information. - Virginia Credit Union League

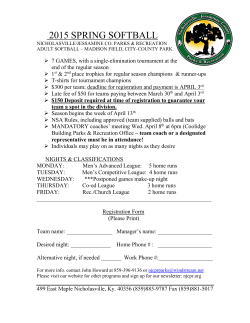

register Return This Form Via: • • Mail - Virginia Credit Union League Attn: Mary Amyx PO Box 11469 Lynchburg, 24506 Fax - 434.237.5068 • Coming Soon at http://bit.ly/VACUL_AM15 Hotel: • Or, Register Online: Our conference hotel is the historic Hotel Roanoke. 110 Shenandoah Avenue Roanoke, VA 24016 Phone: 540-985-5900 (Use the code “VCL” or simply identify yourself as a Virginia Credit Union League participant.) • Reserve your room(s) online here: www.bit.ly/VACUL2015 Choose “Attendee” from the drop-down menu. Our block of rooms is discounted to $140 per night. • Questions about hotel reservations can be directed to Mary Amyx at 800.768.3344, ext. 630 or [email protected]. Reservation discounts are available through March 17.) Annual Meeting Costs: • • Full Registration CUs less than $50 million in assets $375 early bird through March 17; $425 thereafter • CUs $50 million or more in assets $475 early bird through March 17; $525 thereafter Guest Registration • $300 early bird through March 17; $350 thereafter • Payment Options: • About Your Registration Options • Payment may be made by check/share draft made payable to the Virginia Credit Union League. Contact your League’s Cathy Baldwin (800.768.3344, ext. 615) to pay by credit card (over the phone). Online registration also features pay by credit card option. • Deadline for all registrations is April 10, 2015. • Deadline: Name(s) of Registrants This Box for CU Delegate Position With Credit Union • • Full registration entitles participant to attend all events including the Thursday’s Lunch and Learn, all receptions, the Wednesday Night ‘Spectacular Spectacular!,’ and any education sessions. Guest registration entitles participant to attend the Spectacular Spectacular!,’ Thursday Lunch and Learn, and the vendor reception on Thursday afternoon (5:00 pm-7:00 pm). o Full Registration or o Guest Registration o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) o Full Registration or o Guest Registration o Young Professional Registration (Full Annual Meeting + YP Event) o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) o Full Registration or o Guest Registration o Young Professional Registration (Full Annual Meeting + YP Event) o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) o Full Registration or o Guest Registration o Young Professional Registration (Full Annual Meeting + YP Event) o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) o Full Registration or o Guest Registration o Young Professional Registration (Full Annual Meeting + YP Event) o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) Please let us know which events you will likely attend; for our planning purposes only, no obligation on your part. Please Indicate Method of Payment Your Name: Your E-mail: Your Phone: Check/Share Draft Enclosed or Being Mailed Will Pay By Credit Card (Either online or Call your League’s Cathy Baldwin at 800.768.3344, ext. 615). Total Being Paid By Your Credit Union $ April 15-17 Roanoke Join us in the Star City at Historic Hotel Roanoke to celebrate more than 80 years of League service to our member credit unions. We are proud to serve the Commonwealth’s strong, thriving and diverse credit union system. Your League’s 2015 Annual Meeting offers the opportunity to expand your knowledge or advance your career through more than 20 educational and networking events. Registration Options (Please See Notes Above on Registration Options; for planning purposes only, no obligation to attend session/event) o Full Registration or o Guest Registration o Young Professional Registration (Full Annual Meeting + YP Event) o Attend Wednesday Spectacular Spectacular! Mixer o Attend Thursday Lunch & Learn o Attend Thursday Innovation Expo (2-3:30 pm) o Attend Thursday Innovation Expo (5-7 pm) Your Credit Union: Story Stars You! Our Annual Meeting 2015 Annual Meeting Highlights • New this year - Special pricing for credit unions less than $50 million in assets; just $375 for early bird registration. • We take our Young Professionals Network programming to new heights with a full day of educational and networking opportunities on Wednesday, April 15. Our YPN participants can register for the entire Annual Meeting or register only for the YPN event. • It’s Old Hollywood glam at its best for our ‘Spectacular Spectacular!’ networking event. Come dressed as your favorite Old Hollywood stars for our Wednesday night networking event. New to the Annual Meeting are educational sessions and special programming that will appeal specifically to the next generation of credit union leaders. Our Innovation Expo offers a stellar opportunity to expand your resources by meeting one-on-one with industry-leading business partners. And best of all, here is the perfect environment in which to discover best practices and connect with peers from across the state. Greetings! The 2015 Annual Meeting of the Virginia Credit Union League will be held at the beautiful Hotel Roanoke, Roanoke, Virginia. We are able to include a limited number of exhibitors in our innovation expo and we invite you to be an exhibitor at the meeting. We anticipate approximately 400 credit union executives and guests in attendance, providing you an excellent environment for networking with our Virginia credit unions. The exhibitor fee has been established at $2,500, and we suggest you act now to reserve an exhibit space. You need to complete and return the enclosed exhibitor application and agreement with your exhibitor fee of $2,500 as soon as possible to reserve your space. All applications are accepted on a first-come, first-serve basis. Also, please complete and return the bottom portion of the exhibitor overview with the exact information regarding your display. Exhibitors who have been to our showcase of services in previous years will receive priority in space allocations. The enclosed information should cover most questions; if not please feel free to contact Mary Amyx at 1-800-768-3344, ext. 630. We look forward to seeing you at our Annual Meeting & Innovation Expo. Sincerely, Terry R. Childress Executive Vice President Enclosures 1207 Fenwick Drive Lynchburg, VA 24502 • PO Box 11469 Lynchburg, VA 24506 P: 800 768 3344 • 434 237 9600 F: 434 239 8148 www.vacul.org Innovation Expo Overview VENDOR AGENDA Wednesday, April 15, 2015 7:30 am breakfast/ 8:30 am start CU Cares Foundation Golf Tournament – Roanoke Country Club 4:00 pm – 6:30 pm Exhibit Set-Up 7:30 pm – 11:00 pm “Spectacular Spectacular!” Networking Event (Old-Hollywood themed) Thursday, April 16, 2015 9:00 am – 1:30 pm Exhibit Set-Up (All displays must be set up by 2:00 pm opening!) 2:00 pm – 3:30 pm Innovation Expo Preview 5:00 pm – 7:00 pm Innovation Expo ~Community Involvement Benefit ~Heavy Hors d’oeuvres and open bar Friday, April 17, 2015 7:30 am – 9:00 am Innovation Expo ~Continental Breakfast served 9:00 am – 10:30 am Exhibit Tear-Down (All displays must be torn down by 10:30AM!) Your $2,500 exhibit fee includes: 8’x10’ exhibit space 6’ draped table 2 chairs wastebasket 120v conventional wall outlet (Provide your own extension cord – 3 wire grounded) Extra or special electric service and/or telephone lines are available on an advance request and priced on an individual basis. For more information, contact Mary Amyx – 800.768.3344, x630. Exhibitor lodging arrangements are the responsibility of the vendor Please let us know the size of your display so that we may provide enough space for your exhibit. Type of display: □ Floor Model □ Table Top Display Approximate Size of your display: _______________________ Please return with your exhibit fee and executed contract as soon as possible. All information should be sent to: Mary Amyx, VCUL – PO Box 11469 – 1207 Fenwick Drive – Lynchburg VA 24506. VIRGINIA CREDIT UNION LEAGUE 2015 Annual Meeting EXHIBITOR TERMS AND CONDITIONS The undersigned applicant (the "Applicant" or "Exhibitor") desires to lease space and participate as an exhibitor in the 2015 Annual Meeting (the "Annual Meeting") of the Virginia Credit Union League (the "League"), which is scheduled to be held at the Hotel Roanoke, Roanoke, Virginia (the "Facility"), commencing on Wednesday, April 15, 2015 and continuing through Friday, April 17, 2015. The Applicant submits this application (the "Application") with the understanding that, if this Application is accepted by the League as provided herein, the Applicant shall be subject to (i) all of the terms, conditions, rules and regulations attached hereto (the "Terms and Conditions"), all of which are incorporated herein by reference, and (ii) any additional terms, conditions, rules and regulations which may be adopted from time to time by the League or the Facility and which in any way pertain to or govern exhibitors at the Annual Meeting. Upon acceptance by the League, this Application shall constitute a binding agreement between the parties (the "Agreement"). For each exhibit booth requested, the Applicant has enclosed herewith its share draft or check payable to the League in the amount of Two Thousand Five Hundred Dollars ($2,500) (the "Payment"), which, in the event the Application is accepted by the League, shall represent payment in full for the exhibit space requested. This Application shall not become a binding agreement until and unless accepted and executed on behalf of the League. If this Application is not accepted by the League due to a lack of exhibit space or otherwise, the Payment shall be refunded in full, without interest, to the Applicant. Please provide a brief statement as to the nature of the proposed exhibit and the products to be exhibited and/or distributed by the Applicant at the Annual Meeting: IN WITNESS WHEREOF, the Applicant has caused this Application to be executed individually or by an officer, agent or representative duly authorized to execute the same. APPLICANT: (Company Name) By:___________________________________________________Title:______________________________ Address: City: Phone: ( ________________________ ) ______________________________ Fax: ( State: Zip: ___________ ) ________________________ E-mail: _______________________________________________________________________________ Date: ___________________________________________ Name of contact person(s) who will be responsible for booth at the event in Roanoke: ____________________________________________________________________________________ Sign and return with your check to: Virginia Credit Union League, ATTN: Mary Amyx, P.O. Box 11469, Lynchburg, VA 24506. Accepted on behalf of Virginia Credit Union League: Initials: ____________ Date:_________________ VIRGINIA CREDIT UNION LEAGUE 2015 Annual Meeting EXHIBITOR TERMS AND CONDITIONS 1. COMPLIANCE: These terms and conditions (the "Terms and Conditions") are part of the Agreement between the Virginia Credit Union League (the "League") and the Exhibitor. The Exhibitor agrees that failure to abide by any term or condition set forth herein or any rule or regulation concerning exhibits otherwise adopted by the League or the Facility, shall constitute a breach of the Agreement between the Exhibitor and the League. In the event of such a breach, the League may pursue any available legal or equitable remedy. 2. BOOTH SIZE AND ASSIGNMENT: The size of each booth shall be 8ft X 10ft or an approximate equivalent thereof. Booth assignments for all exhibitors will be established by the League on a random basis. The League, however, shall retain the right to change any exhibit booth assignment at any time at its sole discretion. The League shall notify the Exhibitor of the Exhibitor's booth assignment upon arrival of the Exhibitor at the Facility on either Wednesday, April 15, 2015 or Thursday, April 16, 2015. 3. INSTALLATION: The Exhibitor shall assume responsibility for setting up and installing its exhibit between the hours of 4:00 p.m. and 6:30 p.m. on Wednesday, April 15, 2015, and on Thursday, April 16, 2015 between the hours of 9:00 a.m. and 1:30 p.m. All exhibit set-up and installation must be completed by 1:30 p.m. on Thursday, April 16, 2015. All property must be shipped to and from the Facility by the Exhibitor. Any space not occupied by 2:00 p.m. on April 16, 2015 will be forfeited by the Exhibitor and the space may be resold, reassigned or used by the League without refund, unless arrangements for delayed occupancy have received prior approval of the League. 4. PROTECTION OF PREMISES: Nothing shall be posted, tacked, nailed, screwed or otherwise attached to columns, walls, floors or other parts of the building or furniture of the Facility. Exhibitor will not use live animals for any purpose while on Hotel’s premises. Anything in connection with set-up and installation by the Exhibitor which is necessary or proper for the protection of the building, equipment or furniture of the Facility shall be furnished by the Exhibitor at its own expense. 5. ELECTRICAL SERVICE: One 220/110 electrical outlet will be provided at no additional cost. Extra electrical service in the exhibit area is available to the Exhibitor for an additional charge. The Exhibitor must arrange this service in advance directly with the hotel. All electrical set up by the Exhibitor shall be the responsibility of the Exhibitor and shall conform to the applicable electrical code. Notwithstanding the Exhibitor's purchase of electrical service, all of the indemnity provisions set forth herein shall remain in full force and effect. 6. DISPLAYS: All displays shall be confined to the Exhibitor's assigned booth space. The Exhibitor agrees not to display products or literature that are not regularly sold or distributed by it, except as may be necessary to illustrate the applications of its product(s). 7. EXHIBIT DIMENSIONS: Displays covering the back of exhibit booths are not to exceed a depth of three (3) feet so as not to obstruct the view of adjacent exhibit booths. No display shall exceed these dimensions unless a sketch is submitted to and approved by the League at least fifteen (15) days prior to the Annual Meeting. In no instance may the Exhibitor's exhibit protrude into the aisle or another exhibit space, except as expressly permitted by the League. 8. NOISE: Throughout the Annual Meeting the Exhibitor shall keep noise to a minimum and shall not operate sound equipment, loudspeakers or any other noise-creating or amplifying devices without prior approval of the League. The League shall at all times retain the right to require the Exhibitor to modify or reduce sound generated at its booth at the sole discretion of the League. 9. INTERVIEWS AND DEMONSTRATIONS: All activities within the Exhibitor's booth shall be conducted in such a way as to not infringe on the right of other exhibitors or offend visitors to the Exhibitor's booth or the exhibit area. Interviews must be confined to the Exhibitor's booth. Determinations with respect to the Exhibitor's compliance with the provisions of this paragraph shall be at the sole discretion of the League. 10. OBJECTIONABLE EXHIBIT: The League reserves the right, exercisable in its sole discretion, to reject or require the removal at any time of any exhibit (or part thereof) or individual which, in the League's opinion, is objectionable in any fashion to any delegate, exhibitor or other person. No liability or damages whatsoever against the League or any of its employees, agents or representatives shall be incurred as a result of such rejection or requirement of removal. In the event the Exhibitor is rejected or removed, the Exhibitor shall not be entitled to any refund from the League. VIRGINIA CREDIT UNION LEAGUE 2015 Annual Meeting EXHIBITOR TERMS AND CONDITIONS 11. ANNOUNCEMENTS: No announcement of extracurricular activities (e.g., hospitality suites) in which the Exhibitor is to serve as host or participant shall be displayed by the Exhibitor without prior approval of the League. 12. FOOD: Any food items offered at the booth must be wrapped or containerized (e.g., commercially wrapped candy or mints). Exhibitor agrees to respect the Facility's food policies. Perishable foods are prohibited. Exhibitor will purchase all food and beverage through the Hotel. All fees will be charged the day of the Show. 13. INTERFERENCE WITH SESSIONS: In keeping with the character of the Annual Meeting as a working convention, the Exhibitor agrees to refrain from engaging in any activities which may interfere with attendance of the sessions. 14. SALES: The actual sale of goods or services is not permitted on the exhibition premises, but orders for subsequent sale and delivery may be taken. Distribution of souvenirs and samples of products is permitted provided there is no interference with other exhibits. 15. CONTACT PERSON: The Exhibitor agrees to have at least one of the contact persons referenced on the Application present in the booth or within close proximity thereto at all times during exhibit hours. No more than two (2) representatives may represent the Exhibitor in a single booth at one time. The League reserves the right to allow an Exhibitor to have more than two (2) representatives present however the Exhibitor may be charged an additional $100 per additional representative. 16. ENDORSEMENTS: The League does not approve, endorse or recommend the use of any specific commercial product or service without prior agreement. Therefore, the Exhibitor may not without the prior written consent of the League imply, either verbally or in printed literature, that its products or services are approved endorsed or recommended by the League. 17. exhibit area. ADMISSION POLICIES: The League shall have sole control over admission policies pertaining to the 18. LOCAL LAWS: The Exhibitor agrees to comply with local laws, ordinances and regulations and to furnish any permits required by local authorities, all at the Exhibitor's own expense. 19. NO ASSIGNMENT: The Exhibitor agrees not to assign or sublet any portion of any space leased to it and further agrees that it shall not permit individuals other than its employees, agents or representatives to use any space leased to it. 20. CANCELLATION BY EXHIBITOR: It is understood by the Exhibitor that if it cancels its reservation for exhibit space after the signed Application has been returned and accepted by the League, there will be no refund of any money paid toward the rental of this space, unless the League is able to lease the space to another exhibitor at least fifteen (15) days before the Annual Meeting, in which case the League shall retain one-half (1/2) of any amount paid or payable by the Exhibitor for the exhibit space, and any remainder shall be refunded to the Exhibitor, without interest. However, the League shall not be liable, either financially or otherwise, in the event that the Annual Meeting is canceled, postponed, or relocated on account of fire, strike, government regulation, casualty, act of God, or other cause beyond the control of the League. 21. CANCELLATION BY LEAGUE: In the event the Annual Meeting or any part thereof is cancelled by the League, the League shall determine and refund to the Exhibitor its proportionate share of the balance of any aggregate exhibit fee received which remains after deducting expenses incurred by the League and reasonable compensation to the League, but in no case shall the Exhibitor be entitled to an amount in excess of the amount of exhibit fee paid to the League by the Exhibitor. 22. PROPERTY DAMAGE: The Exhibitor shall be responsible for its exhibit materials at all times, including times that the exhibit area is closed to Annual Meeting participants. The League shall not provide security against and shall not assume responsibility or liability for any theft, damage or loss, whatever the cause, to the property of the Exhibitor, its employees, agents or representatives. Any insurance to cover against such contingencies must be placed and paid for by the Exhibitor, and the League assumes no responsibility or liability for the same. VIRGINIA CREDIT UNION LEAGUE 2015 Annual Meeting EXHIBITOR TERMS AND CONDITIONS 23. INDEMNIFICATION: The Exhibitor agrees to protect, indemnify, defend and save harmless the League, along with employees, agents and representatives, against any and all claims, demands, liabilities, losses and damages arising out of or caused by the Exhibitor's installation or removal of exhibit property and materials, maintenance of same, and occupancy or use of the exhibition premises or any part thereof, except as such liability may be caused solely by the negligence of the League. In addition, the Exhibitor acknowledges that the League will not maintain insurance covering the Exhibitor's property or materials, and that it shall be the sole responsibility of the Exhibitor to secure business interruption and property damage insurance covering any losses related to same, if the Exhibitor desires the benefits of such insurance. 24. RELINQUISHMENT OF SPACE: The Exhibitor shall relinquish its exhibit space and have all exhibit materials removed from the Facility within two (2) hours of the time the exhibit area is closed by the League. The Exhibitor shall be responsible for any damages suffered by the League, which may arise as a result of the Exhibitor's failure to relinquish the exhibit space in a timely fashion. 25. INTERPRETATIONS; AMENDMENTS: The League shall have sole authority to interpret and enforce all terms, conditions, rules and regulations as shall be necessary for the orderly conduct of the exhibits and the Annual Meeting. The League shall make reasonable efforts to promptly inform all exhibitors of amendments to the terms, conditions, rules or regulations which may be adopted pursuant to the Agreement. 26. INQUIRIES: All inquiries concerning the 2015 Annual Meeting should be directed to: Virginia Credit Union League, Attn: Mary Amyx P.O. Box 11469, Lynchburg, VA 24506, (434) 237-9630. VIRGINIA CREDIT UNION LEAGUE 2015 Annual Meeting EXHIBITOR TERMS AND CONDITIONS ELECTRICAL SERVICE ORDER The Application and Agreement, along with all Terms and Conditions, shall apply to this order. So that we can accommodate your electrical request please let us know if you requested more than one 220/110 outlet (or other request) with the Hotel. This is to assist us in assigning your exhibit space in a location near the requested special service. ****If you do not require electrical service, please let us know.**** Special Service Description: 0226779.01 Sponsorship Reply Form Annual Meeting & Innovation Expo April 15-17, 2015 To appear in our Event Guide return completed form with check no later than: April 1st Mary Amyx, VCUL PO Box 11469 Lynchburg VA 24506-1469 Wednesday, April 15th Events 2:00 P.M. Education Sessions - $500 each **Session details can be found on enclosed schedule or at www.vaculannualmeeting.org** **Please note topic of session you wish to sponsor** Board/Governance Track Topic: Strategy Track I Topic: Strategy Track II Topic: Operations Track Topic: 3:30 P.M. Education Sessions - $500 each **Session details can be found on enclosed schedule or at www.vaculannualmeeting.org** **Please note topic of session you wish to sponsor** Board/Governance Track Topic: Strategy Track I Topic: Strategy Track II Topic: Operations Track Topic: "Spectacular Spectacular!" - Networking Event DJ Entertainment - $1,500 Thursday, April 16th Events 9:00 A.M. Education Sessions - $500 each **Session details can be found on enclosed schedule or at www.vaculannualmeeting.org** **Please note topic of session you wish to sponsor** Board/Governance Track Topic: Strategy Track I Topic: Strategy Track II Topic: Operations Track Topic: 10:30 A.M. Education Sessions - $500 each **Session details can be found on enclosed schedule or at www.vaculannualmeeting.org** **Please note topic of session you wish to sponsor** Board/Governance Track Topic: Strategy Track I Topic: Strategy Track II Topic: Operations Track Topic: Sponsorship Reply Form Annual Meeting & Innovation Expo April 15-17, 2015 Thursday, April 16th Events Lunch & Learn - Keynote Address: Mark Sievewright Event Sponsor - $2,500 3:45 P.M. Education Sessions - $500 each **Session details can be found on enclosed schedule or at www.vaculannualmeeting.org** **Please note topic of session you wish to sponsor** Board/Governance Track Topic: Strategy Track I Topic: Strategy Track II Topic: Operations Track Topic: Friday, April 17th Events Keynote Address: Karen McCullough Event Sponsor - $2,500 schedule Wednesday | April 15, 2015 TIME EVENT 7:30 am Golf Breakfast with 8:30 am tee time (off-site) 10:00 am - 3:00 pm Young Professionals Event 2:00 pm - 3:15 pm Education Sessions Board Track: It’s Not About the Planning Session Strategy Track: Linking Your HR Strategy to Your Strategic Plan Strategy Track: Seeing the World Through Your Members’ Eyes Operations Track: Underwriting for Loan Growth 3:30 pm - 4:45 pm Education Sessions Board Track: Your Board and Learning to Think Strategically Strategy Track: Serving Members Based on Life Stage Strategy Track: Strategic Lending: An End to Order Taking Operations Track: “Tell Me We Are NOT Doing That” 5:00 pm - 6:15 pm CUSCVA Annual Meeting 7:30 pm - 11 pm Networking Event - “Spectacular Spectacular!” (Old Hollywood-themed event) Community Involvement Committee (Foundation) fund-raiser Thursday | April 16, 2015 TIME EVENT 8:00 am - 8:45 am Social Responsibility Awards Presentation & Networking Session 9:00 am - 10:15 am Education Sessions Board Track: Research Insights Into Credit Union Leadership Strategy Track: Mobile Payment Plays for Financial Institutions Strategy Track: Credit Union Execs - Trumpeting Your To-Do List Operations Track: Mining for Revenue 10:30 am - 11:45 am Education Sessions Board Track: Finding Your ‘Purpose’ as a Board Strategy Track: ‘Thrive in the Shift’ Strategy Track: Bringing Strategy Closer to Your Employees Operations Track: Recruitment and Retention Strategies That Work! Noon - 1:30 pm Lunch & Learn Keynote Address - Mark Sievewright (“Becoming Relevant, Staying Prevalent”) 2:00 pm - 3:30 pm Innovation Expo/Community Involvement Committee Event 3:45 pm - 5:00 pm Education Sessions Board Track: Cybersecurity - What Volunteer Officials Need to Know Strategy Track: US Payments System - Where We Are, Where We’re Going Strategy Track: Strategy is Everyone’s Business - Especially the Rising Executive’s Operations Track: 3D Marketing 5:00 pm - 7:00 pm Innovation Expo/Community Involvement Event (heavy hors d’ oeuvres and open bar) Friday | April 17, 2015 TIME EVENT 7:30 am - 9:00 am Innovation Expo/Continental Breakfast 8:45 am - 10:30 am League Business Session 10:30 am - Noon Keynote Address - Karen McCullough (‘Change is Good...You Go First’ - Embracing a Change Mindset SAVE THE DATE: Wednesday, April 15, 2015 Hotel Roanoke Roanoke, Virginia education VACUL Annual Meeting /Board Track/ Young Professionals! YOUNG PROFESSIONALS THINK TANK Don’t miss this chance to enhance your interpersonal skills and participate in an afternoon discussion designed to help you better understand the future of YP’s in Virginia and the future of our credit unions! Registration: Only $150 for a full-day program (10AM-3PM) Add $50 if you want to attend the networking event, “Spectacular, Spectacular!” Be A Part Of: Understanding Personal Development Realizing Personal Success Getting To The Next Level Shaping The Future Of YP’s And CUs In Virginia Envisioning The Future Of YPs In Virginia Discussing Where We Are Going As An Industry? Speaker: The Young Professionals Program will be facilitated by Andy Janning, President and Founder of NO NET Solutions. Andy is an award winning trusted advisor and consultant to credit unions. It’s Not About the Planning Session Why Strategic Planning Needs to be on the Agenda at Every Board Meeting Your League, working with the Young Professionals Committee, is planning a program at next year’s Annual Meeting designed for young professionals to come together and be a part of something BIG! All YPs registered for the full Annual Meeting are encouraged to attend this special YP program at no additional charge. Contact your League’s Nicole Widell ([email protected]) or Bethany Scott ([email protected]) for details. If you plan to attend only the YPN event on Wednesday, contact Nicole or Bethany to register. If registering for the full Annual Meeting + the YPN event, use the enclosed registration form or register online. He’s passionate about our young professionals and the future of our industry. Don’t miss the opportunity to spend the day with Andy and help shape our future! www.vacul.org/events Speaker: Dr. Michael Hudson Credit Union Strategy /Keynoter/ /Keynoter/ Karen McCullough Mark Sievewright Motivational Speaker Fiserv The riskiest thing any businesses or individual can do in the new world reality is to not change. The transformation continues in the U.S. financial services industry and it’s changing how credit unions do business, how they develop a strategy for their futures and how they collaborate around products, services and information. In her program “Change Is Good,” Karen McCullough empowers you with a change mindset that will help you make positive changes in your business and your life. She debunks age-old myths about change and gives you the three critical keys—awaken, activate, advance—to help you make important positive changes in your life. You will receive the framework to successfully change yourself, and your organization while integrating technology and adaptability across the generations to increase team potential. Her energetic presentation includes real-life examples along with practical solutions that leave you with the tools and a change mindset to elevate new hope, new skills, and a new way of thinking. It’s time to get excited about change and see the opportunities. Mark will highlight industry changes, their implications for credit union leaders and the strategies it will take to remain relevant and become prevalent. /About Our Education Sessions For your convenience and planning, we have organized our education sessions into tracks focused on three broad categories: board/governance, strategy and operations. You are not limited in your choice of education sessions. You can move between the tracks. We do this simply to provide some guidance on which tracks might best meet the needs and expectations of our participants. It happens every fall (and sometimes in the spring)--the annual strategic credit union planning session. It is important. It is necessary. And it adds value. But it is not enough. In this session we’ll identify the value of making strategic planning an agenda item on every Board meeting and provide specific ideas you can use to make strategic planning part of the day-to-day work of the Board to improve your effectiveness in pursuing and achieving your vision for the future. Your Board & Learning to Think Strategically - A 7-Step Process for Getting Outside the Box and Discovering Breakthrough Ideas Speaker: Dr. Michael Hudson Credit Union Strategy Strategic thinking is about ideas--ideas that can be translated into actions that produce results. But getting outside of the box is not easy. This session will show you how and give you tools that will help you take action. We’ll start by defining what the box actually is and why it matters. Then we’ll talk about how to get outside of the box and provide you with a 7-step process you can use to discover ideas that will take your thinking to the next level regarding the possibilities for your credit union. Research Insights Into Credit Union Leadership Speaker: Ben Rogers Filene Research Institute With a wide range of studies offering their insights, what can we learn about the governance of corporations that can help credit unions enhance the effectiveness of their boards of directors and governance processes. We’ll look at areas ripe for improvement in the vast majority of boards, including the board/ CEO relationship, time management, director evaluations and continuing education. Learn how board practices can drive credit union performance, and how credit union leaders at each level can turn best practices into their practices. Finding Your Purpose As a Board Speaker: Ben Rogers Filene Research Institute Warren Buffet once called corporate boards “tail-wagging puppy dogs,” and credit union boards should take that as a caution. Volunteer boards display a broad range of competence and engagement. This candid discussion reflects on several Filene research reports on credit union governance practices and takes aim at both the good and the bad, while prescribing real-world responses through exposure to: • Tracking the relationship between credit union governance and performance. • Best practices from North American credit unions. • Recruitment and selection habits at credit union boards • How can boards add more value? • The board’s role in mergers. uu education education uu Cybersecurity – What Volunteer Officials Need to Know Speaker: TBD You read the headlines about data breaches, compromises and fraud. Here’s your opportunity to acquire a working knowledge of the cyber-threats facing credit unions, including the risks posed by third party vendors; cyber security and disaster preparedness; the measures financial services firms deploy to prevent data breaches; and the regulatory issues surrounding cybersecurity. /Strategy Track/ Linking Your HR Strategy to Your Strategic Plan Speaker: Denny Graham FI Strategies LLC Most organizations view the department of Human Resources (HR) as an administrative function and ignore the need and opportunity to align HR with its strategic plans. When we better understand each member, we can better communicate with them through marketing and at the front line. nel preferences through your consumer lending program? Member experiences, fueled by technology, are driving new expectations for your members. Serving Members Based on Life Stage Review the demographic and technology trends and learn how you can maximize mobile lending for your credit union. Speaker: Eric Gagliano MarketMatch This interactive session will provide attendees with opportunities to learn and discuss generational segments and life stages. Members financial needs are driven by life’s milestones. During the group-work portion of this session, attendees will discuss these milestones in member’s lives, how these changes affect their finances and the financial products and services that would be useful based on these changes. Strategic Lending – An End to Order Taking Speaker: Pierre Cardenas CU Lending Advice LLC But the essence of HR is strategic! When properly aligned, HR contributes to successful strategy and the credit union’s bottom line. Waiting for your members to request a loan from your credit union is so 80’s. The only good thing about the 80’s is the music, and if you want loan business you are going to have to go out and get it! Learn how internally consistent HR practices ensure your people contribute to your business objectives. This session will help you take a strategic approach to a “PROACTIVE” lending program...reactive lending is out! Seeing the World Through Your Members’ Eyes Mobile Payment Plays for Financial Institutions Everyone that walks in a credit union’s front door has different needs and different perceptions based on the world they grew up in and the events happening in their life right now. Integrating Mobile into your Loan Growth Strategy Now that you understand mobile lending, have you learned what it can do for your credit union and your members? Are you meeting your members chan- Speaker: Eric Gagliano MarketMatch Speaker: TBD Credit Union Execs – Trumpeting Your To-Do List - Communicating C-Level Priorities in a Noisy Corporate World Speaker: Andy Janning NO NET Solutions As an executive, you’re keenly aware of the production goals and service expectations necessary to keep your company thriving in a challenging economic climate. But as you share your vision and guidance from the top, your messages are running into stiff competition from powerful distractions that threaten to pull the focus of your staff in other, less productive directions. This fast-paced session will give you the opportunity to hear more about the innovative staff communication techniques other executives are currently using to keep their employees focused on the right goals, and for the right reasons. You’ll leave the session with specific and successful practices that will immediately benefit the employees you lead and serve. Thrive In The Shift Speaker: Patrick Adams St. Louis Community CU The member experience is just not the same. The demand for e-solutions and the coming wave of mobile banking is quickly changing the way consumers choose to interact with financial institutions. And the pace of change is accelerating. Very soon, CUs will have to decide: are you prepared to keep pace or have you decided to let the world pass you by? In this session, we’ll talk about how new ideas, channels and methods can support longstanding CU aims and values. We’ll share examples of companies that successfully made difficult shifts like this and those that failed. Bringing Strategy Closer to Your Employees Speaker: Jeff Rendel Rising Above Enterprises Strategy and leadership do not only reside at the top of an organization chart or in the executive suite. In reality, strategy and leadership are put into place at the managerial level and front line – right where your members and colleagues expect it most. In a world of open communication and flat organizations, strategy and leadership are no longer top-down: they are up, down, and across organization charts, divisions, and job descriptions. Every leader at every level is responsible for leading one’s self, one’s network, and one’s strategic role on every team. It’s up to us – credit union leaders – to explain strategy, gain commitment, and ensure participation in the practical application of strategy at your credit union. U.S. Payments System – Where We Are, Where We’re Going Speaker: Mark Sievewright Fiserv We are only at the end of the beginning of profound changes in the U.S. payments market. The evolution of debit over the past ten years has been impressive but new forms of payment are emerging rapidly, including mobile payments, personto-person payments and the fast-growing prepaid market. Additionally, new regulatory proposals threaten the very fabric of credit unions’ non-interest payments revenue. During this session, Mark will speak on the changes currently underway in the payments market, along with cutting edge technology and emerging trends, and long-term strategies to keep up with the changing landscape. Strategy Is Everyone’s Business – Especially the Rising Executive’s Speaker: Jeff Rendel Rising Above Enterprises Strategic planning – and its execution – is not set aside exclusively for the CEO’s office and the Board Room. For your institution to prosper, its strategy must be defined and put into action at every level – your branch, your department, and your desk. Your role in strategic success becomes indispensable as you perform your duties and direct others with strategic intent and a grounded, real world perspective. Every budding executive’s participation level in and contribution to strategic planning will differ, yet your involvement is necessary for your institution’s success. /Operations Track/ Underwriting for Loan Growth Speaker: Pierre Cardenas CU Lending Advice LLC If you want to capture and deepen a relationship with your members – Give Them a Loan! Easier said than done, right? It is not that many do not qualify, it is that you do not know how to qualify them. Relationship mitigates risk and every loan should be evaluated based on the 4 Ds and the 2 levels of underwriting. Learn all about how you can and should be taking better care of your members’ loan needs! Tell Me We Are Not Doing That! Speaker: Denny Graham “Tell me we’re not doing that” is a direct quote from a credit union CEO after listening to a group of her people walk through the process of handling cash at her branches. It could have been more complicated, but she wasn’t sure how. Every year credit unions spend millions of dollars in labor costs through complex processes designed to make sure errors never occur – at horrendous cost. This session will discuss results from other credit unions who found ways to ensure staff spend more time on the money-making tasks – providing higher levels of sales and service – and less time on the money-losing tasks – wading through mountains of redundant paperwork. Mining for Revenue Speaker: Jeff Rendel Rising Above Enterprises Let’s face it – margins are tight and getting tighter; operations are as lean as we can make them; and, we can’t cut our way to growth. The top line is the new bottom line and we need new, immediate, and lasting sources of revenue. Come learn what credit unions around the nation are implementing to grow their revenue bases in ways that do not require “extraordinary” classification. More important, learn how your credit union can look outside the core business of banking-as-usual to increase revenue, profits, and cash flow in manners that do not compromise – or minimize – member service. Hiring (and Firing) Sally Field - How to Recruit and Develop Top Talent Speaker: Andy Janning NO NET Solutions Whether it’s attracting new team members or helping your experienced staff master new technology, practice sales/service techniques, or build better leaders, your organizational development and recruiting programs are a competitive advantage. But how do you bring in the right people…and correctly measure the way in which you’ve trained them? What’s the best way to show they had the right impact on the right employees, at the right price? And how do you report those results to senior leaders and staff in a way that ensures their support? This session will expose the flaws inherent in many common employee development and recruiting programs – including a crucial one inspired by a certain Oscar-winning actress – and the damage they cause for your staff and members. We’ll turn our focus to timetested techniques – built with a CFO’s brain, 10 key questions, and a 4,000-year-old storytelling pattern – that will revolutionize your approach to organizational development, and learn how they helped one organization add $700 million in assets in less than 10 years. 3D Marketing: Diversity, Demographics & Delivery Systems Speaker: Patrick Adams St. Louis Community CU Our current member base is aging and the general population is becoming increasingly diverse. How is your credit union planning to adapt to these changes? Most credit unions have more retirees who are members than they have members who are under 20 years of age. What does this say about your credit union’s future loan portfolio? And how is your credit union adapting to the increasing diversity in American society? Female members already outnumber male credit union members. An increasing number of Hispanics, Asian Americans, African Americans and Eastern European immigrants have entered the workforce. How is your credit union preparing to serve these new segments while retaining current members? This program discusses strategies to help your credit union market to these new segments, and explains why traditional marketing approaches have already become obsolete. education education uu Cybersecurity – What Volunteer Officials Need to Know Speaker: TBD You read the headlines about data breaches, compromises and fraud. Here’s your opportunity to acquire a working knowledge of the cyber-threats facing credit unions, including the risks posed by third party vendors; cyber security and disaster preparedness; the measures financial services firms deploy to prevent data breaches; and the regulatory issues surrounding cybersecurity. /Strategy Track/ Linking Your HR Strategy to Your Strategic Plan Speaker: Denny Graham FI Strategies LLC Most organizations view the department of Human Resources (HR) as an administrative function and ignore the need and opportunity to align HR with its strategic plans. When we better understand each member, we can better communicate with them through marketing and at the front line. nel preferences through your consumer lending program? Member experiences, fueled by technology, are driving new expectations for your members. Serving Members Based on Life Stage Review the demographic and technology trends and learn how you can maximize mobile lending for your credit union. Speaker: Eric Gagliano MarketMatch This interactive session will provide attendees with opportunities to learn and discuss generational segments and life stages. Members financial needs are driven by life’s milestones. During the group-work portion of this session, attendees will discuss these milestones in member’s lives, how these changes affect their finances and the financial products and services that would be useful based on these changes. Strategic Lending – An End to Order Taking Speaker: Pierre Cardenas CU Lending Advice LLC But the essence of HR is strategic! When properly aligned, HR contributes to successful strategy and the credit union’s bottom line. Waiting for your members to request a loan from your credit union is so 80’s. The only good thing about the 80’s is the music, and if you want loan business you are going to have to go out and get it! Learn how internally consistent HR practices ensure your people contribute to your business objectives. This session will help you take a strategic approach to a “PROACTIVE” lending program...reactive lending is out! Seeing the World Through Your Members’ Eyes Mobile Payment Plays for Financial Institutions Everyone that walks in a credit union’s front door has different needs and different perceptions based on the world they grew up in and the events happening in their life right now. Integrating Mobile into your Loan Growth Strategy Now that you understand mobile lending, have you learned what it can do for your credit union and your members? Are you meeting your members chan- Speaker: Eric Gagliano MarketMatch Speaker: TBD Credit Union Execs – Trumpeting Your To-Do List - Communicating C-Level Priorities in a Noisy Corporate World Speaker: Andy Janning NO NET Solutions As an executive, you’re keenly aware of the production goals and service expectations necessary to keep your company thriving in a challenging economic climate. But as you share your vision and guidance from the top, your messages are running into stiff competition from powerful distractions that threaten to pull the focus of your staff in other, less productive directions. This fast-paced session will give you the opportunity to hear more about the innovative staff communication techniques other executives are currently using to keep their employees focused on the right goals, and for the right reasons. You’ll leave the session with specific and successful practices that will immediately benefit the employees you lead and serve. Thrive In The Shift Speaker: Patrick Adams St. Louis Community CU The member experience is just not the same. The demand for e-solutions and the coming wave of mobile banking is quickly changing the way consumers choose to interact with financial institutions. And the pace of change is accelerating. Very soon, CUs will have to decide: are you prepared to keep pace or have you decided to let the world pass you by? In this session, we’ll talk about how new ideas, channels and methods can support longstanding CU aims and values. We’ll share examples of companies that successfully made difficult shifts like this and those that failed. Bringing Strategy Closer to Your Employees Speaker: Jeff Rendel Rising Above Enterprises Strategy and leadership do not only reside at the top of an organization chart or in the executive suite. In reality, strategy and leadership are put into place at the managerial level and front line – right where your members and colleagues expect it most. In a world of open communication and flat organizations, strategy and leadership are no longer top-down: they are up, down, and across organization charts, divisions, and job descriptions. Every leader at every level is responsible for leading one’s self, one’s network, and one’s strategic role on every team. It’s up to us – credit union leaders – to explain strategy, gain commitment, and ensure participation in the practical application of strategy at your credit union. U.S. Payments System – Where We Are, Where We’re Going Speaker: Mark Sievewright Fiserv We are only at the end of the beginning of profound changes in the U.S. payments market. The evolution of debit over the past ten years has been impressive but new forms of payment are emerging rapidly, including mobile payments, personto-person payments and the fast-growing prepaid market. Additionally, new regulatory proposals threaten the very fabric of credit unions’ non-interest payments revenue. During this session, Mark will speak on the changes currently underway in the payments market, along with cutting edge technology and emerging trends, and long-term strategies to keep up with the changing landscape. Strategy Is Everyone’s Business – Especially the Rising Executive’s Speaker: Jeff Rendel Rising Above Enterprises Strategic planning – and its execution – is not set aside exclusively for the CEO’s office and the Board Room. For your institution to prosper, its strategy must be defined and put into action at every level – your branch, your department, and your desk. Your role in strategic success becomes indispensable as you perform your duties and direct others with strategic intent and a grounded, real world perspective. Every budding executive’s participation level in and contribution to strategic planning will differ, yet your involvement is necessary for your institution’s success. /Operations Track/ Underwriting for Loan Growth Speaker: Pierre Cardenas CU Lending Advice LLC If you want to capture and deepen a relationship with your members – Give Them a Loan! Easier said than done, right? It is not that many do not qualify, it is that you do not know how to qualify them. Relationship mitigates risk and every loan should be evaluated based on the 4 Ds and the 2 levels of underwriting. Learn all about how you can and should be taking better care of your members’ loan needs! Tell Me We Are Not Doing That! Speaker: Denny Graham “Tell me we’re not doing that” is a direct quote from a credit union CEO after listening to a group of her people walk through the process of handling cash at her branches. It could have been more complicated, but she wasn’t sure how. Every year credit unions spend millions of dollars in labor costs through complex processes designed to make sure errors never occur – at horrendous cost. This session will discuss results from other credit unions who found ways to ensure staff spend more time on the money-making tasks – providing higher levels of sales and service – and less time on the money-losing tasks – wading through mountains of redundant paperwork. Mining for Revenue Speaker: Jeff Rendel Rising Above Enterprises Let’s face it – margins are tight and getting tighter; operations are as lean as we can make them; and, we can’t cut our way to growth. The top line is the new bottom line and we need new, immediate, and lasting sources of revenue. Come learn what credit unions around the nation are implementing to grow their revenue bases in ways that do not require “extraordinary” classification. More important, learn how your credit union can look outside the core business of banking-as-usual to increase revenue, profits, and cash flow in manners that do not compromise – or minimize – member service. Hiring (and Firing) Sally Field - How to Recruit and Develop Top Talent Speaker: Andy Janning NO NET Solutions Whether it’s attracting new team members or helping your experienced staff master new technology, practice sales/service techniques, or build better leaders, your organizational development and recruiting programs are a competitive advantage. But how do you bring in the right people…and correctly measure the way in which you’ve trained them? What’s the best way to show they had the right impact on the right employees, at the right price? And how do you report those results to senior leaders and staff in a way that ensures their support? This session will expose the flaws inherent in many common employee development and recruiting programs – including a crucial one inspired by a certain Oscar-winning actress – and the damage they cause for your staff and members. We’ll turn our focus to timetested techniques – built with a CFO’s brain, 10 key questions, and a 4,000-year-old storytelling pattern – that will revolutionize your approach to organizational development, and learn how they helped one organization add $700 million in assets in less than 10 years. 3D Marketing: Diversity, Demographics & Delivery Systems Speaker: Patrick Adams St. Louis Community CU Our current member base is aging and the general population is becoming increasingly diverse. How is your credit union planning to adapt to these changes? Most credit unions have more retirees who are members than they have members who are under 20 years of age. What does this say about your credit union’s future loan portfolio? And how is your credit union adapting to the increasing diversity in American society? Female members already outnumber male credit union members. An increasing number of Hispanics, Asian Americans, African Americans and Eastern European immigrants have entered the workforce. How is your credit union preparing to serve these new segments while retaining current members? This program discusses strategies to help your credit union market to these new segments, and explains why traditional marketing approaches have already become obsolete. schedule Wednesday | April 15, 2015 TIME EVENT 7:30 am Golf Breakfast with 8:30 am tee time (off-site) 10:00 am - 3:00 pm Young Professionals Event 2:00 pm - 3:15 pm Education Sessions Board Track: It’s Not About the Planning Session Strategy Track: Linking Your HR Strategy to Your Strategic Plan Strategy Track: Seeing the World Through Your Members’ Eyes Operations Track: Underwriting for Loan Growth 3:30 pm - 4:45 pm Education Sessions Board Track: Your Board and Learning to Think Strategically Strategy Track: Serving Members Based on Life Stage Strategy Track: Strategic Lending: An End to Order Taking Operations Track: “Tell Me We Are NOT Doing That” 5:00 pm - 6:15 pm CUSCVA Annual Meeting 7:30 pm - 11 pm Networking Event - “Spectacular Spectacular!” (Old Hollywood-themed event) Community Involvement Committee (Foundation) fund-raiser Thursday | April 16, 2015 TIME EVENT 8:00 am - 8:45 am Social Responsibility Awards Presentation & Networking Session 9:00 am - 10:15 am Education Sessions Board Track: Research Insights Into Credit Union Leadership Strategy Track: Mobile Payment Plays for Financial Institutions Strategy Track: Credit Union Execs - Trumpeting Your To-Do List Operations Track: Mining for Revenue 10:30 am - 11:45 am Education Sessions Board Track: Finding Your ‘Purpose’ as a Board Strategy Track: ‘Thrive in the Shift’ Strategy Track: Bringing Strategy Closer to Your Employees Operations Track: Recruitment and Retention Strategies That Work! Noon - 1:30 pm Lunch & Learn Keynote Address - Mark Sievewright (“Becoming Relevant, Staying Prevalent”) 2:00 pm - 3:30 pm Innovation Expo/Community Involvement Committee Event 3:45 pm - 5:00 pm Education Sessions Board Track: Cybersecurity - What Volunteer Officials Need to Know Strategy Track: US Payments System - Where We Are, Where We’re Going Strategy Track: Strategy is Everyone’s Business - Especially the Rising Executive’s Operations Track: 3D Marketing 5:00 pm - 7:00 pm Innovation Expo/Community Involvement Event (heavy hors d’ oeuvres and open bar) Friday | April 17, 2015 TIME EVENT 7:30 am - 9:00 am Innovation Expo/Continental Breakfast 8:45 am - 10:30 am League Business Session 10:30 am - Noon Keynote Address - Karen McCullough (‘Change is Good...You Go First’ - Embracing a Change Mindset Credit Unions Care Foundation of Virginia 3rd Annual Golf Classic GOLFER REGISTRATION Sponsored by CUNA Mutual Group The Credit Unions Care Foundation of Virginia 3rd Annual Golf Classic, sponsored by CUNA Mutual Group, will be held on Wednesday, April 15, 2015 at the Roanoke Country Club, 3360 Country Club Drive, Roanoke, VA 24017. Breakfast will be served beginning at 7:30 a.m. followed by a shotgun start at 8:30 a.m. with an awards reception to follow. The cost will be $125 per player and will include green fees, cart, breakfast, range balls, 1 mulligan/1 throw, door and tournament prizes, and awards reception. Please complete the form below and be sure to include the name(s) of anyone else you wish to play with. All single registrants will be paired with a team. Registration deadline is April 10, 2015. This is a great way to kick off the 81st VACUL Annual Meeting! If you would like more information on the golf tournament, contact David Deacon at 800-768-3344, ext. 634 or [email protected]. Credit Union/Company Contact Person Mailing Address E-mail/telephone Player Player Player Player Please make checks payable to Credit Unions Care Foundation of Virginia and mail to: Virginia Credit Union League Attn: Cathy Baldwin P.O. Box 11469 Lynchburg, Virginia 24506-1469 Registration is also available online at www.vacul.org/events. This tournament benefits the Credit Unions Care Foundation of Virginia, which supports credit unions’ social mission by aiding our communities and offering assistance to those in need. Contributions to the foundation - a 501(c)(3) nonprofit organization - are fully U.S. tax-deductible. Credit Unions Care Foundation of Virginia 3rd Annual Golf Classic SPONSORSHIP OPPORTUNITY Sponsored by CUNA Mutual Group Take advantage of a great opportunity to support the efforts of the Credit Unions Care Foundation of Virginia by becoming an event sponsor of the 3rd Annual Golf Classic. As a sponsor, your name will be prominently displayed at the tournament with the proceeds championing the efforts of the Foundation throughout the communities of the Commonwealth of Virginia. Here are your sponsorship opportunities (see back for sponsorship benefits): Beverage Station Sponsor: $700 Prize Sponsor: $300 Lunch Sponsor: $600 Hole Sponsor: $200 Awards Reception Sponsor: $500 Please check the option above and register your sponsorship today by faxing to 434-237-5068 or e-mailing your information to [email protected] (Your sponsorship slot will not be reserved until we receive your check): Credit Union/Company Contact Person Mailing Address E-mail/telephone Please make checks payable to Credit Unions Care Foundation of Virginia and mail to: Virginia Credit Union League Attn: Cathy Baldwin P.O. Box 11469 Lynchburg, Virginia 24506-1469 This tournament benefits the Credit Unions Care Foundation of Virginia, which supports credit unions’ social mission by aiding our communities and offering assistance to those in need. Contributions to the foundation - a 501(c)(3) nonprofit organization - are fully U.S. tax-deductible. Sponsorship Benefits Beverage Station Sponsor - $700 Includes: hh Corporate signage on beverage station throughout the tournament hh Recognition on Welcome and Registration signage hh Recognition on League website hh Recognition on tournament promotional materials hh Recognition in League e-newsletters Lunch Sponsor - $600 Includes: hh Corporate signage at Clubhouse dining area hh Recognition on Welcome and Registration signage hh Recognition on League website hh Recognition on tournament promotional materials hh Recognition in League e-newsletters Awards Reception Sponsor - $500 Includes: hh Corporate signage at Clubhouse dining area hh Recognition on Welcome and Registration signage hh Recognition on League website hh Recognition on tournament promotional materials hh Recognition in League e-newsletters Prize Sponsor - $300 Includes: hh Recognition on League website hh Recognition on tournament promotional materials hh Recognition in League e-newsletters hh Signage at tournament Hole sponsor - $200 Includes: hh Promotional signage at your sponsored hole hh Recognition on League website hh Recognition on tournament promotional materials hh Recognition in League e-newsletters

© Copyright 2026