CITY OF BELLEVILLE Jeff Shortt Development Technologist

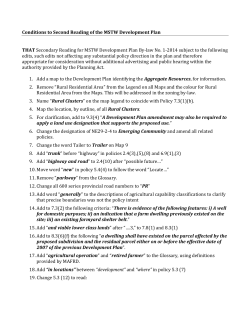

APPROVAL BLOCK CAO _________ DE&DS _________ DF _________ CITY OF BELLEVILLE Jeff Shortt Development Technologist Engineering and Development Services Department Report No. APS-2015-7 March 23, 2015 To: Mayor and Members of Council Subject: Amendment to Development Charges By-Law Conversion from an Industrial Use Recommendation: “THAT a By-law to amend By-law Number 2014-140 (Development Charges), to establish a development charge credit for the conversion of an existing industrial building to a non-industrial use, be prepared for Council’s consideration.” Strategic Plan Alignment: The City of Belleville’s Strategic Plan identifies nine strategic themes. The recommendation within this report aligns with one of the City’s strategic themes. The strategic theme “Industrial and Commercial Development” and the City’s strategic objectives to “Ensure suitable serviced employment lands are available to meet the needs of all potential industrial and commercial investments” and “Encourage remediation and redevelopment of underutilized lands”. The amendment to By-law 2014-140 will help stimulate investment in underutilized industrial lands and ensure suitable serviced employment lands are available for all potential residential and commercial investments. Background: As shown on APPENDIX 1 attached, in Schedule ‘B’ of the City’s current Development Charge By-law (2014-140), any new or proposed building identified as industrial is exempt from development charges. This exemption was enacted to encourage potential industrial investors to develop in our community. As a result, if a developer builds a new industrial building in Belleville no development charges are paid. This is a savings of $4.19 per square foot of gross floor area. When a building is redeveloped and converted from one type of land use to another type of land use, the City’s Development Charge By-law allows a credit for both residential and non-residential conversions. APS-2015-7 2 March 23, 2015 Background: (cont’d) For example, if a developer converts a commercial building into a residential building the developer receives a development charge credit for the amount of commercial floor space that is converted into dwelling units. However, this credit shall not exceed the amount of the development charge that would otherwise be payable. In other words, no refund is given. Due to the aforementioned exemption of development charges for an industrial use a clause was included in the Development Charge By-law that states “no credit is available if the existing land use is exempt under this by-law”. Consequently, as currently written, if an existing industrial building is converted to a commercial use there is no credit given for the previous industrial use. Therefore the developer has to pay the full development cost of the new commercial space which can be cost prohibitive to the redevelopment project and has proven to be a hindrance for potential investors trying to redevelop underutilized industrial lands. As an example, if it was proposed to convert a 20,000 ft 2 industrial building, such as a warehouse, into a 20,000 ft2 commercial use, such as a retail store, $83,800 in development charges would have to be paid. Analysis: Under the current provisions of the City’s Development Charge By-law, properties with an existing industrial use do not meet the requirements of the Bylaw to be eligible for a credit during redevelopment. Denying a credit for redevelopment of underutilized industrial lands does not align with The City of Belleville’s Strategic Plan to “Encourage remediation and redevelopment of underutilized lands”. Development charges exist to offset the costs of growth to the existing community, to ensure that growth carries the responsibility for paying its own way, and does not place an undue financial burden on the existing community. A change in use of an existing building would have a minimal effect on the growth related impacts on the existing community. The City’s current Development Charge By-law provides a disincentive to the reuse or rehabilitation of existing industrial buildings and properties. It is neither in the owners or City’s best interest to have an inventory of vacant industrial buildings. The reuse or repurposing of an industrial building creates economic benefits. APS-2015-7 3 March 23, 2015 Analysis: (cont’d) If a development charge credit for industrial conversions is to be considered it is important that this credit provision is not subject to misuse. Such a scenario could occur where a building permit is issued for a new industrial building and no development charges were paid. However, by the time the building was ready to be occupied, the builder could change plans and decide to open a commercial building without having paid development charges. Therefore it is suggested that any credit for the conversion or reuse or redevelopment of an industrial building only be provided for an industrial building that has existed for at least 5 years. Financial Impact: Should Council determine that a change of use for an industrial building is eligible for a development charges credit, the City would forego a collection of development charges. This amount would be calculated on a case by case basis by multiplying the “Other than Industrial” development charge, currently set at $4.19 per square foot in Schedule “B” of the Development Charge By-Law, by the gross floor area that has been or will be converted to another principal use. The growth-related projects that these funds would normally be used to pay for would subsequently become the responsibility of the general taxpayer to pay for. Respectfully submitted. ____________________________ Jeff Shortt JS/JS APS-2015-7 4 March 23, 2015 APPENDIX 1

© Copyright 2026