MORNING BUZZ

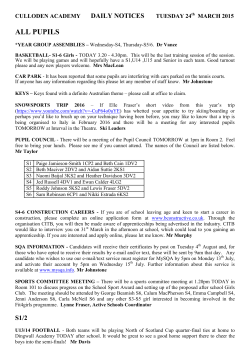

MORNING BUZZ 24 March 2015 Market Indicators Mkt. T/O (S$ mil) 19-Mar 20-Mar 23-Mar 1,189.4 1,554.7 969.6 Stock Advances 274 292 251 Stock Declines 266 220 231 Major Indices DJ Ind Avg 17,959.0 S & P 500 2,089.3 2,108.1 2,104.4 Nasdaq Comp 4,992.4 5,026.4 5,011.0 24,468.9 Hang Seng STI Index 18,127.7 18,116.0 Potential monetary easing by MAS on the cards The STI ended the first day of the week slightly lower (-0.07%) with a total traded value of S$957.6m, a decline of almost 40% compared to the previous trading session, where S$1,537.7m worth of shares were traded. Share price of Noble (+4.00%; S$0.910) surged after the company mentioned that it will start legal proceedings against Hong Kong resident Arnaud Vagner and Enlighten Ace Ltd for conspiracy to injure Noble through the series of reports published under Iceberg Research. 24,375.2 24,494.5 Singapore’s consumer prices fell 0.3% in February, registering a fourth consecutive month dip as a soft housing rental market and fall in private transport costs weighed on inflation. However, core inflation rose 1.3% on the back of stronger increase in food prices and services fees. The decline in headline inflation might prompt MAS to ease its monetary policy further during its policy review scheduled in April. A poll by Reuters showed that seven out of 11 analysts expect MAS to ease its monetary policy further. We expect SGD to weaken further should this happen. Banks (DBS +0.75%; OCBC +0.10%; UOB +0.44%) may benefit from the rise in SOR on the back of the weaker SGD. 3,410.13 (-0.07%) Source: Bloomberg Commodities Current % Chge Price from Close Gold (SPOT) US$ / OZ Oil (NYMEX CWTI|) US$ / bbl Baltic Dry Index 1,188.75 0.59% 47.23 3.69% 594.00 0.51% Exchange Rates Overnight, US markets (S&P -0.17%; DJIA -0.06%; Nasdaq -0.31%) also retreated on profit-taking after initially posting gains earlier in the session on the back of strong gains last week. The USD continued to weaken after US Fed Vice Chairman Stanley Fisher indicated that while an interest rate hike is expected this year, the path upwards will almost certainly not be smooth in anticipation of shocks such as volatility in oil prices. Such dovish expectations may continue to benefit S-REITs in the near term. (By Yuxuan He) Stocks to Watch Roxy-Pacific Holdings: Acquires 4.4ha land in Western Australia with JV partner for A$59mil USD : SGD 1.3681 / MYR : SGD 0.3728 Source: Bloomberg Rex International: Joint entity raises financing facility Loyz Energy: Raises S$14mil through share placement Interest Rates 3-mth Sibor 0.992% SGS (10 yr) 2.432% KGI Fraser Research Team Joel NG Renfred TAY Yuxuan HE [email protected] [email protected] [email protected] [email protected] +65 6231 2850 +65 6231 2630 +65 6231 2557 +65 6231 2389 Hong Wei WONG KGI Fraser Securities Pte. Ltd. PlePlease see important disclosures at the end of this publication MORNING BUZZ Roxy-Pacific Holdings (ROXY SP): Acquires 4.4ha land in Western Australia with JV partner for A$59mil Roxy-Pacific Holdings has, with its joint-venture (JV) partner Hostplus, acquired a 4.4-hectare land parcel in North Fremantle, Perth, Australia for A$59mil (S$63mil). Roxy NF, a subsidiary of Roxy-Pacific, will provide 40% of the equity for the acquisition. The remaining 60% will be provided by Hostplus, which is an Australia-based superannuation fund. The JV partners intend to rezone the industrial site - located next to the prime Leighton beach and a train station connected directly to Perth's central business district - for residential and commercial uses. Rex International (REXI SP): Joint entity raises financing facility Rex International Holding's jointly-controlled entity, Lime Petroleum Norway AS (Lime Norway), has secured an increase of its financing facility from 300mil Norwegian kroner (S$52mil) to 700mil kroner to fund its participation in its offshore exploration drilling programme this year. In addition to this financing facility, the shareholders of Lime Petroleum plc have made capital injections totalling approximately US$35mil in November 2013, January 2014 and March 2015, which were proportionate to their respective shareholding interests in Lime Petroleum plc, of which Lime Norway is a wholly-owned subsidiary. Loyz Energy (LOYZ SP): Raises S$14mil through share placement Loyz Energy has placed out about S$14mil worth of new shares at an issue price of 9.5 Singapore cents apiece. The 146,951,000 new shares represent approximately 34.6% and 25.7% of the existing and enlarged issued and paid-up share capital of the company, respectively. Loyz Energy said that the placement is meant to raise funds to improve the company's financial position as well as bolster its general corporate requirements. Source: The Business Times / Bloomberg / Straits Times KGI Fraser Securities Pte. Ltd. 2 MORNING BUZZ Apendix 1: Corporate Action Dividends Company Results Period Ann Date Payable Share Price 23-Mar-15 Yield (%) Ex-Date Book Close 19-Ja n-15 FY14 SGD 0.119000 17-Apr-15 21-Apr-15 30-Apr-15 SGD 3.790 3.1 Grea t Ea s tern Hl dgs 6-Feb-15 FY14 SGD 0.400000 21-Apr-15 23-Apr-15 7-Ma y-15 SGD 25.160 1.6 Grea t Ea s tern Hl dgs - Speci a l 6-Feb-15 FY14 SGD 0.050000 21-Apr-15 23-Apr-15 7-Ma y-15 SGD 25.160 0.2 Keppel Corp 23-Ja n-15 FY14 SGD 0.360000 22-Apr-15 24-Apr-15 6-Ma y-15 SGD 8.860 4.1 Keppel Tel ecoms & Tpt 20-Ja n-15 FY14 SGD 0.035000 22-Apr-15 24-Apr-15 5-Ma y-15 SGD 1.800 1.9 Keppel Tel ecoms & Tpt - Speci a l 20-Ja n-15 FY14 SGD 0.115000 22-Apr-15 24-Apr-15 5-Ma y-15 SGD 1.800 6.4 Sembcorp Indus tri es 17-Feb-15 FY14 SGD 0.110000 23-Apr-15 27-Apr-15 18-Ma y-15 SGD 4.280 2.6 Ex-Date Book Close M1 DPS Rights & Bonus Issues Company Rights Issue Chi na Fi s hery Group 4 Rts Sha res @ S$0.173 ea ch Rts sha re for every 5 exi s ti ng s ha res hel d 31-Ma r-15 GKE Corp 2 Rts Sha re @ S$0.07 ea ch Rts sha re for every 5 exi s ti ng ord sha res hel d Ma nda ri n Ori enta l Int'l 1 Sha re @ US$1.26 ea ch s hare for every 4 exi s ti ng s ha res hel d Rights Trading Period From To 2-Apr-15 8-Apr-15 16-Apr-15 23-Ma r-15 25-Ma r-15 30-Mar-15 8-Apr-15 9-Ma r-15 11-Ma r-15 17-Mar-15 30-Mar-15 Source: SGX Annoucement Buyout Company Offer Price Remarks Closing Date Offeror Keppel La nd * SGD 4.38 Ca s h 5.30 p.m. on 26 Ma r 2015 Keppel Corpora ti on Ltd Uni ted Envi rotech SGD 1.65 Ca s h 5.30 p.m. on 16 Apr 2014 CKM (Ca yma n) Compa ny Ltd Source: SGX Annoucement Keppel Land: A Base Offer Price of SGD 4.38 in cash for each Offer Share. A higher Offer Price of SGD 4.60 in cash, if KCL is able to reach the Compulsory Acquisition Threshold. KGI Fraser Securities Pte. Ltd. MORNING BUZZ Apendix 2: Financial Calendar Monday Tuesday 23-Mar Wednesday Thursday 24-Mar SG (Feb 2015): CPI 25-Mar 1-Apr-15 31-Mar Q2: Second Chance Properties Q4: China Sky Chemical *Q4: Blue Sky Power / Tan Chong int'l *Q4: Alibaba Pictures 26-Mar 27-Mar SG (Feb 2015): Index of Industrial Production *Q4: Shangri-La Asia 30-Mar Friday 2-Apr 3-Apr Good Friday 6-Apr 7-Apr 8-Apr 9-Apr 10-Apr 15-Apr 16-Apr 17-Apr *Q2: EMAS Offshore 13-Apr 14-Apr SG: 1Q15 Advance GDP Estimates (Not later than 14 Apr) 20-Apr 21-Apr Q4: Mapletree Industrial Trust SG: Prices of Private Residential Units Sold by Developers 22-Apr 23-Apr SG (Mar 2015): CPI Q1: China Aviation Oil * Tentative Source: Company; Bloomberg KGI Fraser Securities Pte. Ltd. 24-Apr SG (Mar 2015): Index of Industrial Production SG: 1Q15 Real Estate Statistics MORNING BUZZ Disclaimer This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an advice or a recommendation with respect to such securities. This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient hereof. You should independently evaluate particular investments and consult an independent financial adviser before dealing in any securities mentioned in this report. This report is confidential. This report may not be published, circulated, reproduced or distributed and/or redistributed in whole or in part by any recipient of this report to any other person without the prior written consent of KGI Fraser. This report is not intended for distribution and/or redistribution, publication to or use by any person in any jurisdiction outside Singapore or any other jurisdiction as KGI Fraser may determine in its absolute discretion, where the distribution, publication or use of this report would be contrary to applicable law or would subject KGI Fraser and its connected persons (as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any registration, licensing or other requirements within such jurisdiction. The information or views in the report (“Information”) has been obtained or derived from sources believed by KGI Fraser to be reliable. However, KGI Fraser makes no representation as to the accuracy or completeness of such sources or the Information and KGI Fraser accepts no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. KGI Fraser and its connected persons may have issued other reports expressing views different from the Information and all views expressed in all reports of KGI Fraser and its connected persons are subject to change without notice. KGI Fraser reserves the right to act upon or use the Information at any time, including before its publication herein. Except as otherwise indicated below, (1) KGI Fraser, its connected persons and its officers, employees and representatives may, to the extent permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit business from, the subject corporation(s) referred to in this report; (2) KGI Fraser, its connected persons and its officers, employees and representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business from, other persons in respect of dealings in the securities referred to in this report or other investments related thereto; and (3) the officers, employees and representatives of KGI Fraser may also serve on the board of directors or in trustee positions with the subject corporation(s) referred to in this report. (All of the foregoing is hereafter referred to as the “Subject Business”.) However, as of the date of this report, neither KGI Fraser nor its representative(s) who produced this report (each a “research analyst”), has any proprietary position or material interest in, and KGI Fraser does not make any market in, the securities which are recommended in this report. Each research analyst of KGI Fraser who produced this report hereby certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of KGI Fraser or any other person, any of the Subject Business involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any sales, trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the compensation received by each such research analyst is based upon various factors, including KGI Fraser’s total revenues, a portion of which are generated from KGI Fraser’s business of dealing in securities. Copyright 2015. KGI Fraser Securities Pte. Ltd. All rights reserved. KGI Fraser Securities Pte. Ltd.

© Copyright 2026