Client Friendly - BMO Capital Markets

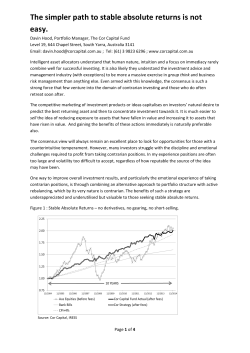

Initial Public Offering May 2015 $10 per unit (initial NAV $10) Target Yield 6.0% This note should be read in conjunction with the prospectus dated May 28, 2015. Capitalized terms used herein and not otherwise defined have the meanings ascribed to them in the prospectus. The information contained herein, while obtained from sources that we believe to be reliable, is not guaranteed as to its accuracy or completeness. This note is for information only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. Some components of this document may express the Manager’s opinions and beliefs. OVERVIEW Income: Attractive 6% target distribution Low Volatility: Diversified portfolio of U.S. dividend-paying, low current volatility stocks Growth: Capital appreciation potential through participation in U.S. economic recovery INVESTMENT HIGHLIGHTS Investor-Friendly Structure Why Invest in the U.S.? $10.00 initial NAV: Caldwell Investment Management will pay all upfront commissions and expenses of the offering No deferred sales charges; annual redemptions at NAV beginning in 2018 Manager believes the U.S. economy is benefiting from a virtuous cycle with heightened consumer demand stimulating U.S. corporate sales and accelerating overall economic growth Quantitative + Qualitative Investment Process Qualitative fundamental analysis augmented with quantitative model to form robust investment decision-making process Rising wages and disposable income Quantitative model designed to assess the health of equity markets and identify top dividend-paying, least volatile securities with strong financial variables Companies deploy record cash on fixed investment to meet demand Fundamental approach to security selection applies qualitative analysis and further assesses merits of individual securities identified by quantitative model Cycle high U.S. Consumer Confidence Active Risk Management Overlay Quantitative model designed to steer portfolio away from most volatile and uncertain sectors of the economy and reduce equity exposure ahead of market downturns Surge in consumers demand U.S. corporate sales accelerate Risk committee seeks to insulate portfolio against anticipated market declines and takes steps with Manager to preserve capital Why Low Current Volatility, Dividend-Paying Stocks? S&P Low Volatility High Dividend Index vs S&P500 200 203.6% S&P 500 Low Volatility High Dividend Index S&P500 86.2% % Total Return 150 100 117.5% 50 0 Source: Bloomberg (as of April 8, 2015) -50 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 Securities that exhibit low volatility tend to experience smaller price movements in declining markets which considerably enhances compounded returns over time Commitment to regularly pay and grow dividends imposes a discipline on management teams who must manage cash flow and be more selective in pursuing opportunities Well-managed dividend-paying issuers that exhibit low current volatility, strong balance sheets and growth prospects will continue to benefit from increasing investor demand for yield INDICATIVE PORTFOLIO Indicative Top 10 Holdings Dividend Yield Market Cap (millions US$) Verizon Communications Inc. 4.45% 202,490 Telecommunications The Coca-Cola Corp. 3.24% 179,850 Consumer Discretionary McDonald's Corp. 3.55% 92,536 Consumer Discretionary Blackstone Group LP 6.12% 47,424 Asset Management Paychex Inc. 3.09% 17,874 Macquarie Infrastructure Company 4.98% 6,316 AGL Resources 4.08% 5,983 Utility Ares Capital Corp. 9.16% 5,434 Mid Market Lender Security Name Sector Technology Infrastructure Tupperware Inc 3.91% 3,464 Consumer Discretionary Apollo Commercial Real Estate 10.19% 1,013 Mortgage REITs Asset Management 4% Telecom 6% Consumer Discretionary Consumer 16% Staples 4% Diversified REITs 11% Technology 4% Mortgage REITs 4% Health Care 5% Industrials 2% Utilities 11% Media Advertising 4% Infrastructure 4% Industrial REITs 7% Mid Market Lender 18% (1) As at April 8, 2015 (2) Annualized dividend yield calculated based on most recently announced dividend (before estimated 15% withholding tax) and the share price as at April 8, 2015. Dividend yield is the ratio that shows the amount paid out by an issuer in dividends each year relative to its share price as at a particular date. CALDWELL INVESTMENT MANAGEMENT Established in 1980, Caldwell has over 30 years of experience providing full service investment management and advisory services to individual and institutional investors and has assets under management and administration of approximately $1 billion Management Team From left to right: John Paul Jeffrey, Capital Markets Risk Strategist and Associate Portfolio Manager, Jennifer Radman, VP, Head of North American Equities and Senior Portfolio Manager, Richard Faiella, Senior Vice President and Portfolio Manager, James Thorne, Chief Capital Market Strategist and Senior Portfolio Manager, Robert Callander, VP and Portfolio Manager, Thomas Caldwell, Founder, Chairman and Director, John Kinsey, VP and Portfolio Manager, Mario Mainelli, Associate Portfolio Manager, Brendan Caldwell, Chief Executive Officer, President, Chief Investment Officer and Director Lead Portfolio Manager James E. Thorne, Ph. D., Chief Capital Market Strategist and Senior Portfolio Manager Over 20 years of investment management experience Former Chief Investment Officer, Equities of M&T Bank, responsible for approx. $23 billion in assets Managed top-quartile performing investment strategies using quantitative and qualitative analysis Developed proprietary risk management processes as CIO, Equities of M&T Bank Founding Partner Thomas Caldwell, Founder, Chairman and Director 50 years of investment industry experience Inducted into the IIAC Investment Industry Hall of Fame in 2014 Past Governor of the Toronto Stock Exchange

© Copyright 2026