MARKET INSIGHTS - 2TradeAsia.com

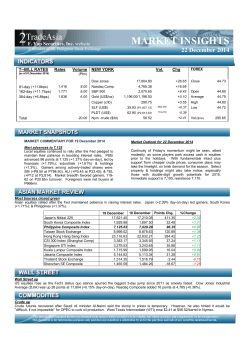

MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 24 – 29 December 2014 I T--BILL RATES Rates (as of 01 December 2014) 91-day (+11.8bps) 182-day (+11.7bps) 364-day (+6.8bps) Total Volume NEW YORK (Pbn) 1.416 1.771 8.00 6.00 1.836 6.00 20.00 Dow Jones Nasdaq Comp. S&P 500 Gold (US$/oz) Copper (c/lb) SLF (US$) PLDT (US$) Nym. Crude ($/bl) Vol. As of 26 December 18,053.71 4,806.86 2,088.77 Copper (c/lb) SLF (US$) PLDT (US$) Nym. Crude ($/bl) 61,691 +0.02 64.38 (P2,876.50) 41,558 +0.59 55.35 Copper (c/lb) SLF (US$) PLDT (US$) Nym. Crude ($/bl) Vol. Close 44.68 Open 44.60 Average 44.62 High 44.70 Low 44.53 1,174.80/1,175.30 -0.80 288.00 399.80 Chg +6.04 +8.05 -0.29 -1.50 36.30 (P1,621.88) 193,800 +0.06 63.79 (P2,850.14) 29,000 +0.16 55.64 -1.26 Vol. Chg As of 23 December 18,024.17 4,766.01 2,082.11 +64.73 -14.00 +3.59 1,175.60/1,176.10 -0.30 289.50 -2.00 36.24 (P1,619.20) 274,700 +0.73 63.63 (P2,842.99) 135,200 +0.32 56.90 FOREX Vol.($mn) As of 24 December 18,030.21 4,773.47 2,081.88 NEW YORK Dow Jones Nasdaq Comp. S&P 500 Gold (US$/oz) +23.50 +33.39 +6.89 36.32 (P1,622.78) NEW YORK Dow Jones Nasdaq Comp. S&P 500 Gold (US$/oz) Chg +1.94 +37.5543 . P P MARKET COMMENTARY FOR 23 December 2014 Market Outlook for 29 December 2014 PSEi gained @7,186 Local equities gained ahead of the holiday break, as Wall Street recovered from a selloff in early December. The PSEi added 47 points at 7,186 (+0.66% day-on-day) led by property (+1.35%); services (+1.27%); & mining/oil (+0.67%). Gainers among actively-traded shares were: VMC (+P0.19 at P4.69); BDO (+P0.30 at P109.70); & SMPH (+P0.24 at P16.90). Market breadth favored bulls, 95-75, on P8bn turnover. Net foreign buying was P12mn. Possibilities for gauge to close above 7,200 could mark Monday’s trading session, being the closing date for the year. Local portfolio fund managers might ride on window-dressing initiatives, as they prepare for 2015 targets. Meanwhile, overall volume might stay light, as players prepare for the long Yuletide break. Trade selectively. Immediate support is 7,150, resistance 7,2007,240. The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. F. Yap Securities, Inc. website A member of the Philippine Stock Exchange MARKET INSIGHTS 24 – 29 December 2014 US markets Friday: higher after Christmas US equities closed higher the day after Christmas as an equities rally that started last week continued through one of the slowest trading days of the year. Dow Jones Industrial Average (DJIA) gained 23 points at 18,053 (+0.13% day-on-day), Nasdaq Composite added 33 points at 4,806 (+0.70%). US markets Wednesday: Mixed, as traders prepare for holiday mode US equities were little changed as indices erased gains in the final minutes of trading after closing at all-time highs the previous session. Dow Jones Industrial Average (DJIA) closed 6 notches up at 18,033 (+0.03% day-on-day), Nasdaq Composite lost 3 points at 4,773.39 US markets Tuesday: DJIA hits 18,000 on economic data US equities rallied past 18,000 for the first time, after data showed the US economy grew at the fastest since 2003 last quarter. The US economy grew to an annualized 5% in 3Q, beating forecasts. Dow Jones Industrial Average (DJIA) gained 74 points at 18,024 (+0.36% day-on-day), Nasdaq Composite fell 14 points at 4,766.01. Friday’s Asian markets: Bourses gained Most Asian markets gained primed by China, following a decline in money-market rates & talks government would take more steps to bolster the economy. Japan also rallied, as investors weighed inflation data, industrial output & retail sales. Japan's inflation slowed to 2.7% from 2.9% the previous month. Industrial output for November was -0.6% month-on-month, versus estimates of 0.8% advance. CSI 300 Index (Shanghai Comp) Shenzhen SE Composite Kuala Lumpur Composite Index Taiwan Stock Exchange Jakarta Composite Index Singapore STI Index Thailand Stock Exchange South Korea Composite Index Hong Kong Hang Seng Index Japan's Nikkei 225 Philippine Composite Index 25 December Points Chg. 26 December 3,445.84 3,335.42 110.42 1,439.48 1,424.62 14.86 1,764.44 1,749.74 14.70 9,214.07 9,158.70 55.37 5,166.98 5,139.06 27.92 3,353.68 3,345.91 7.77 1,507.18 1,504.89 2.29 1,948.16 1,946.61 1.55 23,349.34 23,333.69 15.65 17,818.96 17,808.75 10.21 7,186.32 7,139.27 unch. %Change +3.31 +1.04 +0.84 +0.60 +0.54 +0.23 +0.15 +0.08 +0.07 +0.06 holiday Thursday’s Asian markets: Mixed tone prevailed Asian equities climbed, with Chinese shares climbing the most in 3 weeks as the yuan strengthened after government pledged to support machinery exports. Other bourses were down with gauges in Taiwan & Thailand losing at least 0.3% Thailand Stock Exchange Taiwan Stock Exchange Japan's Nikkei 225 South Korea Composite Index Shenzhen SE Composite CSI 300 Index (Shanghai Comp) Hong Kong Hang Seng Index Singapore STI Index Kuala Lumpur Composite Index Jakarta Composite Index Philippine Composite Index 24 December Points Chg. 25 December -20.17 1,504.89 1,525.06 -27.48 9,158.70 9,186.18 -45.48 17,808.75 17,854.23 7.59 1,946.61 1,939.02 20.22 1,424.62 1,404.40 105.03 3,335.42 3,230.39 unch. 23,349.34 23,333.69 unch. 3,345.91 3,332.51 unch. 1,749.74 1,749.05 unch. 5,166.98 5,139.06 unch. 7,186.32 7,139.27 %Change -1.32 -0.30 -0.25 +0.39 +1.44 +3.25 holiday holiday holiday holiday holiday The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. F. Yap Securities, Inc. website A member of the Philippine Stock Exchange MARKET INSIGHTS 24 – 29 December 2014 Wednesday’s Asian markets: Equities mixed Asian equities remained mixed although markets that were up were led by consumer-discretionary shares. Japan lead gainers (+1.24% day-on-day) & Taiwan (+0.97%), while China weakened (Shanghai Comp. -2.84%). CSI 300 Index (Shanghai Comp) Thailand Stock Exchange Singapore STI Index Jakarta Composite Index Kuala Lumpur Composite Index South Korea Composite Index Hong Kong Hang Seng Index Shenzhen SE Composite Taiwan Stock Exchange Japan's Nikkei 225 Philippine Composite Index 23 December Points Chg. 24 December -94.53 3,230.39 3,324.92 -6.34 1,525.06 1,531.40 -8.89 3,332.51 3,341.40 -8.81 5,139.06 5,147.87 -2.59 1,749.05 1,751.64 0.00 1,939.02 1,939.02 31.72 23,333.69 23,301.97 11.78 1,404.40 1,392.62 88.47 9,186.18 9,097.71 219.09 17,854.23 17,635.14 7,139.27 7,186.32 unchanged %Change -2.84 -0.41 -0.27 -0.17 -0.15 0.00 +0.14 +0.85 +0.97 +1.24 holiday Tuesday’s Asian markets: Mixed on China’s manipulation probe Asian equities were mixed, led lower by China (Shanghai Comp -2.05% day-on-day, Shenzhen SE Comp -1.39%) after its Securities Regulatory Commission probed 19 firms suspected of market manipulation. Meanwhile, the Philippines (+0.66%) led the region higher, followed by Malaysia (+0.44%) & Indonesia (+0.43%). CSI 300 Index (Shanghai Comp) Shenzhen SE Composite Hong Kong Hang Seng Index Thailand Stock Exchange South Korea Composite Index Taiwan Stock Exchange Singapore STI Index Jakarta Composite Index Kuala Lumpur Composite Index Philippine Composite Index Japan's Nikkei 225 22 December Points Chg. 23 December -69.56 3,324.92 3,394.48 -19.68 1,392.62 1,412.30 -106.60 23,301.97 23,408.57 -5.43 1,531.40 1,536.83 -4.10 1,939.02 1,943.12 +2.71 9,097.71 9,095.00 +10.44 3,341.40 3,330.96 +22.10 5,147.87 5,125.77 +7.59 1,751.64 1,744.05 +47.05 7,186.32 7,139.27 unchanged 17,635.14 17,621.40 %Change -2.05 -1.39 -0.46 -0.35 -0.21 +0.03 +0.31 +0.43 +0.44 +0.66 holiday Crude down West Texas Intermediate (WTI) for February delivery fell $1.11 to $54.73/barrel on Nymex - its 5th weekly loss - on concerns OPEC's refusal to cut production will worsen a global supply glut. Saudi Arabia is said to be assuming an oil price of $80/barrel for 2015 as US crude stockpiles climbed 7.27mn barrels for the week ended 19 December, or a total of 387.2mn barrels, the highest since June. December inflation estimates lowered Central bank (BSP) said inflation forecast for December ranges 2.4%-3.2%, the 4th straight month monetary authorities cut their forecast. It is also lower than November's 1-year low headline inflation of 3.7%, due to lower rice prices, jeepney fares, power rates & continued rollback of oil prices. October imports +7.5% Phil. Statistics Authority (PSA) said October imports rose to $5.2bn (+7.5% year-on-year), the fastest since March’s 10% growth. 9M14 imports grew by only 4%, versus government's target of 9%. Bank lending rates trailed central bank’s move Central bank (BSP) chief Tetangco said average bank lending rate increased to 5.697% in October from 5.391% in June after the monetary board elevated the reverse repurchase (RRP) rate by a total of 50 basis points (bps). He also said that December inflation could have eased further to 2.4%-3.2% amid reduced commodity & utility costs. The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. F. Yap Securities, Inc. website A member of the Philippine Stock Exchange MARKET INSIGHTS 24 – 29 December 2014 DoTC to push 5 key infra projects Department of Transportation & Communications (DoTC) will proceed with at least 5 key infrastructure projects before the administration's term ends mid-2016. These will include NAIA Development, the P374bn Makati-Pasay-Taguig Mass Transit System Loop, P177.22bn North-South Railway Project (South Line), a new international airport & new international port. 9 PPP projects due for rollout next year National Economic & Development Authority's (NEDA) Cabinet Committee approved the terms for rebidding the P35.4bn Cavite-Laguna Expressway (CALAX), with floor price of P20.1bn & Swiss challenge for the P18bn North Luzon Expressway (NLEx)-South Luzon Expressway (SLEx) Connector Road. Both are set for NEDA approval January 2015. Other projects to be rolled-out are: 1. P19bn Motor Vehicle Inspection System 2. P374bn Makati-Pasay-Taguig Mass Transit System Loop 3. P1bn Civil Registry System-IT Project 4. P177bn North-South Commuter Railway 5. P18bn Davao Sasa Port Modernization 6. P50bn Regional Prison Facilities 7. P400mn Tanauan City Public Market Redevelopment BPI teamed-up with Japan firm for leasing venture Bank of the Phil. Islands (BPI) entered a Joint Venture (JV) with Century Tokyo Leasing (CTL), for the sale of 49% in unit, BPI Leasing Corp. (BPIL). The new firm will be renamed BPI Century Tokyo Leasing & Finance Corp., & will combine resources & expertise of CTL with BPI’s record growth. CTL is one of the largest leasing firms in Japan. BDO buys into rural bank BDO Unibank (BDO) entered an agreement to acquire rural bank, One Network Bank (ONB). ONB has total portfolio of 105 branches, & micro-banking offices in Mindanao & Panay areas. ONB has P28.1bn total assets, net loans of P19.7bn, deposit franchise of P17.9bn, as of September 2014. The purchase will give BDO access to market segments in Southern Philippines & supports the central bank’s (BSP) thrust to promote inclusive banking via countryside branching & lending. RCB cancels SRO due to Cathay Life’s entry Rizal Commercial Banking (RCB) cancelled its intended Stock Rights Offer (SRO) of up to 124mn common shares at P10 apiece, in relation to the entry of Cathay Life Insurance Co. Ltd. The proposed investment of Cathay will close upon regulatory approvals from the central bank (BSP), Investment Commission Ministry of Economic Affairs & Financial Supervisory Commission of Taiwan. SM unit sold stake in BDO to Malaysia’s investment bank A unit of SM Investments (SM), Multi-Realty Development (MRDC), sold part of its stake in BDO Unibank (BDO), to Malaysia’s Khazanah Nasional (KN), via unit Pulau Kaca Investments Ltd. The transaction covers 2% of BDO’s total capital. Khazanah is the government of Malaysia’s strategic investment fund. MPI unit entered OM accord for Bukidnon bulk water facility Metropac Water Investment (MWIC), a unit of Metro Pacific (MPI), entered an accord to Operate & Maintain (O&M) the 100mn liters (L)/day bulk water facility of Rio Verde Water (RVWC), in Bukidnon. The agreement will be implemented via a unit to be incorporated by MWIC. RVWC is the exclusive supplier of bulk water surface water to Cagayan de Oro Water district, which supplies 80% of Cagayan de Oro (CDO). ALI raised its stake in Trinoma parent firm Ayala Land (ALI) purchased its proportionate share in the interests of DBH (DBH) & Allante Realty (ARDC) in North Triangle Depot Commercial (NTDCC). DBH & ARDC own 4.08% each in NTDCC. ALI’s proportionate interest in both firms amounted to P422.5mn, consisting of 308,574 shares & 1.3mn preferred shares. This brings ALI’s ownership in NTDCC to 63.82% from 58.53%. NTDCC owns & operates Trinoma Commercial Center in North Triangle, Quezon City. ROCK, ATR Holdings to acquire ATR Land Rockwell (ROCK) unit, Rockwell Primaries Development, entered a Memorandum of Agreement (MoA) with ATR Holdings (ATRH) & Dragon Eagle International Ltd (DE), to jointly & collectively invest in & acquire all outstanding common shares of Maybank ATR Kim Eng Capital Partners & ATR Kim Eng Land (ATRKE Land). ATRKE Land & Landco jointly developed Tribeca, a mixed residential/commercial complex in Muntinlupa City. Under a Termination accord, ATRKE Land will become the sole owner & developer of Tribeca. After the purchase in ATRKE Land, the interest will be distributed as: Rockwell Primaries (60%); DE (20%); & ATRH (20%). FLI to boost gross leasable area by 58% Filinvest Land (FLI) will boost gross leasable area by at least 58% next year via the expansion of mall in Muntinlupa City & launch of new shopping centers in Cebu, Laguna, Tagaytay & Cavite. FLI now has leasable space of 134,090sqm. The expansion of Festival Supermall in Alabang & soft launch of 4 other projects will bring gross leasable area (GLA) to 219,195sqm. FLI said in November it wants to raise its GLA to around 995,000sqm within 5 years. The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 24 – 29 December 2014 DD entered CityMall JV for Bacolod lot DoubleDragon (DD) via unit, CityMall Commercial Centers (CMCCI), secured a joint venture for 1ha. prime commercial corner lot in Mandalagan, Bacolod City. The site will be allocated for the construction of CityMall – Bacolod & surrounded by numerous fully-developed residential subdivisions. The property will be the 15th site secured by CMCCI to date, & makes DD on track of its goal of completing 25 CityMalls by end-2015. HOUSE earnings for 2014 might reach P3bn-P3.2bn 8990 Holdings' (HOUSE) 2014 profit likely reached P3-3.2bn (38-48% year-on-year). Revenues are projects to increase to P7.6-7.8bn (4146%). No official announcement has been made by HOUSE on the matter. IMI sold Singapore lot Speedy-Tech Electronics Ltd (STE), a Singapore-based indirect unit of Integrated Micro-Electronics (IMI), completed the sale of its property in Singapore, for $22.4mn. With the sale, IMI is able to monetize its asset, to enhance its capital structure & proceed with investment plans. ANS purchased block in GCCL A. Soriano Corp. (ANS) acquired from General Cable Company Ltd. (GCCL) its 40% in Phelps Dodge International Phils. (PDP) & 0.02% in Phelps Dodge Philippines Energy Products (PDEP), for total of $67mn. With the transaction, ANS will own the entire stock of PDP directly, & PDEP, indirectly via PDP. PDP operates the largest wire & cable manufacturing facilities in the country, providing state-of-the-art products for communication & information technology (IT). STI enforced creditor rights over PWU STI Education (STI) decided to exercise its Creditor Rights versus Phil. Women’s University (PWU) & Unlad Resources Development (UNLAD), for the aggregate obligation of P926mn plus as subrogee for BDO Unibank (BDO) for P223mn debt. STI enforced the security accord under the BDO Loan Facility, & acquired ¾ membership in PWU, plus ¾ of seats in the board of trustees of PWU. PGOLD & COSCO update buyback program Puregold (PGOLD) & Cosco Capital (COSCO) repurchased 28,200 & 472,000 shares, respectively, at an average of P36.6749 & P8.37/share. These are initial purchases of PGOLD & COSCO, pursuant to their share repurchase plan. BLOOM details stock incentive plan Bloomberry (BLOOM) & parent-firm, Prime Metroline Holdings (PMH), approved the transfer of BLOOM shares owned by PMH, to participants of BLOOM’s Stock Incentive Plan (SIP), at a sale price of P12.60/share. The board also authorized the issuance of BLOOM shares for the same subscription details, to PMH, in replacement of shares given to SIP participants. Last October, 2mn BLOOM shares were vested in favor of several participants under SIP. An extra 6.2mn shares were earmarked for additional participants in 2015. PERC power unit gets clearance for Aklan wind farm PetroWind Energy (PWE) obtained approvals from the Energy Regulatory Commission (ERC), bringing the 50MW Nabas Wind Power in Aklan closer to commercial operations. ERC first approved PWE’s authority to develop, own, & operate dedicated point-to-point facilities, connecting the Nabas Wind farm to the National Grid Corp. (NGCP) – Nabas-Caticlan 69Kv overhead transmission line. ERC also approved commissioning tests for the first 8 wind turbine generators (WTGs) in Nabas, for January-March 2015. The Nabas Wind farm is seen to contribute 400MW by 1Q15. PWEI is a JV that is 40%-owned by PetroEnergy (PERC), 40% by Singapore’s CapAsia ASEAN Wind Holdings Cooperatief U.A., 20% EEI Power Corp. Dividend Declaration Company Marcventures Holdings (MARC) Cash Div. P0.15 Stock Div. - Ex – Date 16-Dec-14 Record Date 19-Dec-14 Date Payable 16-Jan-15 The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein.

© Copyright 2026