SICIS North America, Inc.

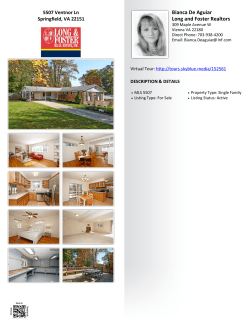

NYCIDA PROJECT COST/BENEFIT ANALYSIS January 8, 2015 APPLICANT SICIS North America Inc. 470 Broome Street New York, NY 10013 PROJECT LOCATION 150 Bruckner Boulevard Bronx, New York 10454 A. Project Description: SICIS North America, Inc., (”SICIS”) a corporation that distributes mosaic and decorative art including furniture, lighting, home accessories and jewelry and its affiliate Bianca USA Real Estate, Inc. (“Bianca”, and together with SICIS, collectively, the “Companies”), a New York corporation that functions as a real estate holding company; seek assistance from NYCIDA in the acquisition, renovation, and furnishing of an approximately 50,000 square foot commercial building on an approximately 25,000 square foot lot located at 150 Bruckner Boulevard in the Port Morris neighborhood of the Bronx. Total Project costs are estimated to be $15.5 million with $14,000,000 for land and building acquisition, $1,200,000 for renovations, and $300,000 for machinery, furnishing and equipment. The Companies currently employ 14 full-time equivalent employees in New York City. Within three years, it is expected that the Company will employ 20 full-time equivalent employees. B. Costs to City (New York City taxes to be exempted): Land Tax Abatement (NPV, 25 years): Building Tax Exemption (NPV, 25 years): Sales Tax Exemption: Total Cost to NYC C. Benefit to City (Estimated NYC direct and indirect taxes to be generated by Company) (estimated NPV 25 years @ 6.25%): $ $ 30,044 9,551,779 51,300 9,633,123 $12,219,085

© Copyright 2026