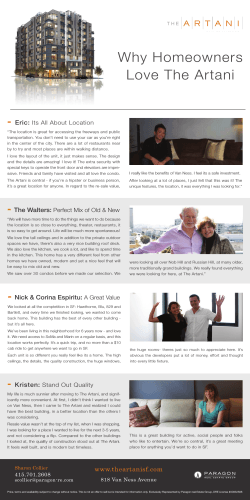

AnnuAl report of the boArd of directors