Industrial News Center

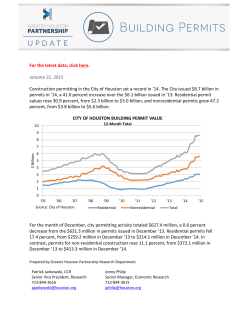

Industrial News Center Q U A RTERLY N EWS LETTER | S U MMER 201 5 Case Study: Pacific Architects and Engineers PAE, a major operation support vendor to the United States government was competing for business from the United States Postal service. The USPS had put out to bid their largest material handling maintenance and repair operation in the country. PAE hired Cresa to provide unbiased market information, and to advise them throughout the bid process. Cresa’s Transaction Management team worked with PAE to identify properties with in the metro area that met the operational requirements of the USPS. This included a very large parking requirement of 365 trailer positions within a fenced yard on site. Cresa identified three (3) potential buildings that worked for the USPS and negotiated aggressive rental rates with all three facilities, presenting to PAE contract contingent signed letters of intent for each. By positioning PAE’s size and credit against their competitor, PAE was able to secure more aggressive rental rates for this requirement. What became difficult during the process was the existence of other potential suitors in the market for the three available buildings. A large E-Commerce company and a large manufacturing group were also vying for these buildings. What’s Happening in the North America Industrial Market By leveraging a more competitive rent stream, PAE was able to win the USPS business. Upon signing the contract with the postal service PAE executed a lease agreement for the entire 723,291 SF development in Romeoville, committing to bringing 150 jobs to the community. Read more at: www.cresa.com/pae-applied-technologies Where in the World is Jim Winter H ouston | May O hio | May Boston | June Job Growth Absorption 49.6M SF Availability 7.0% Demand Kansas City | June C incinnati | July Industrial News Center Q U A RTERLY N EWS LETTER | S U MMER 201 5 Recent Transactions PAE Group | Romeoville, IL 723,000 SF O’Neill Logistics | Santa Fe Springs, CA 288,000 SF Quantum Feul Systems | Lake Forest, CA 156,000 SF Consumer Products Client | Tampa, FL 120,000 SF Houston Industrial Market In the first quarter of 2015, industrial market fundamentals remained strong, with few submarkets showing signs of weakness; however, there is caution moving forward as the answer to the question of what will happen in the Oil & Gas industry and how it will affect Houston remains unanswered. Most experts agree that Houston will not experience a major downturn because the city has benefited from significant economic growth in the recent past and economic indicators continue to see positive numbers. The Houston industrial market is shielded from downturns in the price of oil – there is much diversification within the Oil & Gas industry. While midstream and downstream continue to perform positively, upstream is losing jobs and the overall outlook for this sector is uncertain. We expect overall fundamentals to decline in the months to follow and into 2016, with the market transitioning favorably for tenants. Read more at: www.cresa.com/houston-q1-2015-1 Centric Group, LLC | Jacksonville, FL 117,000 SF Chamberlin Group Inc. | Chicago, IL 100,000 SF 3M Company | Phoenix, AZ 97,000 SF New Team Members Rexel Canada | Toronto, ON 83,000 SF Matt Burton Advisor, Denver Upcoming Conferences Trust Belt IAMC | May - June 2015 | September 2015 CSCMP | September 2015 CoreNet | Oct 2015 Edison Bastidas Advisor, NJ - North/Central Frank Palestini NEW TO INDUSTRIAL Senior Advisor, Calgary Margo Mocarski NEW TO INDUSTRIAL Senior Vice President, Philadelphia

© Copyright 2026