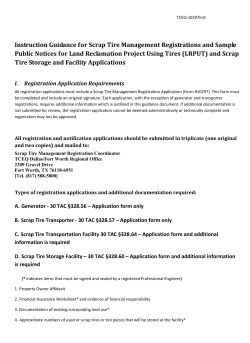

Analysis of New York Scrap Tire Markets Prepared for: