Member News - Quay Credit Union

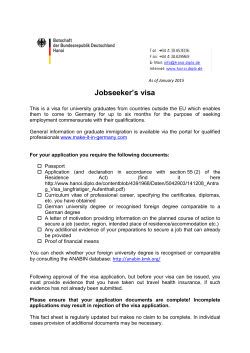

Member News April 2015 CEO’s Message 2. Our new smartphone app is still in the development phase. We are working on building the content and pages for the app. 3. payWave is now available on all new and renewal Visa Debit cards issued from April onwards. Welcome to our second edition of Member News for 2015. It has been a busy couple of months since our first edition in 2015, we have a number of initiatives that we would like to share with you. 1. Firstly, following the recent RBA announcement, we reduced the interest rate on our variable rate home loan by 0.25% effective 1 March 2015. 4. Interest rates on our Visa Credit card will be slashed to 7.99% pa (from 10.99% pa.) effective 1 May 2015. For more information, please see page 3. We will continue to improve our website and launch new products and services to help you manage your banking better. If you would like more information please contact us on 1300 426 728. Kind Regards Anthony Wamsteker CEO, Quay Credit Union All about Visa payWave Visa payWave is considered “contactless,” which means your card does not need to come into contact with the merchant’s terminal in order to process the transaction. With Visa payWave, you simply wave (hold) your card in front of a secure reader instead of swiping it. Nothing else about the transaction process changes; the purchase is authorised, processed and debited from your banking account the same way “chipped” transactions are today. Visa payWave allows you to pay quickly and conveniently in participating stores for purchases under $100. Please note: $300 daily limit applies. Is Visa payWave secure? Visa payWave cards are just as secure as any other Visa chip card and carry the same multiple layers of security protection, including Visa’s Zero Liability*. *Visa’s Zero Liability policy covers Australian and New Zealand-issued cards and does not apply to ATM transactions, transactions not processed by Visa or certain commercial card transactions. What if I do not want Visa payWave? That is fine. Please contact us to advise that you do not want Visa payWave so we can deactivate the facility. For further information on Visa payWave please contact us on 1300 426 728 Contact Details Member Service: 1300 426 728 | Fax: (02) 9237 6750 | Email: [email protected] Web: quaycu.com.au | Mail: Reply Paid 313, Royal Exchange NSW 1224 (no stamp required) Tips for Creating Good Savings Habits Track Your Expenses Tracking your expenses will provide you valuable information on where you spend your money. Based on that information, you will be able to analyse your costs and make decisions on where you can make further savings. Prepare a Budget Good savings habits are key to creating financial stability and financial independence. Here are our tips to developing good savings habits. Set a Goal Having a goal will give you a reason to save money. Start with one goal and work towards achieving that. Ask yourself: ff ff ff ff What do you want? Do you want to have your own place? Do you want to be financially independent? Do you want to get out of debt? Set a Deadline Set a date by which you want your goal achieved. Having a deadline will motivate you to find ways to save money as you are working towards your goal. Planning and monitoring your budget will help you identify wasteful expenditures and adapt quickly as your financial situation changes. Creating and sticking to a budget will decrease your stress levels because, with a budget, there are no surprises. Pay Yourself First Before you pay your bills, before you buy groceries, before you do anything else, set aside a portion of your income to save. When you pay yourself first, you are establishing saving as a priority which encourages sound financial habits. By paying yourself first you are building a nest egg, a buffer for emergencies and financial opportunities down the track. Think Saving If you have money left at the end of the month, save it. You don’t need to spend every cent earned. It’s okay to buy things. But make sure you really need them — don’t spend just for the sake of spending. Saving money can be very rewarding especially when you reach your savings goals and enjoy that holiday, that new car or home that you were saving for. We are slashing interest rates on our Visa Credit card From 1 May 2015, interest rates on our Visa Credit Card will be slashed to 7.99% p.a for purchases and cash advances, and 0% for balance transfers for the first 6 months. Our Visa Credit card provides you worldwide access, secure online shopping and the ability to pay bills over the phone. V000HC VOID A 66 VOID With a great low rate and up to 55 days interest free on purchases, $0 annual fee for the first year*, Visa payWave and special offers from Visa Entertainment, our Visa Credit card can take you anywhere. EAR MONTH/Y 4624 MONTH/YEAR VALID FROM Our Visa Credit card can take you anywhere.. To apply online, visit www.quaycu.com.au or call us today on 1300 426 728. *$36 annual fee year two onwards. Eligibility criteria, terms and conditions, fees and charges apply. GOOD THRU Project Client Quay CU on Descripti ns d desig Visa car Beware of Scams Scams are all over the internet and scammers know all kinds of tricks to get you to hand over your money. Our 10 Tips to Protect Yourself 1. Watch out for scams – scammers target you anytime and anywhere. 2. Don’t respond – ignore suspicious emails, letters, phone calls or SMS messages – just don’t get involved. 3. Don’t agree to an offer straight away – do your research and seek advice if it involves money, time and commitment and get the offer in writing. In this edition we feature two scams and some practical things you can do to protect yourself. Money Transfer With the rise of internet and mobile banking it is now easy to transfer money online. Unfortunately this has also meant an increase in the number and types of scams that try to trick you into sending your money to scammers. Usually you will be asked to transfer money for somebody using your own bank account or a bank account that you set up for this purpose. Once you send money to someone it can be hard to get back – especially if they are overseas. In most cases, you may find yourself being recruited as a money mule. Also don’t be fooled by an email saying you have inherited a large sum of money from a long lost relative – and that you need to pay some fees to claim the inheritance. Job & Employment Scams These scams involve offers to work from home or set up and invest in a ‘business opportunity’. Scammers promise a job, high salary or large investment return following initial upfront payments. These payments may be for a ‘business plan’, training course or software. Some offers may be a cover for money laundering where you are asked to alternatively receive payments and pass them onto a foreign company for a commission. These are all scams and are often promoted through spam email or online advertisements. 4. Ask yourself who you’re really dealing with – scammers pose as people or oganisations that you know and trust. 5. Don’t let scammers push your buttons - do not let anyone pressure you into making decisions about money or investments: always get independent financial advice. 6. Keep your computer secure – update your firewall, anti-virus and anti-spyware software. 7. Only pay online using a secure payment service – look for a URL starting with ‘https’ and a closed padlock symbol. 8. Never send money to someone you don’t know and trust – it’s almost impossible to recover money from a scammer. 9. Protect your identity – keep your personal details private, never send your personal, credit card or online account details by email. 10.Spread the word – if you have spotted a scam, tell your family, friends and report it to SCAMwatch – www.scamwatchgov.au. Membership Education Series The minimum monthly balance is the lowest balance held in each account anytime throughout the month. When members move money between accounts, we take the lowest balance of each account not the overall balance. Example: John has 3 savings accounts with us Account What is a Membership Fee and How Does it Work? Our focus is on providing value to our members through competitive interest rates, personalised service and a fee structure that is based on mutual support. When members use our services soley for transacting, it comes at a high cost and reduces our ability to provide benefits that our ‘supporting members’ deserve. To ensure a fair system is in place, a monthly membership fee is levied on those that do not meet our ‘supporting member’ criteria. What is a supporting member? A supporting member is a member that holds at least one of the following relationships with us:ff Loan account ff Term deposit ff Savings balance over $1,000* Minimum balance Date of minimum balance RediAccess $45.80 20 March Special Saver $362.20 28 March Bonus Saver $115.45 11 March Combined minimum monthly balance $523.45 John will be required to pay the $5 Membership Fee for March. Membership Fee Member Classification Fee per Month Supporting Member Nil Members – under 21 years Nil Members – less than 3 months Nil Other members $5 The Membership Fee will be automatically deducted from your savings account for the month. *Based on the combined minimum monthly balance of each savings account held in a member’s name (joint accounts included). Further information can be found in our “Fees & Charges” Brochure available on our website or for a copy please call us on 1300 426 728. Nelune at the Races The day included a luncheon, beverages and all the excitement of racing. The Nelune Foundation held a fundraising event at Royal Randwick in February 2015. The Nelune Foundation is a not-for-profit charity that supports children, adults and their families to cope with the impact of cancer by providing emotional support, care and post-operative medical aids that are not covered by government or private funding. The Nelune Foundation was co-founded 14 years ago by two friends, Nelune Rajapakse OAM and Anna Guillan. Nelune is a cancer survivor who knows and understands the difficulties diagnosed with this illness. The Apollo Cup Race Day was attended by Nelune staff, Quay Credit Union staff and directors with all proceeds supporting the establishment of the Nelune Comprehensive Cancer Centre (an integrated centre of cancer care) to be located at the Prince of Wales Campus, Randwick. For more information on the foundation please go to their website www.thenelunefoundation.org Important Notices All products are issued by Quay Credit Union Ltd ACN 087 649 723 AFSL 236856 Australian credit licence 236856 unless otherwise noted. All deposits held with Quay Credit Union are backed by the Australian Federal Government Deposit Guarantee up to $250,000 per depositor. This information has been prepared without taking into account your objectives, financial situation or needs. You should consider the Conditions of Use in deciding whether to take up a product or service. All information contained in this newsletter is correct at the time of printing and subject to change without notice. Fees and charges may apply. Standard credit assessment criteria apply and all loans are subject to approval. Terms and conditions available on request.

© Copyright 2026