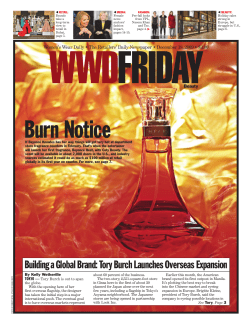

Women's Wear Daily March 13 2015 Fashion News Krakoff Bon-Ton

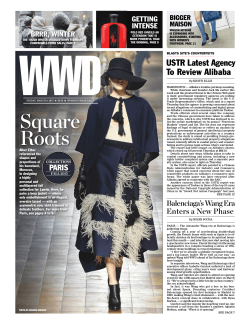

MCQUEEN RETURNS “ALEXANDER MCQUEEN: SAVAGE BEAUTY” OPENS AT THE VICTORIA AND ALBERT MUSEUM IN THE LATE DESIGNER’S HOMETOWN OF LONDON. PAGE 10 WWD FRIDAY, MARCH 13, 2015 ■ $3.00 ■ WOMEN’S WEAR DAILY Lace Is More What might have graced a collar or cuff instead became an entire dress. Valentino’s Maria Grazia Chiuri and Pierpaolo Piccioli made COLLECTIONS elegant use of yards of lace in retro Seventies FALL 2015 colors to create crafty stripe and chevron patterns on this high-necked number. For more, see pages 4 and 5. TREND PHOTO BY GIOVANNI GIANNONI MARC GOES MOD BUFANO’S PLAN MARC JACOBS UNVEILS HIS NEW FRAGRANCE, MOD NOIR, WITH A LITTLE TOUCH OF HIS PAST HITS. PAGE 7 BON-TON STORES INC. CHIEF EXECUTIVE OFFICER KATHRYN BUFANO UNVEILS HER FIVE-YEAR TURNAROUND STRATEGY. PAGE 2 A TOUGH INDUSTRY Krakoff Suspends Biz, Seeking New Investor By LAUREN MCCARTHY and MISTY WHITE SIDDELL NEW YORK — Reed Krakoff ’s rumored growing pains have come to a head. On Thursday, the designer revealed he is suspending operations of his five-year-old brand as the company attempts to “refocus on the accessible luxury segment of the accessories market.” The news was first reported on WWD.com Thursday afternoon. In a statement, the brand said “the company will suspend all future design and production, while continuing to operate its Greene Street and Woodbury Commons stores, as well as the reedkrakoff.com ecommerce site. In addition, the company is reviewing all strategic options for the brand, which may include production and distribution partnerships or a sale of the business and the brand.” The label’s Madison Avenue store will close in the near future — about three weeks, according to sources. Nearly 30 employees will remain with the company to help with the transition. Another source stressed that the brand still has inventory for its stores and Web site and new products are in the pipeline. The aim is to find a new investor as quickly as possible, the source, who requested anonymity, said. No liquidation sales are planned, as the brand plans to operate on a typical retail schedule through the summer. A decision regarding fall season merchandise and what will become of Reed Krakoff stores during that shipment window has yet to be made. WWD first reported instability within Krakoff ’s brand in December, when rumors of layoffs and restructuring spread throughout the industry. At the time, a spokesman for the brand said “a restructuring is in process that will shift the primary focus of the brand positioning and product categories.” In early January, the company tapped Harlan Bratcher, SEE PAGE 12 As Buyers Leave Paris, Hopes for Strong Fall By WWD STAFF PARIS — Something for everyone. That seemed to be Paris designers’ strategy for fall, and it left retailers almost breathless in their praise of the season as they lauded the city’s creativity and showmanship that trumped other fashion capitals. A wide range of trends and styles stirred buyers’ hopes that the several-years-long drought in women’s designer ready-to- wear sales at retail might finally be coming to an end. Karen Katz, president and chief executive officer of Neiman Marcus Group, in reporting higher 2014 profits, said Tuesday, “We believe there is going to be a reason to buy ready-to-wear. We feel pretty positive about the kinds of trends we are seeing.” In trends for fall, retailers pointed to a wealth of outerwear — particularly maxi coats, capes, fur and bathrobe styles — along with cropped pants, tall boots or short booties, lace dresses, turtlenecks, high-neck blouses, tunics, Mod footwear and bold earrings. “Once again, Paris was the highlight of the season,” said Harrods fashion director Helen David. “Paris has slowly been taking more and more of our open-to-buy allocation, and now accounts for approximately two-thirds of our budget.” “Paris has given us the strongest season out of all cities. In fact, it is one of the strongest seasons in years: Every major house has pulled out winning collections,” concurred Sarah Rutson, vice president of global buying at Net-a-porter. Ken Downing, fashion director and senior vice SEE PAGE 6 2 WWD FRIDAY, MARCH 13, 2015 WWD.COM Bufano’s Blueprint for Bon-Ton “Turnarounds are not as quick as you’d like them By DAVID MOIN to be, but we have the goals set and a lot of the team is very energized.” Among the tactics ahead: THERE’S HOPE for a rebound in the heartland. The Bon-Ton Stores Inc., which last quarter ■ Increasing advertising that’s more brand-equity won with sales momentum but lost ground on and fashion-focused, to create a better balance with margins, has a comprehensive turnaround strate- big price promotions. This fall, Bon-Ton will launch gy — from adding brands to the selling floors such new brand positioning and will be more “mindful” as Under Armour and Vera Bradley, to bolstering of how deep the promotions go. key-item presentations and furthering localiza- ■ Buy-online, pick-up-in-store service starts to be tion efforts, while seeking to reduce debt and phased in this fall. balance some of the promotional cacophony with ■ A new 700,000-square-foot e-commerce fulfillment center opens this fall in West Jefferson, Ohio, image branding. “There is a lot of opportunity not only with the for greater efficiency and inventory control. profitability, but also in terms of merchandise ini- ■ Furthering localization efforts, with seven retiatives,” Kathryn Bufano, the regional department gional merchandise managers added in August, store’s president and chief executive officer, told “Regional merchandise teams can be much, much closer to the demographics and can have a very big influence in terms of creating the assortments,” Bufano said. “Our goal is to become the hometown store provider of great fashion.” Bon-Ton is also developing productivity targets by tier of stores — small, medium and large — and recently designated stores into subgroups like college town stores, Midwestern rural stores, those in suburban affluent or ethnic areas or communities shaped by military bases. On Thursday, the York, Pa.-based retailer reported that net income for the fourth quarter ended Jan. 31 rose 17 percent to $71.7 million, or $3.55 a diluted share, compared with net income of $61.3 million, or $3.04 a share in the year-ago period. The quarter’s results included income of 53 cents a share associated with WWD. “Things just drifted away” after Bon-Ton the gain on an insurance recovery, of which about 9 purchased the 142-unit northern department stores cents was attributed to profit recovery and 44 cents of the former Saks Inc. in 2005 and grew its store to asset recovery. Adjusted earnings before interest, base as well as its debt load and lost its way. “There taxes, depreciation and amortization were $104.3 was an erosion of the business,” Bufano said. “The million, compared with $103.7 million in the fourth company was at $3.4 billion. Now we are targeting quarter of fiscal 2013. Comparable-store sales increased 4.3 percent in $2.8 billion for 2015.” On Thursday, just after Bon-Ton reported fourth- the quarter. Increased promotional activity to drive quarter results, Bufano unveiled her turnaround traffic as well as higher delivery expenses associatstrategy for the company, which last year lost ed with omnichannel operations resulted in a gross money. In the six months she’s been the retailer’s margin reduction of 130 basis points to 35 percent ceo, Bufano has been busy conducting focus groups, of net sales. For the year, the company visiting stores and learning what lost $7 million, or 36 cents a Bon-Ton’s midmarket and smalldiluted share, compared with town customers want. a prior-year loss of $3.6 mil“I think the economy is defilion, or 19 cents a share. nitely better, which is helpful. In Comparable-store sales inour small-tier markets, there is a better mind-set. We were running NET INCOME GROWTH FOR FOURTH creased 0.2 percent, with total sales reaching $2.76 billion. behind in the first three quarters, QUARTER ENDED JAN. 31. The Bon-Ton operates 270 but we really had a very strong stores, including nine furnifourth quarter.” Middle-market customers, Bufano said, “want more fashion. They ture galleries and four clearance centers, in 26 are looking for more style. They want more color. states in the Northeast, Midwest and upper Great Up north, they don’t like just all dark. People think Plains under the Bon-Ton, Bergner’s, Boston a small town is not fashionable, but these people Store, Carson’s, Elder-Beerman, Herberger’s and Younkers nameplates. want a broader assortment.” Apparently, investors like the shape of things She said customers are just as readily shopping Bon-Ton’s opening prices, comparable to Old to come. The stock rose 25 percent, or $1.18, Navy’s, as they are Michael Kors shoes, handbags to close at $5.87. In revealing the game plan, Bufano, who was formerly president of Belk Inc., and apparel sold at Bon-Ton. The moderate business has turned for the bet- said, “A significant percent of our sales increase ter largely because the company orchestrated a was driven by the additional expansion of highkey-item buildup for the fourth quarter that’s ongo- er fashion brands such as Chaps, Ralph Lauren, ing. Some key classifications, like sweaters, T-shirts Michael Kors and Calvin Klein. We’ll continue and shorts, had “atrophied” but are being restored, with intensification and rollout of these brands to additional doors in 2015. We’re expanding our Bufano noted. The ceo also cited contemporary labels such as fashion offerings in our young contemporary Jessica Simpson and Hippy Laundry as performing and young men’s business to more stores as well. well last quarter, and said the company saw a big Growth will come from vendors such as Hippie Laundry, Jessica Simpson, Democracy and turnaround begin in denim in December. Bon-Ton is forecasting a comp-store sales in- Celebrity Pink.” Under Armour will be rolled out fast, with men’s, crease of 2 to 3 percent for the year, with the second six months representing “a bigger opportunity” women’s and kids to all be sold at 100 doors right as merchandise initiatives kick in and some ben- off the bat. Vera Bradley will be more gradual. With efits from the new fulfillment center are seen, and private brands, “We plan to build upon the success 2015 earnings per diluted share ranging from a loss achieved in 2014 through brand extensions like the new Ruff Hewn Grey, Ruff Hewn Home Decor and of $0.25 to earnings of $0.25. Among the turnaround objectives to be achieved special sizes in Exertek,” Bufano said. “The one thing I learned from Belk is that rewithin the next five years: ■ Growing e-commerce to more than 10 percent of gional department stores can thrive and grow, which Belk has done nicely,” Bufano said. total volume from just over 6 percent currently. ■ Raising private-brand penetration to 25 percent “There’s a huge amount of loyalty and affection toof total volume from 18 percent currently. Ruff ward hometown stores. People still mourn the loss of Rich’s in Atlanta, Marshall Field’s in Chicago Hewn is the lead private brand in the stable. ■ Increasing sales per square foot from the present and Abraham & Straus in New York. We just have to do a better job of differentiating who we are in $122 to $145. “Those are the targets we need to achieve to the marketplace. “Bigger is better, I agree. But certainly Bon-Ton make our company more profitable. They’re reasonable and achievable,” Bufano said. can get back to historic profitability,” she added. 17% DIGITAL BRIEFING BOX FOR MORE COVERAGE, FIND US ON WWD.COM, SOCIAL AND MOBILE. ON WWD.COM Kate Spade Céline #ICYMI: Our best Instagram moments from New York, London, Milan and Paris. Reem Acra Shourouk Jeremy Scott Fendi FOLLOW US ON SOCIAL MEDIA @ WWD.com/social TO E-MAIL REPORTERS AND EDITORS AT WWD, THE ADDRESS IS [email protected], USING THE INDIVIDUAL’S NAME. WWD IS A REGISTERED TRADEMARK OF FAIRCHILD PUBLISHING, LLC. COPYRIGHT ©2014 FAIRCHILD PUBLISHING, LLC. ALL RIGHTS RESERVED. PRINTED IN THE U.S.A. VOLUME 209, NO. 52. FRIDAY, MARCH 13, 2015. WWD (ISSN 0149-5380) is published daily (except Saturdays, Sundays and holidays, with one additional issue in March, June, August, September, October, November and December, and two additional issues in April and three additional issues in February) by Fairchild Media, LLC, which is a division of Penske Business Media, LLC. PRINCIPAL OFFICE: 11175 Santa Monica Blvd., 9th Floor, Los Angeles, CA 90025. Periodicals postage paid at Los Angeles, CA, and at additional mailing offices. Canada Post: return undeliverable Canadian addresses to P.O. Box 503, RPO West Beaver Cre, Rich-Hill, ON L4B 4R6. POSTMASTER: SEND ADDRESS CHANGES TO WWD, P.O. Box 6356, Harlan, IA, 51593. FOR SUBSCRIPTIONS, ADDRESS CHANGES, ADJUSTMENTS, OR BACK ISSUE INQUIRIES: Please write to WWD, P.O. Box 6356, Harlan, IA, 51593, call 866-401-7801, or e-mail customer service at [email protected]. Please include both new and old addresses as printed on most recent label. For New York Hand Delivery Service address changes or inquiries, please contact Mitchell’s NY at 1-800-662-2275, option 7. Subscribers: If the Post Office alerts us that your magazine is undeliverable, we have no further obligation unless we receive a corrected address within one year. If during your subscription term or up to one year after the magazine becomes undeliverable, you are ever dissatisfied with your subscription, let us know. You will receive a full refund on all unmailed issues. First copy of new subscription will be mailed within four weeks after receipt of order. We reserve the right to change the number of issues contained in a subscription term and/or the way the product is delivered. Address all editorial, business and production correspondence to WWD, 475 Fifth Ave., 15th Floor, New York, NY 10017. For permissions requests, please call 212-630-5656, or fax request to 212-630-5883. For reprints, please e-mail [email protected] or call Wright’s Media 877-652-5295. For reuse permissions, please e-mail [email protected] or call 800-897-8666.Visit us online at www.wwd.com. To subscribe to other Fairchild Media, LLC magazines on the World Wide Web, visit www.wwd.com/subscriptions. WWD IS NOT RESPONSIBLE FOR THE RETURN OR LOSS OF, OR FOR DAMAGE OR ANY OTHER INJURY TO, UNSOLICITED MANUSCRIPTS, UNSOLICITED ART WORK (INCLUDING, BUT NOT LIMITED TO, DRAWINGS, PHOTOGRAPHS, AND TRANSPARENCIES), OR ANY OTHER UNSOLICITED MATERIALS. THOSE SUBMITTING MANUSCRIPTS, PHOTOGRAPHS, ART WORK, OR OTHER MATERIALS FOR CONSIDERATION SHOULD NOT SEND ORIGINALS, UNLESS SPECIFICALLY REQUESTED TO DO SO BY WWD IN WRITING. MANUSCRIPTS, PHOTOGRAPHS, AND OTHER MATERIALS SUBMITTED MUST BE ACCOMPANIED BY A SELF-ADDRESSED STAMPED ENVELOPE. WE COVER THE BUSINESS OF BEAUTY ISSUE April 24 ISSUE June 5 ISSUE August 14 The Beauty Inc Top 100 The 50 All-Time POWER Products Multicultural Beauty Power Brokers CLOSE March 27 CLOSE May 15 CLOSE July 24 MATERIALS April 3 MATERIALS May 22 MATERIALS July 31 ISSUE October 16 ISSUE December 11 Beauty’s Top 25 Iconoclasts The Annual Beauty Inc Awards CLOSE September 25 CLOSE November 18 MATERIALS October 2 MATERIALS November 25 FOR MORE INFORMATION, CONTACT CARLY GRESH, BEAUTY DIRECTOR, 646.356.4705, [email protected] 4 WWD FRIDAY, MARCH 13, 2015 Alexander McQueen Maison Margiela Lace Is More With lingerie-style dresses that flaunted dainty trim, sheer catsuits that exposed satin briefs, and a mountain of fabric tied mummy-style into pants, designers showing during Paris Fashion Week said Je t’aime to lace. COLLECTIONS TREND FALL 2015 Yohji Yamamoto Balmain Comme des Garçons Nina Ricci Chloé Sharon Wauchob Alessandra Rich WAUCHOB PHOTO BY DOMINIQUE MAÎTRE; ALL OTHERS EXCEPT RICH BY GIOVANNI GIANNONI WWD FRIDAY, MARCH 13, 2015 5 WWD.COM of d s k ad. r i- of n lof e WWD FRIDAY, MARCH 13, 2015 WWD.COM Buyers Hope Paris Fashions Spark Rtw Sales {Continued from page one} president of Neiman Marcus, could hardly contain his enthusiasm. “Once Paris kicked in, it was sensational,” he said, classifying the season’s fashion message as “that whole schizophrenic style that defined the Seventies — psychedelia, bohemia, folkloric, the Victorian reference and the early emergence of punk in 1976.” Collections widely lauded by retailers included Chanel, Dior, Dries Van Noten, Givenchy, Haider Ackermann and Maison Margiela, where John Galliano made his rtw debut and a return to the Paris catwalk after his flameout and conviction for anti-Semitic remarks in 2011. Valentino was also a favorite, with Ben Stiller and Owen Wilson walking in the finale to announce the sequel to their cult comedy “Zoolander.” “How can we not mention the Blue Steel moment?” said Downing. “This supersophisticated collection with a supersilly ending. It was great.” “The Paris season for fall was exceptionally strong,” echoed Colleen Sherin, vice president and fashion director at Saks Fifth Avenue, adding that “the strong American dollar is making the European collections even more enticing.” Given the strong dollar, Beth Buccini, cofounder of Kirna Zabête in New York, noted that her budget for Paris is up 20 percent. “We feel it for the first time this season, which is thrilling, because the customer is very price-conscious nowadays, regardless of how much money she has,” Buccini said, projecting sales in designer rtw will go up this year. “We absolutely loved Paris,” she said, mentioning Valentino, Lanvin, Dior, Chloé, Saint Laurent and Givenchy among highlights. “These shows are the reason why we come to Paris. They’re inspirational and we do our best business here.” Kelly Golden, owner of Neapolitan Collection in Winnetka, Ill., said her Paris budgets will be up, too. “We are adding new lines, more categories from current collections and, with the strong dollar, prices will be more attractive for our clients. Our business continues to grow and Paris is a key driver in that growth,” she said. Sebla Refi g Devidas, women’s buying director at Turkey’s Beymen, said more budgets would be allocated to Paris as it had scaled back somewhat on pre-collections. “I feel more confident about the show collections and the most positive aspect was that the collections were more down-to-earth, wearable and easy to create stories,” Devidas said. “That perfectly matches with the client who still wants to spend on luxury, but wear it multiple times.” New discoveries for the retailer included Ellery, Vanessa Seward, Kolor, Sacai and Pallas. Charlotte Tasset, general merchandise manager, women’s apparel, lingerie, beauty and children’s apparel at Printemps, said her budgets were up again this season. “It was a fairly dark season with quite a heavy atmosphere in the choice of colors, fabrics and silhouettes: a lot of jacquard, a return of velvet, a lot of tweed and thick bouclette wool,” she said. “Austere attitudes underlined the general impression,” she added, noting feminine touches came in the shape of fur, lace and embroideries. “The overriding mood in Paris was darkly feminine and very, very sexy. Women love this look. Whether it be neogrunge or a romantic Victoriana vibe, there are so many new items for all our customers to embrace and drive sales. Black is back, what can be easier than that?” said Suzanne Timmins, senior vice president and fashion director at Hudson’s Bay and Lord & Taylor. “When you get to Paris, there’s not one clear message: You get so many original options,” said Jeffrey Kalinsky, executive vice president of design merchandising at Nordstrom. “I thought Chanel was spectacular. You had so many choices there with one collection.” Kalinsky said Paris offered an array of compelling outerwear and rich tex- Balenciaga with midlengths, chunky heels and the blouses. You can’t miss cropped pants, T-necks, velvet, lurex, lace or shearling varietals,” she added. “Designers explored the idea of what it means to be empowered and strong, yet feminine and sensual,” said Brooke Jaffe, operating vice president of fashion direction for women’s rtw at Bloomingdale’s. “With millions of viewers watch- Chanel Dries van Noten Maison Margiela Valentino Haider Ackermann tiles including velvets and brocades. “I think our customer is going to have the same emotional reaction to them that I did,” he said. “Overall, the fall season between New York, London and Milan was lacking some clarity and direction, perhaps due to the amount of change at numerous houses. But Paris crystallized the season for us with an impressive succession of powerful collections,” said Linda Fargo, senior vice president and fashion and store presentation director at Bergdorf Goodman. “There was a lot of diversity of vision, there were also enough unifying specific trends, such as the curiosity in gender-blending, dips into the Seventies PHOTOS BY GIOVANNI GIANNONI r r vn d ht ez, n d o e 6 ing live-streaming and Instagramming, designers need to make their viewers dream about fashion, start a dialogue, disrupt the norm and push everyday dressing into the future,” said Barbara Atkin, vice president of fashion direction at Canada’s Holt Renfrew. “Paris succeeded by offering up purposeful collections with crystal-clear concepts. Collections were powerful, romantic, sumptuous and bold, with a sense of freedom as women are now in control of their individual self expression.” Natalie Kingham, buying director for Matchesfashion.com, said “the mood of the season is a woman undone with raw edges, different to the bohemian trend that is also a strong theme. There is also a strong presence of bold color in collections from red to green, blue and pastels. This season feels ideal for a woman who embraces strong and diverse color, often offset with tones of camel.” While most were in agreement that the Paris shows offered something for everyone, others saw this as a lack of vision. Detractors included Kazuyoshi Minamimagoe, senior creative director at Beams in Tokyo. “Generally speaking, there were no outstanding new trends,” he said. “Luxury brands shifted their collections more toward real clothes, thus allowing buyers more to choose from. Maison Margiela and Carven, both with their new designers, will probably match the Beams clientele.” But this sentiment was rare. “We’ve seen opposing ideas and differentiated aesthetics that coexist beautifully within collections: rough and refined, tough and romantic, dressy and casual, fluid and fitted, shiny and matte,” said Tomoko Ogura, senior fashion director at Barneys New York. “The unexpected mixing of these elements and taking inspiration from different decades [and] centuries and modernizing them for today’s audience feels fresh and exciting,” she said. Macy’s group vice president and fashion director, global forecasting Nicole Fischelis liked the pairing of romantic, feminine ruffles and sheers with more masculine coats, as well as tuxedos and high-end hippie styles. “There are a lot of great items to capitalize on,” she said. Stylebop.com fashion director Leila Yavari predicted, “Come fall, a sumptuous dark romanticism will reign supreme. Amidst all the drama and fin-de-siècle embellishment, the mood was surprisingly upbeat — and the layering provided plenty of wonderful options that will translate from runway to real life.” Yavari said her customers gravitate toward strong statement pieces. “We hope to encourage growth in that sector by investing in one-of-a-kind buys, of which there were plenty. Transitional dressing is also a key market segment — and designers certainly addressed this with many versatile pieces that move seamlessly between climates,” she said. Jennifer Cuvillier, style director at Le Bon Marché, said the Paris season was strong on creativity and salability. “Accessories were strongly represented in this season’s shows, especially jewelry, which had long been absent from the catwalk, so that is a good commercial opportunity,” she noted. “It’s been incredible,” said Ikram Goldman, owner of Ikram in Chicago. “I found that in a pool of so many designers, there was a precision in each designer’s voice that we looked at. The designers were very clear in their message. This season was like a pure understanding of the story.” She praised the variety of pants shapes on offer. “It’s a sailor pant. It’s a high-waist pant. It’s a low pant. It’s a wide pant,” she said — a sentiment mirrored by several buyers when it came to skirts and dresses, too. “We are optimistic about the autumn ahead with the rich textures, feathers, quilting and satin all pointing to luxurious wardrobing of strong and rich pieces with an abundance of fur (or fake fur as seen at Stella), which will increase desirability, and automatically raise ticket prices,” said Averyl Oates, commercial director, fashion divisions at Galeries Lafayette. “The bohemian look will continue from spring into fall, but she will be much more luxurious. The haute bohemian will reign, adorned with suede and silk fringes, beautiful embroideries and elaborate macramés,” summed up Golden of Neapolitan Collection. WWD friday, march 13, 2015 7 WWD.COM beauty Jacobs Talks Scents, Fashion By JULie NaUGHToN WHiLe He LiKes to break new ground, marc Jacobs is including a bit of his past in the launch of his newest fragrance, mod Noir. The scent, which is exclusive to freestanding sephora doors in the U.s. and Jacobs’ own boutiques in June and globally in July, is based around gardenias, the bloom that was the focus of the very first fragrance Jacobs did with former fragrance licensee LVmH more than a decade ago. Coty, Jacobs’ current licensee, acquired the license from LVmH in may 2003. Despite being immersed in the scent business for more than 10 years, Jacobs said the perfume business never gets old for him. “every time i go to an airport or open a magazine [and see one], i think, ‘Wow, i’m a real designer. i have a perfume,’” he told WWD. in fact, Jacobs admits to being surprised by the number of fragrances he has. “i have the same basic attitude toward everything — i get very excited about doing new things and projects,” he said. “When fragrances first started, i was superexcited about being able to do it, and i thought, ‘Well, we’ll see how it goes. if it works, then we’ll do more, and if it doesn’t, we’ll try again to do something else.’ The best test is the customer.” The customer, by the way, may soon be able to purchase shares of the designer’s stock; it has been rumored, but not confirmed, that Jacobs is eyeing an initial public offering. The new floral interpretation, which Jacobs created with Jean-Claude Delville at symrise, has lush green top notes, a heart of gardenia and a drydown of creamy musks, and the fragrance’s packaging also gives a tip of the hat to the retailer in which it will be sold — mod Noir’s bottle is in graphic black-andwhite, sephora’s signature colors. eaux de parfum in two sizes will be offered: 1 oz. for $70 and 1.7 oz. for $90, as well as a $28 rollerball, noted Lori singer, group vice president of global marketing at Coty inc. singer added that Raymond meier shot the brand visuals, The brand visual. which will be used in-store and digitally, and that a comprehensive sampling campaign is also planned. While neither Jacobs nor singer would discuss numbers, industry sources estimated that the scent could do $10 million at retail in the U.s. in its first year on counter. The designer is equally as enthusiastic about the color cosmetics collection he’s created with Kendo, sephora’s product arm. The line launched in august 2013. “[Color] runs parallel to the fragrance experience,” he said. “The idea of beauty, for me, is fra- David Beckham’s Fragrant Decade By NiNa JoNes a maze of mirrors, a mediterranean garden and a meditation session were all part of the immersive experience that Coty inc. and David Beckham created for the press launch of Beckham’s instinct Gold edition fragrance at a London events space Thursday. The fragrance marks Beckham’s 10th anniversary of working with Coty, a span that began with the former soccer player launching the original instinct in 2005. since then, Beckham’s fragrances have gone on to become the best-performing celebrity brand in Coty’s portfolio, which includes fragrances by Beyoncé, Katy Perry and Jennifer Lopez. “it was the goal at the start.…i wanted to be part of something that in 10 years’ time, we could look back on and [it would]…not be perceived as old-fashioned,” said Beckham, who held a question-and-answer session in a room done up to resemble his own stylish study (the event was designed to mimic the sensory “journey” of creating the fragrance.) Yaël Tuil-Torres, vice president of global marketing, celebrities and fashion division at Coty, said over the past 10 years, instinct has sold more than 10 million bottles. Together with the original instinct, there have so far been seven editions of the fragrance, with instinct Gold edition the eighth. “With each fragrance, we’ve put something in that means something to me — the notes that i like, the smells that i like,” said Beckham. The fragrance, created by perfumer aliénor massenet of international flavors & fragrances, combines top notes of lemon oil, bergamot oil and basil grand vert; a heart of cardamom LmR, Juniper berry oil LmR and rosemary oil LmR and base notes of cedarwood ’’ ’’ I think it’s important that children have their own ideas on style and individuality. — david beckham During the event, Beckham — who was sporting a beard and a slim-fitting dark suit — also chatted about his ever-changing style, and his children’s rising fashion-plate status. His eldest son, Brooklyn, has even taken to helping himself to clothes from his father’s closet, Beckham admitted. “i had a pair of saint Laurent leather trousers that i’d never worn, and Brooklyn found them and wore them — they were my trousers and they’re definitely not anymore,” he said. and he noted that his four children’s senses of style is “all themselves” — even his three-year-old daughter Harper’s. “We let them make their own decisions in what they wear,” he said. “Harper’s wearing Victoria’s heels every single day. she’ll literally walk into the house and put her ballerina outfit on and a pair of heels — but she’s very funny, because she always puts the boys’ football boots on as well,” he said. “i think it’s important that children have their own ideas on style and individuality,” he said, noting that he predicts his son Romeo will take on his mantle as a style icon. But Beckham was happy to admit his own fashion record isn’t perfect. “i do look back and think, ‘What was i thinking?’ But at the time it was great — or i thought it was great,” he said with a grin. The fragrance will be priced at 26.50 pounds, or around $40. The limited edition — which Tuil-Torres said is designed as a collectors’ item — will be sold solely as a 50ml. eau de toilette. it will launch at department stores and pharmacies in europe, australia, the far east and south africa this month and remain on counters through June. While Coty declined to provide sales estimates for the fragrance, industry sources predict that the limited edition could generate $4 million in retail sales while it’s on counter. following the Gold edition launch, Coty is working with Beckham on what Tuil-Torres called a new “blockbuster” fragrance, that’s set to bow in august or september. While instinct Gold edition won’t launch in the U.s., the upcoming major launch will be sold there. oil, patchouli and vetiver. “You want to give people something that they feel is new and modern, but also with that timeless effect,” Beckham said. massenet pointed out that while bergamot, vetiver and cardamom were notes in the original instinct, the Gold edition is more “aromatic” and “deeper.” “in the Gold [edition], you have a bit more contrast and sensuality,” said massenet. The new edition is also in a gold lacquered version of instinct’s flasklike bottle. grance, color and eventually, hopefully, skin care. it’s very much like designing a collection — it’s just a different medium. it’s about materials, it’s about creating a certain spirit, assembling the elements, putting them together, and opening up a dialogue. What i love about fashion, accessories and beauty, is that they’re part of a ritual which is such a luxury, and a luxury that i think women — at least all the women i know — enjoy, making those choices and enjoying that ritual in the morning, deciding what you’re going to wear and how you’re going to present yourself. That’s olfactive as well as visual.” Jacobs also isn’t afraid to deviate from the norm, as he proved when he signed sixtysomething actress Jessica Lange as the face of his color cosmetics collection in the spring of 2014. “i’m a big fan of hers, and i always have been,” he said. “i felt that it was really necessary, early on with the beauty, to establish that you should come to expect what you don’t expect, not to get into kind of a formula. so [we decided] to go from edie [Campbell, who was featured in the previous campaign] with a very heavy, very glamorous beauty look to Jessica, just a beautiful woman who is somebody very, very different and extraordinarily beautiful and talented. it wasn’t about doing an age thing or anything like that. it’s just me trusting my instincts. Beauty comes in many shapes and forms and sizes and ages.” L’Oréal USA, Powa Ink Partnership L’oRéaL Usa aND Powa Technologies have formed a strategic partnership intended to drive sales with a high-tech mobile program. Powa Technologies, a U.K.-based commerce firm, creates technologies intended to simplify purchasing and enhance consumer loyalty to the brand. The technology L’oréal will be using is the company’s flagship product, a mobile platform called PowaTag that is intended to transform any consumer touchpoint — from bricks-and-mortar, print and TV advertising to social media — into a platform for mobile transactions and promotions on customers’ smartphones. Dan Wagner, chief executive officer and founder of PowaTechologies, noted the technology will interact with print and electronic advertising and will enable instant purchases through PowaTag both on smartphones and desktop computers. The company is reportedly also using the technology with such corporate giants as Reebok, adidas and Carrefour. “PowaTag provides a way for consumers to deepen their engagement with their favorite brands,” Wagner said. “Being one of the world’s largest advertisers, the possibilities of what can be achieved for L’oréal through a smartphone are endless. mobile devices have become the go-to method for people to explore and connect with brands and PowaTag is rapidly becoming the standard for the world’s leading companies.” The company, founded in 2007, aims to “remove the final barriers to instant global transactions through a revolutionary instant mobile payment technology, the first fully integrated tablet Pos platform, and advanced cloud-based ecommerce solutions,” he noted. Before beginning Powa Technologies, Wagner founded online information database Dialog, and Venda Ltd., said to be the world’s largest provider of on-demand e-commerce. marie Gulin-merle, chief marketing officer for L’oréal Usa, noted her company has an “unrelenting drive to innovate for our customers.” “Through this exciting partnership with Powatag, we see a new way to merge the online and off-line worlds of our customers, adding value to their lives and bringing ease and convenience to their mobile shopping experiences,” said Gulin-merle. — J.N. 8 WWD FRIDAY, MARCH 13, 2015 WWD.COM beauty ‘A Real Guy’ for Kenneth Cole Revlon Sales Jump 30.2% cent to $115.6 million in the consumer business and more than tripled, to $16.3 million, in the professional group. Sales LORENZO DELPANI said he is seeing from Colomer’s retail brands are includearly signs that the repositioning of ed in the consumer segment while those both the Revlon and Almay brands is sold in professional channels are attributed to the professional segment. beginning to work. While it’s early into both the Revlon Delpani, Revlon’s president and chief executive officer, noted that the launch of and Almay repositioning efforts, Delpani said he was encouraged by Revlon’s “Love Is On” campaign in late 2014, followed by this year’s introduction initial market results. The company’s stepped up marketing of Almay’s new tag line Simply American are part of the company’s efforts to battle spending in 2014 by $38.1 million, reprefor lost market share and grow the com- senting a 10.8 percent increase over the prior year. Asked how he gauges success, pany’s top and bottom lines. During the firm’s earnings with Wall he said, “I like to rely on a very simple Street analysts call on Thursday, Revlon measure: Are we growing market share?” At the same time, the company will Delpani referred to 2014 as a year of “significant change and transformation.” continue to focus on “fewer, better” “We integrated [The Colomer Group] product launches, as well as “fewer, into the company and delivered the ex- better” people, Delpani said. “We want pected synergies and related cost reduc- people who are achievers.” tions,” he said. “We Delpani said the company has exredesigned our orgatended the Love Is nization and signifiOn campaign to its cantly increased our corporate culture, but investment to build clarified that “corpoand support our key rate love” is not interbrands. We launched REVLON’S ADJUSTED EARNINGS personal or uncondiour Revlon Love FOR 2014. tional. It does speak Is On campaign in to the organization’s November 2014 and our Almay Simply American Campaign core beliefs, such as the desire to win, in January 2015. Thanks to our strategy celebrate talent and promote diversity. of value creation and the integration For the year, net income was $40.9 synergies, our 2014 financial perfor- million, or 78 cents a diluted share, compared with a loss of $5.8 million, or 11 mance was the best in many years.” In the fourth quarter ended Dec. 31, cents, in the year-ago period. Adjusted Revlon reported net income of $2.7 mil- earnings before interest, taxes, deprecialion, or 5 cents a diluted share, com- tion and amortization rose 32.3 percent to pared with a loss of 33.1 million, or 63 $375.2 million from $283.7 million. Sales for the year gained 30.2 percents a share, in the prior-year period. Adjusted earnings before interest, cent to $1.94 billion, compared with taxes, depreciation and amortization $1.49 billion the prior year, boosted by rose 18.2 percent to $108.7 million from the acquisition of TCG in October 2013. On a pro forma basis — in which $92 million. Total company net sales for the pe- Colomer was accounted for as it had been riod gained 1.9 percent to $501 million part of Revlon one year ago — and exfrom $491 million. Its consumer seg- cluding the impact of foreign currency, the ment’s sales fell 1.8 percent to $383.3 company said sales gained 4.7 percent. Delpani reiterated that integration million in the quarter while the professional segment of the business recorded of Colomer was on track to deliver ana 17.1 percent sales increase to $117.7 nualized cost reduction of $30 million million. Segment profit was up 8 per- to $35 million by the end of 2015. By MOLLY PRIOR 32.3% Ulta Hits $1B in Revenues ULTA BEAUTY reached and surpassed $1 billion in quarterly sales for the first time, capping off a stellar year in which profits surged nearly 27 percent. “Our best comparable sales increase of the year was driven by accelerating traffic growth, continued strength in prestige and mass color cosmetics, a successful holiday selling season, execution of more effective marketing and CRM strategies, a double-digit comp in our salon business, and a 55 percent comparable sales increase in our ecommerce business,” said Mary Dillon, Ulta’s chief executive officer, during the company’s fourth-quarter earnings call on Thursday evening. The Bolingbrook, Ill.-based retailer said its net income in the quarter gained 23.5 percent to $87.3 million, or $1.35 a diluted share from $70.7 million, or 1.09 cents, in the year-ago period. Sales for the three months ended Jan. 31 gained 20.7 percent to $1.05 billion from $868.1 million. Comparable sales increased 11.1 percent, driven by 7.7 percent growth in transactions and 3.4 percent growth in average ticket size. Dillon named IT Cosmetics, Tarte, Urban Decay and Too Faced among the top performers in its prestige business, with NYX and lip products driving mass sales. reflect his journey and his life as a dad and as a veteran. Consumers today really see and feel the difAUTHENTICITY HAS inference of a truly authencreasingly won the heart tic campaign.” of consumers. Between Priced at $72 and beauty vloggers’ product launching in April at critiques and celebriMacy’s, Dillard’s, Belk, Bonties investing in brands Ton Stores, Kenneth Cole because they truly love stores and kennethcole. them, shoppers are atcom, Mankind Ultimate tracted to companies that blends citrus accord with deliver legitimacy. cucumber, a heart of cashFor the first time, mere wood and vetiver root Kenneth Cole and his frawith a base of sandalwood, grance licensee Parlux oak, moss, tonka crystals has tapped a “real guy” and musk. to star in its newest “When I met Kenneth campaign for Mankind The Mankind Ultimate campaign. Cole, he asked what I Ultimate, a limited-edition scent that represents the modern man wanted to leave as my legacy,” Galloway said. “I mentioned whatever I could to — driven, persistent and compassionate. Cole met 33-year-old Alabama-based make sure my family was taken care of and Noah Galloway, a war veteran, double- that I left them something to be proud of.” Galloway’s family has more than one amputee, personal trainer and motivational speaker, when he won the search reason to be proud of him. Besides scoring the campaign, Galloway will appear for the Ultimate Men’s Health Guy. “I wanted to help tell the story of this on the next season of “Dancing with the remarkable man,” Cole said. “Despite his Stars,” premiering on Monday. “I have no dance experience at all,” he adpersonal obstacles, he remains both physmitted. “[My dance partner Sharna Burgess] ically and mentally fit.” The campaign, which will run in Men’s tells me the type of dance we’re doing and Health’s April issue coinciding with the I’m like, ‘I don’t know what that means or annual search for the Ultimate Men’s what you just said.’ But if I dance well, it’s all Health Guy, illuminates Galloway’s jour- credited to Sharna and I told her if I do bad, then I’ll blame her. No, I’m just kidding.” ney with a black-and-white collage. Although executives wouldn’t talk finan“We really wanted Mankind Ultimate to push the limits of traditional advertising,” cials, industry sources estimate that Mankind said Angela Budd, global vice president of Ultimate could do $8 million to $10 million at marketing at Parlux Ltd. “Those images retail during its limited-edition run. By JAYME CYK She noted that Ulta’s loyalty program had grown to reach 15 million active members by the end of the fourth quarter. Its store base continued to grow. During the quarter, Ulta added 10 doors, and closed one, to end the three-month period with 774 stores, which translated to a 14 percent increase in square footage compared with the year-ago period. The company also announced several executive changes. Dillon said Janet Taake, chief merchandising officer of Ulta, plans to retire after six years at the company, effective May 1. She and her team are credited with adding 100 major brands to Ulta’s assortment, according to Dillon. David Kimbell, Ulta’s current chief marketing officer, will assume merchandising in the newly created role of chief merchandising and marketing officer. For the year, net income gained 26.8 percent to $257.1 million, or $3.98 a diluted share, compared with $202.8 million, or $3.15 a share. Sales increased 21.4 percent to $3.24 billion from $2.67 billion. The company said it plans to achieve comparable-store growth of approximately 6 to 8 percent, including its ecommerce business; increase total sales in the midteens percentage range and expand square footage by 13 percent with the opening of 100 net new doors. — M.P. Shiseido Gains Lutens Trademark SHISEIDO CO. LTD. of Tokyo has acquired the trademark of Serge Lutens’ fragrance and color cosmetics brand, according to Carsten Fischer, corporate senior executive officer of Shiseido. The Asian beauty giant was expected to have disclosed the deal in a press release issued this morning, Tokyo time. Lutens will remain head of the brand, which had been distributed by Shiseido. The iconoclastic image maker, photographer and product developer has been a pioneer in the now-budding artisanal, niche fragrance movement. His relationship with Shiseido started in 1980 when he was hired to create an international image for the company, which was then little-known outside of Japan. He shot advertising, designed makeup and created packaging. In 1982, he was commissioned by the company to create Nombre Noir. In 2000, Lutens created his own company, Parfums-Beauty Serge Lutens. Shiseido has acted as the distributor. According to market sources, Shiseido is considering plans to give the prominent brand more of a lifestyle positioning. Shiseido does not break out sales projections, but industry sources indicate that Shiseido could more than double the size of the business in 10 years. Sales are now estimated at more than $15 million at retail. “I am happy that we can bring our cooperation with Serge Lutens to a new stage. The creativity and the style of the brand are unmatched,” said Fischer. — PETE BORN Surratt Gears Up for Growth nation with Japanese beauty TROY SURRATT’S preproducts, the line includes occupation with the dea system of shapes that tails is paying off. allows women to create The makeup artist — personalized palettes, who is often called “beaualong with items such ty otaku” (or someone as Smoky Eye Baton and with an obsessive inAutographique Liner. terest in makeup) when “Women have really retraveling in Japan to tend sponded to the customizato the creation of his nametion aspect of the line,” said sake collection Surratt — is Surratt. He has already exgearing up for growth. Some of the products. panded shade ranges across Surratt will soon expand the cosmetics brand to Sephora, Net-a-porter, certain items, and there’s also a new complexion product slated for fall. Harrods in London and Mecca in Australia. Heleyne Tamir, chief executive officer of The line will launch on sephora.com on March 17, and then on April 20 roll out Surratt, said, “In our first year, sales have to 27 Sephora doors with plans to end the exceeded all forecasts. Our initial launch at year in 40 doors. Sephora will house the Barneys resulted in immediate sell-outs of products and our opening at Liberty is said collection along two three-foot gondolas. “Sephora is the vortex of beauty and to have been their most successful color makeup. It’s a candy store where you can launch to date. This coupled with consumer lose yourself,” said Surratt. The line is excitement over the new Artistique Brush also slated to launch at Net-a-porter and collection has propelled the numbers. With Harrods at the end of March, and at Mecca the new strategic retail partnerships in in July. It is currently sold at Barneys New place for 2015, we anticipate growth of ten times our current sales volume.” York and Liberty in London. As for how Surratt maps out its retail After spending four years on research and development, Surratt launched a sizable distribution strategy, the makeup artist said collection of 106 items at Barneys New York he asks a simple question, “Is it a place in October 2013. Inspired by Surratt’s fasci- that I would like to shop myself?”— M.P. BEAUTY’S Honoring 6 Future Leaders who are Making their Mark in Beauty BEAUTY’S TALENT TALENT AWARDS Selected by CEW Board Members, these Honorees will be recognized for their impressive performance, leadership potential and the impact they’re making on their companies and the industry. AWARDS Keynote Address: ELANA DRELL SZYFER, CEO, Laura Geller Beauty HONOREES WEDNESDAY APRIL 15, 2015 BEAUTY’S 8 - 10AM The Union League Club RESERVE YOUR TABLES AND TICKETS NOW BEAUTY’S CLAIRE FERMONT LANGLAIS Coty JENINE GUERRIERO Givaudan TALENT TALENT ALTHEA KNIGHT The Estée Lauder Companies, Inc. AWARDS AWARDS CEW.ORG HELEN MURPHY International Flavors & Fragrances, Inc. @CEWinsider l #CEWTopTalent BEAUTY’S AMY WHANG L’Oréal Paris BEAUTY’S MIRIAM WHIPPEN Clarins BEAUTY SPONSORS: TALENT AWARDS TALENT AWARDS TALEN AWARD 10 WWD FRIDAY, MARCH 13, 2015 eye ‘Savage Beauty’ Reborn LONDON IS POISED for six months of magical thinking with a fresh take on the “Alexander McQueen: Savage Beauty” exhibition set to open this weekend at the Victoria and Albert Museum. The show is a window into the restless, labyrinthine mind of the late designer, who considered London not only his home, but also his fountainhead of inspiration. “Alexander was a London boy, and what can I say? He’s back in town,” said Philip Treacy, whose dramatic creations feature in the exhibition. Treacy was among a crowd that included Sarah Burton, Kate Moss, Stella Tennant, Erdem Moralioglu, and David and Victoria Beckham, who gathered at the V&A on Thursday night to celebrate the opening of the show. Asked to compare the London show with the one at New York’s Metropolitan Museum of Art in 2011, Treacy said London offered a more heightened experience. Burton said she was reluctant to attend the press view for fear she’d burst into tears. “I’m terrible. I would have been in bits. Lee lived London, and this show feels really personal, really intimate,” the designer said. Tennant talked about the impact of wearing McQueen. “The clothes make you feel indominable. There’s a soft side to them, too, but the feeling you have is one of power.” Katie Grand opted to leave her sole McQueen piece in storage. It was a jacket she swiped from the designer’s home in Essex, England, after traveling to visit him with Isabella Blow. “It had been buried underground and the color The Romantic Gothic gallery. had oxidized. Now I think it even has gotten moldy,” she said. “Savage Beauty” is the biggest and most ambitious fashion exhibition ever staged by the V&A — the archives of which McQueen would plunder for research and inspiration. “It’s the sort of place I’d like to be shut in overnight,” he once said. The show has already been extended by two weeks, with 70,000 tickets sold. While it may follow the template of the original one staged at the Met, the V&A production is bigger, more polished and with greater emphasis on McQueen’s native city. “It is all about coming home,” said Martin Roth, the museum’s director. “My first thought when I saw the show at the Met was: ‘McQueen has to come home.’” The retrospective, which opens to the public on Saturday and runs until Aug. 2, features 66 additional garments and accessories — including a sculpted white feather gown from the Horn of Plenty show; a blood red ballet dress from The Girl Who Lived in the Tree, and early pieces from the wardrobes of old friends and colleagues including Annabelle Neilson, Katy England, Aimee Whitton and Janet Fischgrund. FOR MORE PHOTOS, SEE François-Henri Pinault and Salma Hayek WWD.com/eye. Jamie Hince and Kate Moss It opens with an homage to McQueen’s London, featuring looks from his midNineties shows — the slashed leather pieces, dresses made from corroded lace, and ones bearing tapestry flowers that bleed into streaks of paint. Next door, there’s a short, saucy frock coat with tulle underskirts from his 1992 master of arts graduate collection, and a deconstructed, kimono-style dress that McQueen would use to dress up one of the limited-edition gold cards he designed for American Express, one of his earliest sponsors, and a supporter of the V&A show. There is a lineup of bumster skirts and trousers — inspired by the looks McQueen witnessed on the streets of his city — and a host of tailored pieces highlighting his training on Savile Row, first as a teenage apprentice for Anderson & Sheppard and later for Gieves and Hawkes. “Everything I do is based in tailoring,” reads one of the many McQueen quotes that run alongside the displays. The Cabinet of Curiosities, which features accessories by jeweler Shaun Leane and milliner Treacy, longtime McQueen collaborators, is twice the size of the one at the Met. It’s housed in a double-height gallery and interspersed with film footage of nearly all of the designer’s shows. Meanwhile, the ghostly hologram of Kate Moss, the woman in white silk organza, is bigger this time around. “In New York, we had her the size of Tinkerbell, while here, she’s much bigger — child size,” said Andrew Bolton, who created the original show with the support of Harold Koda, and was consultant curator of this one, working alongside the main curator Claire Wilcox. The Met show had been produced “on the fly, in nine months, so there were some chinks in the armor. Here, the creases have all been ironed out,” he said, adding the London-themed room in particular stood out because of the “rawness, spontaneity, lack of selfconsciousness and modernity” of the looks on display. During a walk-through of the Cabinet of Curiosities, Nadja Swarovski, whose company sponsored the show, discussed how McQueen operated on another plane. Pointing to a crystal mesh top with an executioner’s-style hood, she recalled how the garment came to be. “We could never figure out what to do with crystal mesh, which comes in sheets like fabric,” said Swarovski, whose family company had created it in 1993. “People would use it for handbag trimming. But he asked for five sheets of it, and that’s what he did,” she said of the top. “Crystals were never an afterthought with him.” McQueen would go on to work with crystal mesh for skirts, dresses and other pieces and Swarovski said that once McQueen got going with it, everyone wanted to use it. “We couldn’t produce enough of it — that was a phenomenon we had never experienced before.” As with the Met, the show is molded around McQueen’s dark — and exciting — preoccupations over the years: The Victorian Gothic tradition; death everlurking; nature in all its splendor, horror The Romantic Nationalism gallery. and decay; his own Scottish heritage, and parallel worlds in the past and future. The journey is wondrous, sinister, and otherworldly, and the only real drawbacks are the sometimes hard-toread captions at the foot of the displays, and the discreetly laid-out descriptions of each room’s theme. Visitors would do well to study up beforehand on McQueen, or ignore the captions altogether and allow the clothes to work their magic. — SAMANTHA CONTI • • • MCQUEEN MARK II: Alongside the Victoria & Albert Museum exhibit, London’s Tate Britain is also paying homage to the late designer. Tuesday saw the opening of “Nick Waplington/Alexander McQueen: Working Process” at the gallery, which showcases more than 130 photographs by Waplington that chart McQueen’s process of creating his fall 2009 collection, “The Horn of Plenty.” Waplington’s images chronicle what the gallery describes as McQueen’s “intense and theatrical working process,” following the collection from the designer’s first sketches to the Paris runway show. Waplington, whose subjects have in the past run from families living in the West Bank to the British post-punk movement, has contrasted the images from McQueen’s studio with images from landfill sites shot around east London, where both he and the designer lived, highlighting what the gallery called the “raw and unpolished side of the fashion world.” Before McQueen’s death in 2010, he and Waplington had together created a photo book of the images, called “Alexander McQueen: Working Process,” which was published by Damiani in 2013. The exhibition runs until May 17. — VIVIANA ATTARD PINAULT AND MOSS PHOTOS BY TIM JENKINS The Platos Atlantis gallery at “Alexander McQueen: Savage Beauty.” WWD FRIDAY, MARCH 13, 2015 11 WWD.COM FASHION SCOOPS FRESH SIGHT: Victoria Beckham is placing new emphasis on her sunglasses collection. The designer, who launched eyewear in 2009, has enlisted a fresh roster of manufacturers to help “spice” up her collections. The collection was previously manufactured in partnership with Cutler and Gross. She will continue to use their services along with a bevy of other “specialists,” including lens Victoria Beckham will launch a capsule aviator-style sunglass collection. producer Zeiss. “It was important for me to evolve existing styles and develop new pieces for my retail partners and my own store and Web site and we now have the ability to do this,” Beckham said. “For me, it is about the line continuing to expand and incorporating the best materials and techniques possible. It is an exciting time for the category.” Beckham will debut her new manufacturing initiatives with a capsule collection of colorfully lensed aviator styles that incorporate Zeiss’ handiwork. They will exclusively retail at Barneys New York for $550 for basic styles up to $1,255 for aviators laden in 18-karat gold. A spokeswoman declined to specify other factories that Beckham has begun working with this season but said they are all located in Italy’s Valdobbiadene region. Further details will be unveiled when Beckham’s new collection launches at eyewear trade show Silmo Paris in September. — MISTY WHITE SIDDELL SPANX TO SPADE: Jan Singer, chief executive officer of Spanx, has been nominated to the board of Kate Spade. The company said Thursday that Bernard W. Aronson and Kay Koplovitz will not be standing for re-election at the company’s 2015 annual shareholders’ meeting on May 19, when Singer will stand for election. Prior to being named ceo of Spanx last July, Singer was with Nike as corporate vice president of global apparel and corporate vice president of global footwear. Earlier, she was vice president and general manager of global product, merchandising and marketing for Reebok International Ltd.’s women’s business. She has also held key marketing and global communications roles at Chanel, Calvin Klein and Prada. — LISA LOCKWOOD STRIKE A POSE: It was a snap-happy frenzy at Fendi’s Avenue Montaigne store in Paris Monday evening as the label gathered fur-clad fans to celebrate its sunglasses collaboration with Thierry Lasry, complete with a Twitter Mirror for maximum social-media impact. Anna Cleveland, who appears in the ad campaign for the capsule collection, couldn’t wait to try on the colorful retro styles again. “Any chance to get them on, I will,” said the model, who has a preference for outsize eyewear. “It’s important Lovers + to have some color in life, Friends and these sunglasses do will unveil just that.” swimwear Also spotted at the for spring. cocktail party were Kris Jenner, Caroline Vreeland, Louis-Marie de Castelbajac, Silvia Fendi’s youngest daughter Leonetta Fendi, Miroslava Duma, South Korean model Irene Kim, the music duo comprising AaRON, Helena Bordon and blogger Kristina Bazan. When it came to the collaboration with Fendi, his first, Lasry dove deep. He scoured some 20,000 images from the company’s archives going back to 1966, looking not just at runway photos, but Karl Lagerfeld’s old mood boards, as well. His concept was to “bring art to the sunglasses because Fendi is very linked to art,” according the designer, who set about to custommaking patterns. Patterns are Lasry’s trademark, and he developed two different motifs in two silhouettes, working alongside Silvia Fendi. Contrasting colors are also Lasry’s specialty, and for the Fendi shades he combined navy blue, burgundy and yellow. The designer is already developing styles for spring 2016 for the Fendi and Thierry Lasry collection. — ROXANNE ROBINSON AND ALEX WYNNE POOL TIME: Los Angeles-based contemporary brand Lovers + Friends, cofounded in 2011 by Raissa Gerona and Mitch Moseley, is branching out with swimwear for spring. “It felt like the most natural new category to add to Lovers + Friends,” Gerona said of the launch. “We wanted the swim collection to be an extension of our main line by including vibrant prints, crochet and lace textiles and sexy bodies for every girl.” The 16 looks, which include onepieces and bandeau, halter and triangle bikini styles, come in colorful striped, tropical and python prints. Ranging from $62 to $160, the collection hits retail next month on the brand’s e-commerce site as well as Revolveclothing.com. — KRISTI GARCED FRAGRANCE BUFF: Responsible for fragrances like Estée Lauder Pleasures for Women, Ralph Lauren Safari for Men and Tommy by Tommy Hilfiger, Annie Buzantian, master perfumer at Firmenich will be honored as the perfumer of the year at The Fragrance Foundation Awards on June 17 at Alice Tully Hall at Lincoln Center. Along with Carlos Benaim of International Flavors and Fragrances and Alberto Morillas of Firmenich, Buzantian is the third perfumer to receive this award. MEMO PAD Dior’s “Secret Garden” video series is slated to feature Rihanna. The film and print campaign, shot this week by Steven Klein in Versailles, is scheduled to run this spring, Dior told WWD exclusively. The third installment has logged more than nine million views on Dior’s official YouTube channel, showcasing a trio of models whisking through the chateau and its vast grounds wearing an array of the French house’s fashions and leather goods. — MILES SOCHA CRESSIDA’S DANCE: Mulberry launches the first of three short films in its new digital stories series today, a dance project featuring British actress-model-aristocrat Cressida Bonas. To celebrate the brand’s spring collection, which, per tradition, was inspired by an English garden, set designer Michael Howells, choreographer Martin Joyce and up-and-coming director Ivana Bobic concocted a magical world inside an 18th-century Clerkenwell courthouse with copious amounts of grass, sunlight and mirrors. Set to ESG’s catchy “Dance” track, Bonas enters the house PHOTO BY UZO OLEH/COURTESY OF MULBERRY Cressida Bonas will appear in Mulberry’s digital stories series. wearing the Buttercup dress, and begins grooving her way up the stairs and into a mirrored room containing a handbag. “It was so much fun. I had a choreographed routine, but a lot of it Rihanna will appear in the fourth episode of Dior’s “Secret Garden.” was improvised because the music just makes you want to dance naturally,” said Bonas, who trained at the Trinity Laban Dance Conservatoire in London, and will make her feature film debut in “Tulip Fever” later this year. Bonas, the former girlfriend of Prince Harry, is the youngest daughter of Lady Mary-Gaye Curzon and has acted in several plays in London’s West End. “Cressida is such a natural on camera, and I always like to leave a little room for improvisation with any project,” Bobic said. The writer-director, who studied at Central Saint Martins and is working on an improvised thriller feature, said she’s embracing the digital world as a forum for exposure. “It’s amazing how many people around the world can see your work, although I am still a fan of old-fashioned film.” British actor Freddie Fox also has a cameo in the short, although he conceded, “Cres is the real star.” Although Bonas says she’s not much of a clotheshorse as she prefers long skirts and trainers, she is a fan of Mulberry’s handbags and offered, “I’d wear some of their longer dresses with trainers.” — MARCY MEDINA PHOTO BY KATIE JONES SECRET SERVICE: The fourth episode of REACH THE FASHION INDUSTRY’S TOP TALENT WWD CAREERS.COM PRINT & ONLINE PACKAGES AVAILABLE Contact Tiffany Windju at 310.484.2537 or [email protected] — JAYME CYK STO KEEP the laun in 2 acce dre coll rep said enc line arou wer met mak of th som The in b $225 like Blo bran Sep the hot, to a swe 12 WWD FRIDAY, MARCH 13, 2015 {Continued from page one} formerly president and chief executive officer of A|X Armani Exchange, as ceo. Krakoff hinted at restructuring at the opening of his Greene Street store during New York Fashion Week in February. Rather than hold a runway show or presentation, he said he would no longer be launching new designs in the typical industry format. He added that a secondary brand concept was in the works and that his current ready-to-wear model and brand ethos were under review. Krakoff launched his own label in 2010 while he was still working as executive creative director of Coach Inc., which provided initial financial backing of the endeavor and which he and then-chairman and ceo Lew Frankfort propelled into a multibillion-dollar juggernaut that became the leading accessories brand in the U.S. The Krakoff label’s first few rtw seasons received mixed reactions, with early reviews citing a “utilitarian, uniform aesthetic” and general “growing pains.” At times, his minimalis- Reed Krakoff tic designs were cited for overreferencing category kingpins like Helmut Lang and Céline. While rtw was never a critical success, Krakoff naturally found his stride in the accessories category, handbags in particular. Retailers such as Saks Fifth Avenue and Neiman Marcus quickly picked up his handbag offerings (both department stores carry the label and reported a steady performance). During this time, Krakoff In 2012, Krakoff received the award for Accessory Designer amassed a substantial celebof the Year from the Council of rity following, with fans includFashion Designers of America ing Julianne Moore, Allison for his own brand. “The idea Williams and Kyra Sedgwick, is really about a new luxury who frequently sat front row at which can mean a lot of different his runway shows. Arguably the things, but to me is always some- most notable of his followers was thing that’s about a combination First Lady Michelle Obama, who of design credibility, materials wore the designer on several and construction,” he told WWD high-profile occasions, includthat August in speaking of his ing on the cover of Vogue, in her company, adding: “The luxury second official White House pormarket is really competitive, and trait and at her husband’s secyou’re competing on design and ond swearing-in ceremony. But all the while, Krakoff ’s desire. That’s it. You really need brand appears to have to create something that peobeen plagued by retailing ple fall in love with.” woes. The company operKrakoff left Coach in ated a store in Tokyo’s April 2013 to focus on Aoyama neighborhood his namesake brand. while it was still Four months later, in under Coach Inc.’s August, he purchased Krakoff had purview, but that the label from the found his stride unit closed shortly leather goods megaat one time in after Krakoff and house in a buyout handbags. his investors took deal estimated at $50 control of the label. million. The designer In September, the designer told took the largest stake in the company, while Washington, WWD of his big retailing plans: D.C.-based entrepreneurs Mark “There are somewhere between Ein and Mitchell Rales and cer- 10 and 15 key cities where we tain funds managed by T. Rowe will begin to open stores. As those stores open, we’ll start Price also invested in the brand. looking at secondary locations.” At the time, he said a Paris location would open the following month, but it has yet to do so. In the past, Krakoff has also publicly alluded to plans for a Washington, D.C., store, which never materialized. Beyond the fashion world, Krakoff is widely known for his interest in the art world. In 2012, he created an installation of 99 chairs, titled “Reed Krakoff: One Chair” at Salon 94 in New York; in 2013, “Women in Art: Figures of Influence,” a coffee-table book of his black-and-white portraits, was published by Assouline. Krakoff ’s New York stores were laden with tailor-made art including pieces from Memphis Design Group co-founder Ettore Sottsass’ design firm Sottsass Associati. “I see myself in design, but I don’t see myself as a fashion designer,” Krakoff said at a 2014 luncheon where he was honored by the American Federation of Arts. “I have done that for 24 years, but I look at what I do as much more than creating a design, but creating an aesthetic… I guess in a way, I’m more of an auteur than a fashion designer.” Swatch Unveils Smartwatches Andretta Named tery as replacement. And the new Swatch range was far cheaper. “There are simpler solutions CORGÉMONT, Switzerland — Let that bring much more practical advantages to the customer,” he said. the smartwatch battle begin. Swatch Group on Thursday is- “We want to give consumers techsued its long-awaited response to nology at an accessible price.” Swatch has taken an extremely the new Apple Watch with a family of touchscreen “smart” timepieces focused — and niche — approach to aimed to appeal to a range of spe- its smartwatches. For example, the cialist interest groups. Starting with Swatch Touch Zero One, a sporty, the Swatch Touch Zero One, going rectangular wristwatch and perforon sale by the summer, the family mance tracking device, will focus on will launch with five models, each beach volleyball, with features that expected to sell between 500,000 to go down to measuring the calories 1 million units, predicted Swatch consumed in clapping. The watch will sell for 135 Swiss francs, or $134 chief executive officer Nick Hayek. In introducing Swatch’s own at current exchange — the same as smartwatch, Hayek took a jab at expected for the rest of the range. The Zero Two, due for the winter rival offerings — while praising season, is geared to skiers; the Zero Apple’s new version. Three, expected next spring, Speaking at the group’s will target surfers, and the annual media conference, Zero Four will appear in Hayek stressed Swatch time for next year’s Rio was not in the business of Olympic Games, of which producing slimmed down Swatch is a major sponsor. mobile phones, but rather, A fifth product, also due in extending the use and 2016, will feature special practicality of timepieces. The Swatch cooking applications. Each “We don’t do the reducTouch product will contain special tion of the mobile phone Zero One. sensors appropriate to its to the wrist. We’re not targeted audience. in consumer electronics. Initial reactions were posiOther people do that. We are a tive. “It’s a really interesting first watch company.” Asked specifically about the step,” said Jon Cox, watch analyst Apple Watch, which some analysts at Kepler Cheuvreux. “We just think will cut sales of conventional don’t know how the market will Swiss timepieces, Hayek heaped develop. But there’s room enough praise on the California-based to go around.” Hayek also raised the possibility company. “They did a very nice smartwatch if you compare it to that Swatch’s new watches — and Samsung, Sony and all the others.” many of the group’s existing meBut he argued Apple’s product chanical and electronic timepieces was an opportunity, not a threat, — could soon incorporate so-called given the growing tendency of young near field communications techpeople, especially in the U.S., not to nology — vastly broadening their wear watches at all. “It’s a fantastic functionality. That would stem from opportunity for us. Let Apple do the incorporating know-how from some of the group’s microelectronics and work: I congratulate them.” While not criticizing Apple, battery subsidiaries, which are Hayek emphasized the practical- among leaders in their fields. That ity of Swatch’s new products. They innovation would build on radiowould have a battery life of at least frequency identification technolnine months, probably a year, were ogy, used in stock tracking in retail waterproof and could have their and industry. Swatch’s original batteries changed by anyone, using Access watch — which could be a standard, low-priced Swatch bat- loaded with a ski pass — was proBy HAIG SIMONIAN duced more than a decade ago. The arrival now of broad industry standards has made NFC technology — and its incorporation in watches — more commercially appealing. The technology is being used wisely in contactless retail payments, but also has a vast range of potential other applications, which could be loaded via computer onto a suitably equipped watch. “It can be personalized and configured to your own needs,” the ceo said. Hayek said future group products could be made NFCcompatible for as little as an extra 2 Swiss francs, or $1.98, in manufacturing costs apiece. He hinted the new technology could be seen in products surprisingly soon. As a foretaste, he said Swatch Group had already reached agreement with China UnionPay, the Chinese payments operator, an unnamed Swiss bank, and a leading world credit card company. Hayek declined to name the latter, but said it was also a top Olympics sponsor — pointing inevitably to Visa. Also on Thursday, Hayek revealed group sales in the first two months of 2015 had been “excellent” despite disruption following the Swiss National Bank’s surprise abolition in January of its ceiling for the Swiss franc’s exchange rate against the euro. The move prompted a steep rise in the franc’s value against the euro, though the impact has been less severe against the dollar, pound sterling, and some other major currencies. “In local currencies, the Swatch Group sees very good results everywhere in the world. That is not only in terms of sales, also profits,” Hayek said. The upbeat trading news and new product announcements lifted Swatch shares by 2.35 percent to close at 430.80 Swiss francs, or $429.24 at current exchange, in trading on the Zurich Stock Exchange Thursday. “The outlook for Swatch Group in 2015 is excellent. It will be a very dynamic, a very good year,” he added. CEO of Mulberry By SAMANTHA CONTI LONDON — Shares in Mulberry Group edged down Thursday following the announcement that longtime luxury manager Thierry Andretta would take up the role of chief executive officer. Shares fell 0.4 percent to 8.57 pounds, or $12.88 at current exchange, on the London Stock Exchange after Mulberry said Andretta would start work on April 7, succeeding Godfrey Davis, the brand’s chairman who is serving as interim ceo. Mulberry, which has rebooted its strategy following a tumultuous period for the company under the former ceo Bruno Guillon, looked close to home for this latest appointment. Andretta, who was most recently ceo of the Italian jeweler Buccellati, was named an independent, non-executive director at Mulberry last year. Prior to Buccellati, he held top roles at Lanvin, Moschino, Kering and LVMH Moët Hennessy Louis Vuitton. More than a decade ago, Andretta served as ceo of the LVMH-owned Céline, which is also the former employer of Johnny Coca, Mulberry’s new creative director, who will take up his role in July 8. Davis will revert to his role as company chairman when Andretta takes over. Andretta, whose background is in luxury leather goods, pointed to Mulberry’s “unique manufacturing base in the U.K.,” located in Somerset, England, and said the brand has great international potential. Andretta will carry on Davis’ work over the past year to tweak Mulberry’s market positioning, reconnect with its core British female customer, and consolidate its recent moves into international markets. Guillon stepped down as ceo last March after two dramatic years at the company. His tenure was marred by a rapid and illfated move upmarket, multiple profit warnings, the resignation of creative director Emma Hill, and the collapse of the company’s share price. Since Guillon’s departure, Davis has lowered some key price points in order to woo back the core customer, who drifted away after Mulberry adopted a pricing structure that was too heavily focused on the high-end. There is now a wider spectrum of prices, and in December, Davis told WWD the company was seeing “an increase in the number of items bought.” The company said in the nine weeks to Nov. 29 retail revenue was up 8 percent. Over the past few years, Mulberry has also pushed further into international markets. It has opened a raft of new stores in North America, Europe and the Far East, and plans to cut the ribbon on a Paris flagship store in the spring, which will mark the end of its accelerated investment program. Mulberry is majority owned by Challice Ltd., a company controlled by Ong Beng Seng and Christina Ong. They own 56.2 percent, while the rest is listed on the AIM division of the London Stock Exchange. PHOTOS BY STEPHEN SULLIVAN Reed Krakoff Suspends Business, Seeks Investor

© Copyright 2026