A simple game modeling the effects of wireless roaming charges

A simple game modeling the effects of wireless roaming charges George Kesidis CSE and EE The Pennsylvania State University [email protected] in collaboration with D. Mercer, C. Griffin, S. Fdida Acknowledgements: Thanks to Dr. Ashraf Al Daoud of Telus Canada for preliminary discussions. This research was supported by NSF CNS grant 1116626. 1 / 27 Introduction I To reduce the cost of cellular wireless subscription plans, some governments are interested in promoting competition in this marketplace. I When under the control of incumbent access providers, excessive roaming charges are a barrier to marketplace entry. I So, regulation of roaming charges is under consideration. I Note: incumbents have complained that they are required to maintain comprehensive coverage domains but entrants typically target only the most profitable urban deployments, I while entrants allege unnecessarily high subscription costs and price-fixing by the incumbents. 2 / 27 Introduction - a regulator’s perspective I It’s often the case that a regulator has to weigh arguments based on detailed numerical studies of complex communication-network operations leveraging proprietary “real-world” data, I e.g., estimating sensitivities of different aspects of wireless-access markets to roaming charges. I Also, entrants often have little or no “real-world” data to inform detailed market models on which to base their arguments, and allege that their opponents’ arguments are biased. So regulatory proceedings may value parsimonious (though not completely trivial) models I I I yielding closed-form expressions, or numerical computations easily verfied by third parties, of the quantities of interest, in terms of quantities easily measured/verified from the marketplace. 3 / 27 Introduction - model assumptions I We consider two competing cellular wireless access providers, indexed 1 and 2, that serve overlapping areas. I The coverage lapses of the entrant 2 can be accommodated by incumbent 1, but not vice versa, I i.e., the entrant 2 has much less deployed infrastructure than incumbent 1. I Rather than the entrant offering a subscription rate that’s simply that of the incumbent’s but discounted, I we assume that the entrant attempts to maximize revenue (i.e., acts “strategically”) while it grows its coverage area. I We do not directly model spatial distribution of fixed demand (as in facility location problems) nor the mobility of roamers. 4 / 27 Demand response and ISP-player utilities I Asymmetric case with large incumbent (1) and a small entrant (2). I Let φ be the fraction of the entrant’s demand that roams I Let r be the associated revenue from roamers. I We assume that the effective access price to the entrant’s customers is p2 + φr , and p1 is the access price of the incumbent. We use a model of demand that considers both response to price and congestion, where the congestion based term implicitly depends on demand itself, so that the incumbent and entrant demands, respectively, satisfy I D1 = D2 = (p1 )−1 g1 (D1 + φD2 , B1 ) (p1 )−1 + (p2 + φr )−1 (p2 + φr )−1 Dmax (1 − δ¯ p) g2 ((1 − φ)D2 , B2 ) (p1 )−1 + (p2 + φr )−1 Dmax (1 − δ¯ p) 5 / 27 Demand response and ISP-player utilities (cont) I The first term accounts for how total demand is sensitive to price, here assumed linearly decreasing with average price from maximum, p¯ = 1 2 (p1 + (p2 + φr )), where δDmax is the demand sensitivity to price. I The second (competition) factor models how demand is divided between the ISPs based on their access price. I The third factor g models how demand depends on access congestion via a “demand capacity” B. I Note w.l.o.g. can take δ = 1 by using composites δpk and δr . 6 / 27 Demand response and ISP-player utilities (cont) I The incumbent and entrant ISP utilities are, respectively, U1 (p1 , p2 ) = (p1 − cd,1 )D1 + (r − cd,1 )φD2 − cb,1 B1 U2 (p2 , p1 ) = (p2 − (1 − φ)cd,2 )D2 − cb,2 B2 I where cb is demand-independent operational expenditures (op-ex), including amortized capital expenditures, cap-ex) per-unit infrastructure resource (B), I and cd is per-unit demand-dependent op-ex. I Note that we do not herein consider differences in “per-unit” (e.g., per base station) operating costs between the providers. I If such a discrepancy were known and deemed reasonable, it could be accounted for in our “fairness” condition below. 7 / 27 Incumbent and entrant cellular wireless access providers 8 / 27 Game set-up, simplifications and discussion of objectives I Assuming that op-ex and amortized cap-ex are negligible, and (for now) that congestion is negligible too, take revenues U1 = p1 D1 + r φD2 and U2 = p2 D2 . I So, U1 (p1 , p2 )/Dmax U2 (p2 , p1 )/Dmax p1 p2 + φr + r φ(1 − δ¯ p) p1 + p2 + φr p1 + p2 + φr p1 = p2 (1 − δ¯ p) p1 + p2 + φr = p1 (1 − δ¯ p) 9 / 27 Game set-up, simplifications and discussion of objectives I Assuming both sets of customers roam in the same domain (that of the incumbent), we can take the roaming factor φ = B1 − B2 B2 = 1− . B1 B1 I Thus, the simplified system has essentially one positive parameter in addition to initial prices (play-actions): φr . I Again, we assume that the roaming factor r is set by a regulator, and that p2 is not simply set to discount p1 , so that the only strategic player is the incumbent. 10 / 27 Objectives I Assuming B1 B2 (φ ≈ 1), our objective herein is see how the Nash equilibrium (NE) utilities U ∗ depend on the roaming charge, r . I Specifically, we want to see whether fairness is achieved at NE, i.e., whether net revenue is proportional to expenditures: U1∗ (r ) U ∗ (r ) = 2 B1 B2 or (1 − φ)U1∗ (r ) − U2∗ (r ) = 0. 11 / 27 Analytical results for simplified system I A Nash equilibrium (p1∗ , p2∗ ) is a stalemate, p1∗ = arg max U1 (p1 , p2∗ ) and p2∗ = arg max U1 (p1∗ , p2 ), p2 p1 I i.e., unilateral defection results in less utility for the defector. An “interior” (strictly positive, finite) solution to the first-order necessary conditions (FONC), ∂U1 ∂p1 = 0 = ∂U2 , ∂p2 is a symmetric one where both Nash equilibrium prices p 1 δp1∗ , δp2∗ = −2δr φ + 1 + 4δr φ + 1 > 0 when 4 δr φ < 2, I which allows for feasible prices p1 + p2 ≤ −r φ + 2/δ. Indeed, can directly verify that p1∗ + p2∗ = 2p1∗ = 2p2∗ < −r φ + 2/δ. 12 / 27 Analytical results for simplified system - Nash equilibrium I These FONC prices also satisfy ∂ 2 U1 /∂p12 , ∂ 2 U2 /∂p22 < 0, with strictly positive utilities U1∗ , U2∗ > 0, i.e., they’re “locally Nash.” I The other solutions of the FONC either have p2∗ < 0 (i.e., extraneous) or p1∗ = 0. I But if p1∗ = 0 then U1∗ = 0 = U2∗ . I Also, if p2 = 0 then ∂U2 /∂p2 > 0. I So, there are no boundary NE. I Thus, p1∗ = p2∗ given above is the unique NE. 13 / 27 Consumers’ perspective I Consider the consumers’ perspective for our model at NE. I The total consumer demand is proportional to √ 1 + 4δφr + 1 ∗ , 1 − δ¯ p = 1− 4 which decreases from 0.5 at roaming charge r = 0 to zero at r = 2/(δφ), I i.e., the mean NE price p¯∗ offered to consumers increases with r . 14 / 27 Analytical results for simplified system - fair roaming price I It can also be directly shown for this model that there is a solution r∗ = 2(2 − φ) δ(4 − 3φ)2 at which the fairness condition holds. I Note that r ∗ < 2(δφ)−1 when 0 ≤ φ < 1. I r ∗ increases with demand-sensitivity-to-price parameter δ and increases with roaming parameter φ. I Roaming prices r < r ∗ favor the entrant, otherwise the incumbent. 15 / 27 Numerical study I We considered the example with δ = 1 and φ = 0.9 = 1 − B2 /B1 . I We numerically verify that Nash-equilibrium utilities U1∗ (r ) and U2∗ (r ) are positive. I Both decrease and reach zero at r = 2(δφ)−1 = 20/9 (again, a point where the only feasible prices are p1 = 0 = p2 ). I Below we plot the “fairness” expression and verify that the fairness condition holds r ∗ ≈ 1.3 < 20/9. I And we see below how roaming prices r < r ∗ favor the entrant, otherwise the incumbent. I Note how in this simple model, utilities for both parties are higher for lower roaming charges. 16 / 27 Numerical results: best-response curves I here, r = 0.8 (again, δ = 1,φ = 0.9) I plot of p2∗ (p1 ) = arg max0≤p2 ≤2δ−1 −r φ−p1 U2 (p1 , p2 ) I inverse plot of p1∗ (p2 ) = arg max0≤p1 ≤2δ−1 −r φ−p2 U1 (p1 , p2 ) I Nash equilibria where curves meet, here only at (0.38, 0.38) 17 / 27 Numerical results for φ = 0.9,δ = 1: plots of U1∗ (r ))/Dmax (solid) & U2∗ (r )/Dmax (dashed); ((1 − φ)U1∗ (r ) − U2∗ (r ))/Dmax I roaming charges: incumbent optimal ˆr ≈ 0.3 < fair r ∗ ≈ 1.3 18 / 27 Numerical results for φ = 0.5,δ = 1: plots of U1∗ (r ))/Dmax (solid) & U2∗ (r )/Dmax (dashed); ((1 − φ)U1∗ (r ) − U2∗ (r ))/Dmax I roaming charges: incumbent optimal ˆr ≈ 0.6 > fair r ∗ ≈ 0.5 19 / 27 Maximum incumbent revenue re. r ∗ and φ I U1∗ (r ) is maximum at ˆr = √ 1 + 33 . 24δφ I Thus, r ∗ − ˆr increases with φ and √ 4 9 + 33 √ ≈ 0.54 ⇔ ∀δ, ˆr = r ∗ φ= · 3 19 + 3 33 I In the previous figure for φ = 0.9 > 0.54, ˆr < r ∗ . I But for φ < 0.54 we observed ˆr > r ∗ . I That is, r ∗ − ˆr was observed increasing in φ consistent with the above expressions for r ∗ and ˆr . 20 / 27 Better than fair roaming charges for small entrant I I I I I To promote competition, account for oligopolies among incumbents, etc., a bias for entrants may be warranted while they are small, i.e., while B1 B2 (φ ≈ 1). That is, for α > 1, a fair roaming charge r statisfies U ∗ (r ) U1∗ (r ) = 2 ⇒ α(1 − φ)U1∗ (r ) − U2∗ (r ) = 0, B1 αB2 taking α ↓ 1 as φ ↓ 0. The fair roaming price satisfying this more general equation is + 2 1 − (1 − φ)2 α2 ∗ · r = , δ φ(1 + 3α(1 − φ))2 with r ∗ decreasing in α. Recall that “lower than fair” roaming charges when φ is high also leads to higher revenues for both providers. However, when φ ≈ 0.54, lower roaming charges will result in significantly less revenue for the incumbent. 21 / 27 Better than fair roaming charges for small entrant (cont) As the amount of roaming by the entrant’s customers φ ↓ 0 (by solving “facility location” problems to add base stations), I the entrant may become an incumbent, I join the oligopoly, I and restore high subscription prices for consumers through price-fixing activity I that again prompts regulators to encourage new entrants. 22 / 27 Demand sensitive to both price and congestion I I I A demand-linear congestion term g could be simply be taken as g (D, B) = 1 − ΛD/B. So, the demands for the incumbent and entrant become D1 + φD2 p2 + φr 1−Λ D1 = Dmax (1 − δ¯ p) p1 + p2 + φr B1 p1 (1 − φ)D2 D2 = Dmax (1 − δ¯ p) 1−Λ p1 + p2 + φr B2 where Λ is a parameter capturing demand sensitivity to congestion. By I I I taking δ = 1 (again, w.l.o.g. considering our linear model of demand-sensitivity to price and our model of competition), substituting B2 = (1 − φ)B1 , and ˜ k := Dk /Dmax and lumped parameter using the scaled demands D λ := ΛDmax /B1 , we get the demands ... 23 / 27 Demand sensitive to both price and congestion - Utilities I p1 p1 + p2 + φr p2 + φr = (1 − p¯) p1 + p2 + φr ˜ 2 = (1 − p¯) D ˜2 1 − λD ˜1 D ˜ 1 + φD ˜ 2) . 1 − λ(D Again consider the simplified utilities U1 ˜ 1 + φr D ˜ 2 and = p1 D Dmax U2 ˜ 2, = p2 D Dmax with three different parameters r , φ, λ. 24 / 27 Numerical results I I I We found unique Nash equilibria p ∗ for (φ, λ) ∈ [0, 1]2 . Note that simply because p¯ ≤ 1, the range of roaming price r ∈ [0, 2/φ] and the prices p1 + p2 ≤ 2 − r φ. Fairness parameter α = 1 on left and α = 2 on right: 25 / 27 Numerical results - observations I It’s clear from both plots that r ∗ increases with λ, I i.e., with increased congestion of the incumbent in particular, the fair roaming charge should also increase. I However, r ∗ is more sensitive to the amount of of roaming, φ. I For α = 2, there is a large region where the fair roaming charge is zero for all sufficiently small φ (roughly φ ≤ 0.5), I i.e., no roaming charges once the entrant is established and its customers don’t roam too much on average. 26 / 27 Conclusions and Future Work I For high amount of roaming φ, may be better both in terms of revenues and consumer costs for entrant not to act strategically I For low φ, best to have low or no roaming charges especially in a congested regime In future work, can consider I non-negligible op-ex - recall we assumed cb , cd ≈ 0 above - depending on the situation, op-ex per unit demand might be lower I I for the entrant (e.g., only present in areas involving cheaper deployment costs with higher customer density) or for the incumbent (generally owing to greater scale of operations) I More complex models of price-competition and price-sensitivity for more complex models of demand I Also can consider multiple competing incumbents and entrants 27 / 27

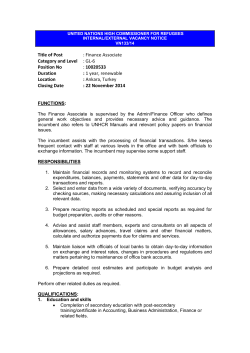

© Copyright 2026