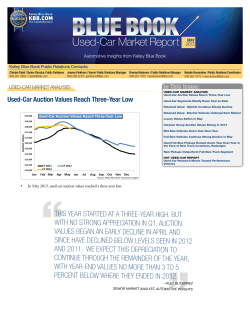

Document 123560