The 2015 Singapore Budget & Tax Outlook

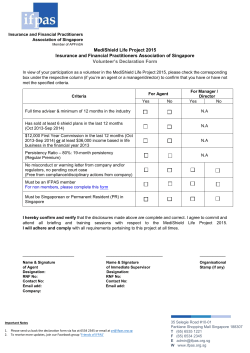

Registration Form ENQUIRIES Tel: 6211 3935 / 6211 3939 Fax: 6224 2555 Email: [email protected] Website: www.cch.com.sg Address: 8 Chang Charn Road, #03-00 Link (THM) Building Singapore 159637 SEMINAR DETAILS The 2015 Singapore Budget and Tax Outlook (0315STE) Date: 6 March 2015 Time: 9.00am – 12.30pm Venue: Marriott Hotel DELEGATE 1 Salutation Each participant will receive a copy of the 2015 Singapore Budget Report published by Wolters Kluwer DELEGATE 2 Mr Mrs Ms Dr Salutation Name Name Job Title Job Title Email Tel Mr Mrs Email Special Dietary Requests (if any) Ms Dr Tel Special Dietary Requests (if any) Address TelFax Nature of Business Company Size Contact Person Email ENROLMENT STATUS WK Executive Events Corporate Member WK Subscriber Non-Subscriber SIATP Member TERMS & CONDITIONS Early Bird Fee (S$) (by 27 Feb 2015) Regular Fee (S$) (after 27 Feb 2015) WK Subscriber / Corporate Member / SIATP Member (Group of 2 pax) 374.50 428.00 Registration & Confirmation Registration will only be confirmed upon receipt of completed registration form. A confirmation email will be sent to you from WK to confirm your registration for the event. WK Subscriber / Corporate Member / SIATP Member 214.00 240.75 Payment Payment must be received prior the event. Please refer to Payment Options for payment details. Non-Subscriber / Non-Member 240.75 267.50 FEE** (includes 7% GST) Cancellation Full payment will be imposed if cancellation is made after 27 February 2015. This also applies to no show on the day of event. In such cases, a complete set of course materials will be sent to you at no additional charge. Notice of cancellation must be made in writing via email/ fax and acknowledged by WK. *Fee includes seminar materials, certificate of attendance & refreshments PAYMENT OPTIONS Substitution A substitute delegate is allowed at no extra charge if you are unable to attend. Please inform WK of the replacement in writing at least one week before the event. By Cheque (Bank Cheque No. Crossed cheque made payable to: “CCH Asia Pte Limited” Please send us an invoice MasterCard ) Programme Changes WK reserves the right to cancel or make changes to the programme without any notification. Visa I have read the Terms & Conditions and agree to abide by them. Cardholder’s Name Card No. Expiry Date Budget and Tax Outlook 6 March 2015 Company By Credit Card The 2015 Singapore Amount Cardholder’s Signature Signature & Company Stamp Date 9.00am – 12.30pm Marriott Hotel Wolters Kluwer presents an event that gives you a practical understanding of the key tax changes presented in the 2015 Budget. Learn how to better manage your tax costs and compliance obligations in the year ahead by: nLeveraging on recent developments to maximise tax planning opportunities. nGetting an analysis of the economic factors impacting your business. nSeeking clarification on your tax compliance concerns from our distinguished speakers through the Q&A sessions. You will also get an update on any recent developments for GST in Singapore. If you have operations or business dealings in Malaysia, the key differences between Singapore and Malaysia GST will also be highlighted to give you a better understanding of how this new tax will impact your operations there. Featuring half-a-day of practical learning, this is the networking event that finance and tax professionals will not want to miss. TARGET AUDIENCE nCEOs, COOs, CFOs nDirectors nTax Managers/Professionals nFinance Executives nAccountants nThose involved in Corporate Tax Planning PROGRAMME This year’s Budget is likely to continue with economic restructuring and strengthen social support for Singaporeans. Expectations run high as Singapore celebrates 50 years of independence. How will the 2015 Singapore Budget impact your business? Budget Highlights and Recent Developments n Highlights of tax Each participant will receive a copy of the 2015 Singapore Budget Report published by Wolters Kluwer changes and implications n Practical pointers and tax planning insights for 2015 Sum Yee Loong Professor of Accounting Singapore Management University Economic Outlook n Regional market outlook n Singapore economic prospects n Implications of 2015 budget on the economy Song Seng Wun Regional Economist CIMB Research Pte Ltd SPEAKERS SUM YEE LOONG Professor of Accounting, Singapore Management University Yee Loong has more than 20 years of experience in Singapore taxation. He has extensive experience in the taxation of multinationals and local companies which includes financial institutions, international trading companies, manufacturing companies and information technology companies. His areas of expertise include devising strategies and leading tax review teams to create and identify tax saving opportunities; structuring and restructuring for IPOs; international and regional tax planning and advising and negotiating tax incentives for corporate clients. Yee Loong was Tax Partner in Deloitte for over 25 years and is now a Professor of Accounting in the Singapore Management University. Singapore and Malaysia GST Updates SONG SENG WUN Regional Economist, CIMB Research Pte Ltd n Singapore GST: Seng Wun holds a Master of Arts in Econometrics from the University of Canterbury, New Zealand. He started his career as an economist in Malayan Banking Bhd. In the early 1990’s, he moved to Singapore and worked as a Regional Economist with various major multi-national financial institutions such as Merrill Lynch (formerly Smith Newcourt); Warburg Dillion Reed (formerly SB Warburg) as well as ABN Amro (formerly ABN Amro Hoare Govette). His areas of focus are in the economies of ASEAN-5. Mr Song is also a familiar icon in South Asia’s news media as he regularly contributes his professional views on the regional financial markets. recent developments n Singapore and Malaysia GST – key differences highlighted Yeo Kai Eng Partner, Indirect Tax – Goods & Services Tax Ernst & Young Solutions LLP BENEFITS OF ATTENDING nKey Issues arising from the major Budget changes in 2015 and their impact on your business nPractical Pointers to minimise risks and reduce potential tax liabilities in the new budget year nInsights from experts you can leverage on for planning and compliance nUpdates on the latest tax changes and planning tips for 2015 YEO KAI ENG Partner, Indirect Tax – Goods & Services Tax Ernst & Young Solutions LLP Kai Eng is Partner specialising in GST at Ernst & Young Solutions LLP. He is actively involved in GST process and internal control reviews under the Assisted Compliance Assurance Programme (ACAP), annual reviews of GST returns under the Assisted Self-Help Kit (ASK) Programme, GST advisory and planning assignments including assisting clients in negotiations with and obtaining rulings from the Inland Revenue Authority of Singapore on critical GST-specific transactions and refunds. Kai Eng is an Accredited Tax Advisor (Income Tax/GST) and a member of the GST Committee with the Singapore Institute of Accredited Tax Professionals. He is also currently actively involved in GST implementation projects in Malaysia. * Programme subject to change based on Budget Announcement on 23 February 2015

© Copyright 2026