AmFraser Morning Buzz 150113

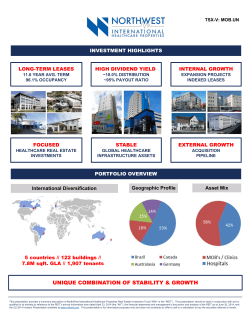

Morning Buzz Tuesday, 13 January 2015 STOCK IN FOCUS STI INDEX (PREVIOUS DAY CLOSE) 3,344.89 (0.19%) FIRST REAL ESTATE INVESTMENT TRUST We initiate coverage on First Real Estate Investment Trust (First REIT) with a BUY rating and a fair value of S$1.380 based on a dividend discount model. First REIT’s 6.4% FY15F yield is anchored by long master leases, with ~95% of the rental income from Indonesia’s healthcare sector backed by Lippo Karawaci and Siloam Hospitals. First REIT stands to benefit from its sponsor’s huge asset pipeline which may continue to offer very attractive yield. Vol (mil): 1,286.0 / Val (S$ mil): 910.6 MAJOR STOCK INDICES Close DJ Ind Avg S & P 500 Nasdaq Comp Hang Seng % Chge 17,640.84 -0.54% 2,028.26 -0.81% 4,664.71 -0.84% 24,026.46 0.45% COMMODITIES Gold (SPOT) US$ / oz Oil (NYMEX CWTI) US$ / bbl Baltic Dry Index Close % Chge 1,230.98 -0.18% 45.85 -0.48% 723.00 1.97% EXCHANGE RATES Distribution underpinned by long master leases. First REIT boasts of a long portfolio WALE of 10.7 years, with the first renewal coming due only on 2017. As ~98% of the rents are priced and paid in SGD with rental growth rates at twice Singapore CPI growth, subject to a cap of 2% and a floor of 0%, the long master leases offers a partial hedge against inflation. A huge asset pipeline ahead. After acquiring 12 properties and enlarging the portfolio nearly fourfold to S$1.2b since IPO in 2006, we estimate that 28 more assets remain in the pipeline. Typically acquired at high 9% to high 10% rental yield with at least 9% discount to valuation, the acquisitions have been highly accretive to DPU and NAV. Asset sustainability with long lifespan. The Indonesia assets, which constitute ~96% of property valuation, are on Hak Guna Bangunan (Right to Build), which is essentially leasehold tenure. Nevertheless, there is a possibility for renewal after the expiration of the initial lease period of 30 years and an additional term of 20 years. Meanwhile, First REIT is poised to benefit from the developments in the Indonesia healthcare market. Initiate BUY with target of S$1.38 with more upside on acquisitions. We see a 15% upside (incl dividends) with our DDM -derived price target. The target price could prove to be conservative, given that it is based only on the current portfolio of assets. If we assume that First REIT acquires another 6 properties with purchase and lease details (e.g. size of asset and NPI yield) that is similar to the average of the most recent 6 acquisitions, our target price rises to S$1.49 (23.0% upside). USD : SGD 1.3348 / MYR : SGD 0.3742 INTEREST RATES 3-mth Sibor 0.641% SGS (10yr) 2.064% Source: Bloomberg NEWS BUZZ SPH Reit: Posts 2.3% rise in DPU to 1.33 cents in Q1 Qian Hu Corp: Q4 profit jumps on lowered expenses AmFraser Research Team Hyflux: Seeks bondholders' approval to amend trust deed www.amfraserdirect.com.sg AmFraser Securities Pte Ltd Page 1 Please see important disclosures at the end of this publication AmFraser Tuesday, 13 January 2015 News Buzz SPH Reit (S$1.040) Posts 2.3% rise in DPU to 1.33 cents in Q1 SPH Reit posted a 2.3% increase in DPU to 1.33 Singapore cents for the 1Q ended Nov 30, 2014 on strong rental reversions and occupancies at its malls. Gross revenue during the quarter improved 1.8% from a year ago to S$50.6mil, while net property income grew 4.9% to S$37.9mil. Qian Hu Corp (S$0.077) Q4 profit jumps on lowered expenses Qian Hu’s profit attributable to shareholders for the three months ended December rose to S$176,000, or 0.04 Singapore cents per share. The company is recommending a first and final dividend of 0.1 Singapore cents per share. Gross profit fell 20% to S$4.8mil from revenue of S$21.3mil, which was down 1.2 per cent year-on-year. Hyflux (S$0.920) Seeks bondholders' approval to amend trust deed Hyflux is seeking approval from bondholders to amend a trust deed relating to its $800-million multi-currency debt issuance programme. Among other things, the firm wants to broaden the programme's interest cover covenant to include its unencumbered cash position. It also wants to change the frequency of providing to DBS Bank, as trustee for the bondholders, certain compliance certificates to a semi -annual basis instead of the current quarterly basis. It has issued $420mil worth of notes so far under the debt issuance programme. Source: The Business Times / Bloomberg / Straits Times AmFraser Securities Pte Ltd Page 2 AmFraser Tuesday, 13 January 2015 Corporate Action Dividends Company Results Ann Date Period DPS Ex-Date Book Close Payable Share Price Yield 12-Jan-15 (%) Fraser and Neave 13-Nov-14 FY14 SGD 0.030000 3-Feb-15 5-Feb-15 16-Feb-15 SGD 2.700 1.1 Frasers Centrepoint 12-Nov-14 FY14 SGD 0.062000 3-Feb-15 5-Feb-15 16-Feb-15 SGD 1.665 3.7 Ex-Date Book Close 29-Dec-14 * Include Ordinary, Cash, Special, Bonus, Variable and Base Rights & Bonus Issues Company Pacific Andes Resources Development Rights Issue 4 Rights Share @ S$0.051 each Rights Share for every 5 existing ord shares held Right Trading Period From To 31-Dec-14 6-Jan-15 14-Jan-15 Swiber Holdings 1 Rts Share @ S$0.15 each Rts share for every 2 shares held 6-Jan-15 8-Jan-15 13-Jan-15 21-Jan-15 Yoma Strategic Holdings 1 Rts Share @ S$0.38 each Rts share for every 3 existing ord shares held 12-Jan-15 14-Jan-15 19-Jan-15 27-Jan-15 Source: SGX Annoucement Buyout Company Offer Price CH Offshore Remarks Closing Date Offeror SGD 0.495 Cash 5.30 p.m. on 26 January 2015 Energian Pte. Ltd. ECS Hldgs SGD 0.68 Cash 5.30 p.m. on 12 January 2015 VST Holdings Ltd euNetworks Group SGD 1.16 Cash 5.30 p.m. on 30 January 2015 EUN Holdings, LLP UE E&C SGD 1.25 Cash 5.30 p.m. on 28 January 2015 Universal EC Investments Pte. Ltd. Source: SGX Annoucement AmFraser Securities Pte Ltd Page 3 AmFraser Tuesday, 13 January 2015 Financial Calendar Monday Tuesday 12-Jan Wednesday 13-Jan Q1: SPH REIT Thursday 14-Jan SG: 4Q14 Advance GDP Estimates Q1: SPH (Not later than 14 Jan) Friday 15-Jan SG: Prices of Private Residential Units Sold by Developers 16-Jan Q4: Cambridge Industrial Trust Q4: Qian Hu Q1: Xpress Hldgs *Q4: First REIT 19-Jan Q3: Mapletree Logistics Trust Q4: Keppel Infras Trust / Keppel REIT / M1 20-Jan Q3: Mapletree Industrial Trust Q4: Keppel Telecoms & Tpt 21-Jan Q2: Spore Exchange 22-Jan Q1: Frasers Commercial Trust Q3: Mapletree Commercial Trust Q4: CapitaCommercial Trust / Keppel Land / Sabana Shari'ah / Soilbuild Biz Space 26-Jan 27-Jan Q3: CitySpring Infrastructure / Mapletree Greater China SG (Dec 2014): CPI SG: 4Q14 Real Estate Statistics Q3: Ascendas REIT Q4: Ascott Residence Trust / Keppel Corp Q1: Frasers Centrepoint Trust Q4: CapitaMall Trust *Q4: Lonza Grp SG (Dec 2014): Index of Industrial Production 23-Jan 28-Jan 29-Jan 30-Jan SG (Dec 2014): Unemployment Rate & Employment Q4: CDL Hospitality Trusts Q4: Cache Logistics Trust 2-Feb-15 3-Feb 4-Feb Q4: Osim Int'l 9-Feb 5-Feb Q3: Global Logistics Properties 10-Feb 11-Feb Q4: OCBC (Before mkt open) / Utd Overseas Insurance 6-Feb Q4: Great Eastern Hldgs 12-Feb Q4: Starburst Hldgs / Wilmar Int'l 13-Feb Q2: Olam Int'l Q4: Hi-P Int'l / Utd Overseas Bank * Tentative Source: Company; Bloomberg AmFraser Securities Pte Ltd Page 4 AmFraser Tuesday, 13 January 2015 Disclaimer This report is prepared by AmFraser Securities Pte Ltd (“AmFraser”), which is a holder of a capital markets services licence and an exempt financial adviser in Singapore. This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an advice or a recommendation with respect to such securities. This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient hereof. You should independently evaluate particular investments and consult an independent financial adviser before dealing in any securities mentioned in this report. This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this report to any other person without the prior written consent of AmFraser. This report is not intended for distribution, publication to or use by any person in any jurisdiction outside Singapore or any other jurisdiction as AmFraser may determine in its absolute discretion, where the distribution, publication or use of this report would be contrary to applicable law or would subject AmFraser and its connected persons (as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any registration, licensing or other requirements within such jurisdiction. The information or views in the report (“Information”) has been obtained or derived from sources believed by AmFraser to be reliable. However, AmFraser makes no representation as to the accuracy or completeness of such sources or the Information and AmFraser accepts no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. AmFraser and its connected persons may have issued other reports expressing views different from the Information and all views expressed in all reports of AmFraser and its connected persons are subject to change without notice. AmFraser reserves the right to act upon or use the Information at any time, including before its publication herein. Except as otherwise indicated below, (1) AmFraser, its connected persons and its officers, employees and representatives may, to the extent permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit business from, the subject corporation(s) referred to in this report; (2) AmFraser, its connected persons and its officers, employees and representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business from, other persons in respect of dealings in the securities referred to in this report or other investments related thereto; and (3) the officers, employees and representatives of AmFraser may also serve on the board of directors or in trustee positions with the subject corporation(s) referred to in this report. (All of the foregoing is hereafter referred to as the “Subject Business”.) However, as of the date of this report, neither AmFraser nor its representative(s) who produced this report (each a “research analyst”), has any proprietary position or material interest in, and AmFraser does not make any market in, the securities which are recommended in this report. Each research analyst of AmFraser who produced this report hereby certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of AmFraser or any other person, any of the Subject Business involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any sales, trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the compensation received by each such research analyst is based upon various factors, including AmFraser’s total revenues, a portion of which are generated from AmFraser’s business of dealing in securities. Copyright 2015. AmFraser Securities Pte Ltd. All rights reserved. ______________________________ LEE Wing How for AmFraser Securities Pte Ltd AmFraser Securities Pte Ltd Page 5

© Copyright 2026