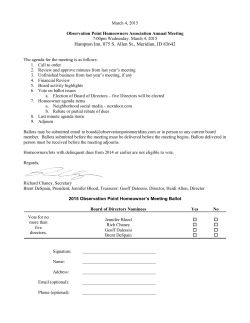

Annual Report and Accounts 2014