer with leave to amend as to each of the three causes of action based upon the finding that Plaintiff had failed to sufficiently plead the claims. On September 24, 2014, Plaintiff filed a First Amended Complaint, raising the same three causes of action as the initial complaint: (1) negligence; (2) unfair business practices; and (3) declaratory relief. Defendants request for judicial notice is GRANTED IN PART and DENIED IN PART. The request is GRANTED as to the documents attached as Exhibits 1-10 to Defendants’ request for judicial notice, which relate to the deed of trust, notice of default, and notice of trustee’s sale, all of which were recorded in the Official Records of the Santa Clara County Recorder. These documents are relevant to the matter before the court and judicially noticeable. (See Fontenot v. Wells Fargo Bank, N.A. (2011) 198 Cal.App.4th 256, 264-265.) The request is DENIED as to the documents attached as Exhibits 11-24 to Defendants’ request for judicial notice because the documents are not relevant to the matter presently before the Court. (Gbur v. Cohen (1979) 93 Cal.App.3d 296, 301 [information subject to judicial notice must be relevant to the issue at hand].) Defendants’ demurrer to the first cause of action for negligence is SUSTAINED WITH 20 DAYS LEAVE TO AMEND. In the FAC, Plaintiff alleges that Ocwen was a signatory to a consent decree requiring it “to provide $2 billion in first lien principal reduction to underwater borrowers.” (FAC, ¶ 9.) The consent decree also requires Ocwen to follow certain servicing standards. (Id., ¶¶ 10-11.) Plaintiff then makes the following allegations in connection with its negligence claim: 14. . . . . On or about October 2013 Plaintiff sought a loan modification from Defendant. Defendant, however, refused to even consider granting Plaintiff a modification of its loan thereby breaching its duty to her as outlined in the NMS Consent Judgment.[] 15. Thus Defendant OCWEN owed a duty to Plaintiff to negotiate her loan modification request in good faith. Defendants have breached said duty by not even giving them the option to modify their loan in order to save her home. (FAC, ¶¶ 14, 15.) Plaintiff is correct that, in Alvarez v. BAC Home Loan Servicing, L.P. (2014) 228 Cal.App.4th 941 and Lueras v. BAC Home Loans Servicing, LP (2013) 221 Cal.App.4th 49, the courts indicated that lenders owe a duty of reasonable care to borrowers in their review and processing of loan modification applications. However, as Defendants point out, these courts required the plaintiffs to allege specific factual allegations to invoke the exception. (See Lueras, supra, 221 Cal.App.4th at p. 55; See also Alvarez, supra, 228 Cal.App.4th at p. 945.) Plaintiff’s allegations are limited to the conclusory statement that Defendants “refused to even consider granting Plaintiff a modification of its loan.” (FAC, ¶ 14.) This statement is not sufficient for Plaintiff to avoid the general rule that lenders owe no duty of care to their borrowers. (See Jolley v. Chase Home Finance, LLC (2013) 213 Cal.App.4th 872, 903.) Defendants’ demurrer to the second cause of action violation of Business and Professions Code section 17200 is SUSTAINED WITH 20 DAYS LEAVE TO AMEND. Plaintiff’s claim is based on the same conclusory statements that are offered to support her negligence claim, i.e., Defendants “mishandled” the loan modification and failed to negotiate the loan modification in good faith. (FAC, ¶¶ 19, 20.) As with the negligence claim, these allegations are not sufficient to support the contention that Defendants engaged in any unlawful, unfair, or fraudulent activities. This failure is fatal to Plaintiff’s UCL claim. (See Wilson v. Hynek (2012) 207 Cal.App.4th 999, 1008 [finding no error in trial court sustaining demurrer on UCL claim where the plaintiffs failed to sufficiently plead an unlawful or unfair predicate act required to plead a claim under Business and Professions Code section 17200].) Defendants’ demurrer to the third cause of action for declaratory relief is SUSTAINED WITHOUT LEAVE TO AMEND. In her opposition, Plaintiff does not address Defendants’ demurrer to the third cause of action. The first declaration Plaintiff seeks from the Court—that Plaintiff is the sole and true owner of the property—is essentially a request to quiet title. Such relief is unavailable as a matter of law because Plaintiff defaulted on her loan and has not demonstrated that she made a proper tender to cure the default. (See e.g., McElroy v. Chase Manhattan Mortg. Corp. (2005) 134 Cal.App.4th 388, 394 [requiring payment of debt by mortgagor as prerequisite to stating a claim to quiet title].) The last portion of Plaintiff’s third cause of action seeks a declaration that “Defendants must engage in a loan modification discussion with Plaintiff in good faith prior to any attempts to foreclose upon the property.” (Compl., ¶ 25(c).) It has been held that a plaintiff may not seek such relief. (See Jenkins v. JP Morgan Chase Bank, N.A. (2013) 216 Cal.App.4th 497 [“the right to bring a lawsuit to determine a nominee’s authorization to proceed with foreclosure on behalf of the noteholder would fundamentally undermine the nonjudicial nature of the process and introduce the possibility of lawsuits filed solely for the purpose of delaying valid foreclosures.”].) This is precisely what Plaintiff is attempting to do in this action: obtain a declaration that foreclosure proceedings cannot commence until certain conditions are met. Based upon the above discussion, and because Plaintiff was given the opportunity to cure these defects, which were also found in connection with the Court’s ruling on Defendants’ demurrer to Plaintiff’s initial complaint, Plaintiff shall not be granted leave to amend this cause of action. (See Mitchell v. Nat’l Auto. & Cas. Ins. Co. (1974) 38 Cal.App.599, 603 [stating that, when a plaintiff is given the opportunity to amend and fails to do so, it will be presumed that the plaintiff has stated as strong a case as she is capable of making].) - oo0oo -- Calendar line 17 - oo0oo - Calendar line 18 - oo0oo - Calendar line 19 - oo0oo - Calendar line 20 - oo0oo - Calendar line 21 - oo0oo - Calendar line 22 - oo0oo - Calendar line 23 - oo0oo - Calendar line 24 - oo0oo - Calendar line 25 - oo0oo - Calendar line 26 - oo0oo – Calendar line 27 - oo0oo - Calendar line 28 - oo0oo - Calendar line 29 - oo0oo - Calendar line 30 - oo0oo –

© Copyright 2026