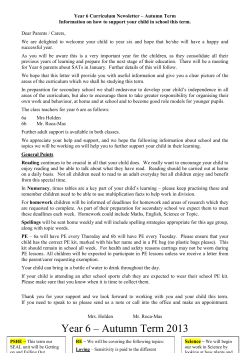

Gordon Heath Autumn statement

Autumn Statement and Business Rates IRRV London and Home Counties Association December 2014 Gordon Heath BSc IRRV (Hons) IRRV National Council Member Chairman IRRV Law and Research Committee Honorary Member of the Rating Surveyors Association NNDR – Financial Background • July 2006 – the US housing bubble burst • March 2007 – the US subprime mortgage industry collapsed • August 2007 BNP Paribas blocked withdrawals from 3 hedge funds • September 2007 – UK – run on Northern Rock • April 2008 - Empty Property Rates doubled to 100% • April 2008 – Valuation date for 2010 rating list NNDR – Financial Background • September 2008 – Lehman Brothers collapsed • October 2008 – UK stock market collapse • October 2008 - UK - £500bn bank rescue package – RBS and Lloyds –TSB were main recipients • April 2010 – Rates revaluation • 2015 Rates revaluation postponed to 2017 NNDR – Financial Background Background - State Aid and NNDR • State Aid limits apply where 1. There is an economic advantage 2. It involves the transfer of State resources 3. The Aid is selective 4. It has a potential effect on competition and trade • BUT – 5 Is it covered by a Block Exemption or de minimis? 6. Is there an existing National Aid Scheme? 7. Otherwise needs individual approval Background - State Aid and NNDR • Generally State Aid does not apply where it is part of how the tax is set up • Generally it does apply to discretionary reliefs above the de minimis limit • Mandatory Rate Reliefs – not State Aid • Discretionary reliefs – State Aid except for de minimis or flooding relief • Flooding Relief covered by GBER 2014, article 50 – limited to net loss incurred. Autumn Statement 2014 • Extending 100% Small Business Rate Relief to 31st March 2016 • Temporary increase in relief from 1 October 2010 • 100% below RV £6,000 • Sliding scale below RV £12,000 • Does not apply where Rural Rate Relief applies • Since April 2012, small multiplier applies to all properties below RV £18,000 (£25,500 in London) except empty properties and properties subject to mandatory relief Autumn Statement 2014 • • • • • 2% cap on inflation increase in 2015/16 Multiplier September RPI increase was 2.3% Provisional small business multiplier 48.0p (+ 1.9%) Small business relief supplement 1.3p (+18%) Provisional non-domestic multiplier 49.3p (+ 2.28%) Autumn Statement 2014 • Increasing the temporary £1,000 discount to £1,500 for 2015/16 for occupied retail premises - shops, pubs and restaurants with RV below £50,000 • Does not apply if the use is not retail use – banks, estate agents , doctors, solicitors, post office sorting offices, etc. • Subject to State Aid limits Autumn Statement 2014 • Extend “transitional relief” for 2 years • RV up to and including £50,000 only • Limits bill increases on small properties (below £18,000 RV or £25,500 RV in London) facing increases above 15% • Limits bill increases on medium sized properties up to £50,000 RV facing increases above 25% • No extension of transitional surcharge • Calculated AFTER other reliefs • It is a S47 DISCRETIONARY DISCOUNT, not transition • Subject to State Aid limits Autumn Statement 2014 • Limits backdating of appeals to 1 April 2010 to ratepayers’ appeals made before 1 April 2015 and VO alterations made before 1 April 2016 • Effectively what would have happened if there had been a 2015 revaluation • Rush of appeals? Autumn Statement 2014 • The Government will review the future structure of business rates and report before the budget in 2016 • Will not change the principle that some business rates will directly fund local government – retention scheme • Will consider the impact on local government funding of any changes to business rates • Will publish the interim findings of the business rates administration review – clearer billing, better information sharing and more efficient appeals system • Will publish a business rates avoidance discussion paper Property Owner BIDs • The Business Improvement Districts (Property Owners) (England) Regulations 2014 (SI 2014/3204) • Came into force on 2 December 2014 • Property owner Business Improvement Districts can be promoted where a Business Rate Supplement and a ratepayer BID are in place • Only in London at present Administration Review – Interim Findings • Published on 10 December 2014 • https://www.gov.uk/government/publications/administrati on-of-business-rates-in-england-interim-findings • Proposals to respond to calls for clearer billing, better information sharing and more efficient appeals system Administration Review – Interim Findings Administration • Most favoured individual valuations, as now • Just over half favoured more frequent revaluations to better align RVs to market conditions • Significant minority did not favour more frequent revaluations – decreased certainty and stability • Billing and collection needed improvement – digital options should be explored • Views varied on improving the gathering of information Administration Review – Interim Findings • Annex – how more frequent revaluations might affect bills • Background analysis by VOA • More frequent revaluations increase the responsiveness of bills but only to relative changes in rental values • More frequent revaluations only increase stability when property values follow a steady trend. When rents are cyclical - pick up rents at different points in the cycle • Historical data indicates cyclical rents with different frequencies – Not possible to say whether more frequent revaluations increase or reduce volatility Checking your RV Consultation - responses • Published on 10 December 2014 • https://www.gov.uk/government/consultations/checkingand-challenging-your-rateable-value • 71 responses – generally supportive but many wider points made • Proposed RV Information Sheet would not provide sufficient information? • Difficult to provide fuller evidence? • Government considering reform of the appeals system within the context of the review of business rates administration Business Rates Avoidance Discussion Paper • Published on 10 December 2014 • https://www.gov.uk/government/consultations/businessrates-avoidance-discussion-paper • Builds on work undertaken by DCLG led working group • Requests responses from interested parties on type and scale of avoidance and ideas for solutions • Responses by 28 February 2015

© Copyright 2026