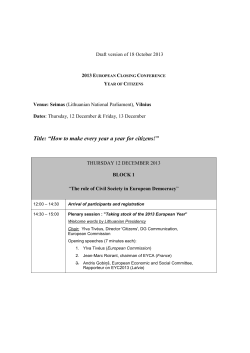

Agenda – ECBC Plenary Meeting 26th of March 2015

ECBC Plenary Meeting Draft agenda _____________________________________________________ Thursday, 26th of March 2015 ABN AMRO, Gustav Mahlerlaan 10, 1082 PP Amsterdam, the Netherlands (Map) 8.30 a.m. - 5 p.m. (All times CET) _____________________________________________________ 8.30 Registration and Welcome Coffee 8.45 Plenary Meeting ECBC Chairman’s note: Mr Carsten Tirsbæk Madsen Welcome speech: Ms Gita Salden, Director General of the Treasury and Director of Financial Markets, Dutch Ministry of Finance 9.30 Legal changes, market action and innovations ahead Introductory remarks on the updated Dutch covered bond law: Mr Wolf Zwartkruis, Dutch Ministry of Finance Lessons to be learned: what are the main take-aways for other jurisdictions in regards to the amendments of the Dutch legal framework? Market reaction: is the response from investors and rating agencies worth the effort? Product allurement: will there be more issuers and more supply going forward? Changes to be seen: what are the next innovative steps on the rise? Panel discussion Panel moderated by Mr Christoph Anhamm, ABN AMRO Panellists: Mr Thijs Naeije, ABN AMRO; Ms Maureen Schuller, ING Bank; Investor TBC 10.15 Harmonisation and transparency in covered bond markets What do we understand by the term “harmonisation”? What is the agenda and what is the timeline? Transparency by harmonising glossaries and definitions: the gateway for comparing data in a highly heterogeneous landscape? What are the IT implications for improving transparency and harmonisation? 1 COVERED BOND & MORTGAGE COUNCIL (CBMC) (EUROPEAN MORTGAGE FEDERATION – EUROPEAN COVERED BOND COUNCIL) Rue de la Science 14 - 1040 Brussels - Belgium Tel: +32 2 285 40 30 TVA BE 411 583 173 www.hypo.org | [email protected] | [email protected] The Covered Bond Label initiative: a key driver for improving transparency and harmonisation? Panel discussion Panel moderated by Ms Anne Caris, Moderator of the ECBC Transparency Task Force Panellists: Mr Florian Eichert, Crédit Agricole; Mr Bernd Volk, Deutsche Bank; Mr Markus Wilken, TXS; Mr Andreas Denger, CBIC; Mr Christian Moor, EBA (TBC); Ms Hélène Heberlein Fitch Ratings. 11.15 Coffee Break 11.45 Keynote speech Mr Ad Visser, European Central Bank (ECB) 12.00 Capital markets union: implications for covered bonds & securitisation, roadmap for the future Industry views on the Capital Markets Union project and Juncker’s plan to support the European Economy What implications for High Quality Securitisation and Covered Bonds? Call for CB Harmonization & market initiatives Brussels and Frankfurt: new regulatory synergies and perspectives Panel discussion Panel moderated by Mr Luca Bertalot, ECBC Panellists: Mr Niall Bohan, European Commission; Mr Waleed El-Amir, ECBC Deputy Chairman; Mr Daniel Loughney, Alliance Bernstein Asset Management GmbH; Mr Carsten Tirsbæk Madsen, ECBC Chairman; Mr Torsten Strohrmann (TBC), DWS 1.00 Lunch Break 2.00 Long-term financing of the real economy How will the latest regulatory initiatives, such as the Capital Requirements Directive (CRD) IV and the Bank Recovery and Resolution Directive (BRRD), impact the funding strategies of European lenders? Through which tools can European lenders finance the real economy in the long term? Long-term financing: from the Green Paper to a White Paper? What is next? SME initiatives on the table: between political and funding needs Panel discussion 2 COVERED BOND & MORTGAGE COUNCIL (CBMC) (EUROPEAN MORTGAGE FEDERATION – EUROPEAN COVERED BOND COUNCIL) Rue de la Science 14 - 1040 Brussels - Belgium Tel: +32 2 285 40 30 TVA BE 411 583 173 www.hypo.org | [email protected] | [email protected] Panel moderated by Mr Boudewijn Dierick, Moderator of the ECBC Long-Term Financing Task Force Panellists: Mr Massimo Bianchi, Société Générale; Mr François Haas (TBC), Banque de France; Mr Friedrich Luithlen, DZ Bank; Mr Peter Voisey, Clifford Chance LLP; Mr Frank Will, HSBC 3.00 Looking at green solutions: are covered bonds keeping up? Introduction to Green & Social Bonds: why? who? how? how much? Next steps A real market or just marketing? How can it be applied to Covered Bonds? Documentation and type of assets? Panel discussion Panel moderated by Mr Tanguy Claquin, Crédit Agricole CIB Panellists: Mr Pascal Coret (TBC), Caisse des Depôts; Mr Joop Hessels, ABN AMRO; Mr Jean-Pierre Sicard (TBC), CDC Climat; Mr Rafael Scholz, Münchener Hypothekenbank; Mr Claude Taffin, Association DINAMIC Closing Remarks 3 COVERED BOND & MORTGAGE COUNCIL (CBMC) (EUROPEAN MORTGAGE FEDERATION – EUROPEAN COVERED BOND COUNCIL) Rue de la Science 14 - 1040 Brussels - Belgium Tel: +32 2 285 40 30 TVA BE 411 583 173 www.hypo.org | [email protected] | [email protected]

© Copyright 2026