Global and Local Raspberry Supply Chains: National

Global and Local Raspberry Supply Chains:

National-level Report of Serbia

Zaklina Stojanovic, Biljana Jovanovic Gavrilovic,Dragan

Loncar, Irena Jankovic,Bojan Ristic, Mirjana Gligoric

Faculty of Economics, University of Belgrade, 2015.

2015

GLAMUR is a EU FP7 project that aims at integrating advancement in scientific

knowledge about the impact of food chains to practice, to increase food chains

sustainability through public policies and private strategies. This general objective

will be pursued through the following specific objectives:

• To develop and validate a performance criteria matrix for assessment and

comparison of food chains operating at a range of geographical scales

through analysis of how food chain impacts are communicated in different

spheres of society.

• To build a database of quantifiable indicators of impact and a set of 20 case

studies aimed at understanding how impacts are generated within specific

food chains.

• To advance knowledge on methodological problems and trade-offs arising

when measuring and comparing the impact of food chains within and between

sectors.

• To assess how performance is perceived by stakeholders in different national

contexts through participatory assessment and multi-criteria analysis of the

different typologies of food chains.

• To assess the actual and potential role of public and private policies

addressing food chains and to turn assessment into policy recommendations.

• To build a network that turns the advancement of scientific knowledge into

decision making tools for domestic and public consumers, producers, citizens,

scientists, policy makers, civil society organizations.

Report to be quoted as:

Zaklina Stojanovic, Biljana Jovanovic Gavrilovic, Dragan Loncar, Irena Jankovic,

Bojan Ristic, Mirjana Gligoric. (2014) Global and Local Raspberry Supply Chains.

National Level Report of Serbia. Belgrade: Faculty of Economics, University of

Belgrade

www.glamur.eu

2

Global and Local Raspberry Supply

Chains: National Report of Serbia

Zaklina Stojanovic, Biljana Jovanovic Gavrilovic,

Dragan Loncar, Irena Jankovic,

Bojan Ristic, Mirjana Gligoric

Faculty of Economics, University of Belgrade

2015

www.glamur.eu

3

Summary

The analysis of the local food chain addresses the Serbian fresh raspberries

produced in the Arilje Municipality (Ariljska raspberry - Ariljska malina). However,

almost entire raspberry supply chain in Serbia has been globally oriented. The

research questions addressed in our case study are defined within the WP3

framework, while specific research questions are collaboratively designed with

the Latvian team (Baltic Studies Centre, Riga) and address specific issues in

berries sector. The report elaborates ten attributes in total while the common list

of attributes was shortened for the purposes of the study. The Serbian raspberry

supply chain was reviewed using the available statistics and studies,

supplemented and strengthened by the WP3 field research (data gathered by indepth interviews with key stakeholders in the chain).

Our analysis shows that the global food chain performs better regarding

resources use (land and labour productivity), wage level and labour relations,

creation and distribution of added value and food safety (volume of production

that has successfully passed the quality control). The Local food chain performs

better than global in environmental, health, ethic, and even partially in economic

(net income) dimension. Additionally, increasing of organic and traditional

products supply in berry sector is marked as the strategic opportunity leading to

the significant increase of the local raspberry food chain importance in the future.

However, the global raspberry food chain has took more attention than the fresh

(local) raspberry food chain in our practice as far as market, public & policy

stakeholders opinion is concerned.

Key words: food chain, local, global, stakeholders, attributes performance.

www.glamur.eu

4

Contents

Summary ...............................................................................................4

Contents ................................................................................................5

Abbreviations ......................................................................................7

1. Introduction ........................................................................................8

2. Case study definition - general overview.................................................9

3. The Raspberries Local & Global FSC in Serbia .....................................19

3.1 Geographical scope ......................................................................19

3.2 Description of local and global product ............................................21

3.2.1 Fresh raspberry (local chain) .......................................................21

3.2.2 Frozen raspberries (global chain) .................................................22

3. Research design ............................................................................23

3.1 Research questions ......................................................................25

3.2 Attributes selection process ...........................................................25

3.3 Selected indicators .......................................................................27

3.4 Selection of stakeholders and interviews - the participatory approach ..31

4. Results and discussion.......................................................................33

4.1 Description of the chains ...............................................................33

4.1.1 Local FSC model (Fresh raspberries) ...........................................33

4.1.2 Global FSC model (Frozen raspberries) ........................................34

4.2 Stakeholder analysis - Global versus Local FSC ...............................36

4.2.1 The Local supply chain stakeholders ............................................36

4.2.2 Global supply chain stakeholders .................................................38

4.3 Description of attributes and indicators ............................................41

4.3.1 Creation and distribution of added value .......................................41

Added value......................................................................................42

Distribution of added value..................................................................48

4.3.2 Contribution to economic development .........................................49

Net income .......................................................................................49

Regional workforce ............................................................................51

www.glamur.eu

5

4.3.3 Governance ..............................................................................57

4.3.4 Labour relations.........................................................................61

Wage Level.......................................................................................61

Other labour relations indicators ..........................................................63

4.3.5 Other indicators .........................................................................64

Resource use/Efficiency .....................................................................64

Food safety.......................................................................................68

Responsibility....................................................................................71

5. Conclusions......................................................................................73

Literature ..........................................................................................75

www.glamur.eu

6

Abbreviations

AWU - Annual working unite

ESU - Economic size of unite

EU - The European Union

NBS - The National Bank of Serbia

PDO - Product Designation of Origin

RS - The Republic of Serbia

RSD - The Republic of Serbia Dinar

SAFA - Sustainability Assessment of Food and Agriculture systems indicators

SIEPA - The Serbia Investment and Export Promotion Agency

SORS - The Statistical Office of the Republic of Serbia

STIPS - The System of the market information for the agriculture in Serbia

SWOT - Strengths, Weaknesses, Opportunities and Threats

www.glamur.eu

7

1. Introduction

Due to its high market share, global recognition and competitiveness, the

raspberry production has been the most important fruit production in Serbia. This

sector is also interesting due to its high potential of fresh and high value added

market development (traditional food and organic production). Furthermore, the

analysis of the raspberries sector allow deeper insights in the value chain

linkages, resulting in local and global food chain attributes description as the

main goal of this report. The Serbian raspberry supply chain holds an important

position regarding the overall agricultural and rural development in the country.

From the economic point of view, raspberries sector contribute in a high share to

total agricultural export from Serbia to the EU and global market. Broader

perspective includes the sector importance for the multifunctional rural

development (development of activities connected with the storage facilities,

packaging, transportation, trade & marketing of products). It includes ethic and

social aspects as well, particularly relevant for the western regions of the country.

This sector generates the significant contribution to farm income in the Sumadija

& Western Serbia District. Currently applied production methods are mainly

traditional and with the positive environmental impact. Finally, raspberries hold

the superior properties compared to other fruits regarding the health benefits

(particularly high antioxidants content is recorded for Arilje raspberry).

The analysis covers specific areas of interests in evaluation of global and local

aspects of food chain. The Serbian raspberry supply chain was reviewed using

the available statistics and studies, supplemented and strengthened by the WP3

field research (data gathered by in-depth interviews with key stakeholders in the

chain). Consequently, the relevant food chain stakeholders, such as

representatives of producers, associations of producers, processors, policy

makers, traders and certification bodies, were specifically targeted and engaged

with the project research. The analysis of the local food chain addresses the

Serbian fresh raspberries produced in the Arilje Municipality (Ariljska raspberry Ariljska malina). However, almost entire raspberry supply chain in Serbia is

globally oriented, and most of the raspberries are processed and exported as

frozen product. Therefore the frozen raspberries food chain represents in our

case the global food chain.

www.glamur.eu

8

2. Case study definition - general overview

Raspberry production in Serbia in the period 2005-2013 year ranged between

68,000 and 90,000 tones (production highly depends on weather conditions). The

highest production of raspberries was achieved in 2011 (90,000 tones, whereas

the lowest production values were recorded in 2012 (70,000 tones) and 2013

(68,000 tones).

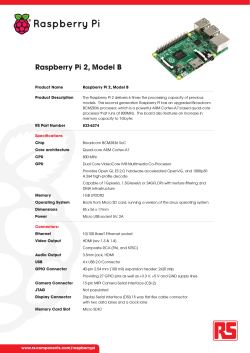

Raspberry production in Serbia, in 000 tons

100

86

84

90

80

87

84

77

84

90

80

70

70

68

2012

2013

60

50

40

30

20

10

0

2004

2005

2006

2007

2008

2009

2010

2011

Source: SORS

Raspberry is produced on the area covering 15,433 ha in 2013. In Serbia, only 35 % of areas planted with raspberry are irrigated (note: open air only).

Area planted, ha

16,000

15,800

15,600

15,400

15,200

15,000

14,800

14,600

14,400

14,200

14,000

13,800

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Source: SORS

www.glamur.eu

9

Raspberries picking in Serbia begins in late June and ends in July, depending on

weather conditions and fields location. Most fresh raspberries are sold and

consumed during the summer season, and only a small number is exported fresh

mostly in the Western Balkan region. The fresh raspberries are cleaned,

prepared and stored at a temperature of 0° C and transported in refrigerated

trucks to their destinations within three days. Fresh raspberries are consumed or

processed for homemade juices and concentrates. They account for less than 23% of total raspberries production in Serbia which includes home made products

of fresh raspberries (juices, traditional food).

For small farms it is difficult to take advantage of the economy of scale and its

production costs are usually high. Investments in transportation and technology

improvements are required to facilitate export of high quality fresh raspberries.

Also, they are characterized by low market and bargaining power. There exist a

limiting number of organizations/cooperatives that can help farms to sell their

raspberries at wholesale/green markets. The Federation of Associations of

raspberry producers of Western Serbia exists from 2012.

Fresh raspberries are sold at farm gates and wholesale and green markets.

Intermediaries (buyers or traders) are buying raspberries directly from producers.

They are usually located close to producers (usually in the municipality centre).

They group fresh raspberries and transport them to processing facilities

(cooperatives). Producers are facing the problems of transportation and usually

sell fresh raspberries to wholesalers adequately equipped with storage and

transportation means.

Total supply of raspberry in Serbia, in 000 tons

100

90

80

70

60

50

40

30

20

10

0

2004/05

VI-V

2005/06

VI-V

2006/07

VI-V

2007/08

VI-V

Begining stocks

2008/09

VI-V

2009/10

VI-V

Domestic production

2010/11

VI-V

2011/12

VI-V

Import

Source: http://www.mpt.gov.rs, Supply utilization balance: Raspberry

www.glamur.eu

10

The total annual supply of raspberries in Serbia varies between 77,000-95,000

tons and includes beginning stocks from the previous season, domestic

production in the concrete period plus the import. The total supply and its

structure for the June 2004-May 2012 period is presented in the Graph above.

The annual consumption of raspberries is divided between domestic

consumption and export. Domestic consumption encompasses domestic use in

fresh and processed form, losses and ending stocks.

Total consumption of raspberry in Serbia, in 000 tons

100

90

80

70

60

50

40

30

20

10

0

2004/05

VI-V

2005/06

VI-V

2006/07

VI-V

2007/08

VI-V

Domestic use

2008/09

VI-V

Losses

2009/10

VI-V

Ending stocks

2010/11

VI-V

2011/12

VI-V

Export

Source: http://www.mpt.gov.rs, Supply utilization balance: Raspberry

The dominant part of Serbian raspberries is exported, predominantly in frozen

form.1 A very small portion is exported as fresh.

Domestic use and export as % of total consumption of Serbian raspberry

2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12

VI-V

VI-V

VI-V

VI-V

VI-V

VI-V

VI-V

VI-V

Total

domestic use

23%

20%

8%

13%

33%

23%

20%

17%

Export

77%

80%

93%

87%

67%

77%

80%

83%

Source: http://www.mpt.gov.rs, Supply utilization balance: Raspberry

1

In Serbia, there are over two hundred cold storages with deep freezing regime (- 18°C), with

capacity of 100 – 5.000 tons.

www.glamur.eu

11

Domestic consumption vs export of raspberry from Serbia, in % of

total consumption

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2004/05

VI-V

2005/06

VI-V

2006/07

VI-V

2007/08

VI-V

2008/09

VI-V

Domestic consuption

2009/10

VI-V

2010/11

VI-V

2011/12

VI-V

Export

Source: http://www.mpt.gov.rs, Supply utilization balance: Raspberry

Export of frozen raspberry amounted from 109.0 million of USD in 2005. to180.2

million of USD in 2012. After continuous growth from the beginning of the period,

the export recorded stagnation in 2009 compared to the previous year and

became volatile since then (recorded drop in 2010, recovery in 2011 followed by

drop in 2012). This volatility is mostly due to prices of raspberry, because

quantity exported was relatively stable during the observed time interval.

Serbia: Raspberries - Export, frozen, without sugar, 2005-2012

250000

200000

150000

100000

50000

0

2005

2006

2007

2008

Export Value, 000 USD

2009

2010

2011

2012

Export Quantity, tones

Source: Statistical yearbook and Monthly statistical bulletin.

www.glamur.eu

12

The main export destinations for the export of frozen raspberries without sugar

from Serbia are Germany, France, Belgium, Austria, Sweden and Great Britain.

Total export to these six countries is 83 % of the export value of raspberries. The

most important destinations for export of these products where more than half of

their value is exported are: Germany (34 %) and France (24 % of total export

value, see Graph below).

Raspberries: Export ‐ categories of raspberries, average Value Exported by country destination in 2005‐2011 total exported value, average 2008‐2012 Original, 4% Other countries, 17% Other, 1% Bruh, 7% Germany, 34% Blok, 7% Great Britain, 4% Rolend, 41% Sweden, 4% Fresh, 9% Austria, 6% France, 24% Belgium, 11% Source: Statistical yearbook and Monthly statistical bulletin Griz, 32% Source: Ministry of Agriculture, Forestry and Water Management based on SORS, Report 2012. Data are given as average exported value share by country destination in the

total value of exports of frozen raspberries from Serbia. Average value is

calculated for a shorter period (from 2008 to 2012) and for the values of export of

frozen raspberries considering that the data of the National Statistical Office were

only available as export data of frozen raspberries with sugar before that time. If

we look at export by raspberries categories, it can be seen that the major part of

the export of raspberries "Rolend" (41% of export of this raspberry category is

average value for the period 2005-2011). This category is followed by a raspberry

"Griz" (32%), which is followed by the export of fresh raspberry (9%). Categories

"Block" and "Bruh" make export share with 7% each, whereas the original

raspberry is exported in small quantities (only 4% of the total export of

www.glamur.eu

13

raspberries). 2 Detailed quantities of categories of raspberry exported are

presented in the Graph below.

Export - categories of raspberries, average 2005-2011

90

79 80

73 71 70

60

000 t 50

62 63 2009

2010

53 42 40

30

20

10

0

2005

Rolend

2006

Griz

2007

Fresh

2008

Bruh

Blok

Original

Other

2011

Total

Source: Ministry of agriculture, forestry and water management based on SORS, Report

2012.

Sale and purchase of raspberries are shown in terms of quantity and value,

respectively (see next two graphs). Data are for the period from 2005 to 2012.

The amount of sale and purchase of the territory of Serbia is in the range of

27,000-47,000 tons. In graph 10 it can be seen that the two extreme values of the

volume of sale and purchase were reached in two consecutive years - 2011 and

2012, respectively.

2

“Rolend” is category of raspberry that represents the name for whole, prime berries of identical

colour. It is packed in 4 packs of 2.5 kg each, and in compliance with standards. “Rolend” is

packed into 300g, 450g or 1kg packages and is used as input for final product in EU shops.

Raspberry “Griz” is ground frozen raspberry, packed in 10kg and 15kg containers and used for

industry. Usually, very small amount of ground raspberry end up in shops. Raspberry “Blok”

represents the third class of frozen raspberry is used for the fruit juice industry. (Radosavljević,

2008).

www.glamur.eu

14

Raspberries: quantity of sale and purchase, 2005-2012

50

47 45

40

41 38 000 tones 35

31 30

34 32 31 27 25

20

15

10

5

0

2005

2006

2007

2008

2009

2010

2011

2012

Sale and purchase

Source: Statistical yearbook

Raspberries: value of sale and purchase, 2005-2012

6000

5279 5000

mil. RSD 4000

4917 3871 3840 3364 3000

2954 2000

1592 1771 1000

0

2005

2006

2007

2008

2009

2010

2011

2012

Sale and purchase

Source: Statistical yearbook

When looking at the values of sale and purchase, they are due to price

fluctuations highly volatile in relation to the data expressed in tons. The lowest

value was recorded at the beginning of the observed period when 1,592 million

RSD raspberries were sold and repurchased. After that, the value of sale and

www.glamur.eu

15

purchase reached its maximum in 2008. After the reduction in 2009, the value

recorded its growth again followed by gradual decline during the last two years.

Statistical Office of the Republic of Serbia regularly publishes information about

the value of sales of raspberries at marketplaces. As we can see, with the

extreme volatility of the value of sale, at the beginning of the period it was much

lower than in the middle and end of the period. After the maximum value of sale

at marketplaces recorded in 2008, the value was falling during the two

consecutive years, and since 2010 this value has gradually increased. Thus, in

2012, the sale of raspberries at Serbian marketplaces amounted to 70 million

RSD.

Sale of raspberries at marketplace, 2005-2012

90

83 80

70

mil. RSD 60

30

63 55 50

40

70 70 62 46 36 20

10

0

2005

2006

2007

2008

2009

2010

2011

2012

Sale of raspberries at marketplace

Source: Statistical yearbook

Market prices data for fresh raspberries and other agricultural products are

available from centralized System of the market information for the agriculture in

Serbia (STIPS, http://www.stips.minpolj.gov.rs).

Data on fresh raspberry prices are collected and provided by STIPS in the fruits

category. It is important to notice that these data are available exclusively for the

fresh raspberry and thus they are available only seasonally, in months when the

raspberry is produced. It can be concluded that STIPS covers local supply chain

of fresh raspberry. The scope of this short supply chain is national.

www.glamur.eu

16

The system offers data on weekly current market prices over time and main

markets (cities in Serbia and their major markets places, plus it offers

comparisons with Croatia and Montenegro markets). The system offers national

reports on product prices, detailed reports on product prices, data on product

prices in different cities and weekly bulletins for each product category.

Weekly average wholesale prices of raspberry in RSD/kg in the period 20042013*

500

450

400

350

300

250

200

150

100

50

40. week

41. week

42. week

43. week

44. week

40. week

41. week

42. week

43. week

44. week

38. week

37. week

36. week

2007

39. week

2006

35. week

34. week

33. week

32. week

31. week

2005

39. week

2004

30. week

29. week

28. week

27. week

26. week

25. week

24. week

23. week

22. week

21. week

0

2008

500

450

400

350

300

250

200

150

100

50

2009

2010

2011

2012

38. week

37. week

36. week

35. week

34. week

33. week

32. week

31. week

30. week

29. week

28. week

27. week

26. week

25. week

24. week

23. week

22. week

21. week

0

2013

* Averages are calculated for weekly prices from wholesale markets in Belgrade, Kraljevo, Nis,

Novi Sad and Subotica

Source: http://www.stips.minpolj.gov.rs/stips/nacionalni

www.glamur.eu

17

National reports of fruit prices are providing weekly prices per kilogram for

different sorts of fruits traded in the wholesale and green (retail) markets in

Belgrade and other major cities (Kraljevo, Nis, Novi Sad, Subotica). Data are

available for particular product sort, size and type of product packaging.

Market prices of raspberry on wholesale and green markets in Serbia vary

depending on product supply. On average, fresh raspberry is available on the

market from week 21 till week 36. Belgrade market is, in general, facing higher

prices of raspberry than other cities’ markets. It can be noted that wholesale

prices in 2013 have increased in comparison to previous years reaching the

levels between 230-500 RSD/kg (Euro 2.03-4.42).

Weekly average green market (retail) prices of raspberry in RSD/kg in the

period 2004-2013*

1000

900

800

700

600

500

400

300

200

100

2004

2005

2006

2007

2008

2009

2010

2011

2012

44. week

43. week

42. week

41. week

40. week

39. week

38. week

37. week

36. week

35. week

34. week

33. week

32. week

31. week

30. week

29. week

28. week

27. week

26. week

25. week

24. week

23. week

0

2013

* Averages are calculated for weekly prices from green markets in Belgrade (Kalenic), Kraljevo,

Nis, Novi Sad and Subotica

Source: http://www.stips.minpolj.gov.rs/stips/nacionalni

Raspberry retail prices on green markets in Serbia differ based on the product

origin, seasonal factors in production and concrete retail market. Availability of

raspberry has prolonged to period between week 23 and week 44. Prices vary

between 80-1000 RSD/kg, while they are significantly higher in Belgrade,

especially at the beginning and the end of the season.

www.glamur.eu

18

3. The Raspberries Local & Global FSC in

Serbia

3.1 Geographical scope

The fruit sector, in general, holds higher relative importance in the total

agricultural activity in the selected regions compared to the Serbian average (see

the graph below). According to Agricultural Census data, the total number of

farms in Serbia is 631552 in the year 2012. More than one third of all farms are

located in the Region of Sumadija & Western Serbia which is in our focus for the

global raspberries food chain. Moreover, one third of total arable land in this

region is specialized for the fruit production 3 (dominantly raspberries). As far as

the local food chain is concerned, total number of farms registered in the Arilje

Municipality is 4793, while 27% of total arable land is dedicated to the fruit

production.

No of farms and relative importance of fruit production in the selected

regions

700000

35

631552

600000

30

500000

25

400000

20

300000

15

262940

200000

10

100000

5

4793

0

0

Serbia

Sumadija & West Serbia Region

Number of farms

Arilje Municipality

% of total land dedicated to fruit production

Source: SORS.

3

The vineyards are excluded.

www.glamur.eu

19

Although raspberries production is the main activity of rural economy the Western

Serbia, it is important to emphasize that the new (modern) farms exist also in the

Northern part of Serbia (Region of Vojvodina). Their activity has been particularly

evident starting from 2010, which have influenced the average yields in the

sector. The new raspberries farms introduce new technology and use new

varieties in production ("Polana" particularly). However, their influence on the

global raspberries food chain is still very low, and therefore, we do not include

data for Vojvodina in comparison of selected food chain attributes.

Raspberry production in Vojvodina:

Area harvested, yields and average yields

3000

6,00

2630

2500

5,00

2000

4,00

1659

1500

3,00

1230

1124

964

1000

506

912

516

500

480

462

470

2,00

457

0

1,00

0,00

2008

2009

2010

Area

Yield, t

2011

2012

2013

Average yield, t/ha

Source: SORS.

From the spatial point of view, farms that belong to the global food chain are

dominantly located in the Region of Sumadija & Western Serbia, while the Arilje

raspberries producers represent the local fresh food chain in Serbia. Arilje

represents a hub of raspberry production. Commercial raspberry growing is

carried out in every village in the municipality (Market analysis of the fruit sector

in Zlatibor County, 2010).

www.glamur.eu

20

The Region of Sumadija & Western Serbia The Arilje Municipality 3.2 Description of local and global product

3.2.1 Fresh raspberry (local chain)

The Arilje raspberry is the protected name for the raspberry with special features

originating from Arilje region in the Western Serbia (reg.no 52 - The Republic of

Serbia Intelectual Property Protection Institute).

Fresh raspberries production from Arilje is an important economic activity of the

Arilje Municipality (rural region). However, fresh raspberries production is also

important for simultaneous development of other mutually dependable activities

of rural economy. Arilje raspberry variety is particularly suitable for organic

production. Fruit production has the largest share in total organic area (46.36%)

in Serbia, while raspberries production counts around 13% of total fruit organic

production (Organic agriculture in Serbia, 2013). Due to its nutritional properties,

the Arilje raspberry is considered a the high value added food with huge

www.glamur.eu

21

potentials both at the domestic and global markets. Description of currently

available product at the domestic market is given in the table below.

Description of product sold at local market

Product - fresh raspberry Market

Fresh Raspberry local green market Arilje

Fresh Raspberry wholesale market Belgrade

Package - plastic box

Net weight: 250 gr +- 10% per box.

Domestic fresh raspberry (I class) retailers

Package - transparent plastic box

Net weight - 250 gr +- 10%

Shelf life: 4 days at temperature range 0

to 8°C .

3.2.2 Frozen raspberries (global chain)

Almost 90% of raspberry production is frozen in cold storage plants, while only

10% of it is used for processing or sale in retail stores. Most raspberries are

exported in frozen state (up to 93%). Semi-organized process for producers

association that includes cold storages, transport and export. Raspberries are

frozen at a temperature of -40 ° C and stored at temperatures between -18 and 20. Most of the production is exported to EU market. Between 90-95 percent of

Serbian raspberries is the North American “Willamette” - variety. Other raspberry

varieties include “Meeker”, “Promise” and “Gradina” from Europe. (Buric, 2003).

www.glamur.eu

22

Description of product sold at global market

Product

Name

Willamet Raspberry

Meeker Raspberry

Raspberry whole and

broken

- 80% whole + 20%

broken

- 50% whole + 50%

broken

- 40% whole + 30%

broken + 30% crumble

Raspberry crumble

Raspberry Block

Packaging

Plastic bags - 500 gr 2,5 kg

Cartons Boxes - 300 gr

Large cartons - 10 kg

Plastic bags - 500 gr 2,5 kg

Boxes - 10 kg

Cartons - 10 kg

Plastic bags - 2,5 kg

Boxes - 20 - 30 kg

Cartons - 10 - 14 kg

Cartons - 14 kg

3. Research design

Serbia’s agricultural sector is dominated by private farms utilizing more than 85%

of available agricultural land with state farms and cooperatives accounting for

less than 15% of the UAA. It is a historical consequence of specific agrarian

reforms performed before 1990s, during the socialist era. The private sector

particularly dominates the supply of fruit, vegetables and milk in Serbia. However,

www.glamur.eu

23

the majority of these farms own less than five hectares, usually fragmented into a

number of small separate parcels. Because of their small size, most of them are

faced with signficant problems of trade negotiations with processors and

wholesalers, who hold the power at the market. Consequently, many farming

families are heavily dependent of farm income generated in highly unfovaurable

conditions. This aspect imposes specific food chain structure and therefore –

specific chain problems as well (for example - what would be best ways for

horizontal and vertical integration, how sustainable development of rural

communities could be achieved, etc.). The following necessary assessment

elements in the comparison are identified:

•

•

•

•

•

•

Number of stakeholders involved in the different stages of food supply and

their importance in terms of volume of production and trade, their size etc.

Quality of relationships between stakeholders - Chain governance (Does

the production or marketing contracts exist or not? How these contracts

are defined, what are their most important elements?)

Market power (related to purchase price of raspberries, value chain

structure)

Production efficiency, positive/negative externalities (yields per ha over

time, technology applied - inputs use per ha (energy, water, pesticides,

fertilizer,…), QIF system, etc.)

How is the system institutionally supported - from local to national level

including the NGO organizations (knowledge transfer, better organization

of food supply chain)?

How local and global food chains contribute the local community and

country competitiveness/development?

This list of important issues concerning our case study includes all five

dimensions (economic, social, environmental, health and ethical). Production and

distribution of fresh raspberries would lead both to development of food supply

chain and rural economy in the country. However, existing system of connections

between food sector stakeholders allow only frozen raspberries market

development. It seems that a lack of higher levels of processing indicates a low

level of innovation, which is a consequence of lack of information and existing

food chain organization.

www.glamur.eu

24

3.1 Research questions

The FP7 GLAMUR overall research questions (RQ) that are addressed in our

case study as well: (1) What are the key food chain performance issues with

regards to a global-local comparison?; (2) What is the methodological strength

and weakness of overall applied comparative analysis?; and (3) What are the

specific interactions of the food chains under study and the policy settings?

The specific RQ are collaboratively designed with the Latvian team (Baltic

Studies Centre, Riga) and address specific issues in berries sector. The

additional questions are: (1) What are the main differences in organization

between the local and global chains?; (2) How are governance and control

enforced in the local and global fruit supply chains?; (3) How do the analysed

LFSC and GFSC influence national and regional economies?; (4) Are costs and

benefits distributed in a fair way among actors in the chain? How does this differ

for the local and global chain?, and (5) What aspects describe labour market and

common employment practices within sector? Elaboration aloud systematic

approach to specific characteristics and attributes both of local and global food

chains, leading to a meaningful comparison of different food chain dimensions in

the focus of our analysis.

3.2 Attributes selection process

The analysis starts from definition of attribute given by the GLAMUR project Work

Package 2. During the comparative study attributes have been defined and

normalized basing on evidence from Latvian and Serbian contexts. Thus

attributes are fine-tuned methodological instrument that serve as an optional tool

for food chain performance assessment and comparison.

The report elaborates ten attributes of local and global raspberries food chains.

The common list of attributes has been shortened for the purposes of the study

due to berry sectors particularities in the Latvia and Serbia. The list of attributes

used in the study has been developed in several steps. First step was based on

quick scan report. Interviews with chain actors and analysis of secondary data

were used to identify initial list of attributes. This list was then discussed with

project partners studying berries sector and trade in Latvia and apples production

and trade in Belgium. During the discussion the list of common attributes were

www.glamur.eu

25

defined. Afterwards second round of interviews was conducted during which

attributes where continuously tuned. The final list of attributes are illustrated in

Table below. The common attributes are underlined (in the marked lines).

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

The list of attributes and attributes selected for the case

Attributes (the list from WP2 Synthesis

Serbia

Report)

Raspberry case

Affordability

X

Creation and distribution of added value

X

Contribution to economic development

X

Technological innovation

Governance

X

Efficiency

X

Profitability/competitiveness

Connection

Resilience

Food waste

Information and communication

Food security

Consumer behaviour

Territoriality

Labour relations

X

Resource use

X

Pollution

Biodiversity

Nutrition

Food safety

X

Traceability

Animal welfare

Responsibility

X

Fair trade

X

Selected attributes address main problems identified in the berry food chains.

The identified list allows responding research questions posed for this study while

the selected attributes corresponds the issues defined in description of the

context. The analysis gives the main insights of the raspberry food chain

development related to local/regional and national economy.

www.glamur.eu

26

3.3 Selected indicators

The attributes are measured by indicators. For each attribute we have defined a

list of indicators. The selected common indicators, as well as specific indicators

described in the Serbian case study, are presented in the table below.

Attribute

Creation and

distribution of added

value*

Contribution to

economic

development

Governance

Ethical/ Economic

Economic/ Social

Economic/ Social

Dimension

The list of indicators

www.glamur.eu

Brief attribute

description (cf.

Comparative

Report)

Used indicators

Research questions

Data collection

methods

The common set of indicators for comparison between Latvia and Serbia

Are costs and

Value added

The attribute

• Financial

benefits distributed in

calculation

represents both –

statements for

a fair way among

how added value is

Price for the

selected companies

actors in the chain?

created and how it is

farmer / final

(database

How does this differ

distributed in FC.

price of the

boniteti.rs)

for the local and

product

• SORS database

global chain?

• In-depth interviews

Attribute that signifies

the contribution that

FSC can bring to

national, regional and

local economies.

Net Income

Regional

workforce

Attribute covers

regulation and

governance structure

as well as power and

presence of

democracy in food

chains.

Grievance

procedures

Conflict

resolution

Legitimacy

Civic

Responsibility

Free, Prior and

Informed

Consent

Sustainability

Management

Plan

Full-Cost

Accounting

Platform for

decision making

What are the main

differences in

contribution to

national, regional and

local economies

regarding local and

global chain

development ?

What are the main

differences in

organization between

the local and global

chains?

How are governance

and control enforced

in the local and global

fruit supply chains?

What aspects

describe labour

market and common

employment

practices within

sector?

• SORS database

• Financial

statements for

selected companies

(database

boniteti.rs)

• In-depth interviews

• Policy documents

• Secondary sources

• In-depth interviews

27

Labour relations

Social/ Ethical

What aspects

Right to Quality

describe labour

of Life

market and common

Wage Level

employment

Employment

practices within

Relations

sector?

Freedom of

Association and

Right to

Bargaining

Health Coverage

and Access to

Medical care

Capacity

Development

The other indicators presented in the study

Attribute identifies

socio-economic

welfare and

recognition of

workers as well as

considers risks these

workers are exposed

to and analyses

availability of

qualified labour.

Affordability

Prices for

consumers

Product quality

and information

Food safety

Product Labelling

Labour

productivity

Resource use/Efficiency

Land productivity

www.glamur.eu

Fair trade

Distribution of

revenues

Responsibility

Expended

sustainability

Price paid by the final

consumer expresed

in eur/kg of fresh or

frozen berries

The share of the total

volume of production

that meets quality

standards which are

necessary to ensure

safety, transparency

in trade and good

eating quality

Product labelling is

an essential part of

transparent

accountability to

consumers.

Total kilograms of

raspberries produced

per labour unit at

farm stage

Total kilograms of

raspberries produced

per land use unit at

farm stage

Price received by the

producer compared

to the price payed by

the consumer

Environmental,

Social, Ethical

Economic and Healht

aspects of

Resposibility

• Policy documents

• Database

boniteti.rs

• SORS database

• In-depth interviews

• SORS database

• MoAFW-STIPS

database

•

•

•

•

Observations

Secondary sources

In-depth interviews

Republic of Serbia /

Institute of public

health

• Observations

• Secondary sources

• SORS

• In-depth interviews

• SORS

• In-depth interviews

• SORS

• MoAFW-STIPS

database

• Secondary sources

• In-depth interviews

28

As indicated beforehand, we have selected four main attributes and the list of

indicators allowing not only comparison of local and global food chains for the

individual country, but also comparison of pairwaise countries case studies for

the berry sectors. The previous food chain analysis in Serbia was performed

without any comments on connections and comparisons of its local and global

perspectives. Different bottom-up initiatives co-financed by the local governments

were included in our report as a valuable input. Quality score of the selected

indicators is given in the table below.

Quality score of indicators used for the berry case studies comparison

Name of the

indicator

Definition*

Grievance

procedures

Stakeholder access to fair grievance

procedures.

Conflict

Resolution

Resolved conflicts of interests between

stakeholders

Legitimacy

Scale*

Benchmark*

Quality score*

LOCAL

CHAIN

GLOBAL

CHAIN

Scale 1

to 4

3

0.4

0.4

%

80

0.4

0.4

Enterprise's compliance to the law

Scale 1

to 4

4

0.2

0.2

Civic

Responsibility

This indicator illustrates the relations of

most powerful actors of food chains with

laws and civic schemes protecting rights of

the weakest food chain actors.

Scale 1

to 3

2

1

1

Free, Prior and

Informed

Consent

Indicator addresses consent achieved

between the big enterprises and the

community.

Scale 1/2

2

0.2

0.2

Sustainability

Management

Plan

Does enterprise have a sustainability plan.

Scale 1

to 3

2

0.2

0.2

Platform for

decision making

There is an interprofessional association or

a platform for all actors of the chain to

meet and to negotiate.

Scale 1

to 3

2

0.4

0.4

Right to Quality

of Life

Primary producers, small-scale producers

and employees in enterprises of all scales

have the right to a quality of life that affords

time to spend with family and for

recreation, adequate rest from work,

overtime that is voluntary, and educational

opportunity for themselves and their

immediate families.

Scale 1

to 3

3

0.2

0.2

Wage Level

Percentage of wage above minimum wage

%

-

1

1

www.glamur.eu

29

level

100

0.4

0.6

3

0.2

0.5

Yes/No

-

0.4

0.6

Do employees have access to capacity

development

Yes/No

-

0,2

0.4

Value added

calculation

Creation and distribution of added value

%

-

1

1

Price for the

farmer / final

price of the

product

Share of price received by picker

%

-

1

1

%

-

0.4

0.6

%

-

0.6

0.6

t/ha

-

1

1

kg/

labour

unit

-

0,6

1

Scale 1

to 3

-

0,2

0,4

Scale 1

to 3

-

0,2

0,4

Euro/kg

-

1

1

Employment

Relations

Percentage of employees that have

legally-binding transparent contracts with

their employers.

Freedom of

Association and

Right to

Bargaining

Evaluation of employees’ possibilities to

associate and bargain.

Health

Coverage and

Access to

Medical care

Do employees have health coverage and

access to medical care

Capacity

Development

Net Income

Regional

workforce

Regional Workforce refers to the

employees hired by the enterprise that

come from the region where the enterprise

operations are based. Shown as % of local

employees.

Land

productivity

Total kilograms of raspberries

produced per land use unit at farm

stage

Labour

productivity

Total kilograms of raspberries

produced per labour unit at farm stage

Product quality

& information

Production that meets quality

standards which are necessary to

ensure safety, transparency in trade

and food quality

Product

Labelling

Product labelling is an essential part of

transparent accountability to

consumers.

Prices for

consumers

Price paid by the final consumer

expresed in eur/kg of fresh or frozen

berries

www.glamur.eu

%

30

Fair trade

Expended

sustainability

Price received by the producer

compared to the price payed by the

consumer

Environmental, Social, Ethical

Economic and Healht aspects of

Resposibility

%

-

-

1

1

0,2

0,2

*Definition – cell definition refers to explanation of our indicator interpretation; Scale –

measurement instrument used; Benchmark – “values or qualitative descriptions of activities,

used as the basis by which the performance of an enterprise is evaluated within an indicator

domain to facilitate a rating of sustainability performance.” (FAO 2013, 216); Quality score –

data quality score calculated basing of pedigree matrix approach; Chain L (local) and G

(global).

3.4 Selection of stakeholders and interviews - the

participatory approach

Activities performed for the WP3 were based on strong interactions with the food

chain representatives (the participatory approach was implemented). From the

very beginning of the case study analysis, main issues and the research

questions where discussed with stakeholders. They were involved in in-depth

interviewing, and during the additional data collection the stakeholders were

constantly involved in verifying previously made conclusions.

In our case study term “stakeholders” is accepted as a broader context, since it

consists of all participants who directly or indirectly benefit from the raspberries

supply chain.

Thus, Government and Governmental organizations are mainly in collaborative

relationships with farmers and raspberries associations, because raspberry is

identified as a strategic exporting agricultural product in some parts of Serbia,

and its production is essential to the standard of the agricultural population in

certain regions of Serbia. In the frame of Government organizations quite

meaningful participation of the SIEPA agency (Serbia Investment and Export

Promotion Agency) should be noticed. SIEPA supports Serbian raspberry export.

In addition to the Government organizations, some foreign organizations also

appear as the game players (such as USAID). In recent past those organizations

have shown considerable interest in this agricultural sector, through the

sponsorship of a number of raspberry production development projects.

www.glamur.eu

31

The list of experts

Stakeholder

Serbian Chamber of

Commerce, Belgrade

SIEPA

Association of

raspberries producers

Raspberry producer

Association of

raspberries producers

Local food company

Certification company

Global food company

Global food company

Ministry of Agriculture,

Forestry and Water

Management, Serbia

Food processor

Function

Advisor for agriculture

Position in the chain

Market analysis

Global-local chain

Global-Local

Serbian export

promotion agency

President

Food industry and

agricultural advisor

The producers

association

Production

Global

Farm manager and

owner

President

Global

Local

The producers

association

Warehouse / cold

storage and trader

Certification

Local

Global

Broker

Advisor

Food company / Cool

storage and Export

Exporter

Policy maker

Marketing manager

Production

Local-Global

Trade specialist

Quality insurance

inspector

Trade sector manager

Local-Global

Global

Global

Global-Local

The actors selected for the interviewing hold the key positions and importance

both in local and global chain. Most of them have worked in the two types of

chains and gave significant insights valuable for the comparisons. The

information regarding the experts interviewed are given in the table above.

Interviews were semi-structured and organized in the way that aloud comparison

of results obtained for the fruit sectors in Latvia and Serbia (WP4). The main

purpose of the interviewing was to find out specific data on production and trade

that could not be found in the official statistics. Findings are qualitative in the

nature, and they are incorporated in our reporting as additional information

together with the secondary data available from the official statistical databases.

www.glamur.eu

32

4. Results and discussion

4.1 Description of the chains

4.1.1 Local FSC model (Fresh raspberries)

In this part we elaborate the typical models of local and global supply chains

connected, respectively, to fresh raspberries from Arilje and frozen raspberries

on the whole Serbian territory, as final products of Serbian agriculture. Therefore,

fresh and frozen raspberries are subjects of our case study. In accordance to the

fact that over 90% of the total raspberries production in Serbia is exported in the

form of frozen raspberries, it is evident that fresh raspberries from Arilje

represents only a small fraction of the total production of that specific fruit. Fresh

raspberries supply chain is predominantly local in its character, and only a small

portion of fresh raspberries is exported to neighbouring countries, i.e. regional

markets when it comes to Serbia. Due to the fact that a negligible part of the local

chain is oriented towards export to the neighboring countries, export is dropped

as insignificant for local chain formation. This is certainly not the case with the

global chain, where domination of export activities is obvious.

Local supply chain, which refers to the fresh raspberries from Arilje is typical

because it is a case of a specific product with a distinctive and protected origin.

Fresh raspberries are predominantly consumed during the summer season

(June-July) on the Serbian wide market, and only a small share (around 3%) is

exported to the nearby countries in the fresh product form. Inputs for primary

production are predominantly local by its origin, since this is a highly labor

intensive production activity. Production of fresh raspberries mainly involves

small farms with up to 0.5 hectares of fields under this perennial crops. For

example, commercial raspberry growing is carried out in every village in the

municipality and, according to estimates, the average farm cultivates raspberries

over 0.25 hectares. Workforce on such farms is mostly made up of the family

members and, when it is necessary during the picking season, seasonal workers.

Logically, labor, water and land as production inputs are local in its nature. A

significant portion of planting materials is produced in Serbia, where we should

emphasizes the importance of the Fruit Research Institute from Cacak (town in

the central part of middle Serbia) with up to 600,000 certified seedlings annually.

www.glamur.eu

33

Only a small portion of imported seedlings is used in the case of fresh

raspberries supply chain (up to 5%).

Figure - Model of the Serbian local supply chain (Fresh raspberries from

Arilje region)

Serbia

INPUT Suppliers

INTERMEDIARIES

FARMERS

WHOLESALERS

(Domestic)

RETAILERS

CONSUMERS

CONSUMERS

The majority of fresh raspberries production (produced mainly on small farms) is

being bought by intermediaries (buying agents or traders) and then directed to

companies which perform fruit selection and refrigerated transport to the

distribution (retail) channels, all the way to the final consumer. Each storage as

well as transport of fresh raspberries involves 0oC cooling mode. A tiny branch of

the local supply chain includes the export of fresh raspberries in the neighboring

countries. Certainly this is the insignificant part of the total production of fresh

raspberries from Arilje, and that’s the main reason why foreign component is

missing in our model of local supply chain.

4.1.2 Global FSC model (Frozen raspberries)

Unlike a local supply chain, global one implies more complexity, since it involves

significant portion of foreign participants. Medium and large farms have been

added to the small farmers in the process of primary production. In accordance to

the production stands Western part of the Serbia (Zlatibor district) should be

underlined, because it alone generates up to 25% of total production of the

country. As well as in the above mentioned case of the local chain, so-called low

input technology in primary production is also present in the global context, with

www.glamur.eu

34

the prevailing share of the seasonal labor force during the raspberries ripening

season.

Over 90% of the total production of raspberry in Serbia is exported in frozen form.

Raspberries are frozen at a - 40oC and stored between -18oC and -20oC (which

applies also to the transportation). The largest portion of frozen raspberries is

exported to the EU (94%) and the rest to the USA, Switzerland, Russia and

Japan. Primary storage and transportation companies possess especially

important role in the global context. They can be classified as intermediaries

(buying agents/traders), cold storage companies, exporters and cooperatives.

Figure - Model of the Serbian global supply chain (Frozen raspberries)

Serbia

FARMERS

INPUT

suppliers

EXPORTERS

FARMERS

INTERMEDIAR.

IMPORTERS

(Wholesalers)

Food service

CONSUMERS

(I t

ti

l)

RETAILERS

FARMERS

COOPERATIVES

PROCESSORS

(Domestic)

Food service

RETAILERS

(D

ti )

CONSUMERS

(D

ti )

Frozen raspberries are exported to foreign markets where they are usually

repacked, because most of the Serbian companies do not meet the high

standards when it comes to raspberries packing. Frozen raspberries are directed

towards food processors, and after processing final food product through the

distribution chain (food service operators) arrives to the domestic and to foreign

consumers.

www.glamur.eu

35

4.2 Stakeholder analysis - Global versus Local FSC

Previous two figures represents typical raspberry production and sales channels

in Serbia from which it is possible to identify key stakeholders and its relationship

network. Therefore, the main stakeholders of both local and global raspberries

supply chains are presented in the following network diagrams based on their

relationship matrices. The nodes represent the main stakeholders on both

diagrams and relationships are depicted by connective arrows. At first glance it is

evident that the global network is far more complex than the local one (similar to

supply chain models) since it has a higher number of stakeholders, and therefore

significantly higher number of connections and relationships between them.

Therefore, we will analyse them separately, starting with the local one.

4.2.1 The Local supply chain stakeholders

In short (local) food chain, as we already underlined, fresh raspberries are sold at

green/open markets or on farm gate. It counts less than 2-3% of total raspberries

production in Serbia. It also includes home made products of fresh raspberries

(juices, traditional food – fruit preserve etc.). As major stakeholders of the local

chain, we have emphasized: (1) input suppliers, (2) farmers, (3) intermediaries,

(4) domestic retailers and (5) domestic consumers. All stakeholders are

predominantly domestic, what is compatible by the nature of a local chain –

subject of our analysis. Unlike the previously shown local chain, in order to

simplify the analysis, we have included domestic wholesalers in the context of

intermediaries.

Based on interviews it was found that the role of intermediaries and wholesalers

are often intertwined, which makes possible to connect them within one node in

the network.

The next table and figure illustrate the relationships between stakeholders in the

local chain. Links can have a characters of: type 0 (no relation), type 1 (one

player informs another one about its needs or demand) and type 2 (one player

sells his product to another player).

www.glamur.eu

36

Relationship matrix of the Serbian local raspberry supply chain

LOCAL CHAIN

Relationship

INPUT

matrix

(Suppliers)

RETAILERS

CONSUMERS

(Domestic)

(Domestic)

2

0

0

0

2

0

2

1

0

2

0

0

0

1

0

2

0

1

0

1

0

FARMERS

INTERMEDIAR.

0

2

FARMERS

1

INTERMEDIAR.

1

INPUT

(Suppliers)

RETAILERS

(Domestic)

CONSUMERS

(Domestic)

Relationship type

0

Row player is not related to the column player

1

Information flow (Row player gives information to the column player)

2

Trade relation (Row player sales to the column player)

INTERMEDIARIES

FARMERS

1

2

2

1

2

1

1

CONSUMERS

(Domestic)

2

2

1

1

2

INPUT (Suppliers)

RETAILERS (Domestic)

Network of actors in the Serbian local raspberry supply chain

In accordance with the number of relations established in the stakeholders

network (Figure above), intermediaries and farmers turn out to be the most

important nods. But in the light of the facts that the structure of farmers is

www.glamur.eu

37

atomized in comparison to the relatively small number of intermediaries,

intermediaries seem to be the key players of the local chain and probably the

ones with the highest market power.

This is also supported by the fact that the production of raspberries is dominantly

labor-intensive activity, where harvesting is done by hand and large number of

seasonally workers is usually hired at picking. On the other hand we have

intermediaries, with significant concentration of capital which, as it is already

mentioned, group fresh raspberries and transport them to processing facilities

(cooperatives). There are around 100 processing facilities (Djurkovic, 2012)

where raspberry processing is done manually. Cooperatives can be also included

under the term intermediaries in our stakeholder analysis of local chain.

4.2.2 Global supply chain stakeholders

Frozen raspberries are sold to food industry or mostly exported. Downstream

food chain consists of regional centres (cooling houses) and brokers/exporters

(Radosavljevic, 2010). EU is the most important market for Serbian raspberries

(94%) and the rest is usually sold in USA, Switzerland, Russia and Japan. In EU

Serbian raspberry is repacked to fulfil required standards and then re-exported to

Australia, USA and Japan. More than 90% of Serbian raspberry production is

frozen in cold storage and exported later on (Djurkovic, 2012).

Accordingly, the global chain, as shown in next Figure, is partly domestic (located

in Serbia), and partly related to the international space. In this sense all

stakeholders can be separated in two groups, respectively, domestic and foreign.

Therefore as the key players within domestic group we have distinguished: (1)

input suppliers, (2) farmers, (3) intermediaries, (4) domestic processors, (5)

domestic retailers, (6) domestic consumers, and within the international: (7)

foreign importers (8) foreign processors, (9) foreign retailers and (10)

international consumers.

As in the case of a local chain, table and the following network diagram show the

relationships between stakeholders in the global supply chain. Links can have a

characters of: type 0 (no relation), type 1 (one player informs another one about

its needs or demand), type 2 (one player sells his product to another player), but

we have also type 3 as the difference from local chain, which implies mutual

www.glamur.eu

38

cooperation between players. Small, medium and large farmers are united into

single nod in our relationship network, since their almost identical interconnection

with other elements of the chain.

Relationship matrix of the Serbian local raspberry supply chain

GLOBAL CHAIN

Relationship

matrix

INPUT

INPUT

(Suppliers FARMERS INTERM.

)

PROCESSORS

RETAILERS

(Domestic)

(Domestic)

CONSUM.

(Domestic

)

IMPORTERS

PROCESSORS

RETAILERS

(Foreign)

(International)

(Foreign)

(Foreign)

CONSUM.

0

2

3

0

0

0

0

0

0

0

INTERM.

1

3

0

1

2

0

0

2

0

2

0

0

0

2

0

0

0

0

0

0

PROCESSORS

0

0

1

0

2

0

2

0

0

0

RETAILERS

0

0

1

1

0

2

0

0

0

0

CONSUM.

0

0

0

0

1

0

0

0

0

0

IMPORTERS

0

0

1

1

0

0

0

2

2

0

0

0

0

0

0

0

1

0

2

0

RETAILERS

0

0

0

0

0

0

1

1

0

2

CONSUM.

0

0

0

0

0

0

0

0

1

0

(Suppliers)

FARMERS

(Domestic)

(Domestic)

(Domestic)

(Foreign)

PROCESSORS

(Foreign)

(Foreign)

(International)

Relationship

type

0

Row player is not related to the column player

1

Information flow (Row player gives information to the column player)

2

Trade relation (Row player sales to the column player)

3

Collaboration relation (Row player collaborates with the column player)

www.glamur.eu

39

Quality control, although shown in the model of the global chain, has been

omitted in order to simplify the network of stakeholders, because it does not

belong to a key players set in the global chain. Also, within the nod that belongs

to intermediaries we have incorporated cooperatives, and wholesalers and

exporters, since their connections are intertwined.

INTERMEDIARIES

1

FARMERS

2

2

2

3

RETAILERS (Domestic)

2

1

2

1

1

1

2

1

CONSUMERS

(Domestic)

1

CONSUMERS

(International)

1

2

2

1

3

PROCESSORS (Domestic)

IMPORTERS

(Foreign)

INPUT (Suppliers)

2

2

1

2

1

2

1

RETAILERS (Foreign)

PROCESSORS (Foreign)

Network of actors in the Serbian global raspberry supply chain

Undoubtedly the largest number of significant relationships in this case belongs

to intermediaries, which makes them as the most important part of network.

Significant position goes with a significant bargaining and consequently

significant market power which is primarily expressed in relation to the farmers as

the primary producers. There are between 200-250 cold storages with deep

freezing regime (-18C), with capacities between 100-5,000t, which at least tells

the approximate number of intermediaries within the global chain. On the other

side it is estimated that there are about 15,000 raspberry producers (Nikolic et

al.). Serbian raspberry farms are small, usually family owned seasonal business.

Average raspberry plots are between 0.5 and 1 ha. Farmers sell their products to

intermediaries rarely directly to processing companies or exporters, usually with

no further engagement.

www.glamur.eu

40

In other words, the bargaining power of farmers regardless of the size is not

significant in comparison to intermediaries. For this reason, we do not distinguish

between small, medium and large farmers when showing the relations among

key stakeholders, since their roles in the network are almost identical.

Government and non-governmental organizations are omitted within both the

local and global chains and respective networks of stakeholders, in order to

preserve the essence and transparency of key relations. Relations that could be

established in the case of government and non-governmental organisations with

other elements of network are provision of information or cooperation. The

associations of raspberry producers are not listed too, because they cannot make

any qualitatively different link with other elements of the chain which farmers

already have.

4.3 Description of attributes and indicators

4.3.1 Creation and distribution of added value

The value added calculation in the process of production and distribution of fresh

and frozen raspberry is important indicator of production factors employed

capacity to efficiently utilize raw materials and other production services. The

distribution of value added along the food value chain provides additional

information about the chain participants’ power and dominance in the concrete

production and distribution process of the generated product from the farm gate

to final consumer.

Thus, the value added indicators provide more information about food chain

structure in sense of measurement of:

•

•

•

•

performance and productivity

growth and size, i.e. importance

vertical integration

economic concentration

The added value is calculated as the difference between farm gate, wholesale

and retail prices and non-factor costs at each stage of the food chain from

producer to final consumer.

www.glamur.eu

41

The unit value added can be calculated as the difference between the sale price

and the production cost of a product plus the unit depreciation cost and the unit

labour cost. Total value added is gained through summing value added per unit

over all units sold. Total value added is equivalent to revenues less outside

purchases of materials and services.

In order to estimate the value added in the raspberry value chains for Serbia we

have collected the balance sheet data for small and medium size companies that

are processing and distributing fresh and frozen raspberries and raspberry

products for the period 2009-2013. We have collected data for 31 companies

based on the Serbia Investment and Export Promotion Agency (SIEPA)

database. Balance sheet data are provided by database Boniteti.rs. In our

sample we have 20 small and 11 medium size companies.

Two subsamples are created: first referring to raspberry processing and export

companies that represent global raspberry food chain and the second composed

of main producers and wholesalers of fresh raspberry. Based on the Balance

sheet and Income statements of these companies the Value added and Value

added per employee is calculated for global and local raspberry food chains

based on the following formulas:

Value added =

(Operating profit – Business loss)

- (Increase in inventories – Decrease in inventories)

- Other operating income

Value added per employee = Value added / the average number of

employees

Data are then aggregated for local and global subsamples and average values

are calculated.

Added value

Global chain

Serbia is predominantly exporting raspberry in the frozen form. The average

value added and value added per employee in the global raspberry chain are

provided in the table. Data indicate high total and per employee value created in

www.glamur.eu

42

the pre-crisis period and significant drop in the recession years characterized by

decreasing demand and export.

Average value added and average value added per employee for raspberry

processors and exporters

In Euros

2009

2010

2011

2012

2013

Average value added

21789.59 1130.36 25827.83 7313.62 -799.1314

Average value

added/employee

497.75

-15

1082.40

87.25

364.25

Source: Authors’ calculation based on SIEPA and Boniteti.rs data

Average value added and average value added per employee for raspberry

processors and exporters, in Euros

30000

1200

25000

1000

20000

800

15000

600

10000

400

5000

200

0

0

-5000

2009

2010

2011

Average value added

2012

2013

-200

Average value added/employee

Source: Authors’ calculation and presentation based on SIEPA and Boniteti.rs data

Based on the available average farm gate, wholesale and retail prices of

raspberry per kg (Statistical Office of the Republic of Serbia and STIPS) and

exchange rate data from the NBS we have estimated value added created and

distributed in each segment of the chain per kg of raspberry.

Value added creation and distribution in global raspberry food chain