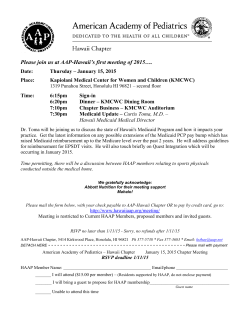

PDF - InsideHealthPolicy.com