Non-Traditional Fixed Income Private Pool

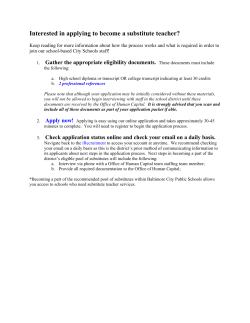

Building your financial future Non-Traditional Fixed Income Private Pool What is a Private Pool? A Private Pool is a private investment fund. In return for your investment in the Private Pool, you will receive units of the Private Pool. The value of these units is based on the value of the Private Pool’s underlying investments. A professional portfolio manager manages these investments on a discretionary basis. Investment Strategy The Non-Traditional Fixed Income Private Pool (referred to hereafter as the “Private Pool”) uses a multi-manager approach to complement your exposure to traditional fixed income securities. Implicitely, the Private Pool seeks to maximize the return potential of fixed income portfolios amid various economic environments. Your Investment Advisor may provide you with the complete Investment Policy Statement. Content The Private Pool achieves exposure to the above asset class by investing up to 100% of its assets in the underlying funds managed by third parties. The Private Pool will seek for protection against interest rates, have greater diversity of risk factors, take advantage of opportunistic arbitrage, and have a short duration. The Private Pool may hold a portfion of its assets in cash, money market securities or money market funds while seeking investment opportunities. Investment Horizon The investment horizon is short to medium term, therefore 1 year or more. Other characteristics Inception Date: April 26, 2013 Initial minimum investment: $5,000 Subsequent investments: $500 Code: TBN397 Portfolio Manager: National Bank Trust Benchmark: FTSE TMX Canada Universe Bond Index Private Pool performance as at December 31, 2014 Pool Benchmark** 1 month -0.11% 0.56% 3 months -0.15% 2.70% YTD -0.44% 8.79% 1 year -0.44% 8.79% Since inception* -1.06% 4.26% Annualized. ** FTSE TMX Canada Universe Bond Index * Returns presented in Canadian dollars after administrative fees Correlation with DEX Universe: 50.00% Strategic Asset Allocation Total Return Bond Fund Fixed Income Plus Fund Currency Management and Arbitrage Short-Term Fund Fixed Income Opportunities Fund Senior Bank Loans Tactical Bond Yield Fund 35.00% 20.00% 15.00% 10.00% 10.00% 10.00% Sector Allocation (%) Canadian Corporate Bonds Canada Government US Governement Mortgages Cash & Other Assets International American Corporate Bonds Others Provincial 31.01% 28.28% 13.35% 12.26% 5.33% 3.61% 3.61% 1.80% 0.75% For more information This Basket is suitable for investors who: • want to add a non-traditional sleeve to their fixed income portfolio. • are willing to tolerate a low level of risk. This summary may not contain all the information you need. Refer to the Discretionary Management Agreement for more detailed information. Should you require further information, please contact your National Bank Financial Investment Advisor. How risky is it? You can have access to this summarized fact sheet and the Disclosure Statement at http://nbfwm.ca/en/baskets. This investment is not guaranteed and its value can go down as well as up. National Bank Financial rates this investment’s risk as low. Low Low to Moderate Moderate Moderate to High High How much does it cost? Investment * Fees* from $1 to $100,000 1.00% from $100,000.01 to $250,000 0.85% from $250,000.01 to $500,000 0.75% from $500,000.01 to $1,000,000 0.70% $1,000,000.01 or more 0.65% A word about tax In general, you’ll have to pay income tax on any gain and revenue generated from your investment. How much you pay depends on the tax laws that are applicable in the area you live in and whether or not you hold the investment in a registered plan, such as a Registered Retirement Savings Plan or a Tax-Free Savings Account. Keep in mind that if you hold your investment in a non-registered account, fund distributions or capital gains are included in your taxable income; whether they are paid, accrued or reinvested. Where applicable, fee schedules attributed to fixed rate accounts supersede these fees. Payable within your brokerage account, management fees are charged monthly as a percentage of the Private Pool's market value. Your Investment Advisor may also charge you a trading fee of up to 2% of your investment. Each Private Pool pays annual operating expenses of up to 0.15% of its market value. Underlying investments in the Private Pool are presented net of all other fees. Private Pool content as at December 31, 2014 Description Weight Description Weight Total Return Bond Fund 36.07% Fixed Income Opportunities Fund 9.37% Fixed Income Plus Fund 19.92% Cash & Other Assets 0.89% Tactical Bond Yield Fund 18.80% Currency Management and Arbitrage Short-Term Fund 14.96% The Private Pools are offered in the context of the Discretionary Management Program offered by National Bank Financial Inc. and National Bank Financial Ltd. (collectively, “NBF”), subsidiaries of National Bank of Canada. Please read the terms of the Discretionary Management Agreement to be entered into between you and NBF before investing. An investment in a Private Pool is not guaranteed, its value changes frequently and past performance may not be repeated. This document may not be copied or distributed, either in whole or in part, without the prior written consent of NBF. Non-Traditional Fixed Income Private Pool Who is this investment for?

© Copyright 2026