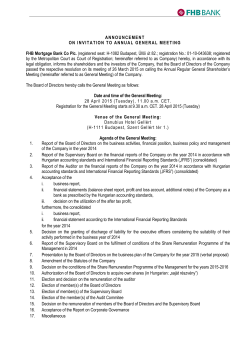

Creating sustainable value