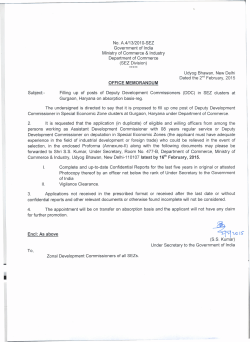

CSR Volume-I Part-II - Finance Department, Haryana