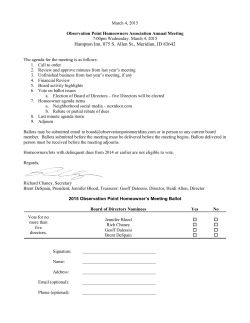

annual report of the board of directors in respect of the