Happy Valentines Day - Petroleum Retailers & Auto Repair

PRARA NEWS

ESTABLISHED 1937

February 2015

IN THIS ISSUE...

Monthly Columns

President’s Page

Nancy’s Notes

General Counsel Corner

2015

OFFICERS

PRESIDENT

Jeff Decker

1ST VICE PRESIDENT

DENNIS BUDZYNSKI

2ND VICE PRESIDENT

GAUTTAM PATEL

SECRETARY

TREASURER

Ray Moore

BOARD OF

DIRECTORS

Jesse Huey

Dinesh Mittal

Kamlesh Shah

John Listak

OFFICE STAFF

Executive Director

Nancy Maricondi

Secretary

Clara Peters

3

2

Articles of Interest

New Members

Rack Prices

Legislative Update

Legislative Update

Advertising Rates

Legislative Update

Legislative Update

CCAC West Hill Class Schedule

Re-cert Class

Member to Member Services

Classifieds

Used Tire Pickup/ Used Oil

2

2

6

7

9

11

12

14

15

16-17

19

19

Happy

Valentines

Day

78 YEARS OF SERVICE TO PETROLEUM RETAILERS AND AUTO REPAIR DEALERS IN PENNSYLVANIA

February

NANCY’S

NOTES

WELCOME

NEW MEMBERS

Rakesh Diora

C-Store

Elizabeth, PA

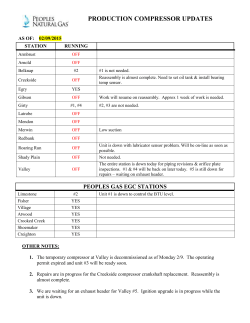

RACK PRICES

Brand

BP b*

Citgo b*

Exxon b*

Gulf b*

Shell b*

Reg.

1.3526

1.3205

1.3495

1.3175

1.3487

01/27/15

Mid.

1.4586

1.4235

1.4495

1.416

1.4388

Prem.

1.6506

1.6065

1.6445

1.6165

1.6467

* 10% ethanoll

Tax of .689 cents per gallon and .011 cent

indemnification fund & .001 cent Oil Spill Tax are not

included in rack price.

Superfund tax eliminated

Ron Brutt Pres. Tire Dealers Association &

Roy Littlefield IV, TIA Legislative Rep. at the

Legislative Meeting on Jan 14 .

PRARA ADVERTISERS

Attorney

Insurance

Law Office of Harry F. Klodowski Jr..................... .....5

Bulava & Associates.................................................. 13

Convenience Store Wholesalers

Jobbers / Distributors

A.J. Silberman & Co................................................ 18

Bradigan’s...................................................................4

Liberty USA......................................................... .... 3

Reed Oil......................................................................8

Turner Dairy...............................................................10

PPC Lubricants............................................................8

Environmental Service

Signs

Flynn Environmental..................................................18

JTB Sign Service.........................................................6

Groundwater Environmental Service Inc......................5

Moody & Associates Inc............................................4

Waste Management

Presise Tank Modifications...................................... 12 .

Environmental Specialists, Inc......................................9

2

PRESIDENT’S PAGE

by Jeff Decker

February

Dennis Budzynski VP PRARA, Ron Brutt Pres

Tire Dealers, Jeff Decker Pres PRARA at Legislative meeting Jan 14. 2014

/LEHUW\86$LVD:+2/(6$/(',675,%8725ORFDWHGLQ:HVWHUQ3HQQV\OYDQLD

6HUYLQJVWDWHVLQFOXGLQJ3HQQV\OYDQLD2KLR:HVW9LUJLQLD0DU\ODQG

'HODZDUH1HZ<RUN.HQWXFN\

5HWDLOHUVIDFHPDQ\FKDOOHQJHVLQWRGD\·V

PDUNHWDQGZHKDYHWKH´62/87,216µ

WRKHOSWKHPEHVXFFHVVIXO

QUALITY SOLUTIONS PROVIDED BY LIBERTY USA:

7HFKQRORJ\

)RRG6HUYLFH

0DUNHWLQJ

0HUFKDQGLVLQJ

&XVWRPHU6HUYLFH

,QYHQWRU\0DQDJHPHQW

'6'5HSODFHPHQW

3URILW(QKDQFHPHQW

&DWHJRU\0DQDJHPHQW

6DOHV*URZWK

®

7R/HDUQPRUHDERXW/LEHUW\86$DQGKRZZHFDQRIIHU “SOLUTIONSIRU\RXUSUCCESS” 3OHDVH&RQWDFW: Liberty USA Sales

,UZLQ5XQ5RDG:HVW0LIIOLQ3$3)VDOHVPDUNHWLQJ#OLEHUW\XVDFRPwww.libertyusa.com

3

February

Experience• Efficiency • Effectiveness

Sample of Services

Moody’s Underground Storage

Tank (UST) Management services

range from tank removal through

Services site characterization, full

scale remidation, and closure of

contaminated sites. Our certified

OSHA trained licensed professional

geologists and staff can assist you

through the PA DEP Storage Tank

Program’s regulations with the

end result being an Environmental

Release of Liability for your site.

Underground Storage Tank

Contamimated Soil and

Ground Water Remediation

Environmental Assessments

Site Characterizations

Brownfield Site Assessments

USTIF’s philosophy is moving

towards Pay for Performance (PFP)

type contracts for their UST sites.

Moody’s is working with our clients

and USTIF on PFP contracts and

we are ready to help you at your

UST site.

Meadville PA

800-836-5040

www.moody-s.com

Houston PA

866-336-0000

Canton OH

877-636-4448

4

Waverly NY

877-602-3120

February

Law Office

of

Harry Klodowski, Esquire

Betts, Hull & Klodowski

Wexford, PA

724-940-4000

25 YEARS OF EXPERIENCE

[email protected]

“Environmental,Commercial,Litigation”

Storage Tank Litigation

Buying/Selling

Contaminated Properities

$39.95

*********************************

WE NOW HAVE:

RVP Labels

Safety Inspection Manuals

Drive Off Labels

2012 Labor Law Posters

Stage II Decals

Low Sulfar Diesel Labels

Spill Containment Kits

Emission Signs

Keystone Ins. signs/number plates

Safety Ins MV-431’s & Motorcycle

Kit contains:

5lb. Lite Dry

2 48” socks

8 absorbant pads

2 pair gloves

2 hazardous waste bags

5

February

SSDA Legislative

PRESIDENT TO PUSH DOMESTIC PLAN

In his State of the Union Address, President Obama proposed to raise $320 billion over the next 10 years in

new taxes.

Specifically, the President is proposing to raise the capital gains tax and dividend tax rates to 28%, impose a fee

on the liabilities of large financial institutions, repeal LIFO and greatly increase the estate tax.

SSDA-AT will oppose an increase in the capital gains, dividend, and estate tax rates; and will oppose the repeal

of LIFO.

To offset the tax increases on business and “wealthy” individuals, the President will seek additional reforms that

will aid middle class and working families, including:

• Propose a new, simple tax credit to two-earner families. The President will propose a new $500 second

earner credit to help cover the additional costs faced by families in which both spouses work – benefiting 24

million couples.

• Streamline child care tax incentives to give middle-class families with young children a tax cut of up

to $3,000 per child. The President’s proposal would streamline and dramatically expand child care tax

benefits, helping 5.1 million families cover child care costs for 6.7 million children. The proposal will complement

major new investments in the President’s Budget to improve child care quality, access, and affordability for

working families.

• Simplify, consolidate, and expand education tax benefits to improve college affordability. The

President’s plan will consolidate six overlapping education provisions into just two, while improving the

American Opportunity Tax Credit to provide more students up to $2,500 each year over five years as they

work toward a college degree – cutting taxes for 8.5 million families and students and simplifying taxes for the

more than 25 million families and students that claim education tax benefits.

• Make it easy and automatic for workers to save for retirement. The President will put forward a

retirement tax reform plan that gives 30 million additional workers the opportunity to easily save for retirement

through their employer.

These new policies build on longstanding proposals to extend important tax credit improvements for working

families, expand the Earned Income Tax Credit, provide quality preschool for all four-year-olds, and raise

revenue to reduce the deficit by curbing inefficient tax breaks that primarily benefit the wealthy. In addition, the

President has put forward a framework for fixing the business tax system on a revenue-neutral basis and using

the transition revenue to pay for investments in infrastructure.

The Estate Tax proposal drew immediate opposition from both Republicans and Democrats who recently

worked on legislation, signed into law by the President, to increase the amount of money exempt from

inheritance taxes, commonly referred to as “death taxes”.

Senate Majority Leader Mitch McConnell (R-KY) responded, “President Obama is asking Congress to

reverse bipartisan tax relief that he signed into law.”

On January 21, SSDA-AT and the Family Business Estate Tax Coalition released the following joint statement

on response to the President’s tax proposal:

“The new capital gains tax regime proposed by President Obama radically departs from the bipartisan

agreement that he signed into law in 2010 and reaffirmed in 2012. Make no mistake – this proposal would harm

small businesses and family farms, introduce massive new complexity into the tax code, and effectively create a

second tax at death on top of the already punitive estate tax. Going forward, we encourage Congress to reject

this misguided proposal, and instead build on the bipartisan progress made in recent years to permanently repeal

the estate tax once and for all.”

6

February

REPUBLICANS COULD USE HIGHWAY BILL TO PASS KEYSTONE XL

With President Obama standing clear in his message that he would veto the Keystone project if it were to end

up on his desk, Republicans now have a backup plan for approving the Keystone XL oil pipeline if Obama

vetoes the bill now moving through the Senate. House Rules Committee Chairman Pete Sessions (R-Texas) is

suggesting the GOP could have other ways to secure a veto-proof majority for the pipeline. This would include

adding Keystone XL approval legislation through a series of amendments to a federal highway bill. With the trust

fund soon to run out of money again, Congress will have to pass another short term bill or an anticipated long

term bill. Either version, could include an amendment that would approve the Keystone XL pipeline. We will

continue to update you on this issue.

ABOLISH THE GAS TAX

As Congress considers options (including a substantial increase in the motor fuel tax) to fund a long-term

transportation bill, a recent Wall Street Journal editorial urged Republicans in Congress to eliminate completely

the gas tax.

The gas tax is a regressive tax that hits hardest on low income families, who drive older cars with lower miles

per gallon.

Agreeing with SSDA-AT testimony, position papers, and lobbying, the Wall Street Journal noted that since the

1990s we have seen more and more diversion of highway funds for programs such as street cars, ferries,

sidewalks, bike lanes, hiking trails, mass transit, airports, and ports.

Diversion has increased by 38% since 2008. In his transportation proposal, President Obama would like to

triple the budget for mass transit.

While the gas tax is regressive on lower income Americans, non-highway projects being funded tend to be used

by upper class citizens who are not paying for the projects. Trolley riders, for example, contribute nothing to the

Highway Trust Fund.

Spending money on highways which were collected for highway use, would make the Highway Trust Fund 98%

solvent for the next 10 years, with no tax increase.

“FULL TIME” EMPLOYMENT

While repealing Obamacare is politically a long-shot, SSDA-AT and other small business associations are

pushing for legislation to change the definition of “full time employment” under the Patient Protection and

Affordable Care Act (ACA).

U.S. Congressman Todd Young (R-IN), and Dan Lipinski (D-IL), with the support of Senate colleagues Pete

Olson (R-TX), Mike Kelly (R-PA), and Time Walberg (R-MI), introduced H.R. 30, the Save American

Workers Act of 2015.

If enacted, H.R. 30 would repeal the ACA’s 30 hour definition of “full time employment” and change it to a

more 40 hour definition.

ACA stipulates that employers with more than 50 full time employees are required to provide employees with a

basic level of health insurance or potentially face a penalty.

ACA defines a full time employee as an individual who works an average of at least 30 hours a week. This

requirement has created an incentive for employers to cut workers’ hours to less than 30 hours a week to avoid

the insurance requirement and the potential fine.

7

February

.

Quality GASOLINE and TRANSPORT Service Since 1972

Celebrating 25 Years of Dependable Service to Independent

Gasoline Retailers in Western PA

Great Reputation, Competitive Pricing

Branded/Unbranded Gasoline, E85, Bio Diesel, On Road/Off Road, Kerosene

Contact Ron Rotolo 724-333-5964

Email: [email protected]

PPC Lubricants & PRARA are proud to announce a new OIL PROGRAM specifically to

help put thousands of dollars back in your pocket. Quarterly rebates , advertising,and

excellant products. Call Dave Ondik Today! 412-719-0063

8

February

Environmental Specialists, Inc.

¾ Hazardous and Non-Hazardous Waste Management Services

¾ Wastewater Treatment

¾ Used Oil and Used Antifreeze Recycling Services

¾ Aqueous and Solvent Based Parts Washing Technologies

¾ EPA and OSHA Compliance and Reporting Services

¾ Industrial Maintenance and Vacuum Truck Services

¾ Used Oil Fuel Sales and Used Oil for Re-refining Sales

¾ Windshield Washer Fluid, Recreational Antifreeze, and Diesel Exhaust Fluid(DEF) Sales

¾ Complete Transportation Services

Serving Ohio, Western Pennsylvania, Northern West Virginia, Southeast Michigan and Maryland

Phone: 888-331-3443 y Fax: 330-746-8175 y www.esrecycling.com

1000 Andrews Avenue y Youngstown y Ohio y 44505

NEW

Advertising Rates

We have made some changes to the format of the monthly advertising.

The prices for a yearly advertisement is as follows:

1/2 page

$600

1/4 page

$450

1/8 page

$330

Insert (one mailing)

$100

9

February

10

February

The Keystone Pipeline:

While there will inevitably be partisan splits in the future, at this point, tax reform is perhaps the least

controversial of the major issues that have already been raised in the new Congress. On the other side of the

spectrum, the Keystone pipeline issue, which was raised on the first day of session, kicked off serious

disagreement that is continuing to occupy congressional attention. While the pipeline’s direct impact on most

small businesses seems to be limited, the growing dynamic between Congress and the White House on this high

profile issue is sure to influence the tone of debate on other issues being considered contemporaneously.

On the first day of the new session, bills were introduced in both the Senate (S.1) and the House (H.3) to

authorize the building of the TransCanada Keystone Pipeline.

The pipeline is not a new issue, as it has been under consideration for six years. However, recent developments

have swiftly moved it to the forefront of political debate.

Almost a year ago, on January 31, 2014, the State Department published its Final Supplemental Environmental

Impact Statement on the pipeline concluding, in short, that the pipeline would not have a significant effect on

greenhouse gas emissions because, without the pipeline, the oil would be transported by other means. However,

in May 2014, the State Department suspended its broader review of the pipeline pending the resolution of a

lawsuit making its way through the Nebraska courts.

On January 9, 2015, the Nebraska Supreme Court decided the case at issue by overturning a lower court ruling

and holding that legislation passed by the Nebraska legislature allowing for the construction of the pipeline

through the state was not unconstitutional. In other words, the Nebraska Supreme Court decision cleared a

major hurdle for the proposed developers of the pipeline.

Just hours after the decision was handed down, the House passed H.3., the third time in six months that it has

passed a bill authorizing the pipeline. The bill passed the House with the votes of nearly all of the Republican

members and 28 Democrats. The issue now moves to the Senate which began debate on amendments to S.1

yesterday. Given the support that the pipeline received during the lame-duck session in November 2014 (falling

one vote short of the 60 needed) and the current partisan breakdown of the chamber, the bill is expected to

pass the Senate. However, the White House has already pledged that the President will veto such a bill. It

appears that the Administration will not respond to Congressional pressures and will instead continue to move

forward with the administrative review process, the timing of which is currently uncertain. If the bill does pass

the Senate and is vetoed by the President, it seems unlikely there will be enough votes in Congress (given the

results of the House vote) to override the veto – though the issue could be close.

This face off, straight out of the gate, between the Republican majority in Congress and the White House, has

made two things clear: first, congressional leaders are not going to be concerned with niceties and will not

hesitate to promote their agenda even in the face of presidential opposition; and second, that the White House

has clearly recognized, and will not hesitate to act on, the math problem that the Republicans have in

overcoming a presidential veto. With no elections for a year and a half and no re-election for the President to

worry about, at the moment, both parties appear less concerned with being saddled with the blame for

legislative inaction than they were leading up to 2014 mid-term election. Unfortunately, this may translate into

both parties being less willing to compromise and establishing an early dynamic of gridlock that will be hard to

step back from.

11

February

Precise Tank Modifications, Inc.

PO Box 274, Madison, PA 15663

Donald J. Maughan, President

James R. Preisach, Project Manager

Phone: (724) 446-3516

Fax: (724) 446-0175

Quality Petroleum Contractors & Distributors

DEP Certified: Pennsylvania, Ohio, West Virginia, Maryland

> Underground & Aboveground Storage Tanks

> Storage System Installations & Removals

> Helium Detection Service

> Site Inspections

> C-Store Installations

> Car Wash Installations

> Design Consultation

> Remediation Coordination

> Permitting & Project Management

> Fuel System Electrial Systems

> Site Preparation & Restoration

> Storm Water Management Systems

> Hydrostatic Testing

> Factory Direct Fueling Components & Equipment

REPUBLICANS COULD USE HIGHWAY BILL TO PASS KEYSTONE XL

With President Obama standing clear in his message that he would veto the Keystone project if it were to end up on his

desk, Republicans now have a backup plan for approving the Keystone XL oil pipeline if Obama vetoes the bill now moving

through the Senate. House Rules Committee Chairman Pete Sessions (R-Texas) is suggesting the GOP could have other ways

to secure a veto-proof majority for the pipeline. This would include adding Keystone XL approval legislation through a

series of amendments to a federal highway bill. With the trust fund soon to run out of money again, Congress will have to

pass another short term bill or an anticipated long term bill. Either version, could include an amendment that would approve

the Keystone XL pipeline. We will continue to update you on this issue.

ABOLISH THE GAS TAX

As Congress considers options (including a substantial increase in the motor fuel tax) to fund a long-term transportation bill,

a recent Wall Street Journal editorial urged Republicans in Congress to eliminate completely the gas tax.

The gas tax is a regressive tax that hits hardest on low income families, who drive older cars with lower miles per gallon.

Agreeing with SSDA-AT testimony, position papers, and lobbying, the Wall Street Journal noted that since the 1990s we

have seen more and more diversion of highway funds for programs such as street cars, ferries, sidewalks, bike lanes, hiking

trails, mass transit, airports, and ports.

Diversion has increased by 38% since 2008. In his transportation proposal, President Obama would like to triple the budget

for mass transit.

While the gas tax is regressive on lower income Americans, non-highway projects being funded tend to be used by upper

class citizens who are not paying for the projects. Trolley riders, for example, contribute nothing to the Highway Trust Fund.

Spending money on highways which were collected for highway use, would make the Highway Trust Fund 98% solvent for

the next 10 years, with no tax increase.

12

February

Consultants / Insurance Brokers

Join the growing number of PRARA members

who insure with Bulava & Associates.

Bulava & Associates values our professional affiliation with the Petroleum Retailers

and Auto Repair Association -- and the opportunity to provide business insurance

protection to members like you.

If your business is already insured through our agency, we thank you and pledge to

continue working hard to earn your trust!

If you’re not currently insured with us, why not join the growing number of your

PRARA associates who place their confidence in Bulava & Associates to protect

their hard-earned assets?

For more information, contact us today.

XXXCVMBWBJOTVSBODFDPNtt'BY

13

February

CCAC WEST HILLS CENTER

1000 MCKEE ROAD

OAKDALE, PA 15071

412-241-2380

EMISSION Re-Certification Course Schedule

Feb 18

March 18

Emission Inspector

Feb 2, 4, 9, 11

March 17, 19 ,24, 26

Safety Inspector

Feb. 24, 26, March 3, 5,

14

February

3/16/2015

SIGN UP NOW

Emission Re-Cert Class

Being held at the PRARA office

March 16, 2015

6:30 pm to 9:30 pm

(412) 241-2380

$79.00 per person

You may take this class up

to 6 months before the

expiration date so take

advantage of the location.

Limited seating.

Non Members $89.

15

February

Member-to-Member-Services

Accountants

RobinsonYoung & Associates

Oakmont , PA 412-423-1093

ATM

ATM Cash World

Tom Ranallo--Pittsburgh, PA

800-937-5169

Attorney

Albert G. Feczko

Pittsburgh, PA

412-833-5554

Inventory Service

Strangis & Swaney

724-493-4090

C-store Distributors

A.J. Silberman & Co.

Indianola PA

412-455-1011

Liberty USA

West Mifflin PA

412-461-2700

PetroSopft Office

C-Store Back Office Program

John Vlasic (412-306-0640x2017

Clean Hands LLC

Pgh Pa 412-961-1207

Computers

Automotive Inspection Systems

MVIRS-Motor Vehicle Inspection Reporting System Pete Kipe / Rick Dunmire

1-866-376-8477

Computer Solutions

Dick Norchi--Allison Park, PA

412-369-8896

Consulting

S.I.S.

J R Bachor Tarentum , Pa

724-224-1220

Environmental-Tanks-Upgrades

Petroleum Technical Service

Mike Gifford--Butler, PA

724-287-4148

Environmental- tanks & upgrades Precise Tank Modifications Inc.

Waste Oil/ Contamined product pick-up

Environmental Specialist

Ron Blinsky-McDonald, OH

1-888-3313443

Flynn Environmental, Inc.

Michael Flynn--Pittsburgh, PA

1-800-690-940

Groundwater & Environmental Srv Inc.

Jon Agnew--Cranberry Twp, PA

800-267-2549 ext 3636

Letterle & Associates, LLC

Lou Letterle--Allison Park, PA

412-486-0600

Moody & Associates

Mark Miller 814-724-4970

Steel City Fueling Systems

William Brandenstein-Pittsburgh, PA

412--327-7030

www.steelcityfueling.com

Donald Maughan--Madison, PA

724-446-3516

S.I.S.

J R Bachor Tarentum, PA

724-224-1220

Steel City Fueling Systems

William Brandenstein-Pittsburgh, PA

412--327-7030

www.steelcityfueling.com

The Weavertown Group

John Lavezoli- Carnegie

724-746-4850

Shockey Excavating, Inc

George Shockey

724-282-3669

Financial Services

Shockey Excavating,

George Shockey 724-282-3669

Financial Transactions Services LLC

Credit Card Processing

Hal Treelisky

412-720-8345 [email protected]

George I Reitz & Sons

Sandy Crawford East Pittsburgh PA

412-824-9976

Advanced Fire Company

Ron Cruder--Greensburg, PA

724-834-6550

McRo Construction Inc.

Donald Rothey Jr.--Elizabeth, PA

412-384-6051

Views expressed in editorials and

text are not always the opinion of

PRARA. Furthermore, PRARA is

not liable for any claims/promises

made by advertiaers.

Fire Supression

Insurance

Bulava & Associates

Joe Bulava--Greensburg, PA

724-836-7610

Pinnacle Group LLC

Kirk Haldeman--Pittsburgh, PA

Jack Bonus Insurance

Mark Bleier- Pittsburgh, PA

412-452-8722

If you have a service that would be useful to your fellow PRARA members,

give us a call at (412) 241-2380 and we will list your name and product/service in our future monthly issues.

16

February

Member-to-Member-Services

Gas Island Restoration & Concrete repair

Simon Surfaces

Rich Serignese

[email protected]

1-866-201-3541

simonsurfaces.com

Parts/Petroleum Equip.

George I Reitz & Sons, Inc.

Sandy Crawford--E Pittsburgh, PA

412-824-9976

Don Parker Sales Inc.

Pam Pitell

1916 Babcock Blvd

412-821-4085

Petroleum Technical Services

Mike Gifford Butler, PA

724-287-4148

PartsCleaner

Petroleum

Purvis Brothers Inc.

Mack Purvis-Mars, PA

724-625-1566

PPC Lubricants

Dave Ondik 412-719-0063

R & W Oil Products

Richard Smith--McKeesport, PA

412-678-6121

Reed Oil Company

Ron Rotolo--New Castle, PA

800-922-5454

Superior Petroleum

Don Bowers-Pittsburgh, PA

412-576-2601

American Agip

1-800-922-9243

Bulk Oil Programs

Parts Cleaners

Kleen-Line

412-466-6277

Petroleum

Bolea Oil Products

Robert Bolea--Coraopolis, PA

412-264-1130

Bradigan’s Inc.

Tom Bradigan --Kittanning

724-548-7654

Glassmere Fuel Service

Dell Cromie--Tarentum, PA

724-265-4646

Guttman Oil Company

Kevin Forsythe-Belle Vernon, PA

724-483-3533

Kehm Oil Company

George Kehm--Oakdale, PA

412-921-5200

Remodeling

McRo Construction Inc.

Donald Rothey Jr.--Elizabeth, PA

412-384-6051

S.I.S.J.R. Bachor Tarentum, PA

724-224-1220

Site Inspections & Technical

Services

Petroleum Technical Services

Butler, PA

Mike Gifford 724-287-4148

George I Reitz & Sons, Inc

Sandy Crawford- East Pittsburgh PA

412-824-9976

S.I.S JR Bachor

Tarentum PA 724-224-1220

Taxes

Robinson Young & Associates

412-423-1093

Tires

Keystone Tire & Auto Supply Inc.

Mark Greenwald--Braddock, PA

412-271-1989

Uniforms

Arrow Uniform

Carrie Weber

724-417-8500

Signs

JTB Sign Service

Jim Rahe--Pittsburgh, PA

412-279-3360

Grease Traps

Steel City Grease Traps

Mark Kuss

412-583-0206

Underground

Storage Tank/Line Testing

George I Reitz & Sons, Inc.- Testing

Sandy Crawford--E Pittsburgh, PA

412-824-9976

Petroleum Technical Services

Butler, PA

724-287-4148

Gulf Oil LLC

Doug Storch-Pittsburgh, PA

724-333-5964

If you have a service that would be useful to your fellow PRARA members,

give us a call at (412) 241-2380 and we will list your name and product/service in our future monthly issues.

17

February

18

February

CLASSIFIEDS

EQUIPMENT

EQUIPMENT

Place your ad here

Place your ad here

USED OIL PICKUP

FOR SALE

ENVIRONMENTAL

C-STORE, RESTAURANT

SPECIALISTS,INC

APARTMENT

1-888-331-3443

GARAGE 2/BAYS

PETRO MAX

GAS & DIESEL

412-279-9040

CHAMPION, PA

Contact Denny or Sandy

USED TIRE PICKUP

724-593-7760 or 7788

1-888-868-0097

LIBERTY TIRE

FOR LEASE

BAY STATION W/GAS

WASHINGTON ROAD

BRIDGEVILLE PA

JOE 724-941-5995

19

February

Calendar of Events

February 2015

February 10, Board Meeting

February 16, Presidents Day

Upcoming Events

PRARA Charity Golf Outing (TBA)

March 4, Liberty Show Trade Show

March 16, Re-Cert Class (Prara Office)

March 17, A J Silberman Trade SHow

PETROLEUM RETAILERS & AUTO REPAIR ASSOCIATION

1051 Brinton Road Suite 304

Pittsburgh PA 15221

20

© Copyright 2026