Superior Court, State of California

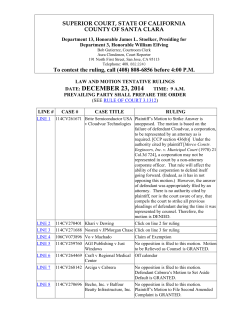

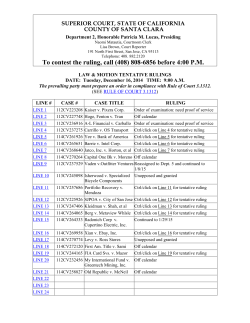

SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS DATE: DECEMBER 16, 2014 TIME: 9:00 A.M. PREVAILING PARTY SHALL PREPARE THE ORDER (SEE RULE OF COURT 3.1312) LINE # CASE # CASE TITLE RULING LINE 1 113CV254800 MSC Industrial Supply v Semifab Order of Examination LINE 2 114CV260606 Mountain States v Royal Plumbing Order of Examination LINE 3 114CV261863 Jehning v Triano Click on line 3 for ruling LINE 4 114CV264802 Kyes v Ocwen Loan Servicing Late opposition was filed. The opposition will be considered. Moving party may file a reply three court days prior to the hearing. . The hearing is continued to December 23, 2014 at 9:00 a.m. in D-13. LINE 5 114CV271546 Harel v Spieker Companies No opposition is filed. Defendant Spieker Companies’ Demurrer to Complaint is SUSTAINED WITH 10 DAYS LEAVE TO AMEND LINE 6 112CV230975 Large v Intero Real Estate Click on line 6 for ruling LINE 7 196CV755027 Pillet v Productivity Technologies, Inc. No opposition is filed. Procedurally, there is no “petition” filed pursuant to CCP section 1285, only a “Notice of Petition”. However, the Notice of Petition and supporting declaration supply all the elements required by CCP section 1285.6. Because there is no opposition raising this technical point, the petition is GRANTED. LINE 8 112CV238524 Simel v NeoClaris, Inc No opposition is filed. Motion for Attorneys Fees is GRANTED in the amount of $6,035.00 SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS LINE 9 114CV272793 Shah v Miller, Morton Caillat & Nevis LINE 10 113CV257133 Wong v Saal Plaintiffs bring this motion for Rejection of Award. This motion is unnecessary to reject the arbitration award against Prasanna Shah because that was accomplished by the filing of Form ADR-104. [The Court does note that the Form ADR-104 indicates that a “new action” is being filed. No complaint accompanies the rejection notice.] However, the Rejection is not and cannot be filed on behalf of Pragmatic Communications Systems, Inc. because the signature of Prasanna Shah would not be effective as to the corporation which must be represented by counsel. Therefore, the award remains binding as to that entity. Plaintiffs’ Motion to Quash Subpoena, Motion for Protective Order and Motion for Stay are DENIED. While the scope of the subpoenas for the medical records could have been more limited, plaintiffs fail to meet the procedural prerequisites to accomplish that purpose including, but not limited to, a meaningful meet and confer. [CCP section 2031.060(a)] Even plaintiffs’ motions do not attempt to define an appropriate scope of the production. Clearly, a substantial amount of the records subpoenaed are discoverable and plaintiffs bear the burden of demonstrating specific items which are not reasonably calculated to lead to the discovery of admissible evidence. No reasonable grounds are provided for granting a stay of the action which has been pending for a year without the assistance of counsel for plaintiffs. LINE 11 114CV261739 Capital One Bank v Madlansacay Continued SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 13, Honorable James L. Stoelker, Presiding for Department 3, Honorable William Elfving Bob Gutierrez, Courtroom Clerk Aura Clendenen, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408. 882.2240 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS LINE 12 112CV232456 My International Fund v Greentech Mining Reassigned to Department 2 LINE 13 112CV235009 Metzgar v 3M Company Off Calendar LINE 14 114CV271290 Lobue v Countrywide Home Loans Removed to Federal Court LINE 15 LINE 16 LINE 17 LINE 18 LINE 19 LINE 20 LINE 21 LINE 22 LINE 23 LINE 24 LINE 25 LINE 26 LINE 27 LINE 28 LINE 29 LINE 30 Calendar line 1 - oo0oo - Calendar line 2 - oo0oo - Calendar line 3 ALBERT & AUDREY JEHNING v. TINA ANNE TRIANO, ET AL Case No.: 1-14-CV-261863 DATE: December 16, 2014 TIME: 9:00 a.m. DEPT.: 13 As an initial matter the Court in ruling on a demurrer or motion to strike considers only the pleading under attack, any attached exhibits (part of the “face of the pleading”) and any facts or documents for which judicial notice is properly requested and may be granted. Any purported requests for judicial notice that do not comply with Rule of Court 3.1113(l) are denied. The Court cannot consider extrinsic evidence in ruling on a demurrer or motion to strike. Accordingly the Court has not considered any exhibits attached to moving papers. “We treat the demurrer as admitting all material facts properly pleaded, but not contentions, deductions or conclusions of fact or law.” Piccinini v. Cal. Emergency Management Agency (2014) 226 Cal App 4th 685, 688, citing Blank v. Kirwan (1985) 39 Cal.3d 311, 318. Defendants’ apparent attempt at a repeat demurrer to the 2nd cause of action for Fraud and 3rd cause of action for Elder Abuse on uncertainty grounds (See Notice of Demurrer at 4:6 and 4:12) is OVERRULED. It is unsupported by any argument in Defendants’ points and authorities and constitutes an improper attempt at a repeat demurrer as this ground for demurrer was overruled in the Court’s prior order. Defendants’ demurrer to the 2nd and 3rd causes of action on the ground that they are time-barred by statutes of limitation (CCP §338(d) and Welf. & Inst. Code §15657.7 respectively) is OVERRULED. In order to sustain a demurrer based on the statute of limitations, the running of the statute must appear clearly and affirmatively from the dates alleged. See Marshall v. Gibson, Dunn & Crutcher (1995) 37 Cal.App.4th 1397, 1403. It is not enough that the complaint might be barred. Id. Both claims remain based on alleged false representations initially made to Plaintiffs before they signed trust documents on December 30, 2008. See FAC at 23. Plaintiffs’ original complaint was filed on March 10, 2014. Accordingly unless Plaintiffs’ amendments satisfy the pleading requirements for delayed discovery the 2nd cause of action for fraud became time-barred on December 31, 2011 after three years and the 3rd cause of action for elder abuse became time-barred on December 31, 2012 after four years. “In order to rely on the discovery rule for delayed accrual of a cause of action, ‘[a] plaintiff whose complaint shows on its face that his claim would be barred without the benefit of the discovery rule must specifically plead facts to show (1) the time and manner of discovery and (2) the inability to have made earlier discovery despite reasonable diligence.’ In assessing the sufficiency of the allegations of delayed discovery, the court places the burden on the plaintiff to ‘show diligence’; ‘conclusory allegations will not withstand demurrer.’” Fox v. Ethicon Endo-Surgery, Inc. (2005) 35 Cal.4th 797, 808, internal citations omitted, emphasis added. The Court employs an objective standard in evaluating allegations of delayed discovery. “The limitations period begins once the plaintiff has notice or information of circumstances to put a reasonable person on inquiry. Subjective suspicion is not required. If a person becomes aware of facts which would make a reasonably prudent person suspicious, he or she has a duty to investigate further and is charged with knowledge of matters which would have been revealed by such an investigation.” McCoy v. Gustafson (2009) 180 Cal.App.4th 56, 108, internal citations omitted. Plaintiffs allege (FAC at 59 and 67) that they did not discover the facts supporting these claims “until May 6, 2013, when they met with an attorney who specializes in trusts and estate planning. As a result of the cover-up perpetuated by Triano and Mentzos on their efforts to discredit the source of any legitimate information, all while acting on their on behalf and on behalf of MT&M and in their capacities as ‘National Trust Institute certified attorney[s],’ as described in more detail at paragraphs 16, 29-36, 38 and 41, above, the Jehnings were unable to reasonably discover the wrongdoing prior to May 6, 2013.” Plaintiffs correctly point out that the attorney-client relationship between themselves and Defendants was a fiduciary relationship that lessens their burden to show diligence for purposes of delayed discovery. It does not, however, eliminate that burden entirely as Plaintiffs suggest. A plaintiff “‘does have a duty to investigate even where a fiduciary relationship exists when ‘he has notice of facts sufficient to arouse the suspicions of a reasonable man.’ If such facts actually do come to his attention he may not sit idly by for at that point the statute of limitations begins to run.’” Czajkowski v. Haskell & White, LLP (2012) 208 Cal.App.4th 166, 176-177, internal citations omitted. The allegations at 16, 29-36, 38 and 41 (and the referenced documents attached as exhibits to the FAC) assert that whenever Plaintiffs (or an affiliated third party such as their accountant) had concerns or questions during the attorney-client/fiduciary relationship one or more of the Defendants would address the issue or question and provide assurances that there was no cause for concern or that the concern was based on an incorrect belief. Defendants dispute these allegations, including whether statements were made with the intent to deceive or conceal as opposed to (possibly incorrect) statements of legal opinion, but this is a factual dispute that cannot be resolved on demurrer and does not need to be resolved to find that the pleading standard for delayed discovery has been met. The bottom line is that the more detailed allegations (and the exhibits attached to the FAC and part of the face of the pleading considered on demurrer), which must be assumed to be true for purposes of demurrer, support a finding at the pleading stage that Plaintiffs did not “sit idly by,” but behaved in an objectively reasonable manner and have adequately established delayed discovery. Accordingly, it cannot be said that the running of either statute of limitation appears clearly and affirmatively from the FAC and the demurrer on that basis fails. Defendants’ demurrer to the 2nd cause of action for fraud on the ground that it fails to state sufficient facts is OVERULED. As noted in the prior order, all elements of a fraud claim must be pled with particularity and, when alleging fraud against a business entity defendant, this requirement “requires the plaintiff to allege the names of the persons who made the allegedly fraudulent representations, their authority to speak, to whom they spoke, what they said or wrote, and when it was said or written.” Tarmann v. State Farm Mut. Auto. Ins. Co. (1991) 2 Cal.App.4th 153, 157; see also Lazar v. Superior Court (1996) 12 Cal. 4th 631, 645. The FAC now includes sufficiently specific allegations that individually identified defendants acted as agents of business entities (such as American Home Buyers Alliance) and/or other individual defendants (see FAC at 6 and 54). Such allegations are accepted as true at the pleading stage. The FAC now also includes sufficiently specific allegations describing the alleged fraud. See FAC at 14-17, 55-58 (and referenced documents attached as exhibits). Plaintiffs’ ability to later prove these allegations is irrelevant on demurrer. Defendants’ demurrer to the 3rd cause of action for Elder Abuse on the ground that it fails to state sufficient facts is OVERRULED. As the Court’s prior order noted, as a statutory claim a cause of action for elder abuse must be pled with particularity. See Lopez v. Southern California Rapid Transit District (1985) 40 Cal.3d 780, 795; Covenant Care, Inc. v. Superior Court (2004) 32 Cal.4th 771, 790. Plaintiffs have now specified that their claim is for financial elder abuse pursuant to Welf. & Instit. Code §15610.30. Plaintiffs were previously granted leave to amend to identify the real or personal property on which the claim was based. Plaintiffs now sufficiently allege that their transfer of the “Higdon Avenue Property” to a purported charitable trust based on Defendants’ representations deprived them of a property right. This now adequately states a claim. See Welf. & Instit Code §15610.30(c), providing that “for purposes of this section, a person or entity takes, secretes, appropriates, obtains, or retains real or personal property when an elder or dependent adult is deprived of any property right . . .” See also Bounds v. Sup. Ct. (2014) 229 Cal App 4th 468. Nothing more is required at the pleading stage and Plaintiffs’ ability to later prove their allegations is not a consideration on demurrer. Defendants’ Motion to Strike the 1st cause of action for legal malpractice “as asserted against Mr. Mentzos in his capacity as trustee of American Home Buyers Alliance,” Notice of Motion at 2:11-12, is DENIED. As an initial matter, a plaintiff’s purported lack of standing to bring a cause of action is not a ground for a motion to strike under CCP §436. More specifically, Probate Code §18004 states: “A claim based on a contract entered into by a trustee in the trustee's representative capacity, on an obligation arising from ownership or control of trust property, or on a tort committed in the course of administration of the trust may be asserted against the trust by proceeding against the trustee in the trustee’s representative capacity, whether or not the trustee is personally liable on the claim.” Defendants’ Motion to Strike the request for punitive damages in the FAC at 61 (2nd cause of action) and for “exemplary damages” in the Prayer at 25:2 is DENIED. Any adequately pled fraud claim suffices to support for a request for punitive damages at the pleading stage. See Civ. Code §3294(a). See also PH II, Inc. v. Superior Court (1995) 33 Cal.App.4th 1680, 1683 (“we have no intention of creating a procedural ‘line item veto’ for the civil defendant.”) Defendants’ Motion to Strike the request for damages under Civ. Code §3345 in FAC at 69 (3rd cause of action) and in the Prayer at 25:25 is DENIED. At least at the pleading stage, any claim alleging unfair or deceptive practices directed at a senior citizen or disabled person that by statute may include a request for punitive damages is sufficient to also support a request for damages under Civ. Code §3345. See Clark v. Sup. Ct. (2010) 50 Cal 4th 605, 612; Johnson v. Allstate Ins. Co., 2013 U.S. Dist. LEXIS 73424 (S.D. Cal. 2013), *13 (“[B]ecause under certain circumstances a successful plaintiff can recover punitive damages for financial elder abuse, Cal. Welf. & Instit. Code §15657.5(c)-(d), section 3345 potentially applies . . .”) - oo0oo - Calendar line 4 - oo0oo - Calendar line 5 - oo0oo - Calendar line 6 Case Name: Large v. Intero Real Estate Services, Inc., et al. Case No.: 1-12-CV-230975 This matter is before the Court on the motion of defendants Intero Real Estate Services, Inc. (“Intero”), Andrew Wong (“Wong”), and Patricia Kalish (“Kalish”) (collectively the “Intero Defendants”) for summary judgment or, in the alternative, summary adjudication of the first, third, fourth, and fifth causes of action in the Complaint filed by plaintiff Lisa Large (“Plaintiff”). The Intero Defendants’ request for judicial notice of Plaintiff’s Complaint is GRANTED. (Evid. Code, § 452, subd. (d).) Plaintiff’s request for judicial notice of the California Senate Committee on Judiciary report on AB 3450, which authorized the enactment of, among other laws, Civil Code section 1088 is GRANTED. (Evid. Code, § 452, subd. (c); Kaufman & Broad Communities, Inc. v. Performance Plastering, Inc. (2005) 133 Cal.App.4th 26, 33 [noting that the California Supreme Court has taken judicial notice of committee reports of the Assembly Committee on Judiciary].) The Intero Defendants’ motion for summary judgment and/or summary adjudication is DENIED in its entirety. All four of Plaintiff’s causes of action against the Intero Defendants rely upon the allegation that Wong and Kalish misrepresented that the Addison Property would not be reassessed, keeping the property taxes low, and that Plaintiff’s rental payments were tax deductible. The Intero Defendants argue that they cannot be held liable for those misrepresentations for the following four reasons. First, they argue that they cannot be liable for a misrepresentation because Plaintiff was aware that they were simply passing along unverified information from Sims. Second, they argue that, under California law, a person may not rely upon representations concerning future tax assessments. Third, they argue that the Addison Property contract and related disclosures relieve them of any liability. Finally, they argue that there was not actual reliance on any misrepresentations made by the Intero Defendants because Plaintiff relied solely on Dollar’s advice for her purchase of the Addison Property. Each of these arguments lacks merit. Concerning the first argument, the Intero Defendants rely upon the rule that, “when the buyer’s agent transmits material information from the seller or others to the buyer, the agent must either verify the information or disclose to the buyer that it has not been verified.” (Pagano v. Krohn (1997) 60 Cal.App.4th 1, 11.) The Intero Defendants’ first argument fails for two reasons. First, the argument ignores the existence of Civil Code section 1088, which provides that, “If an agent or appraiser places a listing or other information in the multiple listing service, that agent or appraiser shall be responsible for the truth of all representations and statements made by the agent . . . .” (Civil Code, § 1088, emphasis added.) The statute does not provide an exception for situations in which the buyer is informed that the information in the listing has not been verified. If false information is placed by an agent in an MLS listing and a buyer is injured, section 1088 provides a statutory negligence claim for such representations. (Saffie v. Schmeling (2014) 224 Cal.App.4th 563, 568.) Thus, while an agent may be able to avoid liability for unverified representations made to a buyer (that were not put in an MLS listing), Civil Code section 1088 provides for no such exception for statements that are made in a listing. Second, disputed facts exist as to whether Plaintiff was informed that the tax information had not been verified. (See Large Depo., 68:2-21 [Plaintiff testifying that she repeatedly asked Kalish to verify the information supplied by Wong and that Kalish did so prior to closing].) Turning to the second argument, the Intero Defendants assert that a buyer of real estate may not reasonably rely upon representations concerning future assessments or levies of taxes. In support of this argument, the Intero Defendants direct the Court to the holdings from Holder v. Home Savings & Loan Association of Los Angeles (1968) 267 Cal.App.2d 91, and Brakke v. Economic Concepts, Inc. (2013) 213 Cal.App.4th 761. Both of those cases stand for the proposition that, to be actionable, a misrepresentation must be of an existing fact, not an opinion or prediction of future events. (Holder, supra, 267 Cal.App.2d at pp. 106-107 [applying rule to tax predictions in real estate transaction]; Brakke, supra, 213 Cal.App.4th at p. 769 [applying rule to tax predictions pertaining to purchase of pension plan].) This argument fails for two reasons. First, not all of the alleged misrepresentations concern future tax consequences. In the MLS listing, Wong expressly represented that “Buyer . . . keeps low prop tax base (only $293/mon) . . . [and] Buyer will pay $1391/mo to the landowner plus the property taxes for the land (only $293.00 per month.).” (Wong Depo., Ex. 4.) In Holder, the court stated that “reliance may be made by a buyer of real estate upon representations as to existing tax liens, amounts of taxes for current or prior years, or assessed values for current or former years.” (Holder, supra, 267 Cal.App.2d at p. 106.) The above representations, which do not concern future assessments, do not fall within the rule that reliance may not be made upon representations of future tax consequences. Second, to the extent that the alleged misrepresentations do concern future assessments, an exception applies. In Brakke, the court noted that one of the exceptions to the prohibition on reliance upon predictions of future events is where a fiduciary relationship exists. (Brakke, supra, 213 Cal.App.4th at p. 769.) Here, Wong had a statutory duty not to make false statements in the MLS listing under Civil Code section 1088. Similarly, as Plaintiff’s real estate broker, Kalish stood in a fiduciary relationship with Plaintiff. (See Saffie, supra, 224 Cal.App.4th at p. 568.) The Intero Defendants’ third argument (i.e., that Plaintiff was provided with certain disclosures that relieve them of any liability) fails for the following reasons. The disclosure contained in the lease contract does not render Plaintiff’s reliance unreasonable as a matter of law. She testified that she understood the language concerning California property tax law to be irrelevant to the Addison Property transaction because, as the contract was for a lease of the property, ownership was not changing hands. (See Large Depo., 131:11-133:22.) Whether that interpretation was reasonable is a question of fact to be determined at trial. (Furla v. Jon Douglas Co. (1998) 65 Cal.App.4th 1069, 1078-1079 [“whether a plaintiff reasonably relied on a defendant’s misrepresentations or failed to exercise reasonable diligence is [] ordinarily a question of fact for the tier of fact.”].) As to the second disclosure (i.e., the standard disclosure that real estate agents do not provide tax advice), the Intero Defendants’ reliance upon Carleton v. Tortosa (1993) 14 Cal.App.4th 745, is misplaced. In that case, the broker refused to give tax advice and the court of appeal held that the broker had no independent duty to do so. In contrast, notwithstanding the disclosure that the Intero Defendants were not tax professionals, they elected to affirmatively provide information concerning the tax consequences of the transaction. Having done so, they cannot now claim that the disclosure, which they themselves failed to follow, absolves them from liability. (See Valdez v. Taylor Auto. Co. (1954) 129 Cal.App.2d 810, 817 [noting that a person may assume a duty, even if one would not have otherwise been imposed, by voluntarily performing a service].) Concerning the fourth argument, the Intero Defendants argue that Plaintiff relied on attorney Dollar’s advice for the purchase of the Addison Property and that their earlier representations (which were the same as Dollar’s advice) were not the cause of Plaintiff’s alleged injury. The flaw in the Intero Defendants’ argument is that the evidence does not support the factual conclusion that Plaintiff relied solely upon Dollar’s advice. As Plaintiff points out in her opposition, reasonable reliance may be based upon multiple representations so long as each representation is a substantial factor in inducing the plaintiff to act. (See Wennerholm v. Stanford Univ. Sch. of Med. (1942) 20 Cal.2d 713, 717 [“In actions for fraud it is not required that a defendant’s representations be the sole cause of the damage. If they are a substantial factor in inducing the plaintiff to act, even though he also relies in part upon the advice of other, reliance is sufficiently shown.”].) Here, in response to questions concerning why she believed that the taxes would not be reassessed and why she ultimately decided to buy the Addison Property, Plaintiff testified that “everything that I’d been told was consistent” (Large Depo., 122:1-2); “I was told that by Andrew Wong, I was told that by Patricia Kalish . . . [a]nd I went to Steve Dollar and he verified [it]” (id., 148:22-23). Based upon this testimony, the Court finds that the Intero Defendants have not carried their burden of demonstrating the absence of any disputed material facts and entitlement to judgment as a matter of law on the issue. The Intero Defendants’ motion for summary adjudication of Plaintiff’s fourth cause of action for breach of fiduciary duty and fifth cause of action for negligence rely upon the same arguments addressed in the above analysis. For the reasons outlined above, the Court rejects the arguments as they apply to the fourth and fifth causes of action. - oo0oo - Calendar line 7 - oo0oo - Calendar line 8 - oo0oo - Calendar line 9 - oo0oo - Calendar line 10 - oo0oo - Calendar line 11 - oo0oo - Calendar line 12 - oo0oo - Calendar line 13 - oo0oo - Calendar line 14 - oo0oo - Calendar line 15 - oo0oo - Calendar line 16 - oo0oo -- Calendar line 17 - oo0oo - Calendar line 18 - oo0oo - Calendar line 19 - oo0oo - Calendar line 20 - oo0oo - Calendar line 21 - oo0oo - Calendar line 22 - oo0oo - Calendar line 23 - oo0oo - Calendar line 24 - oo0oo - Calendar line 25 - oo0oo - Calendar line 26 - oo0oo – Calendar line 27 - oo0oo - Calendar line 28 - oo0oo - Calendar line 29 - oo0oo - Calendar line 30 - oo0oo –

© Copyright 2026