Leather clothing in Austria

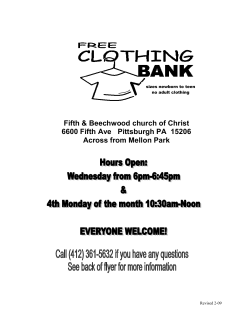

Leather clothing in Austria The market for leather clothing in Austria has grown. Austrian people spend relatively much on their outfit, as they regard quality important. However, fashion becomes more important with the fast fashion retailers. Younger people look for items at the lowest possible price. There are more opportunities for fashionable leather clothing in modern classic designs for trendy and affluent women. There are also opportunities for partnerships with exporting Austrian manufacturers looking for lower cost sources. Market characteristics • • Consumer’s expenditure increased, despite the recession. The Austrian market for leather clothing was valued at € 1.3 billion in 2010, a 1.2% annual increase since 2006, representing 2.7% of EU market value (€ 47.6 billion). This was well-above the EU as a whole, which registered a 0.8% decrease. Austrian performance for this product group was lower than the leading EU Member States, but higher than Belgium or the Scandinavian countries. See also the module on promising EU export markets with all trade statistics. In general, Austrian people are well dressed, but are less influenced by fashion trends than Italy, France or the UK, but spend average on clothing (5.1% of all consumers spending in 2010). The Austrian market is characterised by a majority of consumers paying much attention to the quality and exclusivity. They are less influenced by the fast changing trends in fashion than people in other EU countries. As more retailers open up new sites, on-line clothing sales continues to grow steadily in Austria. Some other characteristics of the Austrian market were: o Around 80% of the Austrian leather clothing market were coats and jackets. There is now much more variety in jackets in different styles, including biker jackets. o Within the other leather clothing segment, skinny leather trousers and leggings gained popularity among younger Austrian women. Other popular items were dresses, skirts, waistcoats and vests. o The most preferred leather for women’s fashion is lambskin and calfskin, both very soft leather with a pleasing handle. o The strong traditional part of the clothing market in Austria includes leather trousers for men and children, the so-called Lederhosen. This product is also popular in Southern Germany and Switzerland; specific trade fairs are even organized for this niche market. Source: CBI Market Information Database – www.cbi.eu • Contact [email protected] • Publication date 30.07.2011 Leather clothing in Austria • o Women aged between 25-45 years, are an important target group for the industry. They spend relatively much on their outfit and trendy women within this group regard leather clothing as a symbol of status, power and personal taste. o However, for the (leather) clothing market there is a polarisation in terms of: - Grading up by older consumers looking for leather jackets that can be used longer. - Grading down by younger consumers who look for fashionable jackets and other leather clothing at the lowest possible prices. They are sometimes referred to as ‘Smart shoppers’ and buy at clothing chains, textile-discounters or online sellers. According to Mintel, the Austrian clothing market is expected to grow by 2.1% in 2011. However, most Austrian people remain careful in their spending, due to the rising cost of living (energy, food) and the rising clothing prices. In addition, discounters (Kik and Takko) have been successful in the lower to medium segments. This implies that more people are expected to shop around to find the best leather clothing for the lowest possible price. Foreign brands remain popular in the high-medium segments. • Production continued to rise. Austria is a medium sized EU producer of leather clothing valued at € 92 million, almost 2% EU production. Austrian production rose by 4.1% annually since 2006, which was high, compared with -2.1% for the EU production of leather clothing. Austria is a sizeable exporter of leather clothing and since 2009 exports were up and were valued at € 18.8 million. • Substantial DC increase in imports. Imports of leather clothing were valued at € 692 million in 2010, a -1.6% annual average decrease since 2006. However, volume imports decreased by -4.5% to 1,134 tonnes, mainly due to falling volume imports from China that fell since 2008 mainly due to currency hikes and higher prices. There was more demand for higher quality items and Austria imported more from Italy and India. The value decrease in Austrian imports was below the EU decrease rate in the period of -0.8%. Austria is a medium sized importer of leather clothing from DC’s and accounted for 4.6% of EU imports. Austrian imports from DCs were valued at € 94 million (14% of all imports by value and 19% by volume), and increased by +0.6% over the period 20062010 (volumes were down by -9.8% at 216 tonnes), as the majority is being imported from Germany and Italy. Leading DC suppliers (by volume) were India (10%, 24% average annual growth by value; +19% by volume), China (3.2% of total, -17% by value; -32% by volume), Pakistan (2.0%, +4.6% by value; -1.1% by volume), Turkey (1.7%, -6.0% by value; -5.7% by volume) and Ukraine (1.7%, -13.2% by value; -21.5% by volume). • • Figure 1 Top 5 DC suppliers of leather clothing 90 60 Quantity 30 0 India China Pakistan 2006 • Turkey 2008 Ukraine 2010 The top five DC suppliers (see figure 1) represented 19% of all Austrian volume imports, but represented the lion’s share (97%) of all Austria volume imports from DCs. India could benefit from the devaluation of the Rupee and there is much availability in Source: CBI Market Information Database – www.cbi.eu • Contact [email protected] • Publication date 30.07.2011 Leather clothing in Austria good quality leather. Other growing DC suppliers were Vietnam, Argentina, Indonesia, Brazil, Thailand, Panama and Mexico. Imports from China continued to fall. • Average DC import prices increased substantially from € 29.85 to € 43.69 per kg in 2010, which can be partly attributed to imports of higher quality leather clothing. IntraEU prices increased to a lesser extent from € 62.31 to € 64.67, making intra-EU import prices 1.5 times higher than average DC import prices. Key opportunities Due to the intensified competition, especially for jackets, the main opportunities should be sought in other leather clothing in new variations for the medium-higher segments and in outsourcing. • New variations in leather clothing could be for example in terms of products, for example, such as waistcoats, dressed trousers, jeans trousers, harem style trousers, jeggings, multi panelled skirts, simple and casual dresses, T-shirts, tops, blousons or cape coats. Austrian women become more conscious about their look. There is a growing market for fashionable leather clothing in modern classic designs. For seasonal designs – see the CBI fashion forecasts at www.cbi.eu • Tourists. Opportunities can be found in the rising number of immigrants and tourists. Next to the major cities, winter sports areas remain popular. Austria has around 15 million tourists and, increasingly, from neighbouring Eastern EU countries and Russia. All sorts of leather jackets, trousers, shorts, dresses or accessories could attract this target group. • Plus-size fashion. Increasing obesity has meant more demand for fashionable or vintage style (mix & match) leather dresses that flatter more the women’s shape and for leather skirts or trousers with waistbands featuring self-altering tabs and side elastics. • Lederhosen. There are specific trade fairs in München (South Germany) and Salzburg (Austria). Some companies include: Meindl Fashions (http://www.meindl-fashions.de); Hammerschmid (http://www.hammerschmid.de); Spieth Wensky (http://spiethwensky.de). They might look for low cost suppliers for leather or for outsourcing. • The ethical clothing sector. The availability of fashionable ethical products has stimulated sales in all clothing segments. Organic or vegetable tanned leather could be used in leather clothing. More information can be found in the module ‘Compliance with EU buyer requirement for leather clothing’ and the module ‘Promising EU export markets for knitted and woven clothing’. • Outsourcing – Many manufacturers in Austria have developed an outsourcing policy. The rising demand for lower cost leather by the younger ‘smart shopper’ has led to a further sourcing of leather products in low-cost countries. How to approach the market • The main trade channels for market entry are either via importing manufacturers, wholesalers or via specialised retailers. It depends on what type of leather clothing exporter you are (CMT, FOB, private label or own brand manufacturer). Some exporters make use of fashion sales agents. This channel would be appropriate if you were manufacturing on behalf of a known designer. Many retailers, importers and fashion houses export to Eastern EU countries, Russia and Asia. Exports were on the rise since 2009, reaching € 18.8 million in 2010. Austrian importers or manufacturers would be interested in partnerships with new suppliers in low cost countries who can offer products with an original design, as China has become more expensive. Austrian buyers regard quality, price and the ability to produce small orders very important. Source: CBI Market Information Database – www.cbi.eu • Contact [email protected] • Publication date 30.07.2011 Leather clothing in Austria • • • • • Most of the Austrian clothing (including leather clothing) suppliers can be found on http://www.fashion-industry.at; this website includes an online directory of the 200 members of the Austrian branch organisation Fachverband der Textilindustrie Österreichs (FBÖ). The number of manufacturers of leather clothing is limited and includes: Walser GmbH (http://www.walser.net or http://lederwalser.at); Othmar Helmut Meisl; Samuel Kern & Co and Steinbock Mode Gmbh (http://www.steinbock.at – general fashion including leather). Wholesalers/importers of leather clothing can be found on the site of the Austrian Chamber of Commerce http://www.wko.at. Search under ‘Firmen A-Z’ for information about Austrian companies for example under ‘Lederbekleidung’ (leather clothing). Leather specialized Sportalm (http://www.sportalm.at) operates as exporting wholesaler and owns seven stores in Austria. Clothing specialists represented some 55% of the Austrian clothing market in 2010. The Austrian clothing sector is relatively fragmented compared to other West European countries. Only two operators have a market share of over 6%: o C&A (http://www.c-and-a.com) from Germany, which has 85 C&A stores. o H&M (http://www.hm.com) from Sweden, with 63 stores. Most other clothing chains (including leather clothing) include: o Vögele (from Switzerland with 150 stores; http://www.voegelemode.com/corp/en/home_en). o Schöps 93 general clothing stores (from Austria: http://www.schoeps.at). o 235 KiK stores (Tengelman Group), 168 Esprit stores, of which 11 directly managed, 78 New Yorker stores, 250 TPS stores (NKD), 42 Orsay stores and 108 Takko stores. These chains came from Germany. Clothing chains have been successful in cooperation with celebrities for example the Kate Moss collection for Topshop. In addition, the release of Lanvin for H&M and Valentino for Gap were extremely successful in many EU countries. H&M has been the most successful high street retailer in regards to designer collaborations. In 2011, they launched a new leather clothing line with Donatella Versace. Home shopping, including online sales of leather clothing, has grown substantially. Important players in the home-shopping sector came from Germany such as: Universal Versand (http://www.universal.at; part of Otto), Neckermann (http://www.neckermann.at; part of Arcandor), Quelle (http://www.quelle.at; part of Arcandor) and Klingel (http://www.klingel.at). The French La Redoute (http://www.laredoute.at) is also active on the Austrian market. You need to decide whether to approach this market directly or indirectly. See the module on distribution strategy for more information. Information on buyer requirements can be found in the module on buyer requirements. As for labelling, buyer would highly appreciate it if you can specify the composition of textiles, fibres used in the product in German. If you make a direct approach, it is recommended that there is some personal communication before a trading relationship commences. Developing country exporters may approach customers in the Austria through direct (e-) mail, personal visits (as followup), inviting potential customers to visit you in your country, building a network and visiting international trade fairs. Please note that Danish fashion companies often do double-sourcing, i.e. asking several supplier for a quotation and production samples. Other interesting contacts • • • The main trade association is the Fachverband der Bekleidungsindustrie Österreichs, http://www.fashion-industry.at, the website includes a list of members. http://www.austriantrade.org, website of the official Austrian Foreign Trade Promotion Organisation. No clothing trade fairs have been encountered in Austria; buyers visit foreign trade fairs, especially German and French ones. Source: CBI Market Information Database – www.cbi.eu • Contact [email protected] • Publication date 30.07.2011 Leather clothing in Austria • • • The leading magazine is clothing and textiles trade journal Österreichische Textil Zeitung http://www.textilzeitung.at Search under ‘Firmen A-Z’ on the site of the Austrian Chamber of Commerce – http://www.wko.at – for information about Austrian companies. Market information can be found at Regioplan Consulting - http://www.regioplan.eu, at Makam Market Research - http://www.makam.at - and at Gfk – http://www.gfk.at. Labelling of leather in Austria According to a 1986 decree of the Austrian Ministry of Commerce, leather clothing have to be labelled (clearly visible and in the German language by means of stamps, labels, information leaflets). Mandatory labelling requirements for leather clothing in Austria concern: • Animal species: such as Rind (bovine), Kalb (calf), Ziege (goat), Schaf (sheep), Lamm (lamb), Pferd (horse), Hirsch (male deer), Reh (deer), Antilope (antelope) and Schwein (pig); • Material description: such as Volleder (grain leather), Narbenspaltleder (split leather – grain spalt) and Fleischspaltleder (split leather – underpart); • Type of leather: such as Velours (suede), Nappa (nappa), Nubbuk (nubbuck), Anilin (aniline) and Sämisch (shammy). This survey was compiled by Searce in cooperation with Dhyana van der Pols Disclaimer CBI market information tool: http://www.cbi.eu/disclaimer Source: CBI Market Information Database – www.cbi.eu • Contact [email protected] • Publication date 30.07.2011

© Copyright 2026