27th Feb 2015 - Lanka Securities (Pvt)

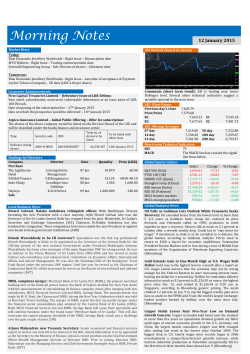

udithgpseall14 21gpgppivg Morning Notes 27 February 2015 Market Diary ASI Outlook (based on charts) Today: Softlogic Finance - Right Issue – XR date Vallibel Power Erathna - Dividend payment – (LKR 0.50 per share) Cargills (Ceylon) - Dividend payment – (LKR 0.70 per share) Monday: Nestle Lanka – XD date (LKR 28.50 per share) Corporate Announcements Interim Financial Statements 31-12-2014 - Sanasa Development Bank (SDB), Hatton National Bank (HNB), The Lanka Hospital Corporation (LHCL), Seylan Bank (SEYB), Kahawatte Plantations (KAHA), Nations Trust Bank (NTB). ASI - Pivot Points Previous day’s close Pivot Point R1 R2 United Motors Lanka – Interim Dividend of LKR 2.00 per share: XD – 10th Mar 2015 Payment date – 18th Mar 2015 The Nuwara Eliya Hotels Company – Interim Dividend of LKR 22.50 per share: XD – 10th Mar 2015 Payment date – 19th Mar 2015 ASI - Moving Averages 07 day 14 day 21 day Seylan Bank – First & Final Dividend of LKR 2.50 per share: XD – 01st Apr 2015 Payment date – 10th Apr 2015 Nations Trust Bank – First & Final Dividend of LKR 2.10 per share: XD – 01st Apr 2015 Payment date – 10th Apr 2015 Softlogic Finance – Extraordinary General Meeting (EGM): At the EGM of the Softlogic Finance held on 26th February 2015, the right issue of shares was approved by the shareholders by way of an ordinary resolution. Commercial Bank of Ceylon – Establishment of an employee share option plan 2015: The total no. of options to be granted for the period commencing from 2016 to 2018 – 16,210,714 ordinary voting shares (subject to exercise of existing ESOPs and scrip dividend). Percentage of ordinary voting shares to be issued – up to 2% (Refer attachment for more details) Sale Lanka Walltiles Date J.A.P.M. Jayasekara 23-24 Quantity 11,000 7,306.80 7,295.75 7,277.31 S1 S2 7,304.47 7,291.49 50 day 100 day 200 day 7,309.17 7,307.91 6,978.85 Global Equity Indices Hayleys – Debenture Issue of LKR 2bn: Company has received applications for over LKR 2bn for the above debenture issue by Hayleys and accordingly the issue has been oversubscribed. Therefore, the issue closed yesterday (26th Feb 2015) as per the prospectus. Director 7,317.44 7,312.85 7,325.83 7,334.21 Short-term Technical Indicators RSI 51 MACD The MACD line has crossed the signal line from above. Commercial Development Company – Final Dividend of LKR 3.00 per share: Dates to be notified Dealings by Directors Company Purchase Comments (short term trend): ASI is trading near the lower Bollinger. Several other technical indicators suggest an uptrend in the near term. Price (LKR) 100.00 Local Business News Sri Lanka’s forex reserves down to US$7.26bn in Jan 2015: Central bank: Sri Lanka's forex reserves fell to 7.261 million US dollars in January 2015, from 8.208 million US dollars in December 2015,official data showed. The Island’s foreign reserves were up in August 2014 at 9.2 billion US dollars amid weak credit growth and since then it was falling steadily as domestic credit picked up. According to analysts, the Central Bank would mop up excess liquidity in the banking system permanently and allow the market interest rates to move up if the foreign reserves are to be safeguarded. . The interim budget 2015, which raised public sector salaries from February is also expected to boost consumption and put pressure on the credit system. (LBO) Sri Lanka Central Bank asked all banks to pay 15-pct interest to 60+ depositors: Sri Lanka's Central Bank has asked all the banks to pay 15% interest for term deposits of up to a million rupees, held by depositors over 60 years of age, the bank said in a statement. Senior citizens who opened fixed deposits up to 2.5 million rupees before the 16.01.2015 under the previous scheme would also get 12% interest, the bank said. The rule applied to all banks. The Government of Sri Lanka has now finalised the procedure for implementation 30the Special Interest Scheme for Senior Citizens announced in the Interim Budget 2015. of Accordingly, the Central Bank of Sri Lanka issued the necessary Operating Instructions on behalf of the Government to all banks today. (LBO) S&P 500 (USA) FTSE 100 (UK) NIKKEI 225 (Japan) Shanghai Comp (China) BSE Sensex (India) KSE All (Pakistan) MSCI frontier markets MSCI emerging markets Index 2,110.74 6,949.73 18,799.26 3,299.04 28,746.65 33,762.80 610.29 992.80 Change -3.12 +14.35 +13.47 +0.69 -261.34 -82.50 -0.14 +4.91 % Change -0.15 +0.21 +0.07 +0.02 -0.90 -0.24 -0.02 +0.50 Global Business News Japan’s Output Jumps While Retail Sales Sag, Inflation Slows: Japan’s industrial output increased the most in more than three years while retail sales slid and inflation slowed, underscoring strength in export industries and weak domestic demand. Production jumped 4 percent in January from the previous month, exceeding forecasts with the biggest gain since June 2011, according to trade ministry data. (Bloomberg) Merkel’s Truths Lead Greece to Unavoidable Deal on Euro Bailout: It took a few simple truths from Germany’s Angela Merkel on the basics of euro-area crisis management to pacify the combative new government in Athens. The chancellor explained to Greek Prime Minister Alexis Tsipras what an aide in her office called reality. (Bloomberg) Yellen Seeks Right Blend of Inflation Data to Raise Rates: Chair Janet Yellen and her Federal Reserve colleagues are just about finished making promises about short-term interest rates. They want investors to focus instead on indicators related to their mandate to keep inflation stable and employment high. (Bloomberg) Goldman Asset Predicts Bond Rout as Standish Sees Low Yields: Goldman Sachs Asset Management says rising Treasury yields this year will curb returns. Standish Mellon Asset Management says borrowing costs will stay low. U.S. 10-year Treasury yields will climb almost 1 percentage point to 3 percent by Dec. 31, according to Candice Tse, a senior strategist at Goldman Asset in New York. (Bloomberg) Dollar Jumps Versus Emerging Peers as U.S. Futures Drop: Emerging-market currencies weakened against the dollar, with China’s yuan at its lowest since October 2012, and Standard & Poor’s 500 Index futures dropped on speculation rising U.S. inflation will spur interest rate increases. (Bloomberg) Morning Notes Local Business News Overhanging debt, lack of liquidity hampering better ranking – Fitch: The country's strengths and weaknesses were looked into analytically comparing it to countries in Emerging Asia by Fitch Ratings Lanka at its second Sovereign and Banking Roundtable. "Sri Lanka is slightly above the 6% GDP growth which is what other countries in Emerging Asia is bordering on. Sri Lanka being a country with a BB- ranking is marked as a stable economy," she said. "Though the country's GDP growth is positive, in other aspects Sri Lanka is below the expected ranks when compared to its BB- peers. One of these aspects is the overhanging debt which is far above Sri Lanka's peers such as Bangladesh," Chandra said. "In terms of voice and accountability and political stability Sri Lanka is still lower than its peers. However there is potential for change with changing of the government," Chandra said. The country's Net IDI inflow is recorded as 1% which so much lower than Sri Lanka's peer countries with BB medians recording 25% inflow. (DN) Sri Lanka port city project would create infrastructural and sewage disposal issues: Deputy Minister: Sri Lanka’s Chinese funded port city project would have infrastructural and sewage disposal issues once implemented, Eran Wickramaratne, Deputy Minister of Highways, Higher Education and Investment Promotion said at an event held in Colombo. “Much has been said in the recent weeks about the port city development in Colombo and I am not going to make any particular comment on that as the whole project is being reviewd,” he said. “But I do not know if you have realized, apart from the immediate environmental issues with the port city, when it is completed and in full flow there will be 300,000 people living on those 500 acres of land which is half the population of this city (Colombo),” “Can you imagine this issues in terms of water, transport and also in terms of sewarage?” he asked. (LBO) CSE must broad base to attract rural base - Dr. de Silva: The Government is aiming at creating an environment where people will want to participate in the stock exchange activities knowing that they have the equal challenge in either losing or making money. The government is determined to create a highly competitive social market economy while creating an asset owning middle class, Policy Planning and Economic Affairs Deputy Minister, Dr. Harsha de Silva said. “The government's objective is to create a country where we have a large middle class that own shares we will have two pillars on which our economy will be built. One is competition and other one is the trust. It is imperative to broad base the activities of the exchange not just to Colombo, but also to the rural areas. We want to play the level we ought to play,” de Silva said. The Deputy Minister urged the CSE to make sure to attract more people to list in the exchange and to start trading in stocks. He said it is the responsibility of the Securities and Exchange Commission to take necessary measures to free the market from interference and manipulations while taking necessary action against wrong doers. (DN) SEC to give investors a fair deal: Securities and Exchange Commission Chairman Thilak Karunaratne said the SEC's objective is to formulate a well regulated capital market where all the investors get a fair deal. The SEC is working on addressing the existing weak points by bringing more amendments to our Act. It will give us more strength and teeth to take care of shortcomings in the capital market. Karunaratne also added that the Securities and Exchange Commission was looking forward to closely working with the Colombo Stock Exchange. (DN) Sri Lanka’s CSE to go for ‘Central Counterparty System’: Colombo Stock Exchange (CSE) is to set up a ‘Central Counterparty System’ (CCP) as a measure to safeguard both the investors as well as the stockbrokers. This is being done for the first time in Sri Lanka, CSE Chairman Vajira Kulatilaka said this morning (26 February). The CCP is a fund which would safeguard both parties in a CSE transaction, according to Kulatilaka. Currently, if a stockbroker/investor faces a problem after a transaction he has no assurances for relief. The Central Counterparty System will be a mechanism to provide this relief. (ADB) Upward pressure on interest rates: Interest rates are on an upward trend made worse by a Central Bank of Sri Lanka (CBSL) circular which has made it mandatory for banks to pay a 15% interest on senior citizens' deposits, market sources told Ceylon FT. The market in secondary market trading in Treasury (T) bills and T-bonds are dealing in the short term Tbills due to expectations that interest rates will rise in the near term, they further said. For instance, the 'more liquid' three months maturity is being traded at between 6.05 – 10%, whereas in the primary market auction of Wednesday it fetched a yield of only 5.98%, the sources said. Meanwhile, commercial banks' average weighted prime lending rate in the week ended Friday (20 February) increased by a massive 32 basis points (bps) week-on-week to 6.62%. In related developments, the weighted average rate of call rates increased by 1bp to 6.01% and that of overnight market repo transactions by four bps to 5.61% at yesterday's trading. (CFT) Bansei by Hotel J opens in Hikkaduwa: The first tourist resort of the Maithri-era Bansei by Hotel J was opened recently in Hikkaduwa by Japanese investor Bansei Securities in partnership with Jetwing. Bansei by Hotel J consist of 30-rooms. (DFT) 27 February 2015 Global Business News Google Is Making Its Biggest Ever Bet on Renewable Energy: Google Inc. is making its largest bet yet on renewable energy, a $300 million investment to support at least 25,000 SolarCity Corp. rooftop power plants. Google is contributing to a SolarCity fund valued at $750 million, the largest ever created for residential solar, the San Mateo, California-based solar panel installer said Thursday in a statement. (Bloomberg) Saudis’ Oil Price War Is Paying Off: Three months after Saudi Arabia made clear it was going to let oil prices keep tumbling, the strategy is showing signs of working. U.S. drillers are idling rigs at a record pace, gutting investment plans and laying off thousands of workers. (Bloomberg) Easy Money Outweighs Fed to Fuel Record Debt Flows to Asia Haven: This year was tipped to be the one when U.S. interest-rate increases would suck money from emerging markets. It’s not turning out that way in Asia. Unprecedented economic stimulus from Europe to Japan has prompted investors to pump a combined $14.4 billion into Indian, South Korean and Indonesian local-currency government debt this year, the most on record for the three markets, exchange data show. (Bloomberg) Morning Notes 27 February 2015 Local Business News Rupee ends steady on dollar selling by banks: Rupee forwards recovered to end steady on Thursday after falling intraday as dollar selling by banks late in the day erased early losses. One-week forwards, which fell to 133.50/60 per dollar in early trade, ended steady at 133.40/45, as dollar sales by banks offset importer demand for the greenback earlier in the day, dealers said. Finance Minister Ravi’s statement on Wednesday that Sri Lanka would defend the rupee currency and that the country has enough foreign exchange reserves to prevent any further depreciation created uncertainty in the market, dealers said. “If foreign investors digest the real situation of the reserves, it could trigger profit-taking in their bond portfolios and will demand more dollars. That might be an additional burden on the reserves while pressurising the exchange rate,” a currency dealer said. (DFT) The information contained in this report, researched and compiled for purposes of information do not purport to be complete description of the subject matter referred to herein. In preparing this report care has been exercised to collect information from sources which we believe to be reliable although we do not guarantee the accuracy and completeness thereof. Lanka Securities (Pvt) Ltd. and/or its affiliates and/or its directors, officers and employees shall not in any way be responsible or liable for loss or damage which any person or party may sustain or incur by relying on the contents of this report and acting directly or in directly in any manner whatsoever. Lanka Securities Research

© Copyright 2026