Putting-the-Flow-Back-in-Cashflow_FifoCapital

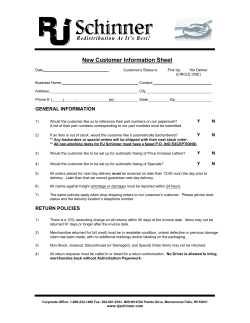

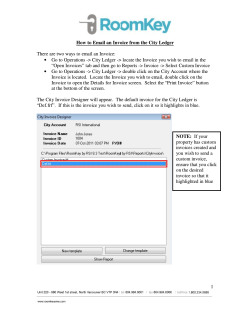

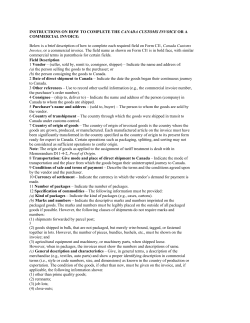

Funding Connector – Sydney Flexible Funding for High Growth Presenter: Lachlan Handley Fifo Capital Cash is king ! Cashflow is key for all businesses ! Rapid growth can o>en mean an increase in expenses (product dev, BD, supplies, wages, rent, tax etc) ! You may even be profitable from a P&L perspecJve ! But cash is different to profitability ! We’ve all heard the sayings: -‐ Cashflow is the lifeblood of every business -‐ A sale is not a sale unJl you’ve collected the cash Cashflow -‐ the lifeblood of every business Source: Dun & Bradstreet Business Expectations Survey, Q2 2015 What are the typical funding opJons for SME’s: TradiJonal sources of finance ! Credit card ! Overdra> ! Loans from family members ! Trade and equipment finance What does the bank look for? CharacterisJcs the bank is looking for: ! ! ! ! ! ! ! Profitable and can service the loan Property security (home or business premises) Trading history of at least 2 years Creditworthiness and lack of adverse reports Tax up to date Capable management Usually operates in the “right” industry So … Bank finance is ideal if: ! You have property security ! Have been in business for at least 2 years ! Are looking for a medium to long term funding opJon What challenges do small businesses face? ! ! ! ! ! ! ! ! NegaJve equity Possibly no property security or security fully uJlised May have been operaJng less that 2 years Lack of presentable financials and forecasts Credit issues ATO debts or ATO payment plan Lumpy, seasonal or rapidly growing sales Industry? Outcome… 1. Businesses that need funding LESS are more than likely to get it. 2. Businesses that need funding MORE are less likely to have access to it. ! MOST SME businesses fall into category 2 at some stage ! What are some alternaJves to tradiJonal bank finance? The “bricks & mortar trap” 500,000 450,000 Cash need 400,000 350,000 300,000 Overdra@ 250,000 200,000 150,000 100,000 50,000 0 Year 1 Year 2 Year 3 Year 4 Cash Flow Finance in focus Also known as……. ! Invoice DiscounJng ! Invoice Finance ! Factoring ! Debtor Finance ! Receivables Funding ! Cashflow finance What the financier is looking for ! Business to business sales (not B2C) ! Credit terms ! The good / service has been fully delivered ! Your credit worthiness important ! But more so looking at the creditworthiness of your customer Debtor Finance Turnover – a $63bn industry! (A$ in millions) 63,157 70,000 CAGR 13% 60,000 50,000 40,000 30,000 20,000 12,863 10,000 Source: Debtor & Invoice Finance Association 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 How it works Funder Client Customer 1. Sells product 1. Client provides goods or service to their customers and invoices them 2. Copy invoice 2. Invoice details are sent to the funder 3. Advance funds 3. Funder makes available up to 80 – 90% of the value of the invoice (s) 4. Customer pays invoice(s) to funder 4. Payment to funder 5. Funder then repays the balance of the moneys less charges 5. Surplus funds Worked example Example Invoice for completed work $100,000 Payment to you by financier (80% x invoice value) $80,000 Debtor later pays the $100,000 invoice: Invoice discount fee (5% x $100,000) Residual payment to you Total amount received by you $5,000 $15,000 $95,000 Key benefits of cash flow finance ! Immediate working capital injecJon ! ApplicaJon turned around faster than a typical bank loan ! Converts debtors to cash (A/c Receivable usually the biggest asset) ! Not debt on the balance sheet (replaces Ac/Rec with cash) Key benefits of cash flow finance ! Property not required as security ! Greater buying power, early payment discount ! Negates the need to offer customers discounts and rebates (which o>en become perpetual) ! Facility increases as the client grows (contrast typical overdra>) The “bricks & mortar trap” -‐ solved 700,000 Debtors 600,000 Debtor Finance 500,000 Cash need 400,000 300,000 Overdra@ 200,000 100,000 0 Year 1 Year 2 Year 3 Year 4 Broadly 2 different facilities: 1. Whole of ledger / turnover / book facility 2. Spot / selecJve facility 1. Whole of ledger facility ! Finance enJre debtor ledger (i.e. all your invoices) ! Minimum turnover requirements, facility size and fee ! 12 month contract ! Fees – generally 1-‐2% of turnover, 8-‐12% on drawn funds, some establishment fees, audits ! Suitable if you need to fund a high proporJon of your invoices each month 2. Spot factoring facility ! ! ! ! ! ! ! ! Can finance a single invoice Only use (and pay for) the facility when needed Low minimum invoice size, typically $10,000 Not locked in to a contract No property security Fees – generally a discount fee of ~5% Suitable if need for the short term High value low volume ledgers work best Spot v Whole of ledger Whole of Ledger Factoring business and Banks (e.g. GE, NAB, Westpac, Bibby, Scottish Pacific) Invoice Value $10k $200k+ Niche providers (e.g. Fifo Capital) Single Invoice Invoice Amount $400k+++ Industries well suited to Cash Flow Finance ! ! ! ! ! ! ! ! ! ! Light manufacturing Wholesalers / Importers Transport & LogisJcs Earthworks ConstrucJon Professional services Mining services Recruiters / labour hire IT MarkeJng & media Using Cash Flow Finance to Secure a Future Business Loan ! As menJoned, factoring your receivables is usually faster than a bank loan and the financier is more interested in the credit worthiness of your customers. ! Once you qualify for cash flow finance you now have the funds available to maintain growth, pay bills on Jme, pay tax, hire more staff etc. ! Banks love to see trading history, profits and that tax is being paid. ! Over Jme you will develop a good trading history (hopefully) with a strong case to present to the bank if you decide to apply for an overdra>. Case study 1 ! Client had a blue / yellow collar labour hire business ! Small bank overdra> but quickly exhausted due to rapid growth ! Requirement to pay his staff weekly ! His payment terms 14 days so cash flow stress from carrying 2 x weeks wages bill ! Then started picking up larger clients who refused 14 days terms, demanded 30 days end of month terms ! Rather than turn away the business, Fifo able to fund just the longer term debtors Case study 2 ! Wine importer supplying large naJonal grocery chain ! Payment terms 90 days end of month ! His supplier offers 45 day terms from when shipment leaves overseas ! Product selling well and more orders coming in ! Cash flow squeeze as cash required to pay supplier, shipping company, freight, insurance, tax etc before payment received from customer ! Invoice finance facility bridged the cash flow gap and funded growth Contact details Lachlan Handley Ella Bryan Fifo Capital - NSW Fifo Capital - NSW P: (02) 9925 3960 P: 1300 784 770 M: 0417 061 341 M: 0408 291 550 E: [email protected] E: [email protected] W: www.fifocapital.com W: www.fifocapital.com

© Copyright 2026